Last fall, Gold Terra Resource Corp. (YGT:TSX.V; TRXXF:OTC; TXO:FSE) announced that veteran mining executive Gerald Panneton was joining the company as executive chairman. The geologist, who has more than 35 years of experience in gold exploration and mining development, founded Detour Gold. Over six years, he raised more than $2.6 billion in capital to bring the Detour Lake project to production and, in late 2019, Kirkland Lake bought the company for $4.9 billion. Prior to Detour Gold, for 12 years Panneton was with Barrick Gold, and was instrumental in advancing two gold projects in Tanzania toward production.

So what did it take to bring Panneton to Gold Terra, which until February was known as TerraX?

"It's not always easy to find very good projects. Sometimes you have to go very far around the world. Sometimes you find it in your backyard," Panneton told Streetwise Reports. "My 12 years with Barrick was like going to school; I was able to advance two projects toward production and I visited countless deposits around the world, doing due diligence. You know what it takes to make a project work or not work."

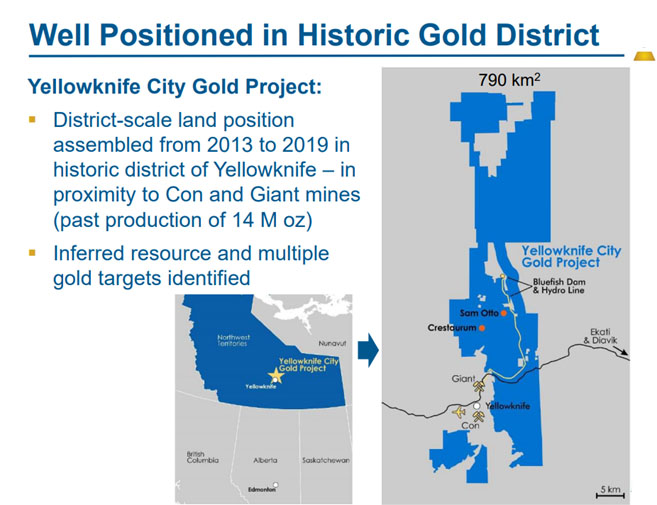

Panneton saw lots of advantages in Gold Terra's Yellowknife City Project. "It's in town. It has location, infrastructure and people going for it. Everyone goes home at night; you don't have to work in a remote area or remote camp. We were able to do all our drill programs this winter without stopping despite what the world is going through," Panneton explained. "We have a tremendous project, of district-scale size (almost 800 sq km), so there's a lot of ground, thanks to all the people in the company before us who put this land package together."

The Campbell Shear straddles the camp and covers more than 70 km of strike length on Gold Terra's property. "Gold was produced over approximately 8 km and produced 14 million ounces of gold at an average grade of 16 g/t Au. So you can imagine, a property that covers 70 km and only about 10% has been mined and the potential to find additional ounces is there," Panneton said. "It's a tremendous project that has a lot of upside. And it's up to us to raise the money, drill the project and find those million ounce deposits that have a good chance of being there."

The Yellowknife mining camp dates back to 1934 and entered into production in 1938. "It produced gold on a relatively regular basis until early 2000, when, with gold at $250/ounce (1999), the mines shut down. And there's been very limited exploration done over the last 20 years at Yellowknife," Panneton stated. "Mining is a tough business and if you don't have the belief in staying in when gold prices go down, sometimes you shut down the mine and you think it's over. After the Detour Lake mine was closed in 1998, there had been very limited exploration. Following the property acquisition in 2007, the team under my leadership was able to find approximately 15 million ounces of reserves and put the project in production in just six years. The open-pit mine has been in production for the last six years and has produced 3.5 million ounces of gold."

"So there remains potential in those old camps, and when I sat down about a year ago with the geologists working on the Yellowknife City project, I was hooked," Panneton explained.

The large size of the Yellowknife City Project presents challenges. "When you have 800 sq km to digest, that means lots of work and lots of drilling. We wanted to increase our mineral resources—you have to realize that there had been no mineral resource estimate up until November 4, 2019. That was the first mineral resource released; the company had been working on the property for six years," Panneton said. "We defined an inferred resource of 735,000 ounces of gold, two-thirds mainly at Sam Otto, which is low-grade, with open-pit potential, and the remainder at Crestaurum, which is high grade, with underground potential, very similar to the Con Shear mineralization (quartz veins and alteration) that hosted a portion of the gold at the Con Mine. That is a good start: two very good gold deposits, a low grade and a high grade; they could be good synergy."

Lower-grade Sam Otto was drilled in this past winter when the "logistics of drilling from the ice is a lot easier than drilling it in the summer," Panneton explained.

"Crestaurum is a great deposit with high-grade potential. It's one kilometer long, we drill only down to 200 meters, and it's open at depth and open to the north and south. I personally think Crestaurum has good potential to go to maybe a million ounces, and maybe Sam Otto goes to a million ounces. Then we have 2 million ounces," Panneton said. "Plus we still have the Campbell Shear target that, in my mind, has been completely underexplored."

On June 2, Gold Terra announced that the next drilling program will focus on the Campbell Shear and Crestaurum, high-grade gold targets. "What's very important about the Campbell Shear is that it is the lode for the Con and Giant mines, responsible for almost all of the 14 million ounces that have been produced there. Crestaurum and Sam Otto are satellite deposits. You can imagine that if you were to find a 5 million ounce deposit, you would find it along the Campbell Shear," Panneton explained. "So our target to drill the Campbell Shear to the south and to the north of the previous mining operation has tremendous potential to deliver some future ounces to the project."

Panneton holds 4.4 million shares of Gold Terra, all purchased. "As chairman of the company, I don't take any stock options; I prefer to keep them for people that you want to attract. I'm attracted by the project and its potential for high grade," Panneton said. "Recently I bought another 150,000 or 200,000 shares when the stock dipped to about 20 cents. I said I believe in this project and I'm going to buy more. And if a financing comes in the future, I'll likely participate again."

Gold Terra has around 160 million shares outstanding, and 177 million fully diluted. Management and employees own 11%, institutions 31% and close associates 21%.

The company has caught the attention of industry analysts. Beacon Securities analyst Michael Curran set out the firm's investment thesis for Gold Terra: "We consider Gold Terra to be an attractive investment for the potential expansion of resources with 2020 exploration efforts.

- Low Geo-Political Risk: we view NWT as a favorable jurisdiction for mining investment, and do not expect this view to change in the coming years.

- High-Grade Targets: the Con and Giant mines produced over 14MMoz at an average grade of ~16g/t gold. Drill results over the past few years on YGT ground has shown similar high grades, as well as similar structures and mineralization to the nearby historic mines.

- Mixed Grade Mineralization Could Boost Economic Viability: having a combination of both low and high grade mineralized zone could help the YCG property towards development, as perhaps a central mill could be fed ore from a combination of open pit and underground operations."

Brien Lundin wrote in Gold Newsletter April 30, "the company's district-scale gold play in Northwest Territories should only grow more valuable as drilling proves up more of the yellow metal and gold prices continue their upward trend."

Jay Taylor wrote in Hotline on April 24, "This is most certainly a company to keep an eye on, particularly since it upgraded its management team with the addition of Gerald Panneton–Executive Chairman, and David Suda–President & CEO."

Read what other experts are saying about:

Disclosure:

1) Patrice Fusillo compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Gold Terra. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Gold Terra, a company mentioned in this article.

Additional disclosures:

Disclosures for Beacon Securities, Gold Terra Resource Corp., June 3, 2020

Does Beacon, or its affiliates or analysts collectively, beneficially own 1% or more of any class of the issuer's equity securities? No

Does the analyst who prepared this research report have a position, either long or short, in any of the issuer’s securities? Yes

Has any director, partner, or officer of Beacon Securities, or the analyst involved in the preparation of the research report, received remuneration for any services provided to the securities issuer during the preceding 12 months? No

Has Beacon Securities performed investment banking services in the past 12 months and received compensation for investment banking services for this issuer in the past 12 months? Yes

Was the analyst who prepared this research report compensated from revenues generated solely by the Beacon Securities Investment Banking Department? No

Does any director, officer, or employee of Beacon Securities serve as a director, officer, or in any advisory capacity to the issuer? No

Are there any material conflicts of interest with Beacon Securities or the analyst who prepared the report and the issuer? No

Is Beacon Securities a market maker in the equity of the issuer? No

This report makes reference to a recent analyst visit to the head office of the issuer or a site visit to an issuer’s operation(s)? No

Did the issuer pay for or reimburse the analyst for the travel expenses? No

Analyst Certification

The Beacon Securities Analyst named on the report hereby certifies that the recommendations and/or opinions expressed herein accurately reflect such research analyst's personal views about the company and securities that are the subject of the report; or any other companies mentioned in the report that are also covered by the named analyst. In addition, no part of the research analyst's compensation is, or will be, directly or indirectly, related to the specific recommendations or views expressed by such research analyst in this report.

Gold Newsletter: The publisher and its affiliates, officers, directors and owner actively trade in investments discussed in this newsletter. They may have positions in the securities recommended and may increase or decrease such positions without notice. The publisher is not a registered investment advisor. Authors of articles or special reports are sometimes compensated for their services.

Disclosures from J Taylor's Hotline, April 24, 2020

The opinions expressed in this message are those of Jay Taylor only and they do not necessarily represent the opinions of Taylor Hard Money Advisors, Inc., the publisher of J Taylor's Gold, Energy & Tech Stocks. The management of THMA may, from time to time, buy and sell shares of the companies recommended in J Taylor's Gold, Energy & Tech Stocks newsletter and in this Hotline message. No statement or expression of any opinion contained either in this Hotline or in J Taylor's Gold, Energy & Tech Stocks newsletter constitutes an offer to buy or sell the securities mentioned herein.

Companies are selected for presentation in J Taylor's Gold, Energy & Tech Stocks strictly on their merits as perceived by Taylor Hard Money Advisors, Inc. No fee is charged to the company for inclusion. The editor, his family and associates and THMA are not responsible for errors or omissions. They may from time to time have a position in the securities of the companies mentioned herein.