All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

As I discussed recently in other articles, 2020 is shaping up to be a remarkable year, with COVID-19 disrupting the markets and real economy, prompting central banks around the world with huge stimulus packages to perform damage control. The negative real interest rates combined with a devaluating U.S. dollar appeared to be the perfect storm for precious metals, including silver, the metal of focus for Alianza Minerals Ltd. (ANZ:TSX.V). This Kitco chart shows the explosive extent of this year's run up of the gray metal, after years of flatlining:

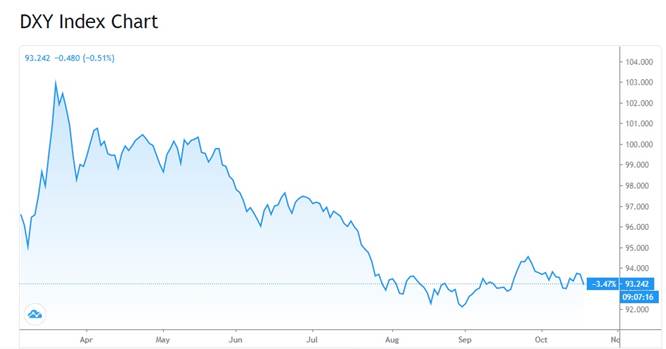

Silver has been correcting lately as the U.S. dollar is regaining some strength on the premise of being a safe haven lately, on the background of encouraging economic data, the second COVID-19 wave, fears linked to trade war tensions with China and, last but not least, the upcoming presidential elections in the U.S. Analysts overall expect the latest surge of the U.S. dollar not to last very long, as the Fed's dovish policies are likely to continue, and are negative for the yield advantage of dollar-denominated assets. The short recovery in September can be seen here in this chart of Tradingview:

A low U.S. dollar price is usually a positive for precious metal prices, especially in combination with a negative real interest environment as we have now, and which seems to be forecasted for several years from now, as the colossal U.S. debt will have problems handling any serious increase in interest rates.

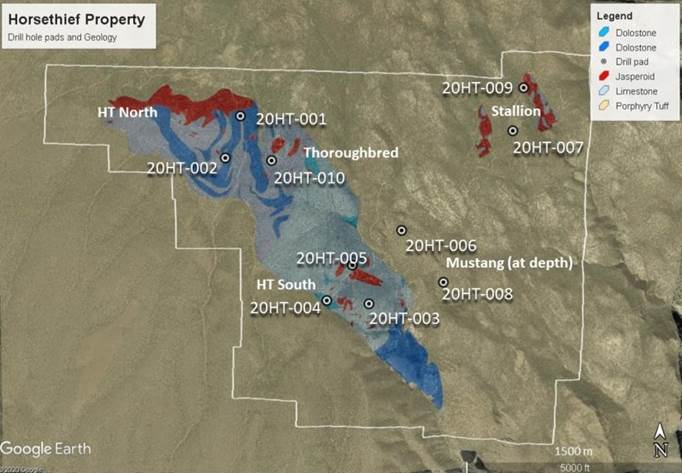

In the meantime, Alianza Minerals has been busy this summer and autumn after the COVID-19 lockdown was lifted, with a variety of activities. After having received the BLM approval for more drilling at its Horsethief project in Nevada, most of the second quarter was filled with reverse circulation (RC) drilling by JV partner Hochschild.

The first three holes didn't intercept significant mineralization, but anomalous gold like 12.2m @ 0.13g/t Au and 19.9m @ 0.11g/t in best hole 20HT-003. The next three holes returned nothing special either, with one hole reporting noteworthy anomalous values, being 3m @0.141g/t Au for hole 20HT-005. CEO Jason Weber is still positive:

"The first six holes at Horsethief have demonstrated the presence of alteration and mineralization features typical of productive gold mineralizing systems over a broad area," stated Jason Weber, President and CEO of Alianza Minerals. "We are encouraged by the size of the mineralizing system and confirmation of gold mineralization in carbonates beneath younger volcanic cover but have only intersected anomalous gold values to date. The four remaining holes all tested further, under-evaluated parts of the system particularly at the Stallion and Thoroughbred targets."

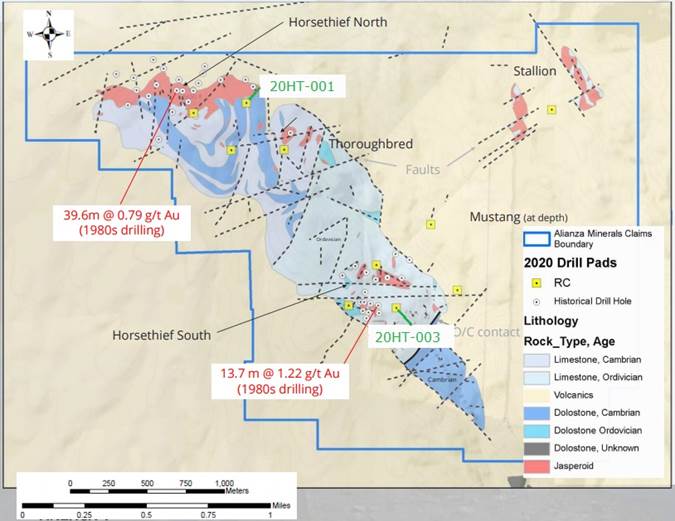

At first sight the results seem disappointing, as they didn't even come near the historical drill results from the 1980s:

Hole 20HT-003 was only about 100 meters from the historical hole that reported 13.7m @ 1.22g/t Au. It appears that the area is faulted a lot (the dotted lines are fault lines), which could complicate the finding of the structural controls.

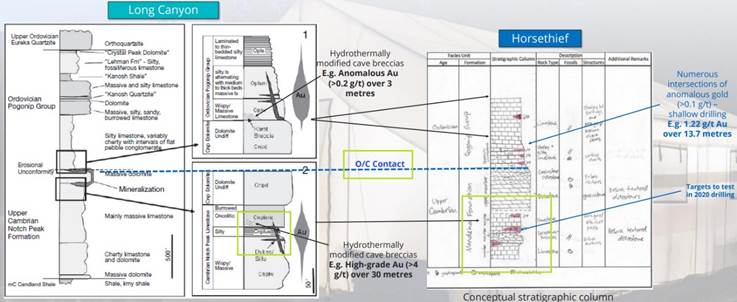

Alianza is looking to find another Long Canyon as it has similar geological characteristics. Both projects have a contact between Ordovician quartzite and Cambrian limestone/dolomite, the so-called O/C Contact. In line with this, the low grade intercepts were also found at Long Canyon in breccia layers, just like with Horsethief so far. Alianza was also looking to test the deeper targets in this campaign, following the Long Canyon analogy:

Holes 20HT-006, 007 and 008 were targeting this contact beneath volcanic rocks that were hypothesized to cover the prospective stratigraphy, and this was proven correct according to management, interpreting the results of the final four holes that have been reported on October 22. Unfortunately, regarding intercepts, only hole HT20-009 hit a very modest 76m intersection of anomalous gold results up to 0.185g/t, the other three didn't return results worth mentioning. This is obviously disappointing, although many indicators point towards the right direction. CEO Jason Weber had also hopes for more, but was honest about the results so far, as he showed in the news release:

"Although clearly not the discovery we were hoping for, the size and distribution of altered carbonate rocks along with widespread anomalous gold concentrations is encouraging. We will carry out a detailed examination of the pathfinder elements from the ICP data once it is available from the lab to determine if any vectors towards remaining targets exist."

After discussing the results a bit more in-depth with him, I asked him what he needs to find in the data in order to remain on track with the O/C Contact Long Canyon concept, if he thinks he has to adjust his strategy for this, or what kind of alternative concept he thinks could be present as well. Furthermore I wondered if Hochschild is only interested in the Long Canyon type opportunity, or is also open to investigate further. Weber had this to say: "While the gold results have been disappointing, we don't have the multi-element ICP results for most of hole four and holes five to ten. Hopefully this data will help vector to more productive portions of the system. Any decisions on how to proceed will be made after examining that data."

In between reporting the first and second batches of Horsethief results, the company also announced the hiring of a VP Exploration Rob Duncan, a very experienced geologist (Rio Tinto, Inmet) and a pretty solid addition to management. Weber was pretty happy with the hiring of Duncan: "Besides being an excellent technical mind, Rob allows Alianza to be active on more projects, including generating the next set of exploration targets to be optioned out."

At the end of the Horsethief drill program, Alianza also acquired the lease of the Twin Canyon Gold prospect in southwestern Colorado, for up to C$200k in cash and up to 2 million shares in 10 years, depending on the achievement of several milestones. The claims are organized around a small underground gold mine that operated at Twin Canyon during the 1980s and early 1990s. Historical sampling of the underground workings has returned grab samples ranging from 0.1 to 15.77 g/t gold. Twenty-eight historical channel samples 1.5 to 10 meters in length were anomalous in gold, eight of which exceeded 2 g/t gold (highlight of 8.1 g/t gold over 3 meters).

Historical rotary drilling confirms the presence of a gold grade over 0.5 g/t over a 500 by 500 meter area, indicating disseminated gold mineralization with low and high grade areas. The company completed a first soil sampling program, and based on this it has commenced a second exploration program, which will consist of detailed prospecting and geological mapping within areas of gold soil anomalies, expansion of the first soil sampling campaign, and detailed structural mapping to determine the primary controls focusing on gold mineralization.

All this exploration work has to be funded of course, and the company has been busy on that front as well, culminating in the close of an oversubscribed C$3.2 million financing on October 16, 2020. This round consisted of C$1 million non-flow through at C$0.135 and a 2 year 20c half warrant, and C$2.2 million flow through, at C$0.155 and no warrants. The non-flow through proceeds will be spent on Nevada and Colorado exploration and working capital, the flow through proceeds will be spent on Yukon exploration, including Haldane. As the company is cashed up nicely now, investors are waiting in anticipation for incoming results, the share price obviously being supported by higher silver prices:

Share price Alianza Minerals, 1 year period; Source: tmxmoney.com

As the company has several ongoing exploration projects, and Horsethief wasn't its flagship project (which is Haldane), the share price has held up relatively well after the disappointing news of Horsethief, but is now suffering like almost all juniors from election risks in the markets. Closing the oversubscribed financing slightly above the current levels didn't hurt either. Investors are clearly curious what Alianza could achieve here.

Besides Haldane and Horsethief, another exploration project is the Tim Silver project in the Yukon, part of a JV with Coeur Mining. Exploration at Tim is targeting high-grade silver-lead mineralization similar to that being mined by Coeur at its Silvertip operation, located 12 kilometers south of the property. As the new owner of Silvertip, which has a relatively limited resource and likewise mine life, Coeur could have an interest in Tim to develop it as a backup resource, if Silvertip exploration doesn't generate the desired resource expansion.

If Tim results in an economic resource, it could at the very least serve as an extra source of ore for the Silvertip mill and processing plant. Of course the hypothetical Tim resource would need to have the same metallurgy otherwise Coeur would have to install a different flow sheet at the processing plant, increasing sustaining capex further. According to Weber, the potential for likewise metallurgy is one of the reasons Coeur is keen on Tim, as it sees the same units and style of mineralization so it feels the metallurgy has a good chance to likely be similar.

The exploration program at Tim is expected to target high-grade silver-lead-zinc Carbonate Replacement Mineralization ("CRM"), similar to that found at Coeur's Silvertip operation. Coeur's exploration plans will consist of detailed mapping, soil geochemical surveys and reopening old trenches. Coeur has been very active with a multi-rig drilling program at the Silvertip Mine and surrounding exploration targets this summer, and its work will be looking for analogies between the geology at Tim and the Silvertip Mine. Currently, the status and results of this exploration program for Tim is as follows, according to CEO Weber: "Coeur has pushed back the exploration program at Tim to early 2021, to allow for the remediation of the access into the property. The idea is to identify targets for a larger program to take place later in 2021."

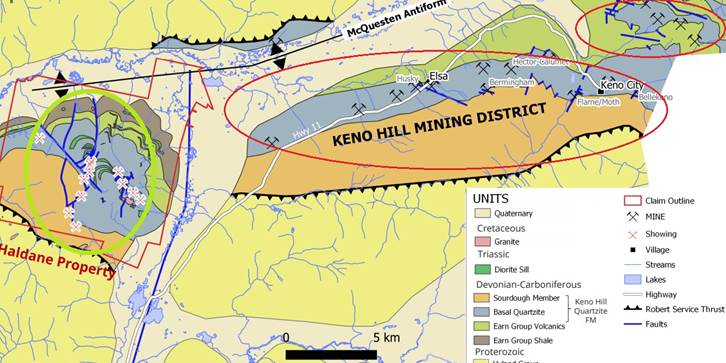

So Alianza has to wait longer than anticipated for Tim Silver exploration, but fortunately it still has its flagship Haldane Silver project with a drill rig turning now. Until recently, the Haldane Silver project in the historical Keno Hill Mining District in the Yukon has seen the most reconnaissance exploration work, although not too much drilling. According to Weber, this could imply promising exploration potential at several targets at both the Middlecoff Zone and West Fault. Alianza is looking to find economic concentrations of vein type mineralization in the Keno Hill District, similar to the numerous historical mines, as can be seen on this map (red ellipses represent mines, green represent silver showings, both located within the gray Basal quartzite units):

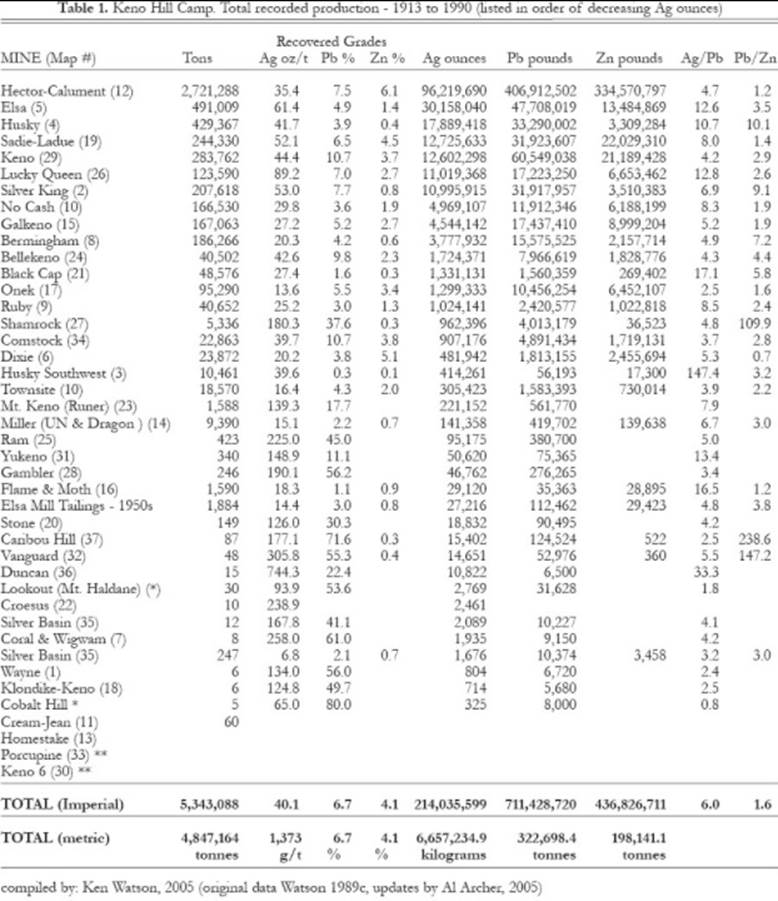

To get an impression of silver, zinc and lead production of the Keno Hill mining district, management was so kind to provide me with a table containing production of all separate mines:

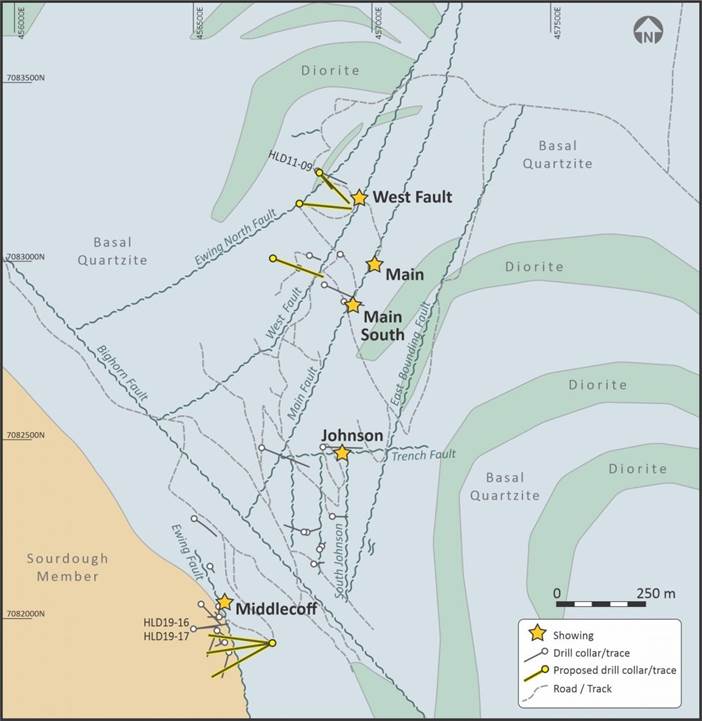

Quite a few mines exceeded 10 Moz Ag, and producing, for example, 1 Moz Ag per annum at grades over 30 oz/t should generate very profitable mines nowadays, so it is clear for me where Alianza is after. Historical drill results at Haldane generated 2.2m @ 320g/t Ag, 1.1g/t Au and 0.7% Pb at West Fault, and drilling in 2019 returned 1m @455g/t Ag and 0.35m @ 996g/t Ag, 1.486g/t Au and 28.35% Pb in hole HLD19-16 at Middlecoff Zone. Another historical underground hole returned 1.2m @ 2,791g/t Ag.

Haldane project; drilling ongoing

Haldane project; drilling ongoing

The phase 1 drilling program has commenced on October 26, a phase 2 program is planned for the spring of 2021, which will also target the recently discovered Bighorn Zone (2.35m@125g/t Ag, 4.39% Pb). The yellow marked collars represent the proposed trajectories of the current program:

I wondered about the analogies between Haldane and the other deposits in the Keno District, and why management thinks the historically mined, silver-rich mineralization is likely to continue at Haldane. Did they identify deeper feeder systems that could have provided silver to all these quartzite zones? Weber had this to say:

"It is clear that the mineralization at Haldane shares all the key characteristics that define Keno-style mineralization: vein and breccia mineralization which is hosted in structurally controlled, complex vein systems with northerly orientations located in proximity to the Robert Service Thrust Fault on the south limb of the McQuesten Anticline within the prospective Basal quartzite unit.

"Additionally, Haldane vein mineralization is comprised of the same mineralogy, galena, sphalerite, tetrahedrite and likely pyrargyrite in manganiferous carbonate and quartz veins. Historical mining at the Middlecoff and Johnson zones at Haldane was very limited in scope and our work in 2019 at Middlecoff points to a high-grade shoot that is relatively flat in its orientation. With high-grade silver mineralization almost 150 meters to the south in the 1960s underground hole UM-02, we feel there is excellent potential for the Middlecoff zone to extend to the south, that we can test in this program."

Looking at the maps, it seems logical for the mineralized quartzite to continue, but as we all know exploration nearology isn't that simple. Let's wait and see what the drill bit brings in.

Conclusion

With the recent closing of an oversubscribed financing of C$3.2 million, Alianza Minerals has a full treasury, and is able to continue drilling at Haldane now, start at Tim next year and, if warranted, could continue at Horsethief. The drilling results at Horsethief disappointed so far, but management and Hochschild aren't ready to call it a day here, and further analysis of drilling data could be putting the pieces of a difficult puzzle together after all. Greenfield exploration is not easy, and a nice example of this that I often use is the famous "Hole 76," indicating that the legendary Hemlo deposit was found only after drilling 75 holes with no results. Times have changed of course, and investors aren't as patient anymore as they were back then, with less options to their disposal at the time and no 24/7 information compared to these days. Notwithstanding this, Alianza is working diligently at three exploration assets, and in my view at least two chances at success. Let's see what Haldane drilling could have in store for us first.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

[NLINSERT]Critical Investor Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Alianza Minerals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.alianzaminerals.com and read the company's profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Streetwise Reports Disclosure:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts and graphics provided by the author.