Seabridge Gold Inc. (SEA:TSX; SA:NYSE.MKT) announced in a news release that "it that it has filed its Report to Shareholders, Interim Financial Statements and Management's Discussion and Analysis for the three and nine months ended September 30, 2020."

The company explained that going into Q3/20 it faced significant risks and uncertainties surrounding the effects of COVID-19 on its operations and planned field activities. The firm stated that it was concerned as to what it could safely achieve while still protecting its employees, consultants and its Treaty and First Nation partners. The company said its management team worked closely with all of these stakeholders and as a result successfully prevented infection at its work sites and in the surrounding communities.

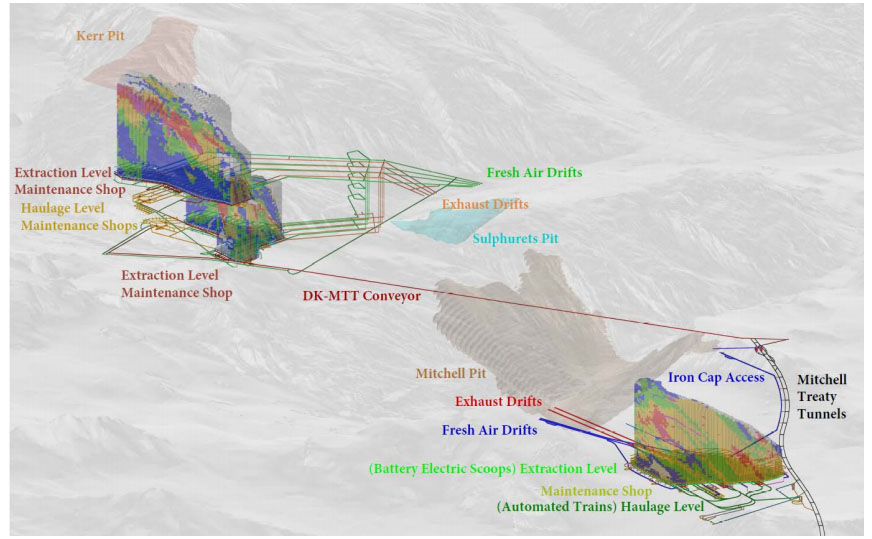

Seabridge Gold stated that even though it had to scale down its 2020 programs somewhat in response to the coronavirus it was still able to garner several accomplishments including the completion of the geotechnical drill program along the Kerr-Sulphurets-Mitchell (KSM) project's tunnel route. The company also advised that while drilling at its B.C. Iskut project it found additional evidence of a large gold-copper porphyry system. In addition, the firm indicated that it began drilling at its Snowstorm project in Northern Nevada.

The company stated that in Q3/20 it recorded a profit of CA$5.0 million, or CA$0.07 per share, compared to a loss of CA$2.5 million, or a loss of CA$0.04 per share in Q3/19.

The firm advised that in Q3/20 it invested a total of CA$12.0 million in mineral interests, compared to the CA$10.8 million it invested in Q3/19.

Seabridge Gold indicated that as of September 30, 2020, it had net working capital of CA$39.9 million, versus the CA$18.0 million it had as of December 31, 2019, which it said allowed the company to exit the third quarter with one of the strongest working capital positions its 21-year history.

Read what other experts are saying about:

Disclosure:

1) Stephen Hytha compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Seabridge Gold. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.