Maurice Jackson: Joining us for a conversation is Tim Termuende of Taiga Gold Corp. (TGC:CSE; TGGDF:OTCBB).

Sir, please introduce us to Taiga Gold, and what is the unique opportunity the company presents to the market?

Tim Termuende: Taiga Golds is a new company. It's only been around about two years. Our flagship property is the Fisher Property located in Saskatchewan. All our projects are located in Saskatchewan. And we feel that due to the nature of Saskatchewan being very underexplored, yet holding very high geological potential, we think we have a good chance to enhance shareholder value.

Maurice Jackson: To truly appreciate the opportunity before us, I believe it is paramount to understand the genesis of Taiga Gold, which is a spin-out of Eagle Plains that has a lineage of rewarding shareholders with multi-baggers. Mr. Termuende, share with us the history of Taiga Gold and what is the relationship with Eagle Plains?

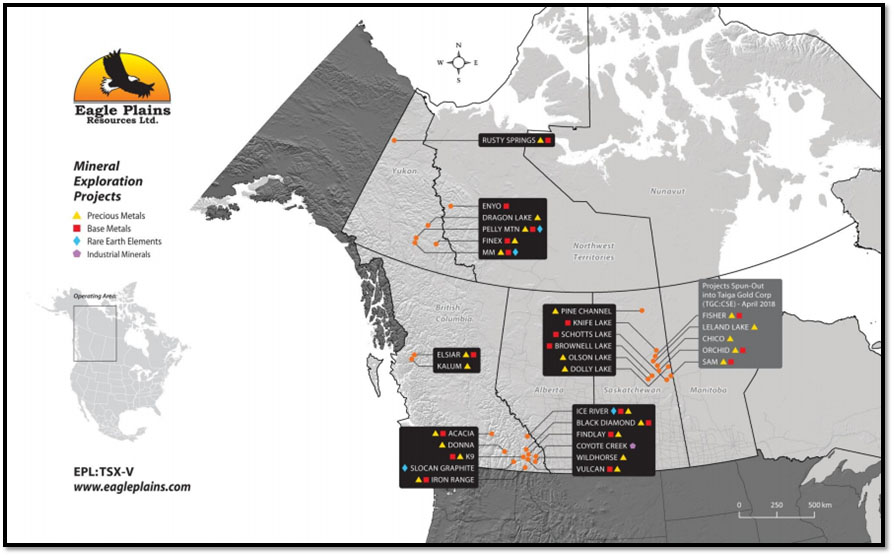

Tim Termuende: We have to go back almost 30 years. Eagle Plains was founded by my father and me in 1992 and listed on what was then the Alberta Stock Exchange in 1995. Eagle Plains has been a public company for over 25 years. Eagle Plains is a prospect generator. We have a basket of projects that we work on regularly, and we do constant research and acquisitions.

When Eagle Plains has a project that sort of takes a life of its own or sort of rises above all the rest of the projects, we find that the rest of the projects kind of got eclipsed there. They sit in the shadow of this flagship property that's sort of been developed by us or by a partner, with a partner.

And so, what Eagle Plaines does about every three or four years is spin-out a project into a separate company and basically dividend our shareholder's shares in this new company. It's an interesting, rewarding kind of a different approach, because we're taking a perfectly healthy company with a great project and getting rid of it. But we transfer that benefit directly to our shareholders. We've done that a few times over the years through Eagle Plains; our most successful spin-out was Copper Canyon Resources, which in 2011 was taken out in a hostile turned friendly merger with multiple resources and our shareholders benefited about $65 million on that transaction.

We found when we were working on Fisher and got a good deal with our partners on Fisher, that the same thing was happening. The Fisher Project was rising above all the rest, and as a result we determined: "now it's time." We spun out Fisher into a new company called Taiga. We also took several projects that were in the Fisher area and put them in Taiga's project portfolio. This was a way of directly benefiting our shareholders. In the meantime, Eagle Plains continues to execute our busines model of acquiring projects, constantly working on them, waiting for the next one (project) to rise above.

Maurice Jackson: From a 30,000-foot level, take us to northern Saskatchewan where the company has strategically acquired six projects located along the Trans-Hudson Corridor, which is just an absolute wonderful environment for discoveries. For those of us that are not familiar with the Trans-Hudson Corridor, please tell us about the region, why it is the focus of your project portfolio.

Tim Termuende: The geology of the Trans-Hudson Corridor known as an orogenic belt that has very similar rocks to other belts of this type in other places in Canada, namely the Red Lake District in Ontario and the Abitibi belt in Quebec. What's different about the Trans-Hudson Corridor is that it has had very, very little exploration over the years.

I think that if you tally up 2018, for example, in Quebec, there was almost $500 million in mineral exploration in Ontario. Yet, just over $150 million in Saskatchewan, and the same kind of prospective rocks. The belt of rocks in the Trans-Hudson Corridor hosts several gold mines, despite its relative lack of exploration, such as the McClellan Gold Mine, the Snow Lake Gold Mine, the Seabee Gold Mine, which we are very closely associated with. And the biggest in that package is the Homestake Gold Mine located in South Dakota; it's within that same belt. The Homestake Mine is over 40 million ounces and was one of the biggest gold deposits in North America.

What's also interesting about the Trans-Hudson Corridor, is most of it is undercover. Once you get north of South Dakota, you get into grasslands that extend up into central Saskatchewan. It's only when you come out of the prairie fields of Saskatchewan that the Trans-Hudson rocks become exposed again.

And in areas that have had exploration, which is still relatively few in this area, there have been fantastic discoveries made. And we plan on being involved in the next one, with any luck.

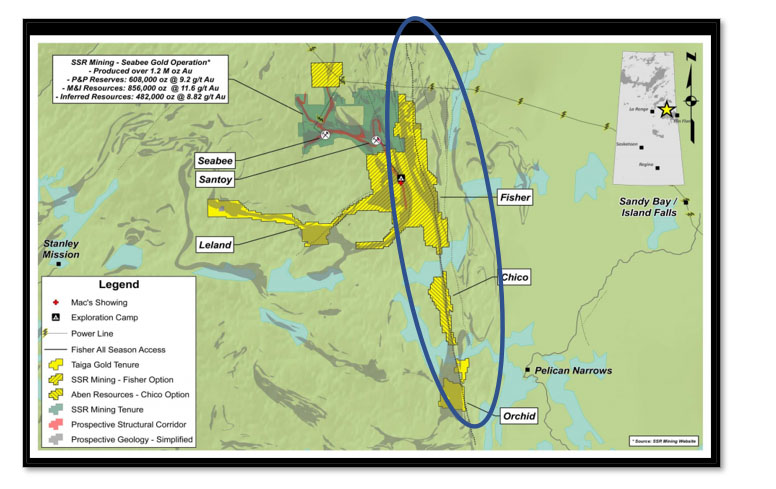

Maurice Jackson: Closing in at the 10,000-foot level, take us through Taiga's project portfolio, beginning with your flagship Fisher Project, which in my opinion is in the right place at the right time. Sir, please acquaint us with the Fisher Project and the potential before us.

Tim Termuende: The history of Fisher Project goes back actually to 2012. Eagle Plains was conducting research analysis and we were notified by the Saskatchewan government that they were going to conduct a map staking system, which means you don't have to go out there with field crews in helicopters or floatplanes and cut down trees and flag lines. It's a very capital-intensive endeavor. Map staking is a much more cost-effective way to acquire tenure. The first people in to stake online get the ground.

The government gave us a date when map staking was coming online. And we prepared as we had been planning for it for a couple of months in advance. One month before the staking date, we locked a couple of geologists in the basement and told them to "research everything you could see in Saskatchewan. Go through all the older parts, find an area that we want to stake on opening day." Our geologists came up with the area just south of the Santoy Deposit as the number one priority staking target.

On opening day, we were ready for it; we staked it. We were successful in acquiring the ground we wanted. And it turned out that our property boundary butted right up against Claude Resources, who at the time owned the Seabee and Santoy deposits. We were able to stake within a kilometer and a half of the actual decline of the Santoy. So we were very, very happy with the outcome. And we worked on that property for a couple of years, with Eagle Plains.

And then in 2015, Silver Standard Resources took over Claude Resources in an all-stock deal that was $350 million. But what Silver Standard was after was the Seabee Mill, the Santoy deposit and the ground around it and in between it as an exploration project. It wasn't long after the ink dried on the deal between Silver Standard and Claude that we were in negotiations with Silver Standard on our Fisher property. They wanted our Fisher ground. They made it very clear when we were negotiating and they've been on the property ever since.

Silver Standard, which is now SSR Mining, have been great partners. They have been aggressively exploring the Fisher property now for four years. They've spent over $10 million exploring the property, and have drilled about 79 holes on the property right now. Taiga Gold is very, very bullish on that. We've also got other projects in the area that have a lot of geological similarity to that, but the Fisher Project is the flagship property.

And our hope, in the end, is that SSR will have exploration success, enough to warrant taking out Taiga as a whole. And that's what we've planned all along. That's normally what we plan with our spin-outs they're built to be bought. And we hope that Taiga is one of those in a chain of them.

Maurice Jackson: And speaking of SSR, there's a red line that begins on their property and extends to the middle of the Fisher Project. What does that red line represent and how may this significantly increase the value of the Fisher Project?

Tim Termuende: The red line is the Santoy Shear. It was discovered in the mid-1990s, where SSR were mining at the Seabee Deposit, which is directly beneath or around the Seabee Mill. They were also exploring the rest of the property. And there was a big fire year, in the mid-1990s. The fires exposed a whole bunch of outcrop that normally you wouldn't get to without trenching and other expensive procedures. Luckily, the forest fires exposed mineralization that in the end turned out to be a deposit, which is right along the Santoy Shear.

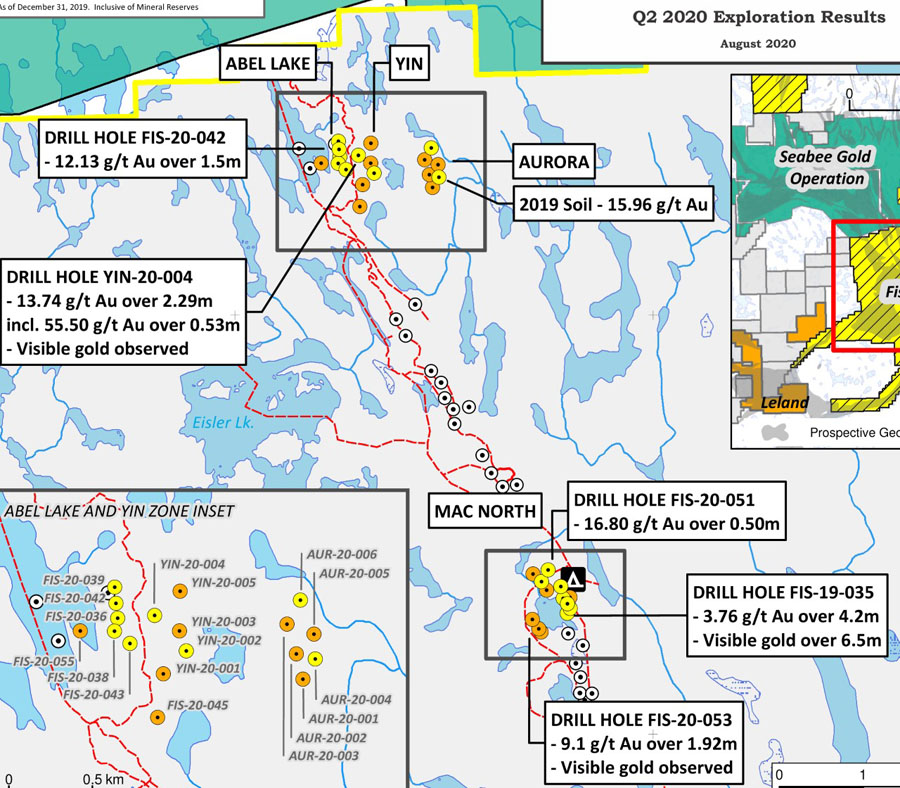

The Santoy Shear runs roughly north-south. And since SSR has started working on the Fisher property, they've traced the shear through the entire length of our property. Roughly 25 kilometers now of the Santoy Shear goes through the Fisher Property. And it's that shear that is the focus of exploration for SSR in the past and going forward in the future.

Maurice Jackson: If we're looking at the map here and we moved to the right of the Santoy Shear, there's a black dotted line coming through and it's a fault. Can you tell us about that fault and why all of your projects are strategically aligned along that fault?

Tim Termuende: That is a fault that is call the Tabbernor Fault Structure and it's a major regional structure; it goes over 1,000 kilometers. In fact, the Tabbernor Structure does reach all the way down into South Dakota. And exploration in the past now, so far in our neck of the woods anyway, has shown that the Tabbernor seems to be sort of a trunk or a root structure. And it splays off the Tabbernor that are the focus of mineralization, so that the Santoy Shear is a splay off the Tabbernor, the Seabee Shear is a splay off the Tabbernor.

So all of our projects in that area, the Fisher, the Chico, the Orchid, the Leland, are focused on splays or sheers that we believe are linked to the Tabbernor's structure and all have sort of the same genetic model, as what's being mined now at the Santoy and historically mined at the Seabee deposit.

Maurice Jackson: And going back to the Fisher Project, can you provide us an overview of the genetic and exploration model that has Taiga Gold basically in full confidence that this may be the next multi-bagger spin-out from Eagle Plains?

Tim Termuende: We see that the Santoy Shear is essentially the structure that is being mined. We now know—we didn't know when we staked it—we hoped that it continued through our property. It's now been confirmed by mapping and exploration by SSR and drilling to some point, that this shear is present. It is a very strong exploration target. And that's the focus of our exploration at Fisher and their exploration as well.

Maurice Jackson: The Fisher Project has some neighbors that are heavily invested in the region, who have also had some drill success near your property. Who are they and how do they fit into the narrative?

Tim Termuende: The neighbors are SSR and they are exploring at their risk and their cost to earn an interest in our property. They have been working away at it since 2015. But this year, 2020, they did a drill program that targeted six different areas of the Fisher property. They were only able to get to four of the six target areas. And in three of the four target areas, they intercepted very, very significant mineralization.

Three out of four targets hit in the last program. The other two targets they have not been able to get to yet, for various reasons. One is COVID, another is there were freeze-up conditions last winter. So those targets remain high priority targets that we understand that SSR will be tackling in the near future.

It's very important to remember exploration is a very risky business. You do have to kiss a lot of frogs, trust me, in this business. Having another company spending that much money on our property that is absolutely non-dilutive to us from a capital standpoint is as good as it gets for us.

Maurice Jackson: And leaving the Fisher, Taiga has four more, make that five more as of this week, projects in their property portfolio. What would you like to share with us about them, respectively?

Tim Termuende: Each one of our other projects has a genetic similarity or a geologic similarity. They are all structurally hosted gold targets. All of the targets have high-grade mineralization documented in the past. There has been very little exploration in Saskatchewan, so we feel that a lot of these targets have very good potential, and ultimately, we would like to think that they may be attractive to SSR in the future as well. Taiga Gold is working on each project at various stages right now. Noteworthy of mention, they all share the same target model, in that they are structurally related gold targets.

Maurice Jackson: What type of activity is actively being conducted on your projects at the moment?

Tim Termuende: We have just finished a field program on the Sam Property. Fisher is going to see more exploration in Q4. SSR is planning a 3,000-meter program on Fisher. We also have an option partner in our Leland Project and they are planning a program this year. The Chico Property is currently at a standstill right now, but that is optioned to Aben Resources, so we expect more work in the future on that. Two other projects, we have the Orchid Property and the recently acquired Mari Lake Property. We are planning programs on those this year. We just haven't got firm budgets in place yet, but we will be on those projects to see what we have.

Maurice Jackson: Let's discuss some important topics germane to the projects. Are your projects 100% owned, or do they have any reversionary interests?

Tim Termuende: All of our projects are 100% owned. A couple of them have options now, as I mentioned, the Fisher's optioned, the Leland's optioned, and the Chico is optioned off. All of the projects that we do own 100%, there may be are one or two claims within these packages that have a small underlying NSR or 1 or 2% NSR. Those are claims that we had to purchase from another prospector or do deals with other staking groups to consolidate these projects. But overall, yes, 100% interest and 100% control at this point.

Maurice Jackson: Always good to hear. We're going to get into some numbers later in this discussion, but from a capital expenditure standpoint, how is the infrastructure on your projects?

Tim Termuende: In Saskatchewan, it's very good. A lot of the projects are floatplane access, which makes it quite easy to get around. A couple of them have road access. The entire Seabee Mine operation has a year-round road. They have a winter road that they do their main hauling in, but over the other months of the year that the winter road isn't active, everything is done by air either by floatplane or by wheels. Occasionally, we have helicopters used, but for the most part, it's floatplane access.

Most of these projects also do have winter road access. Should we get to the point where we have a major drill program or major camps to build or whatever, we would certainly use the winter road access option, which is quite cost effective from an exploration point of view.

Maurice Jackson: What is your relationship with the First Nations?

Tim Termuende: Overall, I would say it's excellent. Most of the First Nations in northern Saskatchewan is very pro-development. The road isn't without speed bumps. There is a group around one of our projects, around the Chico Project that there's a small group within that community that is opposed to development in that area. And that's a route where we're working on right now. We've been doing a lot of consultation. We feel we're making progress and we'd like to think that's getting better and better. I'd say overall, our relations are excellent.

Maurice Jackson: Are you fully permitted?

Tim Termuende: Depends on the project. The Fisher is fully permitted. The Leland is permitted. The Orchid, we're waiting for a permit. Most of our work at this stage is more grassroots. So, for us to go in and do geophysical work or geological mapping or prospecting or soil sampling, the permitting issues are essentially minimal or nonexistent. But yes, for the bigger programs that are planning drill programs, yes, they're permitted.

Maurice Jackson: Is the ultimate goal for Taiga Gold to build a mine or discovery and then sell the projects?

Tim Termuende: No. We are not mine builders. We're not mining engineers. We're geological explorationists. Our goal is to find an economic deposit, prove it as an economic deposit, and then sell it. It's a completely different skill set for people to go into mining. I've seen it happen a lot of times that exploration companies think they can become miners, and it usually doesn't end very well.

Maurice Jackson: Yes, it certainly is a different skillset.

Tim Termuende: And we're not kidding ourselves about that. We're very excited about making discoveries, but also monetizing them through a sale to actual miners that know what they're doing.

Maurice Jackson: We've discussed the good; let's address the bad. What can go wrong and what are your action plans to mitigate that wrong?

Tim Termuende: Well, I guess the world's seeing it right now. COVID-19 has been a challenge for us. It's slowed down exploration at Fisher because in mid-March, SSR shut down the Seabee Mine due to COVID restrictions. And because the Seabee Mine is the hub of exploration for SSR in that area, a lot of the work that they were planning to do on Fisher this summer got deferred until the mine reopens. SSR just announced a few days ago that the mine is reopening now, so it's getting back to business as usual.

But we're also finding that a lot of our projects are in or around First Nations communities. And a lot of those communities have locked down. Much of our work when we go in would be conducted off the floatplane docks in the middle of one of these communities. Now that's very difficult to do. Therefore, we have had to sort of change our logistics to fly in off a lake along the road kind of thing. It adds a little complexity and a little bit of cost, but that's certainly something that can go wrong.

Realistically, we could see the market fall apart again. We have spent the last nine years sort of struggling to keep everything going and keep all our people employed and to keep our offices open. I don't think we're coming out of this bull market anytime soon, but it's certainly something that we have to be aware of and we have to plan for if it happens.

Maurice Jackson: Switching gears, let's discuss the people responsible for increasing shareholder value. Mr. Termuende, please introduce us to your board of directors.

Tim Termuende: Myself, I'm the president and CEO. I'll just say overall too, that our board is of six directors we have on our board, four of them are geologists or geological technicians or geographical technicians. We also have a chartered accountant and a lawyer on our board. Our board is very geologically strong with enough horsepower on the legal and financial side to get everything done.

I am a 35 year veteran of mineral exploration. Started with Cominco when I got out of the University of British Columbia in the late 1980s. Chuck Downie's is VP exploration. He and I worked together with Cominco back in the 1980s. He and I have worked together for just about 30 years. Chuck's the DPX.

We've also got Paul Reynolds as a director, he's a geologist as well. He too has over 30 years of exploration experience and also experience corporately; he's had a couple of successes on the corporate side, as well as successes on the exploration side.

We've also got Jesse Campbell as our COO. Jesse runs TerraLogic Exploration, a consulting service that's owned by Eagle Plains. Jesse's worked with us for 20 some years. Also, Glen Diduck is our CFO. He's an accountant by trade. I've worked with Glen since the mid-1990s. Also Darren Fach is our corporate counsel and a director, and he's our lawyer out of Calgary.

So again, very, very skilled set of individuals with collectively 150 years of exploration experience and corporate experience on publicly traded companies.

Maurice Jackson: You have a proven pedigree of success. Tell us about Tim Termuende and what makes him qualified for the task at hand.

Tim Termuende: I'd like to say I have a Ph.D. in the school of hard knocks. I have a geological degree of B.Sc., but I've been involved with public companies for over 25 years now. And I've seen it all. I've experienced virtually everything from mergers to consolidation. I've seen everything you can see. I've ridden through three or four of these cycles now, bear market, bull market cycles. I think I can recognize them now. I think I know how to take advantage of either one.

For a company like us, like Taiga and Eagle Plains, which I'm president of both, we start to see these bear market downturns as opportunities too. We have successfully been able to seize these opportunities in a bear market and make hay in the bull markets. And again, we are in a bull market now. I think everybody would agree to that. Our whole board of directors, again, with our experience, has seen those same cycles. We've been very successful in the past with Eagle Plains of delivering great returns to our shareholders. And I think we're poised to do that again.

Maurice Jackson: Who is on your management team, and what skill sets do they bring to Taiga Gold.

Tim Termuende: Management is Chuck Downie, essentially, and Jesse Campbell as well. We're all very seasoned exploration people. We have had a lot of experience now in primarily in Western Canada, that's where our primary operations are. We also have a couple of things going on in the Yukon and Northwest territories.

But essentially, we are focused on Saskatchewan. We are getting a very, very good handle on the geology and politics of Saskatchewan along with the intricacies of working with First Nations. As far as infrastructure goes and logistics go. I mean, all of that experience pays off over time and for us, we feel it's paying off now.

Maurice Jackson: Tell us about your technical team.

Tim Termuende: Our technical work is run through TerraLogic, which again, Jesse Campbell heads up TerraLogic. TerraLogic has a very, very strong geological capability; very high tech. Most of the employees of TerraLogic are younger folks. Unlike the board of Eagle Plains; we're mostly older, the mid-50s, and on. The average age of TerraLogic workers is probably 30 to 40. And again, these people have been with TerraLogic for a long time. We've got a very strong, loyal group.

And Jarrod Brown, who's our chief geologists with TerraLogic, has been working in Saskatchewan for 15, maybe 20 years now. And again, he knows his way around very well. And Jarrod, frankly, was instrumental in us getting a lot of the projects that are now in Taiga. So yeah, I think we have a very strong technical group and poised to move forward with that.

Maurice Jackson: All right, let's get into some numbers. Please share your capital structure.

Tim Termuende: Taiga Gold has roughly 80 million shares outstanding and roughly 20 million warrants that are currently in the money right now. That is a double-edged sword. Yes, there's an overhang on these warrants, but it also will be generating a lot of cash to the company. Should these warrants get exercised, we would expect to see another $2 or $3 million come into the treasury.

Maurice Jackson: How much cash and cash equivalents do you have?

Tim Termuende: We have roughly $850,000 in cash and receivables. Roughly $100,000 in shares in other companies. Again, we've mentioned that we have optioned a couple of our projects. So with those option deals come cash and shares to the company. So $900,000 to a million in treasury right now.

Maurice Jackson: How much debt do you have?

Tim Termuende: We have zero debt.

Maurice Jackson: I always love to hear that one.

Tim Termuende: Yep.

Maurice Jackson: What is your burn rate?

Tim Termuende: Our burn rate is a modest $33,000 a month. Again, we are pretty lean and mean, and everything's close to the bone.

Maurice Jackson: Who are the major shareholders and what is their level of commitment?

Tim Termuende: The largest shareholder in Taiga right now is Eagle Plains. When we did the spin-out, we kept 19.9% of the shares of Taiga in Eagle Plains. Eagle Plains owns 12 million shares of the 80 million shares outstanding. Other large shareholders, myself, I'm the second-largest shareholder. My father is the third-largest shareholder. And then we've got groups like Teck owns some shares, NovaGold owns some shares. Essentially it's retail-based. We don't have a lot institutional investors. RedCloud Capital participated in our last financing.

But a lot of our shareholders too are long-term Eagle Plains shareholders; because of the nature of the deal, when we spun out Taiga, we did it on a one for two basis. So every two shares of Eagle Plains got one share of Taiga. So most of our shareholder base are Eagle Plains shareholders who have been with us for a long time, who appreciate what we're doing, who have had the wins we've had in the past from these spin-outs we've done. I consider those shares in fairly safe hands.

Maurice Jackson: What is the float?

Tim Termuende: Given the discussion that we just had earlier, I would say there's probably 20 to 30 million shares that are in float right now. The last financing we did, a lot of people participated that I had not known before, or were not sort of part of our history. I would say 20 to 30 million shares.

Maurice Jackson: Well, that's always good to hear. Are there any redundant assets on the books that we should know about?

Tim Termuende: Not really, no. Again, it's a fairly new company, only two years old, two and a half years old. Everything's out there that I think would affect our share price moving forward, or our chance of success moving forward.

Maurice Jackson: Are there any change of control fees? And if yes, what is the compensation?

Tim Termuende: A couple of our management contracts, myself included, have a break fee or a change of control fee. I make roughly $96,000 a year. I have a change of control of two years' salary if that happens. One or two of the directors have a similar contract in place, but again, not an onerous amount of money if that ever came to be.

Maurice Jackson: No, that's certainly isn't, I'm used to hearing seven figures or something. So you're not a lifestyle company?

Tim Termuende: No.

Maurice Jackson: Is management charging a consultant fee for any services?

Tim Termuende: Myself, again, I run my fees through a private contracting company, and again, that's $96,000 a year. Other directors are mainly salaried. All of the salaries are well under $100,000 a year. Most of the directors do not take any salary. Myself, Mr. Downie and Mr. Campbell are the only ones that regularly draw the salary. So again, that's why our burn rate is so low.

Maurice Jackson: All right, sir. In closing, multilayered question. What is the next unanswered question for Taiga Gold? When can we expect a response, and what determines success?

Tim Termuende: Good question. The next unanswered question is what lies beneath. All of our projects are our grassroots green field projects. They all need drilling; all that drilling costs money. We have partners carrying the load on a couple of these projects. Again, the main one is the Fisher Project, $10 million in expenditures so far. We see that to continue certainly in the next quarter. SSR just announced a 3,000-meter program for Fisher starting in mid-September.

It's a loaded question, but it comes down to success at the drill bit. We can't guarantee that we're going to have a deposit. But we are very confident given we have so much of the Santoy Shear on our property; very little exploration on it. The exploration that has been done is starting to yield results now.

Some of the drill intercepts that SSR had, which was announced in May, we're actually if they were on that Seabee gold operation property, they would be considered ore grade intercepts. SSR Mining starting to hit those on the Fisher property. Their stated goal now is to target inferred resources. So as they develop these areas that they know are starting to shine, they will focus their drilling activity on those areas.

In the past, they've been picking away along the Santoy Shear looking for hot spots and they've now found three hot spots. They will be focusing on those while they continue to do exploration further to the south and throughout the whole property.

Maurice Jackson: Sir, what keeps you up at night that we don't know about?

Tim Termuende: Reading business emails just before bed, but that's an aside. What concerns me a little bit, is like I just mentioned, a lack of success at the drill bit. From what we've seen here in the last round of drilling that SSR has done into Fisher, I see that as being unlikely right now. I am a little worried that this COVID situation will get worse. We haven't seen the second wave as the first wave has inconvenienced us. It has caused again, logistical challenges for us; a little extra costs because of that.

But if COVID gets much worse, we will see a lot of the areas, particularly remote areas, particularly areas that have native communities clamping right down. And that'll make it very difficult, I think, to have meetings, to get permits, to do anything. I mean, everything's been slowed down already. If it gets worse for us, it will, in turn, get worse.

Maurice Jackson: Mr. Termuende, last question. What did I forget to ask?

Tim Termuende: How about, why is Saskatchewan so underexplored, because it is, given the favorable geology that is very similar to large belts elsewhere in Canada. I think that would be a good one to dwell on. And the short answer is, Saskatchewan for years had a socialist government from 1944 to 2003, over those 60 years, 40 or 50 of those years was a socialist government. And they were very great if you were a civil servant or a farmer, but not so good if you were an entrepreneur or a resource developer in the province.

For many of those years, the Saskatchewan government forced companies to joint venture with the government. It was almost bordering on the communist regime and it drove away investment without a doubt. I talked to Mike, you're familiar with Michael LaBach.

Maurice Jackson: Yes.

Tim Termuende: He said he grew up in Saskatchewan and he had to leave in the mid-1980s because there was just no work. Nothing was going on there.

It's a symptom of mostly political reason for a lack of exploration in an extremely high potential mineral belt. And the Saskatchewan party that's in there is a central right government. They're very, very pro-development. Saskatchewan government right now has an incentive program for that part of northern Saskatchewan, where they will refund or rebate up to 25% of drilling costs.

They have certainly shown that they are open for business. Bringing on map staking as they did in 2012 is a very, very strong signal that they're open for business. And frankly, our experience is, they're putting their money where their mouth is.

Maurice Jackson: Mr. Termuende, for someone readers that wants to get more information on Taiga Gold, please share the website address.

Tim Termuende: www.Taigagold.com.

Maurice Jackson: Mr. Termuende, it has been an absolute delight to speak with you today. Wishing you and Taiga Gold the absolute best, sir.

Before you make your next bullion purchase, make sure you call me. I'm a licensed representative for Miles Franklin Precious Metals Investments, where we have several options to expand your precious metals portfolio. From physical delivery, off-shore depositories, and precious metal IRAs. Call me at (855) 505-1900, or you may email [email protected]. Finally, please subscribe to Proven and Probable for mining insights and bullion sales. Subscription is free.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

[NLINSERT]Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Taiga Gold. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Taiga Gold is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Aben Resources. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Aben Resources, a company mentioned in this article.

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.