Maurice Jackson: Joining us for a conversation is Jordan Trimble, the CEO of Skyharbour Resources Ltd. (SYH:TSX.V; SYHBF:OTCQB), a preeminent uranium and thorium explorer in Canada's prolific Athabasca Basin.

Glad to speak with you again, to get us up to date on the uranium market and the latest developments on Skyharbour Resources. Jordan, a lot has happened since we last spoke in September, beginning in the U.S. Perhaps take us through the elections and how that might affect the uranium market.

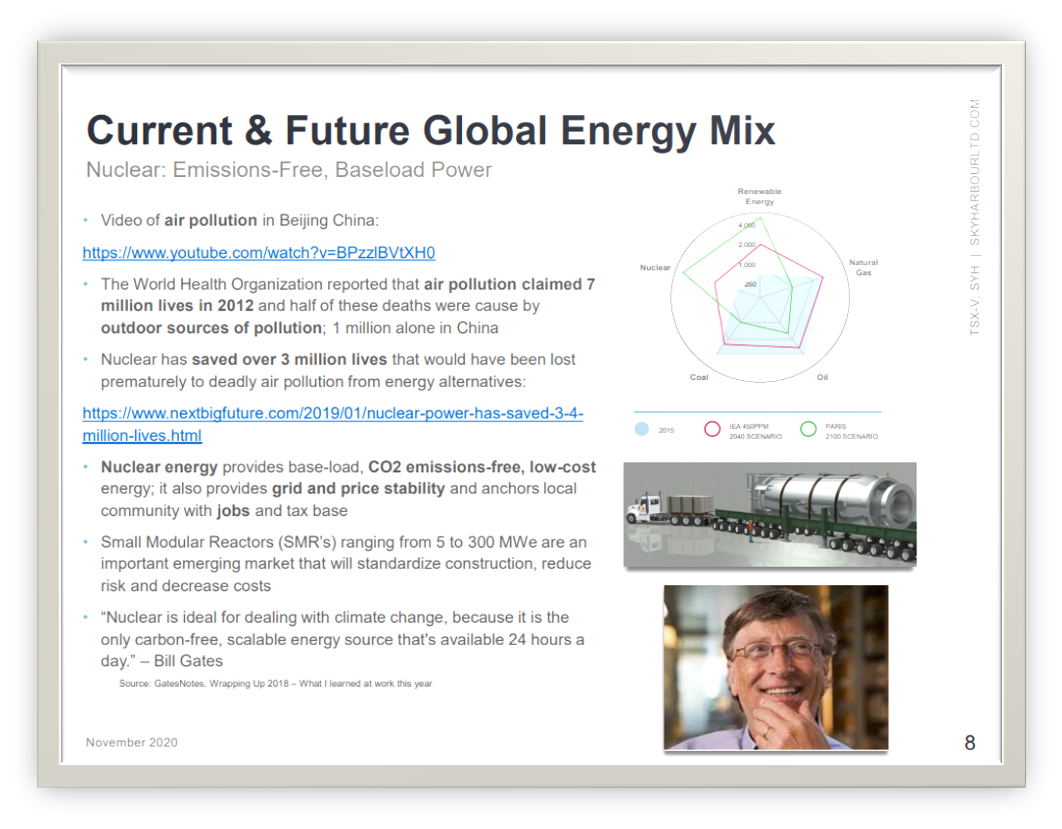

Jordan Trimble: I do believe that either outcome was going to be positive for the uranium market going forward. The bottom line is both candidates have shown that they're pro-nuclear. If readers look at what Trump was doing during his tenure, and what would likely have continued under a Trump presidency, he was a strong advocate for nuclear energy for different reasons than a Biden administration. One of the focus areas for Trump was on the development of small modular reactor (SMR) technology, which would likely continue under either administration.

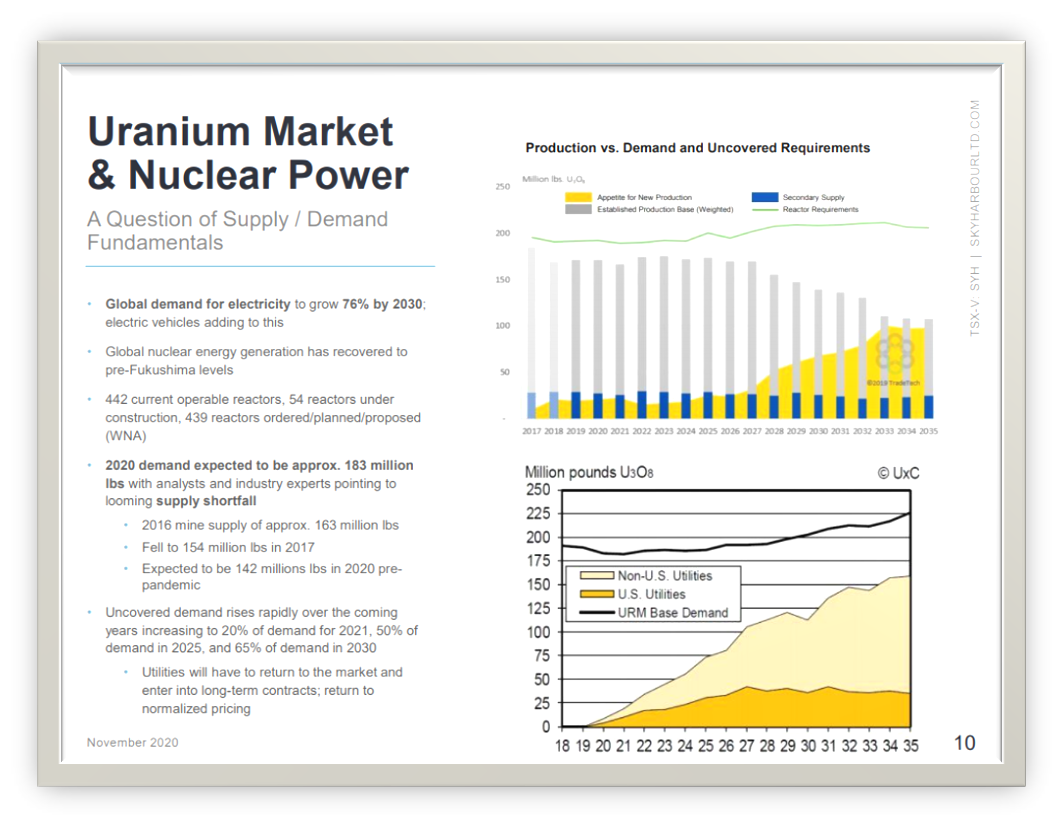

We also saw, over the last several years, a renewed focus on the uranium mining industry and nuclear industry in the United States, beginning with U.S. Department of Commerce initiating the Section 232 investigation into uranium imports, which was, as you recall, an investigation into the security of supply of uranium, which again, powers about 20% of the country. It accounts for 55% of the clean electricity generated in the U.S.

The U.S. still has the largest fleet of nuclear reactors. And almost all of the uranium and the fuel for these reactors has to be imported from foreign sources—a good chunk of that coming from ex-Soviet states, including Russia, Kazakhstan and Uzbekistan. Section 232 led to the Nuclear Fuel Working Group, which has now led to—and this was just recently ratified—a $150 million-a-year budget for a domestic uranium reserve.

And so we're seeing a renewed focus and attention on this space, which is positive. It's positive for uranium, North American uranium companies, mining companies; it's positive for U.S. nuclear utilities. It's important to keep in mind that nuclear energy is the only source of baseload CO2 emissions-free electricity. It provides baseload 24/7; it's not intermittent like other sources of clean electricity. It provides grid and price stability and anchors local community with jobs and a tax base.

And just on that note, coming out of this pandemic, I think we do see a very large infrastructure spend. I think we see that particularly under a Biden administration. And one of the things that Biden's talked about is this $1.7 trillion climate change budget—a massive amount going into fighting climate change and nuclear is included in that. Also, as I mentioned, the development of these SMR, small modular reactors.

We'll see, likely under a Biden administration, the U.S. reenter the Paris Climate Agreement again, which will be positive for nuclear in the U.S. and the demand for uranium going forward. Regardless of the outcome, it's, I think, going to be positive for nuclear and for uranium mining. It's one of the few topics or subjects that has bipartisan support, which I think, in particular, under a Biden administration, they're going to utilize that to get legislation through.

And so I think we're in for a good couple of years, as a result of the U.S. elections. Looks like Biden has the edge here, and I think, as a result of that, we will see this new nuclear renaissance, in particular, in the U.S. As a Canadian uranium company, that's positive for us. We will, I believe, see an increase in demand going forward and that's just in the U.S., along with global demand. The demand side has been driven by growth in nuclear energy, in places like China and India, and other parts of the developing world.

Maurice Jackson: The uranium spot price has had a steady increase in price from the lows of $19/pound back in 2017. Two-part question: What is the probability that we may see the uranium price potentially reaching the highs that we saw back in 2007? I think everybody wants to see this $135/pound. And what global events should we be looking at as a potential catalyst?

Jordan Trimble: Well, it's a good question. Unfortunately, I do not have a crystal ball, so I'd rather not speculate on how high the price could go, but I will say right now we're trading at about 29 to $30/pound in the spot market. That is still relatively low. We saw in 2016 the spot price gets down to just under $18 a pound in the U.S., which in inflation-adjusted terms is one of the lowest it's ever traded at.

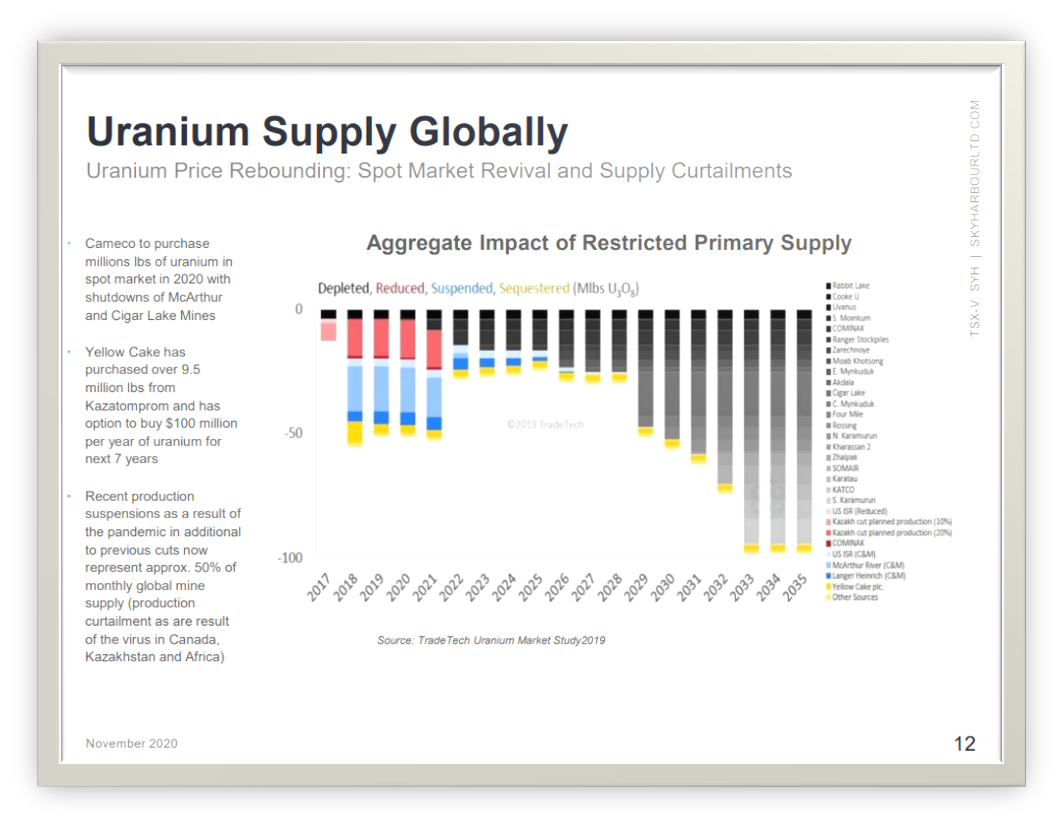

We have seen that trend reverse. We've seen the price ticking up. In particular, in 2020, we saw a spike in the price back in April and May, as we saw a major supply-side response. Due to the pandemic, we saw almost 50% of primary global mine supply offline at that point. Part of that had to do with recent production curtailment. Due to low prices, we've seen some mines shut down over the last several years. And then this was exacerbated by the pandemic and we saw, for example, Cigar Lake, which accounts for over 12% of global primary mine supply, shut down for several months. We've seen the Kazakhs announce additional production curtailment.

And look, we saw the world respond to a black swan event and uranium mining, like many other industries, was a victim to that. And we can safely say now that the supply side for this metal, for this commodity, that the risks to the supply side far outweigh the risk to the demand side. We see a relatively sticky demand side.

Nuclear energy through this pandemic has been a source of reliable, affordable electricity. We haven't seen much of a pullback on the demand side. We have seen the supply side hit hard for a period of time. And again, going into a second wave, I wouldn't be surprised if we saw additional production cuts over the coming months. And so that's just something to keep an eye on.

Now, as far as the price goes, we are trading well below the average, global, all-in cost of production. We do need to see a higher price, at $30/pound. Very few operating mines make money and we're trading well below the price needed to incentivize new production to come online. And I think that's a key talking point here, is we haven't seen any major new mines come online in the last five or six years. And we're a ways off from seeing any new major mines come online. And so I think as time goes on, we will see this continued strain on the supply side, which will ultimately drive higher prices.

And just one last note on that—we've talked about this in previous interviews. The key driver over the next few years, I believe, for a higher price will be new utility contracting. And this has been relatively dormant for the last several years. And there are several reasons for that, but we are starting to see renewed utility interest in new contracts. I believe, in 2021, we will start to see some higher price contracts being signed. In particular, I think you could see that in the U.S.

We just talked about the implications of the election. I think that we will see now that the air has been cleared with Section 232, the Nuclear Fuel Working Group and a push to this new nuclear renaissance, if you will. I think you will see in particular, U.S. nuclear utilities enter into some longer-term contracts and this new contracting cycle will be what I think drives a much higher price over the coming years. It's important to note that 50% of the existing contracts that are out there expire by 2027. We will have to see these utilities come back to the market sooner than later.

Maurice Jackson: Jordan, can nuclear energy play a part in the economic recovery from COVID-19? And if yes, how?

Jordan Trimble: Yeah, absolutely. Look, there's one trend that we've seen continue for, in particular, the last number of decades and just more recently with the advent of electric vehicles and just growth in electrification globally. We need more electricity and we need reliable baseload sources of clean electricity generation for that. And that's what nuclear provides.

And coming out of this pandemic and the economic shock that it's created, I think you'll see a drastic increase in infrastructure spending globally. We've seen that talked a lot about in the U.S., but I think you'll see that globally. And the nuclear industry is a perfect fit for that. It provides baseload clean electricity. As I mentioned, it provides jobs. It provides a tax base.

And just recently we saw an announcement out of the UK—a £12 billion, about $16 billion, budget for a new climate change budget initiative. A big part of that includes new nuclear reactors, these small modular reactors. They partnered with Rolls Royce on it. We are starting to see now, coming out of this pandemic, countries like the UK, like the U.S., focus on nuclear energy as a part of that response.

Maurice Jackson: Now that we've got an update on the uranium market, let's get more specific on Skyharbour Resources. The company is completing a drill program on its flagship Moore project and has plans for additional work there. Can you provide us with an update on the program and what's to come?

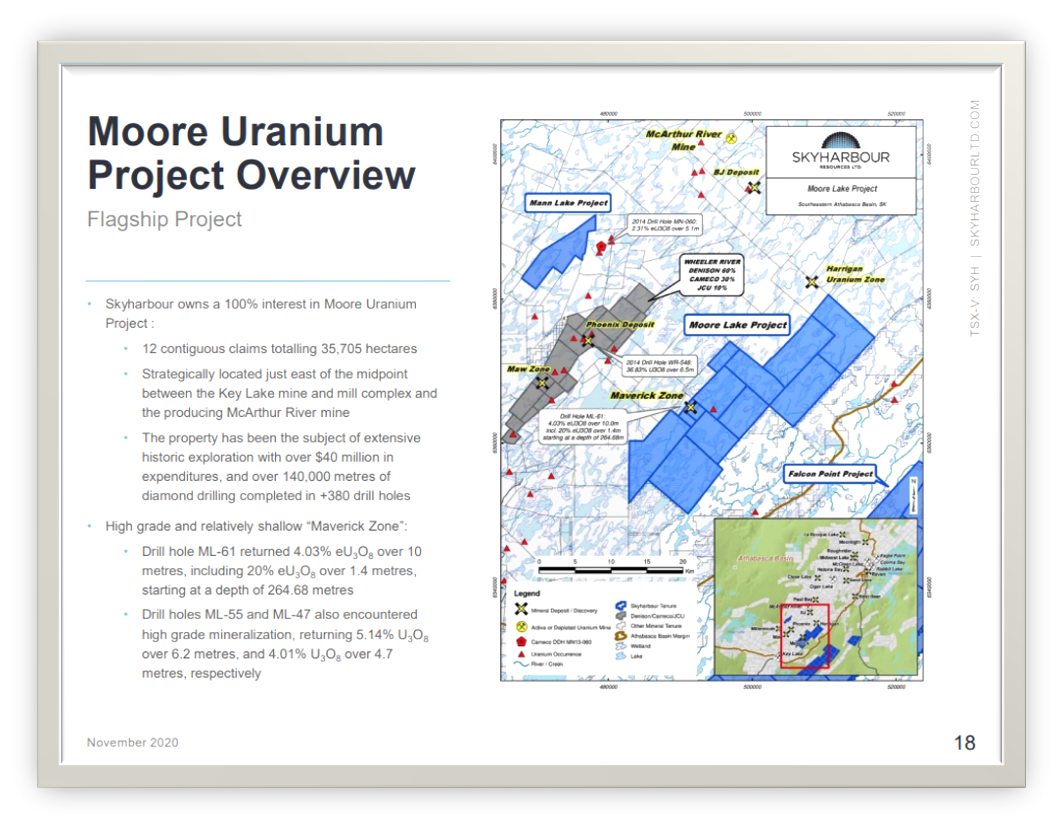

Jordan Trimble: As you and readers are well aware, this is our flagship, high-grade uranium project. It's situated strategically on the east side of the Athabasca Basin, about 15 kilometers east of Denison Mines Corp.'s (DML:TSX; DNN:NYSE.MKT) Wheeler project. Denison is a large strategic shareholder of Skyharbour, so we're proximal to infrastructure, we're proximal to strategic partners.

This is a project that we've been exploring for the last several years. We've had some notable discovery success, including drill results as high as 21% U308 over a meter and a half. We've more recently been focused on exploration and drilling into the underlying basement rock. Most of the high-grade mineralization at this project is located at what's called the Maverick Zone. It's on a five-kilometer long conductive corridor, only half of which has been systematically explored and drill tested, so we still have a lot of upside potential along strike and at depth on this corridor.

But most of the uranium—high-grade uranium mineralization—has been found at the unconformity or in the sandstone. More recently using some new techniques, some new geophysical surveys, we've been able to identify and refine targets in the underlying basement rocks. And what's interesting about these targets is that this is where the mineralization, the uranium's come from—these feeder zones. And so we've now more effectively targeted these feeder zones at depth and this program that we're just wrapping up, we have results pending. We're very happy with what we've seen and what we're drilling into.

And we have plans right now to follow this up in the new year, fully funded for another winter drill program, but we should have results out shortly and that's going to be a key catalyst for the company over the next month or two here.

Maurice Jackson: Your last news release was a letter of intent (LOI) signed for an option agreement with an Australian company, Valor Resources Ltd. (VAL:ASX), through their subsidiary, Pitchblende Energy. Perhaps walk us through the deal and the benefits to Skyharbour shareholders.

Jordan Trimble: This was a pretty significant announcement for us. And you will see additional announcements over the coming months as we finalize the deal and work toward a definitive agreement.

Pitchblende is a private company that's doing an RTO (reverse takeover) with an Australia listed public company called Valor. That's going through right now. We've announced an earn-in option, an LOI for an earn-in option with the company, which would see them earn up to 80% of what's called the North Falcon Point Project. This is the north end of our Falcon Point Project. And that's significant because we are keeping the southern half of the project, which includes a small Inferred uranium resource that we have.

Valor will earn in on the northern part of the project and do that over the next three years. There are just under half a million dollars in cash payments that have to be made; about a $1 million worth of stock has to be issued. And then there's a multi-million-dollar exploration program planned over the next several years.

And this is a part of our prospect generator business, which we've talked about in the past. We have a dual-pronged approach to running the business here at Skyharbour. We're a high-grade discovery and exploration company focused on our flagship Moore project, but we have a large portfolio, over half a million acres of properties in the Athabasca Basin, that we then look to option out or find strategic joint venture partners to fund the exploration on.

And so this is just the latest, the third, deal that we've consummated. And what's great about it too, is it's a new group coming in, an Australian company. It's led by a gentleman named George Bauk, who's a well-known mining executive based in Perth. He's built several multi-hundred-million-dollar mining companies. And he previously ran a uranium company called Northern Uranium Corp. (UNO:TSX.V). And so he knows the sector quite well.

The head geologist is a gentleman named Gary Billingsley, who's based in Saskatoon. I got the pleasure of meeting Gary when I was out there a couple of months ago. And Gary's a multi-decade veteran geologist who knows the province of Saskatchewan very, very well. Knows my geological team very well. And so we're very much looking forward to working with a Valor going forward.

And just on that note, as you know, we have several other partner companies—Azincourt Energy Corp. (AAZ:TSX.V; AZURF:OTC) at our East Preston project, we should have some news out shortly on their plans for future exploration at East Preston. And industry leader, Orano, previously known as Areva, is earning in at our Preston project. Now three partner companies, funding exploration at our other projects, and we also get some cash and stock payments from these companies as well.

Maurice Jackson: Before we close, Mr. Trimble, what would you like to share with shareholders?

Jordan Trimble: I'd say in the next several months, we have some major catalysts for the company, including drill results, future drilling at our flagship Moore project. We're fully funded. We raised money this summer with a generalist fund that started taking positions in uranium companies and our partners, Valor, Orano and Azincourt, have plans for exploration at our other projects. We're going to have a very busy six months and this is in the backdrop of a rising uranium market. I think we see this price continue to move higher. We do see it kind of move in fits and starts. We've seen that here this year, but the general trend has been up.

And like I said earlier, I do see new contracting driving a higher uranium price. I do see continued risks to the supply side, driving a higher uranium price. And one last thing I didn't touch on was the fact that because of these production cuts we've seen, we will see continued purchasing from uranium producers in the spot market to make up for some of their lost production. That too, I think will help contribute to a higher uranium price.

Maurice Jackson: Speaking of purchasing, full disclosure, I have been adding to my position with Skyharbour Resources for the virtues conveyed in today's message. Mr. Trimble, if investors want to get more information about Skyharbour Resources, please share the contact details.

Jordan Trimble: The best way to get more information on the company is to simply go to the website at www.skyharbourltd.com. All of our contact information and details are on there. All of our news releases, all of the information, pertinent information on the company that you need is on the website. And I'm happy to chat with anyone interested in the company. A shareholder, looking to become a shareholder—again, all of our contact information is on there.

Maurice Jackson: Mr. Trimble, it's been an absolute pleasure speaking with you today. Wishing you and Skyharbour Resources the absolute best, sir.

Before you make your next precious metals purchase make sure you contact me. I’m a licensed representative to buy and sell physical precious metals through Miles Franklin Precious Metals Investments, where we have several options to expand your precious metals portfolio from physical delivery of gold, silver, platinum, palladium and rhodium directly to your home or office, to offshore depositories and precious metal IRAs. Call me directly at (855) 505-1900 or e-mail [email protected]. Finally, please subscribe to Proven and Probable, where we provide mining insights and bullion sales. Subscription is free.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

Read what other experts are saying about:

Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Skyharbour Resources. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Skyharbour Resources is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Skyharbour Resources. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Skyharbour Resources and Azincourt Energy, companies mentioned in this article.

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.