Maurice Jackson: Joining us for a conversation is the chairman and president of Novo Resources Corp. (NVO:TSX.V; NSRPF:OTCQX), Dr. Quinton Hennigh.

What a delight to have you back on the program today as Novo Resources has just positioned itself 'On the Fast Track to Production.' Dr. Hennigh, before we begin, please introduce Novo Resources and the opportunity the company presents to the market.

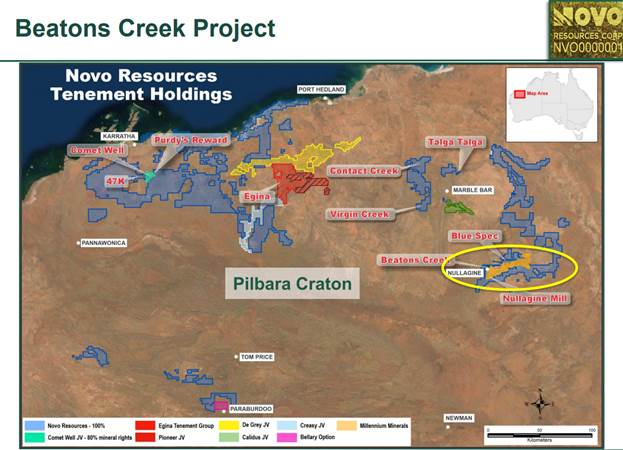

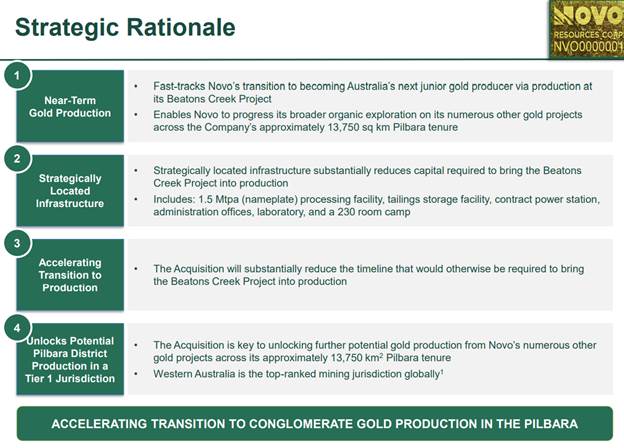

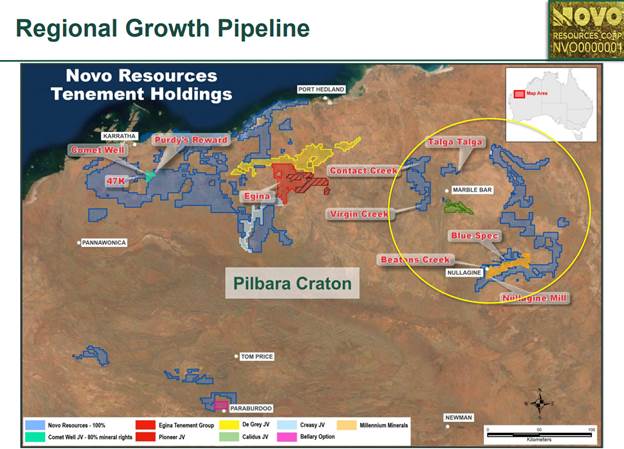

Quinton Hennigh: Maurice, you and I have interviewed several times over the past three years, and I've always talked about NOVO being an explorer, but now I get to talk about NOVO going into production. So, here we are! We are moving towards production through a new acquisition. We are focused in Northwest Australia, in a region called the Pilbara. The Pilbara is better known for iron ore, perhaps, but we've discovered conglomerate gold deposits, which are unusual with respect to most gold deposits, but they're what we think is a very, very big prize, and we're just delighted to be able to now put these into production.

Maurice Jackson: Speaking of the Pilbara, let's go to the 100%-owned Beatons Creek Project where Novo Resources has some breaking news. Dr. Hennigh, what would you like to tell shareholders?

Quinton Hennigh: Novo has been advancing Beatons Creek now for 10 years. We acquired the project through an earn-in joint venture with Millennium Minerals, the neighboring company when we first started. Mark Creasy also put in some ground into NOVO through a joint venture. It was a ground that surrounded the Beatons Creek area. So, that's really where we got our start. We started drilling there way back in 2011. We advanced it to a point where we had an initial resource in 2013. We upgraded that resource in 2015, and we've been diligently working on this deposit since. We've been doing a lot of hard yards around things like native title, getting a commercial agreement with the native corporations. We've also gotten our permitting done. We have our oxide permitted and so forth. These are things that we've been ticking away at on the background. They're all done. They're ready. Why are they ready? Because we wanted to put this in production.

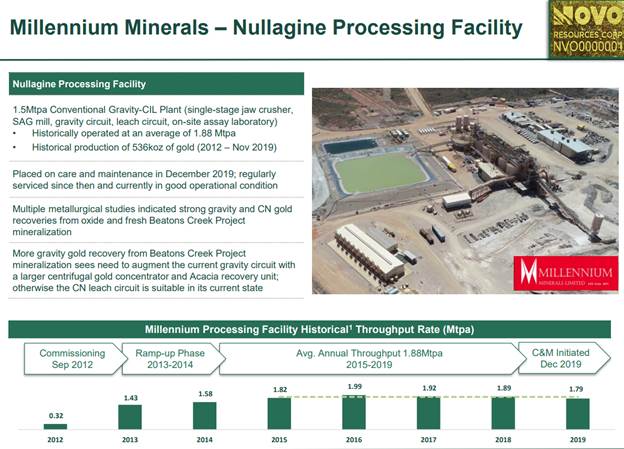

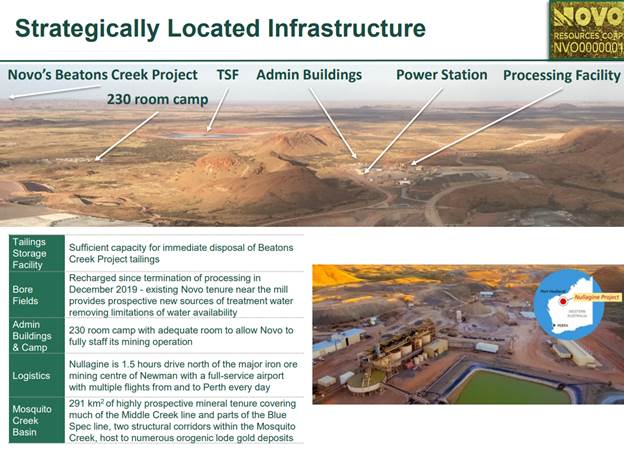

There's a mill very nearby, belonged to Millennium Minerals, which was an operating company until late last year. They mined their oxide deposits, depleted those. Got into their sulfide, had some struggles around recoveries around the sulfide mineralization. So, they had cash flow issues and went into administration around November 2019. The company then went through receivership, and came out the other end in May. We've just announced that we're acquiring the Millennium company in its entirety, out of the private current holding company, which is IMC Holdings out of Singapore.

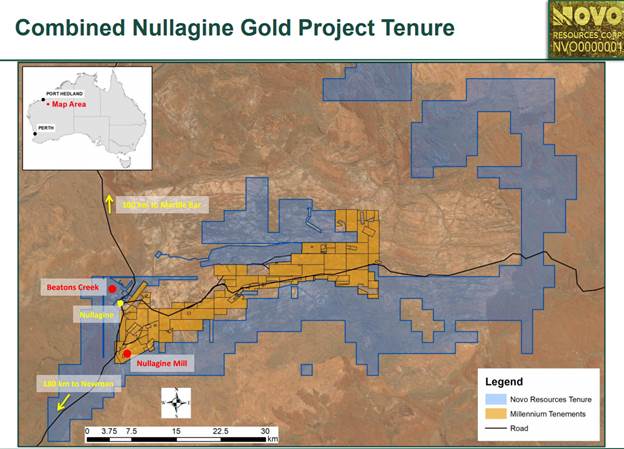

This, combined with our assets in the region, basically bolts together the entire Nullagine district, which is a big win for us, but it also gives us access to we'll call it a very large mill. It's been operating a 1.88 million ton per annum over the past few years. And it is ideally suited. It's ideally designed. It's compatible with all our mineralization of Beatons Creek. So we're delighted because this gives us a fast track to production.

Maurice Jackson: I always talk about the geological and business acumen that the entire team has. And I always share with people when I reference your name, you are a business and geological chess grandmaster, and this transaction exemplifies it because you've strategically positioned the company to grow organically. Can you talk about that some more?

Quinton Hennigh: To grow Novo organically has been our chief objective. I worked for Newcrest many years ago, and it was a time when the company was just getting started and it grew through organic means. I want to replicate that. That was a fun experience. Love exploration. I love the possibility and potential of finding more deposits and moving them towards production.

In this case, we're going to use this acquisition as a foundation. This mill has a good capacity. We can use Beatons Creek as a base load, but we have lots of other assets in the immediate region. We also have assets across the greater Pilbara region, as you know. What does this do for us? Well, it allows us to start tapping some of our existing assets, particularly in the immediate area, and looking at those now more on a production-based schedule. We can start advancing them through the various motions, permitting and so forth, that are needed to get them into production.

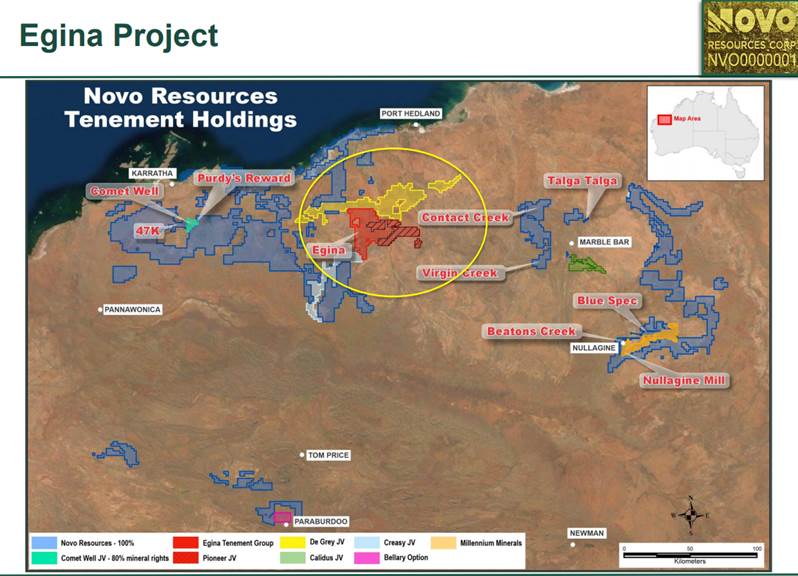

So, that's a big win. I mean, we're looking at building a pipeline of deposits we can bring online, keep production going at the mill for many, many years, but the cash flow also allows us to open up other projects. Egina, for example, we can now fast track through the cash flow that we're deriving from this operation. As people know, the Egina story is gravel at surface. We envisioned mining it, on a continual mining basis where we have machines in the field that mine, process, recover the gold on a continual basis. So, this can be fast-tracked now through this cash flow.

Things like Karratha, way out in the West Pilbara. Karratha is interesting. It's a conglomerate deposit, very similar to Beatons Creek, but it's got very coarse gold. What do we know about it? We know we can mechanically sort the rock there, upgrade the rock and produce a very high-grade concentrate. What this mill does is it gives us a place to put that concentrate. So we can now turn Karratha into a new producing asset. Let's say we scale it at something just hypothetically like a million tons a year. I'm not saying that's the number we're picking, I'm just saying for easy math, so people can understand where we're at mentally around this. A million tons can be reduced to maybe 10,000 tons of concentrate. So a hundred to one, and then that concentrate will have a resulting grade that's much, much higher. You know, approximately 101. All right, so you can then truck that concentrate over to Nullagine, put it through the mill and you have instantly increased gold output. This is a huge win for us!

Maurice Jackson: Yeah, it certainly is. And if you could, could you somewhat compare and contrast the strategic vision you have in the cash flow versus what this transaction did to the balance sheet?

Quinton Hennigh: As an exploration company, you don't have cash flow. You're always reliant on equity raises to sustain yourself. We're moving past that now. We're going to have very good cash flow. I think this acquisition, the production we'll see from it, is going to make NOVO self-sustaining for forever at this point. I mean, that's our vision.

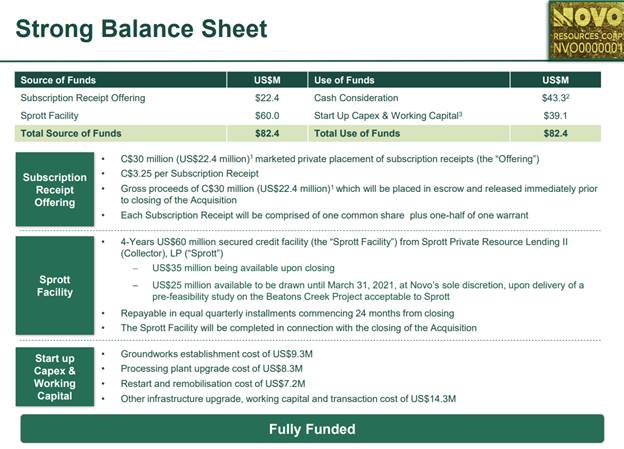

Regarding cash balance, we had just under $30 million in the bank at the time we announced this deal. We do have to pay up for the asset. We have to pay in cash and shares. We also have to capitalize on the operation. We know what needs to be done. We've estimated the capital that's required. We figure it's on the order of $30 million. So let's go through the numbers.

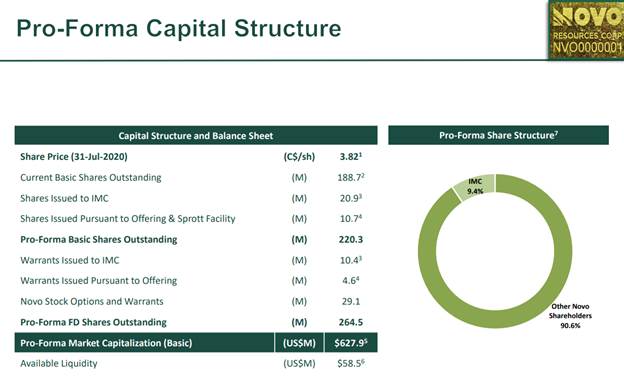

Right now, I think $26–$27 million in the bank. We have a loan facility that helps with this acquisition. That was from Sprott Lending. By the way, that loan facility was very key. We had that support from Sprott on that front to help us get this deal done, to demonstrate to IMC that we're not mucking around and we're very serious about getting this deal done. So, the Sprott Lending facility, the first tranche, about $35 million US, which is I think roughly $45 million Canadian at the moment. All right, that gives us a lot of the cash we need for the acquisition. Now we're raising some as well. We announced the raise of $30 million on the back of the transaction that was on Tuesday. It was upsized to $42.5 million on Wednesday, I believe it was Wednesday afternoon. That money will help go to pay the remaining cash for the purchase price, but also help capitalize on things.

Okay. So, we've thought about this inside and out. We know exactly what kind of magnitude of dollars we need to make things work. We didn't want to be caught short. God forbid we'd do something like try to acquire this and then go back to the market to raise money. That's usually the kiss of death because everybody knows you need money desperately at that point. We did this in what I think it was the right way. We were aggressive about how we pursued the equity raise. The guys at Sprott, including Eric and the head of Sprott Lending, knew that this loan that they gave us would help leverage a raise. Okay? So we're coming out of this smelling like a rose. In my view, it was the optimal case for advancing this and getting us into the position where we're a producing company.

One thing, Maurice, that's important for people to understand, and it's this context that is really where our mind is at, okay? Production companies don't just fall out of the sky. To go from exploration to production, there's a kind of quantum. You have to have money and effort and so forth that you have to get past to make that leap. Well, most exploration companies, if they advance their project and they have to take it to production, they have to oftentimes spend years and capitalize things. And I mean, it's a painful exercise. By the time they're to the point of building the mine, they dilute, dilute, dilute. In this case, 15% dilution. If you think about that for a minute, we're an exploration company. We're making this quantum leap. Both the acquisition and the capital we're raising debt to meet this goal is going to result in something like 15% dilution. I think that's a huge win. I can't think of any exploration company that's made this kind of leap for that little sacrifice. So, I think it's a great outcome.

Maurice Jackson: Well, I don't think you're alone. Look at how the market has responded. You start with $30 million. The market says, "No, no, no, we want in and we want more." Just speak to the shareholders if you would there.

Quinton Hennigh: Having the support from our shareholder is extremely encouraging to see that level of support. I can share with you that we had a lot of existing shareholders show up. Literally, as soon as this deal was announced, Leo and I were getting calls like, hey, you wouldn't believe it. Leo's phone message bank or whatever was full almost instantly. I had probably 200 or 300 emails come in within two or three hours of the announcement. You know people interested in helping with the finance, and we were just busy scrambling, pointing them in the right direction. Who to talk to, etc. But we got it done. I mean, it was very encouraging to see that level of interest. We got the money that we need. And I think we'll have a lot of very happy shareholders here when they see how well this story's going to perform. This is going to be... I think this will be one of the lowest-cost gold producers in the industry, quite frankly. Very good ending.

Maurice Jackson: And speaking of that, I had an opportunity to interview a mutual friend of ours, Bob Moriarty, the founder of 321Gold. And he shared an interview that we just did this week, that NOVO Resources in his opinion is going to be the biggest gold company in the next 50 years. That speaks volumes when it comes from Bob. If anyone knows Bob, and I know you know Bob, he is a straight shooter. He's a marksman, he's a sniper. And for him to make that comment, that's a tall order, but that's how much confidence he has in what you're doing there.

Quinton Hennigh: Bob's been down to Australia, to the Pilbara, many times now. I think at least six times that I can remember. He knows all of the assets. He's been to most of them at least once, if not multiple times. He knows the potential. He's been there from the beginning and we're very grateful for all the help he's provided. I remember the first time I met Bob was before NOVO. It was in 2008. It was during the global financial crisis. And I was running a company called Evolving Gold at the time. We had a project in Wyoming. We drove up to Wyoming in the middle of a blizzard. I remember this. Bob was just chattering away the whole way up in the car, and I'm desperately trying not to drive off the highway, but we made it up there. We made it up to the top of the mountain. He looked out the window. He said, "I'm good," and we drove back in one day.

Maurice Jackson: Yeah, that's Bob.

Quinton Hennigh: You know how Bob is. Anyway, he came over to the Pilbara, I think in 2009 after I told him about this project. This is before NOVO, of course. He helped... we'll say persuade Mr. Creasy to do the deal with us. Bob's been there at every step. He knows the story of the company very well, and he's been a tremendous help. So we're very grateful.

Maurice Jackson: Now, sir, before we leave the Pilbara, do we have an expected timeline on when production will begin on the Beatons Creek?

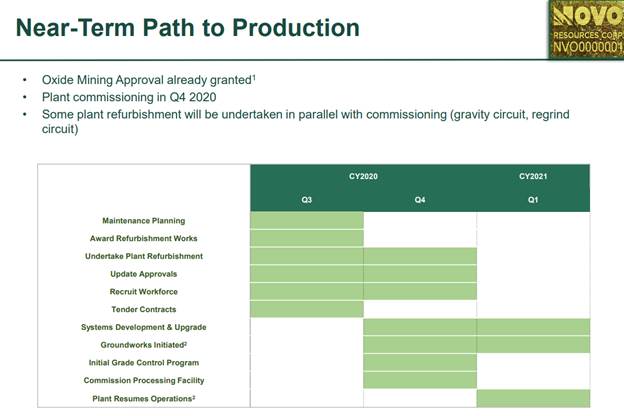

Quinton Hennigh: That's a very good question. Just so people know, we do have our oxide or stage one permit at Beatons Creek, so we've done all that work in the background to make sure that we're ready on our side. What we couldn't advance until we had this acquisition out of the way was the permitting on their side. So we need to obtain permits for disposal of Beatons Creek tailings in the tailings facility, for example. These are formalities. This is not a huge undertaking. It's just stuff we have to do. These things are going to take a few months, maybe three or four months. So by the end of the year, we expect to have all our permits in hand to go ahead and start processing rock. But in the meantime, because we do have the mining permit, we envision commencing mining excavation activities within a few weeks after closing the deal, right?

So from right now, the timeline looks like this. We've got probably a three- to four-week period to close the deal, close the financings, get everything done and dusted. They will then do things like they're going to do... we'll call it an initial grade control program on the areas they're going to start mining. That's doing some RC drilling and very rapid assaying and so forth to understand and better define. It's just a part of mining, very controlled drilling. And then we'll start excavating, and probably in the first part of the fourth quarter. The goal is to get a stockpile of ore to the mill. Build up a stockpile of maybe a few hundred thousand tons before the mill's turned on. That gives us some breathing room. We don't want to be left scrambling. We will probably flip the mill on sometime, maybe late this year, but probably more likely first quarter next. My bet is first quarter.

Bear in mind, we have a lot of things to do right now. We've got to hire a lot of people. We're going to have a big, big, big company here soon. So, everybody's down in Australia, scrambling. I'm very lucky, because I'm in Colorado, so I don't have to do all that stuff. I let the professionals handle that, but look, we're quite busy.

Our ore has more gravity gold, so we don't want to just put the rock through with the mill in its current configuration. We want to put a gravity circuit on the front end that's more compatible with the large volume of gravity gold we expect. So we'll put out a beefier gravity circuit. It's not a big dollar item, it's just something that has to get done. It's probably, a million and a half dollars or so.

We have to do some, we'll call it cosmetic work on the mill itself. We have to re-line a couple of tanks and stuff. They're looking at haul roads and all of these things, okay? There's a lot of things that have to be ticked off before we get into production, but we'll get there. We'll get the team to do it. I'm very confident in everyone. We have hired a new GM; Chris Mardon is his name and he's a very well-seasoned mining engineer. He has operated many mines. He'll run circles around us.

One of the other things that I'd like to address is this: the water that's needed for processing, Millennium always struggled for water. They started production in 2012. They had very little cash to work with at that time. So they kind of tried to... we'll say bootstrap the water situation by drilling water bores on an as-needed basis, but it always a bit off-center. They just couldn't keep up with the water demand. We don't want to get in that situation. The ground we picked up from Mark Creasy here recently is very critical because that ground, especially the ground to the south, has some rock that we know is highly fractured, has a lot of water in it. What that means is we can now take the next few months, drill proper bore fields, make sure we have a source of water. We don't want to get off on the wrong foot here. We want to have lots of water ahead of us. So there's a lot of things we've been thinking about for many years. Everything we've done is very deliberate, very focused on getting our production in place. We've seen this day coming for a long time. And here we are.

Maurice Jackson: Today's press release is a huge, huge feather in your cap, but let's leave Beatons Creek here if we can, for a moment. You've got a commanding land package of 13,750 square kilometers. Talk to us about the other projects in the property bank.

Quinton Hennigh: Let's talk about the opportunities in the immediate vicinity. First of all, at Beatons Creek itself, now that we have 100% control on the ground surrounding Beatons Creek, through buying out Mark Creasy, his joint venture interests, we can now expand the deposit right there. So that's a huge one. I think we'll be able to grow Beatons Creek dramatically within the next few years.

We have other things, like we bought Mt. Elsie from a private party. That's a gold system that many people have known about for eons. It's right there in the Nullagine camp. It's been a stranded asset. We're going to get out there and explore it. I think we might find some nice add-ons onto our production story.

Here's a real win for us. This is one of the best in terms of just immediate potential: the Golden Eagle deposit, which was Millennium's main pit, which is right next to the mill. There's an extension of that deposit onto the ground that we bought from Mark Creasy recently. When I say extension, geologically, we see the deposit going over onto this ground. We think that there's a very good chance we can discover oxide resources right there, right next to the mill that could quickly be developed. What's a win like that? I mean, that's worth something right there. Okay. So, all of this stuff we've been doing around acquisitions and stuff, very strategic, we knew exactly what we wanted and how we're going to bring it into this picture. We've been thinking about this for years.

Let's step out a little further from Nullagine. Let's go up to the Marble Bar area. We've got Talga Talga. That's a load system. We've talked about it in the past a few times. It's not been front and center. We do conglomerates, mainly, but Talga is a very high-grade system we think we can start to develop very quickly as an open-pit operation, and truck that material. And when I say high-grade, I'm talking like 3 to 5 gram kind of set up an open pit. We might be able to truck that down to Nullagine. Okay, there's a big win.

There are things like Contact Creek and Virgin Creek up by Marvel Bar, which are conglomerate systems like Beatons Creek. What can we do there? Well, the cash flow helps us advance those more quickly, but we've also been doing the mechanical sorting. We can envision, say, upgrading material from those deposits, like through mechanical sorting, upgrade the gold content, but also decrease the overall volumes we have to deal with. And we can maybe truck that down to the mill.

So, those are wins in the East Pilbara. Where's the big win? Cash flow for developing the rest of this. Moving onto Egina, I think as a standalone project, as we move it forward and it can accelerate over the next few years, I think that's going to be a big, big win. I think that alone is going to be as big or bigger than the Nullagine operation, in terms of gold production and so forth, and meaning to this company. But we can tap things like Karratha. Like I said earlier, we can now look at Karratha as... we'll call it a gravel operation where you mine, crush, screen, sort the material, and you truck it over to Nullagine.

All of a sudden we're getting value out of all of these assets. There's more, I'm not looking to just find a level and stop. I see this as a beginning. This acquisition is an absolute foundation for the company and we're going to grow from here. NOVO's picked up strategic positions in several companies here recently. Why? Well, I want to grow the company. I've told people this several times. I want to build what is the highest-margin, best performing gold company on Earth. I've got about 10 or 12 good years left before I retire or else I keel over. This is my passion. I want to get the company going. I want to go through this organic growth and build something that's going to just blow everyone else out of the water.

Maurice Jackson: Well, we look forward to seeing everything come to fruition as it has. You've demonstrated it in the past. You have a proven, proven pedigree of success. And I'm a proud shareholder. I don't think I shared this with you, but I was in the last financing at 0.66 cents, and I have not sold those shares nor the warrants, and I will be participating in this financing. So, I have full confidence in you, sir.

Quinton Hennigh: Thank you. Me too. I'm going to participate.

Maurice Jackson: All right. Leaving the property bank. In closing, we've covered the good. What keeps you up at night that we don't know about?

Quinton Hennigh: Well, inside of NOVO at this point, I am so comfortable with all the technical work and our understanding of all our assets. I'm very comfortable with working in Western Australia, where they're very mining focused. I know that we're not going to have dramas and headaches and stuff. I know that through this acquisition, we can get to the goal of sustainability. I know that we have the team to operate this, and I'm very grateful for the team we have. The people we have just been absolutely fantastic. The new people coming in are also equally fantastic. I'm very grateful to everyone.

You know, what keeps me up at night isn't anything to do with NOVO. It's more to do with what we're seeing in the world today, I got to say. I've seen gold cycles. This one is very interesting. Since March, when the pandemic kind of hit the U.S., we've seen gold go from, I don't know, it was around $1,400 and something up to well over $2,000 an ounce. That's a huge increase. And when you put that into perspective of gold news in the past, I can't think of anything quite like this, other than maybe the late 1970s. When there was just a sickening feeling inside the country that we were heading down a very bad path. Inflation was running rampant. And there was nothing settled in this nation. We're back at that point where I hate to say, but here in the United States, and now it's the world. I mean, there's definitely a palpable sense there's trouble in the world. I'd love to say a $3,000 gold is a dream. It's great for gold mining, I guess. I suppose I don't know, but I'll tell you... I'm not sure any of us want to live in a world when gold's $3,000 bucks an ounce. Yeah, it's a worry.

Maurice Jackson: Those are very responsible words, and you and I had that discussion last night about the social impact. As precious metals and natural resource investors we may benefit, but what about the rest of society for the metal prices to be in that position. We're not here to make a projection on the gold price, but fundamentally speaking I only see it going higher. Very responsible words, so I commend you on that. Finally, sir, what did I forget to ask?

Quinton Hennigh: Well, I guess if there's one thing I'd like to leave people with or frame this whole discussion with: where are we going to be in 10 years? This is the big vision. I guess I touched on it, but If we said, "Where's NOVO going to be in 10 years?" There's your question. We don't necessarily have to be the biggest gold producer on Earth. In fact, I'm appalled to have seen companies that focus just on volume. I want to be the highest-margin gold producer on Earth. That's what my vision is. I want to build a company where we're producing gold at a sustainable level for the highest margin we can achieve. That's where I think gold mining should focus, is the margins. It's not about volume, so much as it is the margin. And I want to see us get there.

Maurice Jackson: Yeah, it's all about quality versus quantity and I'm with you on that one, sir.

All right. Dr. Hennigh, for someone listening that wants to get more information about Novo Resources, please share the website address.

Quinton Hennigh: Yeah, we can be found www.Novoresources.com.

Maurice Jackson: Dr. Hennigh, it's always a pleasure to have you on the program. Wishing you and NOVO Resources the absolute best, sir.

Quinton Hennigh: Thank you very much, Maurice.

Maurice Jackson: As a reminder, I'm your licensed representative from Miles Franklin Precious Metals Investments, but we have several options to expand your precious metals portfolio, from physical delivery to offshore depositories and precious metal IRAs. Give me a call at 855-505-1900, or you may email [email protected]. Finally, please subscribe to Proven and Probable for mining insights and bullion sales. Subscription is free.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

[NLINSERT]Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Novo Resources. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Novo Resources is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.