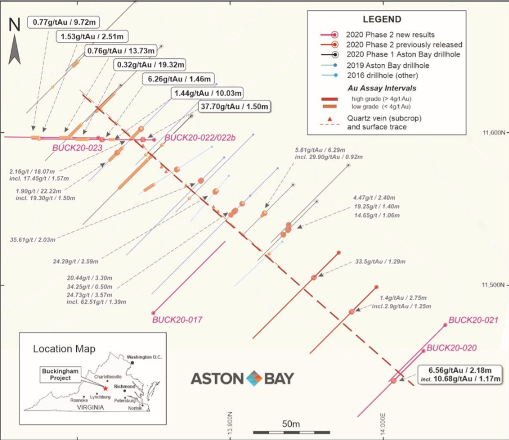

Aston Bay Holdings Ltd. (BAY:TSX.V; ATBHF:OTCQB) announced results from its Phase 2 drill program (seven holes, 803 meters [803m]) at the Buckingham Gold property in central Virginia (USA). Phase 2 added to the 1,218m (10 holes) from Phase 1 in March.

The new holes included one strong, very near-surface intercept [1.5m @ 37.7 g/t gold, @ 16.3m depth]; another good shallow interval of 1.5m at 12.5 g/t; and 6.6 g/t over 2.2m in a 50m step-out. Note: All drilling in past 18 months has been <~90 m in vertical depth, so we're wide open at depth!

Four of today's reported drill holes intersected quartz vein material, indicating an along-strike extension of 150m from last year's drilling—for a total strike length of >200m for the vein.

Yes, everything has been taking too long, but drill results are good

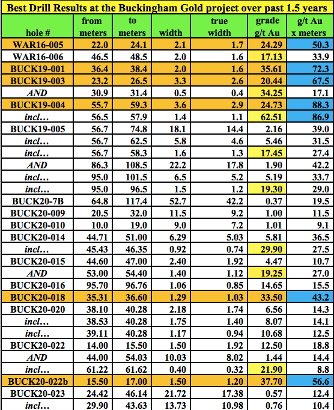

Instead of focusing solely on the latest results, I review all (the best) recent drilling activity at Buckingham (see chart above) and conclude that we're off to a promising start. However, make no mistake, it has taken a long time to get here.

Slowness in obtaining drill results in Virginia has been due to a combination of COVID-19, protracted negotiations with partner timber companies, delays at the lab and difficulty raising capital. It took 551 days (1.5 years) from the start of drilling at Buckingham in mid-April 2019 to today's press release.

As evidenced by the share price and company valuation, taking longer than hoped for to reach this stage has exacted a toll. Aston Bay is in the bottom 10% of junior gold stock performers. That's not good. However, I argue that the drill results have not been bad, they've just been slow to unfold.

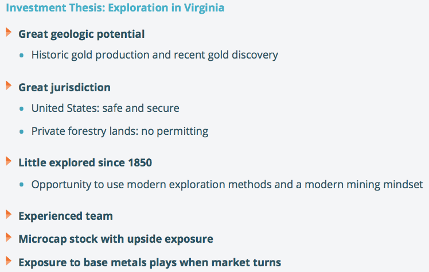

Despite these challenges, I continue to believe that the company has one of the best management teams/boards/technical teams of any North American gold junior with a market cap under $50 million ($50M). (BAY.V market cap = CA$7.4M/US$5.6M). And, Virginia is a tremendous jurisdiction to work in. [Note: While nothing's been announced, management will probably need to do an equity capital raise in the near future to explore and drill more aggressively on three properties in Virginia.]

More important than the delays—how about that gold price!

For readers and shareholders who are frustrated, I feel your pain. I'm a shareholder myself. But, ask yourself, if the entire body of drill results at Buckingham had come out over the course of six months instead of a year and a half, would you be happy with the progress? For me, the answer is yes.

Furthermore, readers are reminded that when drilling at Buckingham started in mid-April of last year, the gold price was ~US$632/ounce lower than it is today. That's right, gold is up +50% in the past 18 months!

Does this spectacular increase dominate the exploration delays? Some might disagree, but I say yes.

The high-grade, near-surface Buckingham Gold project in Virginia

The northwest–southeast trending Buckingham Main Zone comprises a series of visible gold-bearing quartz vein outcrops extending over a strike length of ~200m at surface. Grab samples have returned up to 701 g/t Au (22.5 troy ounces).

Buckingham remains open at depth and along strike. Drilling has identified several high-grade intercepts at shallow depths. The six best drill holes (in orange, on chart at top of page) have an average depth of just 32.5m.

Those six intervals averaged 2.3m at 29.4 g/t gold. The latest strong intercept [1.5m @ 37.7 g/t gold] was intersected at 16.3m depth. Is there anything better in mining than near surface + high grade?

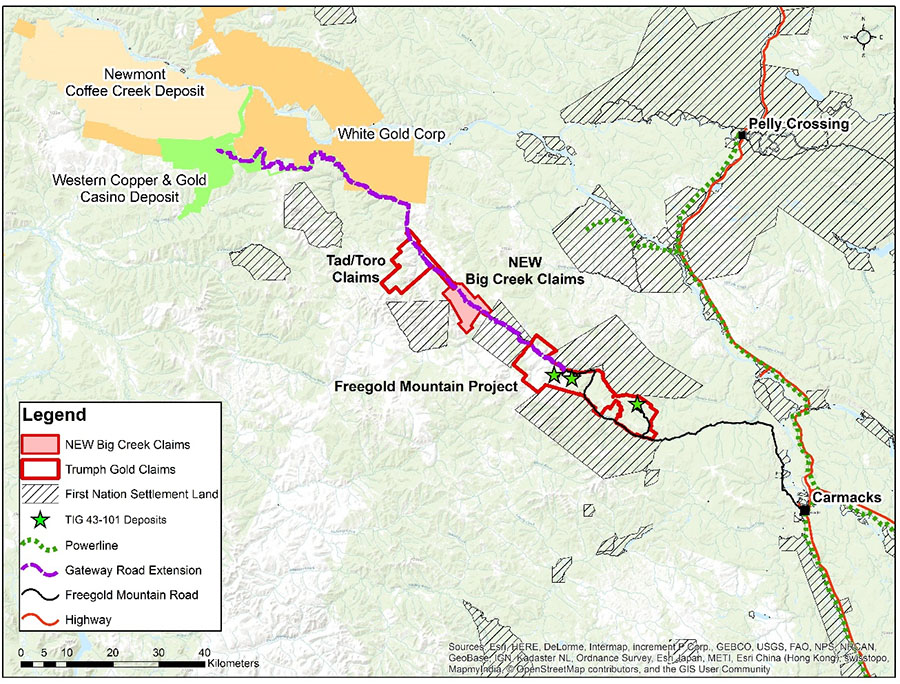

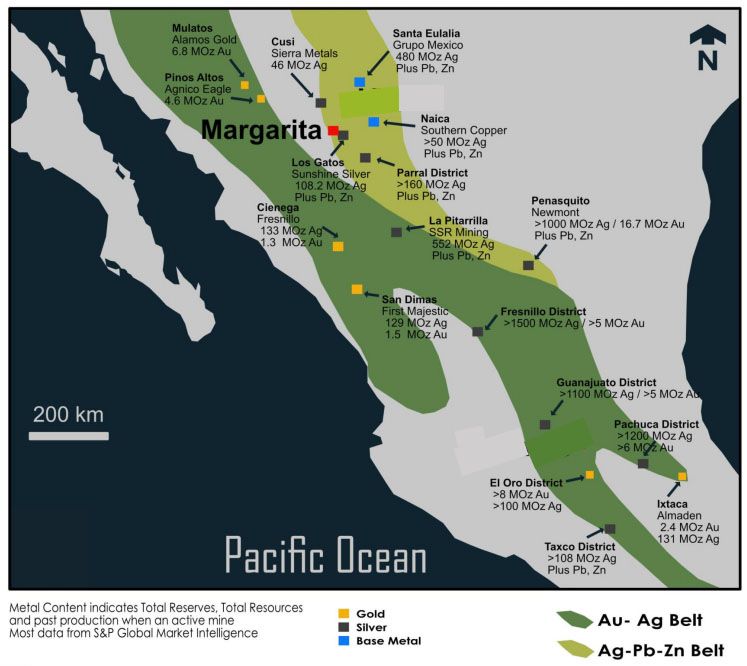

The gold-bearing system at the Buckingham gold project is in the Appalachian orogenic belt, host to past-producing and current mines plus advanced gold exploration plays stretching across Georgia, the Carolinas, Virginia, up to Nova Scotia and through to Newfoundland.

OceanaGold's analog Haile mine (4.4 million ounces @ 1.5 g/t gold)

This belt hosted > 250 gold mines prior to the California gold rush of 1849, but has seen minimal modern exploration.

Production in the Carolina Slate Belt includes OceanaGold Corp.'s (OGC:TSX; OGC:ASX) Haile mine in South Carolina, forecast to produce 200,000 ounces next year (peaking at 250,000 ounces later this decade), for 14 years (4.4 million ounces (4.4 Moz) Measured, Indicated and Inferred at 1.5 g/t gold). In February 2019, Haile reported impressive drill results to a maximum depth of 436m.

Compare Buckingham to recent results at peer projects. Last month Radisson Mining Resources Inc. (RDS:TSX.V) drilled 45.9 g/t gold over 2.1m, but at ~500m vertical depth. Ascot Resources Ltd. (AOT:TSX.V) hit 6m of really strong mineralization at ~250m. Wallbridge Mining Co. Ltd. (WM:TSX) delivered a wide intercept at nearly 25 g/t gold, but at ~1,000m.

To be fair, there are a number of companies with strong results at depths of <100m, but most have much higher market valuations, or are in less favorable jurisdictions—perhaps with less access to critical infrastructure, and relatively more complex and expensive drill programs.

CEO Thomas Ullrich had this to say about the Buckingham gold project: "Our drill programs confirmed a high-grade, at-surface gold vein system at Buckingham as well as an adjacent wider zone of lower-grade disseminated gold mineralization. With almost no rock outcropping at surface, this discovery is a testament to the exploration expertise of Don Taylor and his team, and confirmation of their exploration thesis. This is just one of several targets in the region generated by that team, most of which are still to be investigated.

The next step is to examine potential subsurface extents of the Buckingham Vein. We're excited to follow up this discovery with an IP geophysical program to delineate anticipated down-dip and along-strike extensions. In addition to Buckingham, we plan to conduct similar geophysical programs this fall on two other properties where shallow pre-1850 mining also confirms the existence of near-surface gold. We're eager to use modern geophysical methods on these properties, methods unavailable to historic explorers, and to follow up with drilling."

Three properties with near-surface, high-grade gold potential in Virginia

How many US$5.6M companies have not one or two, but three highly prospective properties, in a strong jurisdiction, with limited drilling histories, and having had very minimal (if any) modern exploration?

Not all exploration projects have nearby roads, power, water, workers, mining services, year-round mining and no permitting required for exploration or drilling.

In addition to 4,953 acres surrounding the Buckingham vein, management has locked up agreements for another 4,399 acres of private land around several historical gold mine workings in Virginia.

An exploration program, including surface rock and soil sampling, has been completed on land located over and adjacent to two historic past-producing mines. Results from 194 soil and rock samples are pending. Continued exploration in these and other brownfields areas is planned throughout the fall.

Conclusion

Aston Bay Holdings has fallen off the radar screen of most investors. Sure, there have been disappointments, but that's why a compelling investment opportunity exists to acquire shares in the company at a valuation of just US$5.6M. This is a company making slow, but steady, progress in the midst of a robust gold bull market.

If results were not so near surface, or did not boast considerable high-grade gold values and multiple zones of lower-grade disseminated mineralization, I would not be nearly as enthusiastic.

If the management team, board and advisors were less impressive or the three Virginia properties were in Africa or central Asia—I would not be so optimistic. If the valuation were 3x higher, the investment proposition would be a lot less compelling.

No, Aston Bay truly has a lot of good things going for it. It's not as sexy or as well promoted as some other high-grade gold juniors—like several in the Golden Triangle of northwestern British Columbia, Canada—but many of those names are up >500%. By contrast, BAY.V is up just 29%, from a 52-week low of $0.035/share to $0.045/share (down $0.01 on today's news).

More boring exploration work, punctuated by continued good-to-very good, near-surface and increasingly deeper high-grade drill intercepts, along an expanding strike length (currently >200 meters), should attract new investors. There's a great deal of blue-sky potential embedded in Aston Bay's anemic valuation. Will patience be rewarded in coming months?

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

[NLINSERT]Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Aston Bay, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Aston Bay are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Aston Bay was an advertiser on [ER] and Peter Epstein owned shares in the company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts and financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events and news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.