Maurice: Joining us for our conversation is Christian Easterday, the CEO of Hot Chili Ltd. (HCH:ASX).

Glad to finally have an opportunity to speak with you and to share the value proposition before us in Hot Chili, which has just announced a maiden resource on a world-class copper-gold discovery. Before we delve into the exciting news you have for current and prospective shareholders, Mr. Easterday, please introduce us to Hot Chili Ltd. and the opportunity the company presents to the market.

Christian Easterday: Hot Chili has been toiling away for several years over in Chile on the coastline, some 600 kilometers north of Santiago. And we've consolidated a major copper super hub combining quite a number of our key assets.

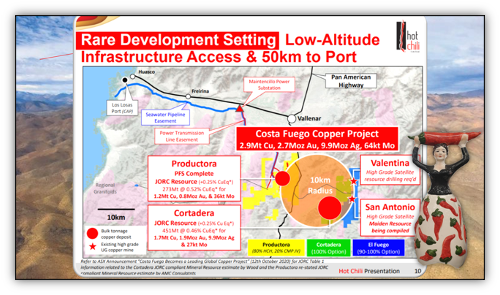

Our original and first exciting discovery, [which] we made it along the coastline was Productora [view here], some quarter of a billion tons of copper and gold sitting very shallow, an open-pit resource that we completed a large amount of work on back in the last cycle where copper was doing well.

And I guess, over the last few years, we've transformed ourselves. And that was off the back of being able to secure an agreement to acquire 100% interest in a very, very exciting discovery that was made only 14 kilometers from our key asset. And that was the Cortadera porphyry discovery.

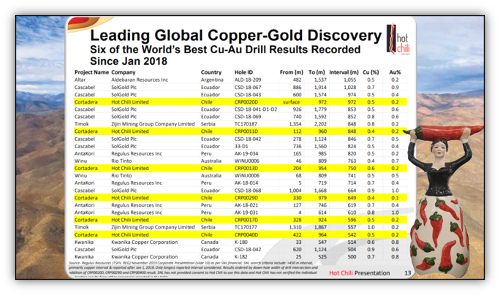

The Cortadera was a private discovery that was relatively unknown to the rest of the world. And it was hiding some world-class drilling intercepts that they'd been walked away and there was no close-out drilling. So we put a deal together that allowed us to secure that asset at the beginning of last year. We commenced drilling that project in April of last year. And we started producing our first world-class intercepts, 1,000-meter intercepts from surface at 0.5% copper and 0.2 grams per ton gold. And since that period, we've recorded some six of the world's top 25 drilling results from Cortadera, which has shot it to quite an enviable position within the global copper space.

So last Monday was a very big milestone for the company. We were able to jump our resource base from a quarter of a billion tons to some three-quarters of a billion tons. And now we're sitting here in a very, very strong position on the ASX really, with no other ASX copper peers alongside us.

And we have a resource base, now, of 2.9 million tons of copper, 2.7 million ounces of gold, and some molybdenum and silver credits thrown in there—so a very, very strong position, sitting with an asset that looks like the next step is going to push the company toward one of the very, very few known major companies holding a tier-one copper asset. It's very, very exciting for the team, the company, and for all of our shareholders to have been able to achieve this.

Maurice: Well, I'm smiling ear-to-ear just like you are right now. Hot Chili has a multitude of catalysts and successes here. And I know you're delighted and so are the shareholders. To set the stage for today's interview, you and I had a discussion last week regarding one of Rick Rule's mini famous quotes regarding the differences between investing in gold and copper. Would you mind sharing that with us? I thought it was quite intriguing.

Christian Easterday: And I'm not sure I've got the facts exactly correct, but he told me, "Christian, you invest in gold as a shareholder to buy your family its next holiday. But you invest in copper for the long-term to buy your family a holiday house."

So very, very different investment space, very different time frames, and almost an order of magnitude and difference in terms of value and capital required to get a copper project off the ground in relation to a gold project, in general. We set ourselves on a strategy to be a junior that could break into that very elite class of projects at tier-one status; some $US35 billion in-ground value generally is the marker in the sand on those assets, and five million tons of contained copper and above, which very, very few companies hold that have not been taken out by a major or have a major that has a controlling interest in.

Rick very much knows this space. And I believe that he was one of the early supporters of Ross Beatty, and the fantastic wealth generation period that Ross went through where he picked up assets in a down cycle over in Chile, and put these large assets together, and simply enjoyed an extremely profitable period as those assets turned into multi-billion dollar assets from acquisitions that were in the sub-$100 million space. So it is a space [where] you look at big, big value numbers and big capital numbers. And there's no better place to be than to be developing a large scale asset in Chile, which is the home of big copper, and where 30% of the world's copper comes from, from these top deposits.

Maurice: Well, it appears that there's a new lineage of wealth generation may be right here before us. To truly appreciate the opportunity before us in Hot Chili, we should first consider the macro-picture on the supply-and-demand fundamentals for copper, as this is a huge component of the value proposition that Hot Chili presents to prospective shareholders. Mr. Easterday, share with us the projected outlook for copper in the next 25 years.

Christian Easterday: Wow. Well, the next 25 years is quite a time frame, Maurice. We generally, in this market, are quite short-sighted in terms of what does the next six months or year look like? So I'll address short, medium and long-term.

The short term, I'll be very honest, is anyone's guess. In such a volatile global market with a global pandemic, a once-in-a-hundred-years pandemic, upon us, there are quite many things to be concerned about and there's also quite a list of things to look forward to. I've certainly been watching some of the fundamentals behind the medium- and long-term view mapped to 25. And it looks very strong.

We're in a changing world that is pushing toward renewables, and electrification of the world is key to that. So not just the renewable energy space, but the EV (electric vehicle) space, in terms of automobiles, is going to transform copper consumption going into the long term. I think that most people know that macro story and it paints a very good picture for players that are in the long-term copper business with large assets, as opposed to the high-grade, short life more associated with a gold investment profile.

We certainly have that to look forward to. Your key people in the industry—the Robert Friedlands that are masterful at talking their book—are very much not that thematic and know that they're holding the assets that are undoubtedly going to receive extreme value transformations over the long period.

But if we move to the medium term, which is where I think most of the copper players are positioning and most of the copper majors are trying to gobble up most of the large assets in the world, I think that you look out in the one- to two-year space and it looks very strong, particularly for a global recovery upon a vaccine being introduced to get the market moving.

But if we can look in the short term and qualifying it with what I said earlier, the space is fraught with uncertainty.

But interestingly enough, this has happened three times in the last hundred years. Bull markets, not just across gold, seem to follow a precursor event, and the precursor event is often a bit of a stall in the global market, associated with the Great Depression, associated with the Asian crisis.

And this has happened before—when everyone thinks that the world is about to shatter to a halt and Dr. Copper is one of those commodities that is a barometer for global growth. It's interesting that we see some of the largest bull runs in the commodity space that the world has seen. And we're seeing that now. We're seeing a real shift in the purchasing of copper from the Chinese, and a real scramble to get ahead to get people's hands on stockpiles. So we've seen a real rise in the amount of consumption going on, at the same time as a pandemic is sort of choking off the ability of the copper industry to respond.

And against all of that, a real fundamental problem with the copper industry is global discovery. The global discovery has four major copper finds around the world that have fallen off a cliff since 2014. So to be sitting here with one of just two major copper discoveries globally, really since 2014—and we have Marimaca, which was discovered and recorded by S&P Global in 2016; a smaller oxide-copper discovery and very good oxide-copper discovery in Chile also.

But really, Rio Tinto and Hot Chili are the beneficiaries of the two most recent copper discoveries we know—for Rio Tinto, over here in western Australia, and of course, Cortadera, which was just announced to the world last year, and now is culminated in a first resource of some 450 million tons from surface.

For Hot Chili to be sitting in that space, and with these problems, that supply of copper is being choked off by a real decline in global high grades, and a decline more importantly in new copper supply—new copper supply that can make that growing demand in the world.

Maurice: And speaking of copper, the company just released your maiden resource [view here] on the Cortadera Copper-Gold Project, which has placed Hot Chili in an elite category among your peers. Sir, walk us through the maiden resource, because this is truly an eye-opener!

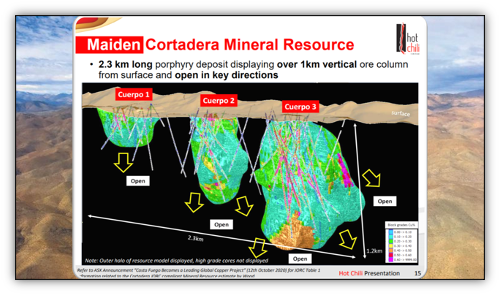

Christian Easterday: It's not every day you drill 17,000 meters of drilling, and in less than one year, on top of 23,000 meters of private drilling that was undertaken. We're talking about 40,000 meters of drilling. And that's produced nearly half-a-billion-ton initial resource on Cortadera. It speaks to the sheer potential of this deposit. We haven't closed out the discovery zone. The discovery zone is some 2.3 kilometers long, comprising three porphyries from surface and extending to almost 1.2 kilometers vertical depth. So these are vertical columns that the company has just started getting its teeth into.

And if it wasn't for the pandemic that hit the world this year, we probably would keep continuing to drill and pushing that discovery toward what we believe is the ultimate potential of copper equivalent (Cu eq), one billion tons.

So we've gone early with the resource, and because of the quarter-billion tons that we had in resource base at our Productora asset some 14 kilometers away, what we've been able to do is bring together the Costa Fuego project that we now refer to—which is a low-altitude play, 800 meters altitude. The Pan-American Highway goes right through the middle of us, and a cluster of deposits that accounts for some three-quarters of a billion tons at about half a percent copper equivalent on all deposits from surface.

The Cortadera is certainly the centerpiece. Most people know that we have a high-grade core that we discovered only a year ago. It is supported really by about nine drill holes, and is already over 100 million tons at a very strong grade, which certainly competes with some of the biggest underground copper mines in the world.

So, a lot to be excited about in the next phase of growth with Hot Chili. But certainly you go early with the preliminary resource and you come out with Cu eq half a billion tons within a year with very little drilling, I think people can see the ultimate potential of this deposit and where it goes next.

Maurice: I admire the intangibles just as much as the tangibles, because the intangibles, they're not discussed in the resource. And I'm referring to the commercial success and the business acumen that define the success of management and the technical teams respectively. You have to tell us, how were you able to acquire this project? Because it just seemed to come out of nowhere.

Christian Easterday: Look, I'd love to tell you we've been a company that just turned up yesterday and have had this amazing success, and we sit with the largest copper resource base on the ASX now and one of the largest gold resources—not forgetting we have 2.7 million ounces in gold as a credit.

But look, when we step back to when we founded this company in 2008, we were privately backed by our chairman, Murray Black, to go over to Chile and try to break into the copper sector there as a junior, which is a very, very difficult thing to do. Chile is owned and dominated by the major mining companies in the world. So doing deals in Chile has always been viewed as expensive. They have a use-it-or-lose-it policy, which makes it hard to be able to break in and get a good land position.

The story of Hot Chili is one of grinding it out and persisting and developing very strong partnerships in-country. It took many, many years of me living over there and refusing to leave some of the companies alone until they would do deals with me, probably just to get rid of me. I suppose persistence is part of the Hot Chili DNA and deal-making is one of our biggest strengths—being able to partner with some of the major mining companies and also some of the very large high-net-worth families that control all of the leases outside of the major company.

So we go back to a period where Hot Chili had a very great success out of its ASX listing in 2010. Three months later, we hit a great discovery in Productora. And that drove a lot of value in the company. And we pushed that through, and we were one of the stars in the market in the copper space back in 2013–'14.

And then, as most people know, the commodity market hit a bit of a brick wall. The copper price fell off a cliff, and that dried up the amount of capital available to invest in big copper. So again, speaking to our persistence, it was sort of four or five years of being on life support from our major shareholders, including the likes of Rick Rule, supporting management, and supporting a vision to build a major copper play on the coastline of Chile at low altitude.

So that was what kept us going and why we never ran away. We had the backing of some very reputable people. And so we sit here today. We used to be among 40 peers on the ASX in the copper development and exploration space, and I couldn't put names on my fingers at the moment. Probably less than five peers, and now we're the largest through that persistence.

But to get to the crux of where we're going with the question, Maurice, it was a few years ago that a report fell off the back of the truck so to speak. And we found out about this private discovery, that it occurred, and when the results of that short report hit my desk and I looked at this thing, my eyes nearly jumped out of my head.

And I was looking at SolGold Plc (SOLG:AIM) drilling intercepts, near one-kilometer intercepts from surface. And when we got our hands on the data, without the knowledge of the owners of this project, it had been handed back to the Corella family in Chile—a very, very wealthy family in Chile that operates mines and owns department stores and a portfolio of 400 retail properties and business chains across Chile and Spain. That group had been given the project back and we were looking at the data. The key thing that I realized was this deposit had been walked away. This discovery did not have that closeout drilling. And we were looking at something that was a blank canvas.

So they had put an estimate on this thing. And I, not for once, believed that estimate was representative of what was sitting there. So we went about two years of trying to [convince] the Corella family that this naturally should sit with Hot Chili to be able to bring this project forward, to be able to apply heavy investment into this, and for the township of Vallenar and that local community to be able to unlock a major copper development on the coastline and employ a lot of people. [That is] something that most Chileans hold true to their heart, that it was two years of negotiating with the Corella family. And really, it was probably a case of them telling me and my key legal adviser, Jose Ignacio, just to go away: "We don't sell assets. We don't sell assets to BHP or Lundin. Why would we sell an asset to you?"

It was really about a relationship build and most of the deals that I've done in Chile are years in the making. And so two years, while we're watching our share price get ground down. Our master plan is to bring Cortadera together with Productora. So we were able to pull off a US$30 million deal over 30 months, in scheduled payments, for 100% acquisition. And I remember doing this deal back in February of last year.

And at that point, our $250 million company was sitting at $10 million value; we were at $0.01 a share. And I think most people were stunned by what they were seeing with the results we showed off this private discovery. But at the same time, we were aghast with, how in the hell is Christian and Hot Chili going to be able to afford this project?

And it's funny how life works. You take on an opportunity and you spend all of that time trying to get that opportunity. And most of the people in Hot Chili were sort of holding their breath for what happened next, once we started drilling it. And to have drilled our first pass RC (reverse circulation) drilling program to confirm that the drill results on the diamond holes that were at surface. The results were real and the assay data could stand up to scrutiny. And then to turn on a diamond drill rig in probably about May and drill one hole that looks good; we went for an extensional hole first.

And then again, as we were compiling the data on this private discovery, we came across the reports from a very well esteemed porphyry expert that had been guiding this team on the Cortadera discovery. And his final report to his boss was probably trying to convince his boss to keep the asset.

We should keep drilling was what we think; we can see that the main porphyry is now, gee, nearly 800, 900 meters long and 600 meters wide, and vertical over 1.2 kilometers. But back then, it was the early beginnings of Cuerpo Three, which means body, body three out of the three major porphyries at Cortadera in the discovery.

And it was, "This thing is getting a higher grade. Give me some more holes. We'll test this concept." So, unfortunately, that guy and that team did not get to test that concept. And as soon as I saw that, I asked the team to turn the mast vertical and I want to drill down this thing and see whether this thing is getting a higher grade at depth, and the rest is history, as they say.

The 750-meter intercept is one of the best intercepts going around in the last two years. But we hit a near-200-meter zone running at nearly a 1% copper and 0.5 gram gold. And, wow, did our eyes open at that point!

So that's when we were speaking to guys like Steve Garwin about this, and we're very, very lucky to have Steve Garwin, who's now one of the key architects of the Cascabel discovery and the growth of that asset with the whole SolGold team, which has done an amazing job building a 10-million-ton copper play with some 23 million ounces of gold up in Ecuador, and is one of the leading discoveries globally.

So to have Steve Garwin come over and say, "I'll help out and I'll lead your team," to guide us through how we're going to model this and target this—I guess the proof is in the pudding, six world-class intercepts now and a maiden resource of nearly half a billion tons within a year, it speaks volumes.

Maurice: This is exactly why I always reference the virtues of having proven management. What I heard in this narrative right here, I heard resiliency. I heard determination and vision. And that now produces success not just for the company but the shareholders. And that's what it's all about. You have to have champions with a proven pedigree of success, and that's exactly what we have right here before us in Hot Chili. And then you blend that in, of course, with the maiden resource. You alluded to this before the commentary, there were the gold credits. Germane to this discussion should be the gold credits. How do they fit into the organic growth of the company?

Christian Easterday: Look, gold is a very, very key commodity for us. Obviously, copper is the dominant value that we hold within our portfolio of deposits in Chile. I see a lot of commentary in the gold sector about the gold majors starting to look into the large, porphyry, copper-gold space and it's very real.

I was a gold geologist for many, many years with some of the Australian notable companies, but also the Placer Domes of the world, and cut my teeth in gold. So back then, I remember I used to go to a biannual conference that talked about the biggest gold discoveries in the world, and gee, over my 20-odd years in this industry, I've seen, at the start of my career, where we used to find plus million-ounce gold deposits.

I remember you couldn't get into this conference unless you had at a minimum a discovery. I think it started at probably about 3 million ounces of gold. Gee, and that New Generations Gold Conference held over here in Western Australia, there are not many gold deposits that sort of sitting in the plus-million-ounce gold space now.

The gold industry is also having a tough time finding large accumulations of gold in one deposit. It's probably pretty natural that they start looking over into the copper-gold space, where the Newcrest Mining Ltd. (NCM:ASX) companies of the world have fantastic deposits like Cadiam and we spoke about SolGold. Twenty-three million ounces of gold sitting in Alpala at the moment and obviously some very exciting exploration upside that some playing out at the moment. But to have a 23-million-ounce gold deposit just on its own, gee, I think that probably marries with one of the biggest deposits that the gold space has been trying for many years to get up and developed, which is Pascua Lama. It's sitting at 4,200, 4,600 meters altitude, with the border of Argentina and Chile going through the middle of the pit they've tried to develop. That thing is what?—$6 to $7 billion, now stated development value for 23 million ounces of gold.

So you get that as a credit now in a porphyry copper-gold deposit. And importantly, you've got the primary value attribute, which is the copper, which if you want to look at it from a gold perspective, wow, you're getting all your gold for probably, I don't know, the lowest quartile of production costs in the industry. So these deposits are immense stores of metal, and gold is one of those things that now has the gold space looking into large, porphyry copper-gold just to be able to get their hands on big gold deposits, and something that the gold industry is finding hard to find is tier-one gold deposits. The five-million and the 10-million-ounce-plus deposits are very rare.

Maurice: Is Hot Chili fully permitted, licensed on the Cortadera?

Christian Easterday: Yeah. I guess we're not an overnight success as we just discussed, with the persistence of Hot Chili. It takes a bit to knock the Hot Chili team down. So we've been at this for a while and that means, outside of your question on permitting—which is a yes, we're fully permitted—all of the leases that contain all of our deposits or resources, mineral resources now, and all of the deposits that will be mineral resources shortly, and added to Costa Fuego's growing inventory, they're all on granted mining leases that we make sure that we had to secure all of the titles.

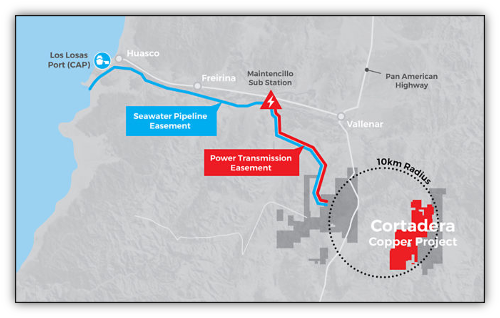

But in terms of permitting, gee, having had spent US$100 million on our Productora asset, which is now just a very large satellite for Cortadera, 14 kilometers to the west, we've spent a lot of money on a pre-feasibility. I spent many years securing infrastructure access agreements with our major partner at Productora, which is the Chile CMP CAP group, one of the big three. They're the largest iron ore miner and steel fabricator and infrastructure business in Chile. So we brought them in for a 20% interest in Productora, into work on that joint venture, and they handed us the keys to the coastline of Chile. Surface rights, easement corridors for water pipelines, for access to water from the coast for electrical easements.

Hot Chili has spent a lot of time setting up the infrastructure. And some of those access agreements—those things take eight, 10 years, generally, to be able to secure in Chile. And, in the background, we've been trying to secure our maritime concession on the coastline to be able to extract sea water. That's been seven years in the making and hopefully, we're not far off—have been one of the very few juniors in Chile to have a maritime water extraction license.

So, Maurice, it's a very good question, because a lot of people don't see all of the work that goes into building a mine. Building a mine is a very, very hard thing to do and it's getting harder. And so your social license to operate and have all of those things in place mean a great deal to any large developer hoping to transition into production, particularly into the major space.

Maurice: Before we leave the Cortadera, there is a multilayered question I have here for you. What is the next unanswered question? When can we expect the response? And what would determine success?

Christian Easterday: I think that's a big question for everybody having. The dust will settle a little on the resource that's occurred, but the market is very forward-looking. So I imagine the next question for everybody is, "Where's the next big drilling intercept going to come from?" And most people know that we're drilling some very big potential at the moment. We're not just sitting and incrementally growing the resource that's still not closed out. We're answering big questions, such as we just focused on drilling Cuerpo Three. And we've discovered this big high-grade core that gives us not just a grade open pit situation, but a potentially very large high-grade underground development opportunity.

So what happens when you drill Cuerpo Two at depth? We haven't done that yet, and we've got a hole going down and meet that at the moment. And let alone what happens when we get over to Cuerpo One and drill that small little porphyry that doesn't have any drill holes underneath it either.

So I think the next question for the market is, "Where's the next real big leg of growth going to come from in this project?" And we even have a drill rig up at a very, very exciting lookalike target to Cortadera, which unbelievably sits two kilometers away—an entire two-kilometer zone that shows a similar footprint to the footprint of the Cortadera discovery that unbelievably hasn't been drill-tested yet. So we just started our second drill hole on that.

So I think the next question for the market is, "How does this sort of near half-a-billion-ton play? How does it become a billion tons quickly?" So we're answering that question now. And I imagine over the next few months, we'll be skirting around and drilling all of these big growth targets. And we hope to answer that very quickly.

What determines success for Hot Chili? It's at the end of the drill bit. I think that the market wonders where everything goes from here with Hot Chili. We're sitting in a space where we've just defined something, where we're up amongst the North American players that dominate the copper sector on the development pipeline and holding all of the big assets in the world. We're this curious thing, probably, for the North American market. We're a big copper play that's just arrived on the back of a kangaroo.

Success for us is being able to play up in the big space amongst the copper developers and aspiring next copper majors that are generally in the $100 million to $500 million space and to be sitting in the ASX where we don't have a lot of peers. It's about translating that value proposition to our market because at the moment, we've just defined probably one of the next very few tier-one discoveries being put to the global copper industry.

So, success for me is our next step. It's at the end of the drill bit, and it's about pushing in three million tons of copper inventory to five million tons and doing that rapidly.

So to do that, we've got to go and answer those big questions. What happens at depth on these other porphyries? Are there other high-grade cores? Do these porphyries come together at depth like what has happened for SolGold at Cascabel when they started drilling deeper? And more importantly, do we have another one two kilometers away? So it's going to be a very, very exciting probably three months, six months. Certainly, a very exciting year as we answer those questions initially, and we focus on building this resource as rapidly as we can.

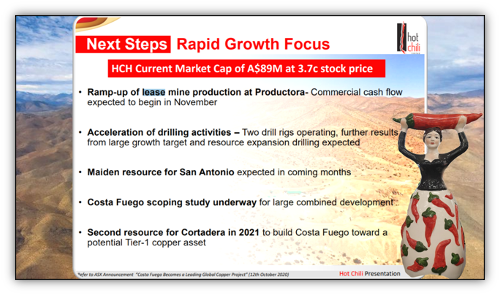

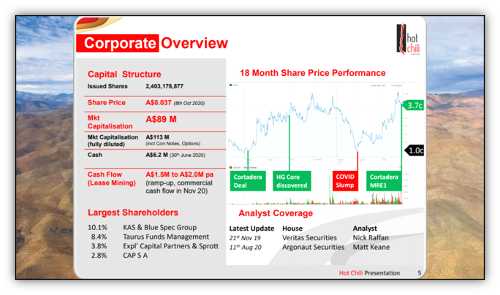

Maurice: All right, switching gears, let's get into some numbers. Please share the capital structure for Hot Chili, sir.

Christian Easterday: You don't go through 10 years in the market and surviving five years of downturn without having a big capital structure. We have 2.4 billion shares on issue and fully diluted, sitting around 3 billion shares. So not dissimilar to where the SolGold guys find their capital structure.

But a very wise person said to me, "Is it easier to go from 40 cents to $4, or easier to go from four cents to 40 cents?" The equation is the same. We look at this as, what's the value of the company, the market capitalization of the company? And we are putting a value proposition to take our company, which at the beginning of last year had gone down to $10 million. And we're putting a value proposition to the market to build our company toward a $1 billion market capitalization. That is the aim and that's what sits underneath that capital structure of 2.4 billion shares on issue. And I imagine that most people can do the math on what that multiple looks like at the end of this journey.

So our capital structure is around 2.4 billion shares. We're trading, I think, at around $0.048 today or $0.049 today. And since this resource announcement, we've been seeing a huge amount of liquidity in the stock. Yesterday, we had nearly $4 million traded. So certainly, we're getting the attention. And yeah, I think we have a very exciting period ahead for our shareholders, and we're very fortunate to still have quite a decent treasury sitting around $4 million in the bank.

And we're advancing well, with option money coming in. And part of the aspect of the Hot Chili story, which is also very important, is we're about to see the first commercial cash flow into our business from a lease mining and processing agreement that we have with the government of Chile. At our Productora asset, we have, a couple of months ago, just commenced mining some of our high-grade material and being able to fill up their local processing facility some 15 kilometers away in the township of Vallenar. And that's been not really about cash flow, although that helps the company out in terms of its expenditure and its working capital position.

But more importantly, that's about our relationship with the government and with the local community and safeguarding jobs. And we have an aspiration to build a very large copper production hub. And if we can help out local jobs and help the government out in that community, then it's a win-win for everybody.

Maurice: You referenced the treasury. Is that the cash and cash equivalents there, the number you provided?

Christian Easterday: Just cash at the moment. So we have a weird situation where our last capital rising put out 0.025 options. And so we have quite an inflow of conversion on those options into shares, which is providing an inflow of cash into our treasury at the same time as we're spending. And hopefully, by the end of next month, we'll see that supplemented with further cash flow injections coming in from that lease money and processing agreement, which we're also in the process of discussing with the government, expanding that agreement. And hopefully, we'll have some news flow coming out on that shortly.

Maurice: Well, that's not a bad problem to have some cash flow.

Christian Easterday: Whenever we're going to develop a tier-one asset with that kind of treasury and even with those modest amounts of inflow, it's very helpful. And no doubt, we're a junior like every junior. If you get success, and the results speak for themselves, and things are going the right way, the market well supports you as your share price lifts. And it's funny how each capital raising becomes less and less diluted.

And more importantly, we go back to where I started this interview with you, Maurice, where I said that the reaction for the Cortadera acquisition was one of amazement, with the drilling intercepts I was saying, and one of sheer terror, and how many shares we would have to put into the market to be able to fund this thing.

It's funny that cause of concern has dampened down on volume as we've gone on with this. It's an exercise of seeing an escalating share price being counterbalanced with the number of shares that the company may have to put out to fund this. But we look at multiple funding scenarios and funding options, and we have a very good dialogue with parties that have much broader funding shoulders than Hot Chili. But at the moment in this market, the market has been supporting me very well. And we have the support of several large institutions over here in Australia, not least of all, some of the large shareholders that have carried us through the bad times.

Maurice: How much debt do you have, and what is your burn rate?

Christian Easterday: We have no debt. We do have a historic debt facility that we took out with our major shareholders with a convertible note. That convertible note has the equivalent of some 200 million pieces of paper against it. But that was an automatic conversion. It converts automatically. I think we have about two years or 18 months left and all of those convertible notes become paper. So a capital structure, you instantly add about 200 million shares to that.

But those noteholders, while they hold the convertible notes, they enjoy a quarterly interest payment of 8% that the company can pay out in cash or shares that are eligible that is based on a floating share price at the end of that quarter. So as the share price increases we have to service that note for the next 18 months or so, with an ever decreasing amount of shares to those convertible noteholders.

But look, we assume that convertible note is paper, and so you can instantly turn 2.4 billion shares into 2.6 billion shares. And so we don't have a debt instrument with the company, and we have an equity instrument that's sitting on our balance sheet. That is why I always talk about our fully diluted capital structure.

Maurice: You've referenced major shareholders. Who are they?

Christian Easterday: Our largest shareholder and our spiritual leader of Hot Chili is Murray Black, our chairman. He's the guy that backed me when I was a young geologist that had a bigger ambition in the world to eventually run my own company. Murray's been my closest friend, my biggest ally, and one of the company's biggest supporters. The Kalgoorlie Group, we sit at 10.1%. We used to hold a 19.9% position, but that has been diluted somewhat. So he's still the largest shareholder, and Murray and the Kalgoorlie Group, which I'm associated with, have well over $20 million of hard cash into the company to support it in each of the raises that we've completed over the years.

After that, we have some very notable names, one of them being the Taurus Funds Management Group, a private equity group over in Sydney run by Gordon Galt, and represented on our board by Michael Anderson. They've been extremely supportive and share the long-term vision of the company and we couldn't have done this without some shareholders like that.

And for the North American market, of course, the Rick Rules of the world and the Sprott Group, which again were instrumental in Hot Chili still being alive and still being here today, to be able to succeed in actually executing this long-term business plan.

We also have local large shareholders in our partners at Productora. The CAP CMP group—they not just have 20% of our assets at Productora in an operating joint venture, but they also have a large shareholding that they've maintained on a register.

And so some very, very notable names and just sitting underneath the 5% level, we have a growing stable of very high net worth over here in Australia, sprinkled in with a growing institutional presence. Look, so they're not over the 5% line, so I am not at liberty to discuss those names. But I imagine, in due course, we'll see some of the Australian institutional and fund space probably growing their positions in the company.

Maurice: Those are some exclusive and reputable names you just referenced there. What is the float?

Christian Easterday: We used to have quite a small retail component. It used to probably comprise about 20%. That retail component has grown to probably about 50% or around 45%. So we've seen a movement to retail, small mom and pop investors. And it's represented by how many shareholders.

You go back to before the Cortadera deal was announced and we might have had a thousand shareholders. We have nearly 3,000 shareholders. So that tells you a lot. We've probably seen a movement of about 25% of our register towards retail now, but that's not uncommon for an Australian stock or even a Canadian stock in the resource space.

Retail has been driving this resource boom or renaissance if you want to call it that. And in Australia, share prices are made and rewrites are instigated and sustained by retail investors and that's been going on for quite a several years. The institutions and the fund space have been taking a backseat to that. They've been instrumental in how the companies have funded themselves going through their rewrites, and some very exciting stories are invigorating the market over here. But it's the retail investors that are driving this. And so the messaging that we have is very much pivoted toward the retail sector and trying to try to give the retail guys what they're looking for.

And so the retail space in Hot Chili, or the float in Hot Chili, is probably around 45% at the moment, which means that the major shareholders, which we used to have 56% of the company in the hands of five players, some of the names I just mentioned, now, those five players represent some 28% of the company. So probably tells you a lot as to what's happened with the changing dynamic on our register.

Maurice: In closing, sir, what keeps you up at night that we don't know about?

Christian Easterday: There are many things to keep a CEO up at night. I'm always extremely interested in my drilling report in the morning, from the two drill rigs on the ground, and hopefully, we'll push that out and have a further drill rig or two on the ground in the coming months. But it's all about what the next 30 or 60 meters of the diamond hole looks like on holes that are exciting, and they dictate the coming year for us. So that keeps me up at night from an excitement perspective.

And then from a worrying perspective, I guess it's this ever-changing environment in the market. Watching the news is one of those things that has your head spinning sometimes, especially what's going on in the U.S. with the election, and where that will push global markets.

But at the moment, having just gone through such an intense phase for our company trying to produce a very robust resource figure that can be scrutinized by many independents that no doubt will have a look at that in the coming months, I sleep pretty well after not sleeping probably for about 12 weeks and going through that resource so thoroughly that we ironed out every little thing that we couldn't understand or it didn't make sense. And why is the block out grade of the model here and why is the assay right here? These things don't make sense. And spending 12 weeks of my life hunting down every little aspect of that resource that could make that bulletproof and representative of the world-class asset that is coming together.

So now, I'm sleeping pretty good, but you do wake up at two o'clock in the morning and go and have a glass of milk and try and make sure that you can get four or five hours of sleep and turn your brain off. So those are the things that keep me up at night.

Maurice: And if anyone's questioning your veracity, I can vouch for it that you and I are 12 hours apart and we've been in discussions here in the last month and a half. And whenever I pick up the phone or send you an email, there's a response immediately.

Christian Easterday: There's one thing about having your head office over in Perth, where your family is, and having all of your people and your operations over exactly 12 hours out. So all of the people in Hot Chili are quite used to late-night emails and conference calls and very early morning conference calls and emails, etc. So yeah, we run a 24-hour business, and management has got to be switched on 24 hours a day. So you get used to it, Maurice.

Maurice: All right, sir. Last question, what did I forget to ask?

Christian Easterday: Gee, pretty thorough interview. Maybe we can think about that for next time. And hopefully, I'll be able to give some of your viewers an update, and we can address some of the things. For now, we'll maybe save some powder and keep it dry for our next interview.

Maurice: Looking forward to it, sir. Mr. Easterday, please share the contact details for Hot Chili.

Christian Easterday: Visit our website at www.hotchili.net.au and you can find us on the ASX:HCH.

Maurice: Mr. Easterday, it's been an absolute delight to speak with you today. Wishing you and Hot Chili the absolute best, sir.

Before you make your next bullion purchase make sure you contact. I'm a licensed representative to buy and sell physical precious metals through Miles Franklin Precious Metals Investments where we a number of options to expand your precious metals portfolio from physical delivery, to offshore depositories and precious metal IRAs. Call me directly at (855) 505-1900 or email [email protected]. Finally, please subscribe to Proven and Probable, where we provide mining insights and bullion sales. Subscription is free.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

[NLINSERT]Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Hot Chili Ltd. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Hot Chili Ltd. is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Disclosures for Proven and Probable: Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.