Note: Unless stated otherwise, all $$ = US$. Gold = Au, silver = Ag, copper = Cu, cobalt = Co, nickel = Ni, palladium = Pd, platinum = Pt.

Gold producers are benefiting from a significant increase from ~$1,200/ounce nine months ago, to an eight-year high of $1,788/ounce in March, and ~$1,750/ounce in mid-May. Yet, gold bugs say we're still in the early stages of a gold bull market. Pundits and analysts are moving price targets ever higher due to the shocking economic fallout and massive debt issuance/money printing resulting from COVID-19.

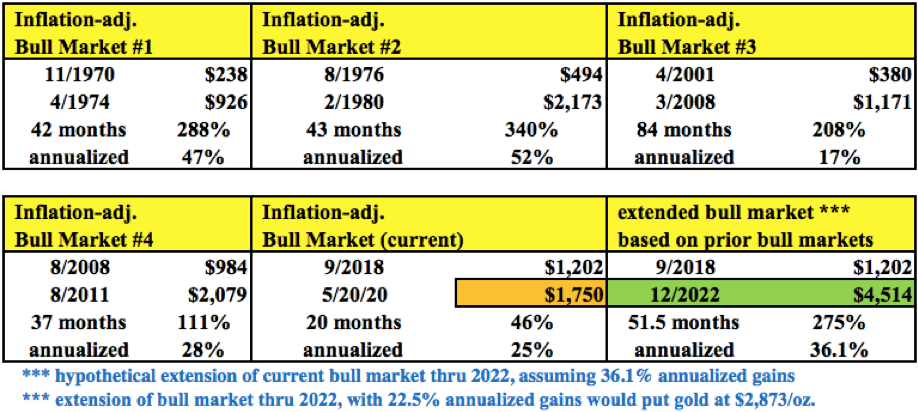

What might past bull markets say about today's gold market?

In the four largest historical bull markets since 1970, the average inflation-adjusted gain has been +237% over an average 51.5-month period, for an annualized gain in each period of +36.1% (see chart below).

Notice that in today's rally (the current bull market), the price is up +46% from September 2018 to May 20, 2020 (~20 months). With this in mind, consider the following possible scenario between now and the end of next year.

If one were to extend the current bull market from 20 to 51.5 months (to December 2022), and assume the average historical 36.1% CAGR (compound annual growth rate), the gold price would hit $4,514/ounce. Or, instead of using the four most robust bull markets of the past 50 years, consider the top two of the past 20 years.

In those more recent cases the average annualized gain was 22.5%. If gold were to increase by +22.5%/year from September 2018 to December 2022, it would reach $2,873/ounce. Well-respected Canadian economist David Rosenberg of Gluskin Sheff sees $3,000–$4,000/ounce possible within a few years. Last month, Bank of America forecasted $3,000/ounce within 18 months.

Importantly, the current gold price is already quite strong

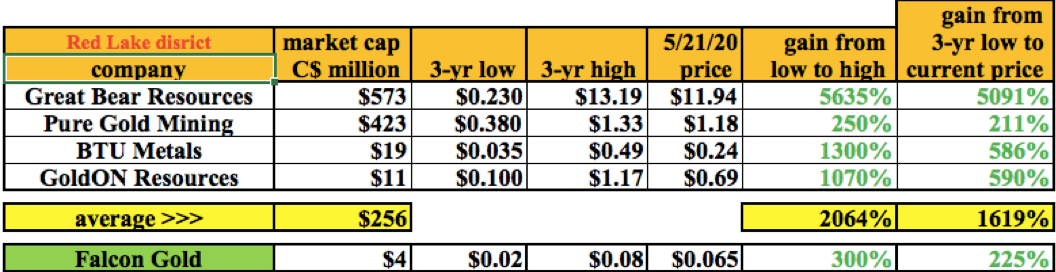

Do investors need $2,873 to $4,514/ounce for juniors with good quality management/technical teams and high-quality projects in safe jurisdictions to be multi-bag winners? Of course not. Readers are reminded that most preliminary economic assessment (PEA), preliminary feasibility study (PFS) and bankable feasibility study (BFS) reports delivered over the past seven to eight years pegged long-term gold prices at between $1,100 and $1,300/ounce.

A company I'm bullish on is Falcon Gold Corp. (FG:TSX.V), a junior miner that owns or controls exciting brownfield and greenfield opportunities in Canada. The company has near-term catalysts that could turn its CA$0.065/share stock into something much greater within a matter of months. Falcon is fully funded for a nine-hole diamond drill program at its flagship project.

Shares are tightly held, including by largest holder CEO Karim Rayani. Rayani has been an active buyer in the open market. With a market cap of CA$4 million, this is a high-risk, high-return, high-grade gold story with near-term catalysts. In other words, exactly what investors with the ability to stomach high risk are looking for.

A funded (recently expanded to nine holes) drill program is well underway at the company's Central Canada gold and polymetallic project, ~20 km SE of Agnico Eagle Mines Ltd.'s (AEM:TSX; AEM:NYSE) Hammond Reef gold deposit, (Measured and Indicated resource of 4.5 million [4.5M] ounces Au). Central Canada hosts a past-producing mine with a 40-meter shaft and a 75-tonne/day mill.

Current drilling on flagship project offers near-term catalysts

While Hammond Reef lies on the Hammond fault, the Central Gold property lies on a similar major structure, running >10 kilometers (10 km) along the Quetico Fault. Contiguous with the Central Gold project, the English Claims Option reported an interval of 0.64% Cu, 0.15% Co, 1.1% Zn and 0.35 g/t Au over a true width of 40 meters (40m).

The first three shallow drill holes from the current program at the Central Canada project intersected mineralization over large intervals. One of the cores had visible gold in it. The first hole—designed to intersect the gold-bearing zone 20 meters west along strike of the historic producing shaft—intersected the zone from 33.5 to 79.8m (46.4m width). Note: true widths unknown.

The second intersected the zone a further 70 meters west, along strike of the shaft, from 26.9 to 62.2m (35.3m width). The third hit the zone 155m west, along strike, of the shaft from, 26.8 to 59.8m (33.0m width). Assays on these three holes are expected this month. The results will inform the drilling of the next six holes.

Historical drilling by multiple operators dates back decades. In 1965, drilling returned several winners, including 44 g/t Au over 2.1m, and 37 g/t over 0.6m. In 1985, 13 holes included a 1.2m interval of 27.5 g/t Au and 4.0m of 7.1 g/t. In 2012, a wider interval, 23.3m of 1.8 g/t, was delineated.

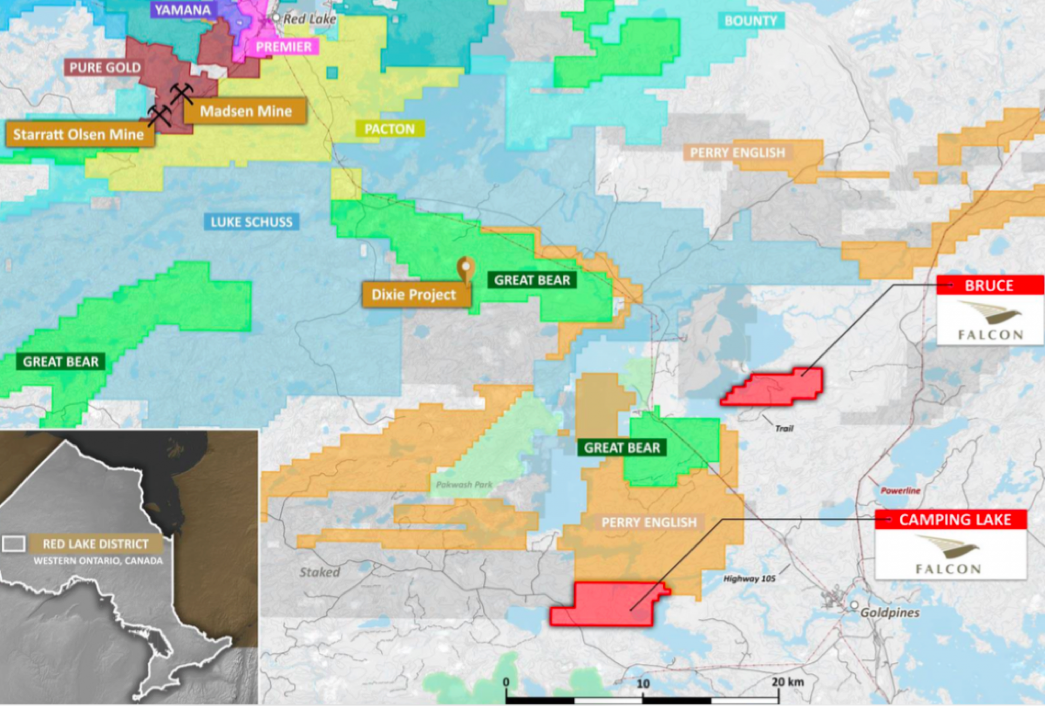

Red Lake mining district of northwestern Ontario

In addition to the Central Canada project, other Falcon properties could see drilling this year. There's a "tonne" of attention on the Red Lake mining district as Great Bear Resources Ltd. (GBR:TSX.V; GTBDF:OTCQX) released yet another important drill hole at its blockbuster Dixie project. Their latest reported hole went much deeper than previous efforts and hit an intercept of 68.6 g/t over 2.7m from 1,009m downhole.

Falcon has two gold properties in the Red Lake District, Camping Lake and Bruce Lake. International Montoro Resources (IMT:TSX.V) has an option to earn a 51% interest in the Camping Lake property and can acquire a further 24% interest (for a total of 75%) for CA$500,000.

The property consists of five claims comprising 109 cell units (approx. 2,250 hectares/5,560 acres), ~20 km south of Great Bear's discoveries at Dixie Lake, and ~8 km south of BTU Metals Corp.'s (BTU:TSX.V) base metals targets.

Bruce Lake adds an additional ~3,460 acres to Falcon's Red Lake District portfolio. The project contains excellent targets for both Red Lake-style gold mineralization and gold-bearing base metal prospects. A combined ~3,650 hectares, for both Bruce and Camping Lake, equates to roughly 20% the size of BTU Metals' Dixie Halo project. BTU Metals has a market cap of CA$20M.

Wabunk Bay Platinum/Palladium/Base Metals Project

At its ~1,192-hectare Wabunk Bay platinum/palladium/base metals project, also in the Red Lake District, Falcon hopes to follow up on a promising field program from last year.

Grab samples from 2019 assayed up to 760 parts per billion (ppb) Au, 0.272% Ni, 0.478% Cu, 171 ppb Pd and 221 ppb Pt. Select areas around Wabunk Bay are currently being explored by Eric Sprott-backed Argo Gold (ARQ:CSE), which has reported ultra-high grades, such as 132 g/t Au over 1.8m.

Spitfire and Sunny Boy Claims in British Columbia, Canada

The Spitfire/Sunny Boy claims, totaling 502 hectares, are ~16 km east of the town of Merritt in south-central British Columbia. Spectacular ultra high-grade gold values were reported on Falcon's newly secured property, including 124 to 127 g/t Au, (midpoint of 4.0 ounces/ton) and 309 to 514 g/t Ag over 0.9m. On the Master Vein, an extreme, ultra, high-grade gold value of 50.5 ounces/ton (about 1,570 g/t) was sampled in 1974.

Several copper discoveries in this prolific area became major mines, including Craigmont, Copper Mountain, Afton and Highland Valley. Southwest of Sunny Boy, soil geochemistry, magnetometer and VLF geophysics, trenching, sampling and diamond drilling returned a drill intercept of 3.8 g/t Au, 0.24% Cu and 32.9 g/t Ag over 13.4m.

Due-diligence work last year confirmed the presence of gold mineralization along the Master Vein over a 300-meter strike length with samples ranging from 0.33 to 2.74 ounces/ton.

The company is planning tightly spaced soil sampling, Electromagnetic and IP (induced polarization) geophysics and structural mapping to identify new mineralized structures. Although nothing has been announced, I'm hoping that a drill program can be done at Spitfire/Sunny Boy this year.

Conclusion

Falcon has five prospective projects, at least two of which are highly prospective in the near-term. The bonanza-grade, multi-ounce per ton showings at Spitfire/Sunny Boy alone could be a company-maker upon a successful drill program or two.

Likewise, the flagship Central Canada gold and polymetallic project is also a potential company-maker. A total of nine assays will be announced in the next few months, the first of which are due this month. Management is very pleased and cautiously optimistic about the visual inspection of the cores. As mentioned, one had visible gold.

In today's metals/mining space, nothing is more sought after than new discoveries/high-grade gold intercepts at projects with blue-sky potential in safe jurisdictions (like Canada).

Make no mistake, Falcon Gold is a high-risk exploration play, but now is arguably a wise time for investors with an appetite for risk to be looking at gold juniors. In past bull markets, top performing gold companies enjoyed gains in the thousands of percent. Falcon has a lot going for it. Drill results this spring and summer, possibly from multiple projects, could be a game-changer.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Falcon Gold, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Falcon Gold are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Falcon Gold was an advertiser on [ER] and Peter Epstein owned shares in the company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts and financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events and news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Graphics provided by the author.