Few investments are working these days. Oil, blue-chip stocks, cotton, lumber major mining companies. . .all have been decimated in the past six weeks. Teck Resources Ltd. (TCK:TSX; TCK:NYSE) is down 73% from its 52-week high. Copper is 27% lower than it was a year ago. Yet the gold price has done quite well, up 30% from last year's low and near a seven-year high.

With the strength in gold, gold juniors could make a move higher even as other stocks languish. Juniors with strong management teams, good projects in favorable jurisdictions and attractive valuations offer compelling upside potential, albeit with commensurate high risk. Precious metals companies in Canada are also benefiting from a significant move in the Canadian dollar/US dollar (CAD/USD) exchange rate (project costs in CAD declining versus USD gold price).

A small-cap company worth learning more about is Falcon Gold Corp. (FG:TSX.V). It has an amazing team for a company with a market cap of just CA$2 million. Management has a lot of skin in the game, there are multiple Canadian projects, and more assets are poised to possibly come into the company. The following interview is of CEO and director Karim Rayani. Please continue reading to find out why an investment in Falcon Gold is well worth considering [corporate presentation].

Peter Epstein: Please give readers a history of Falcon Gold Corp.

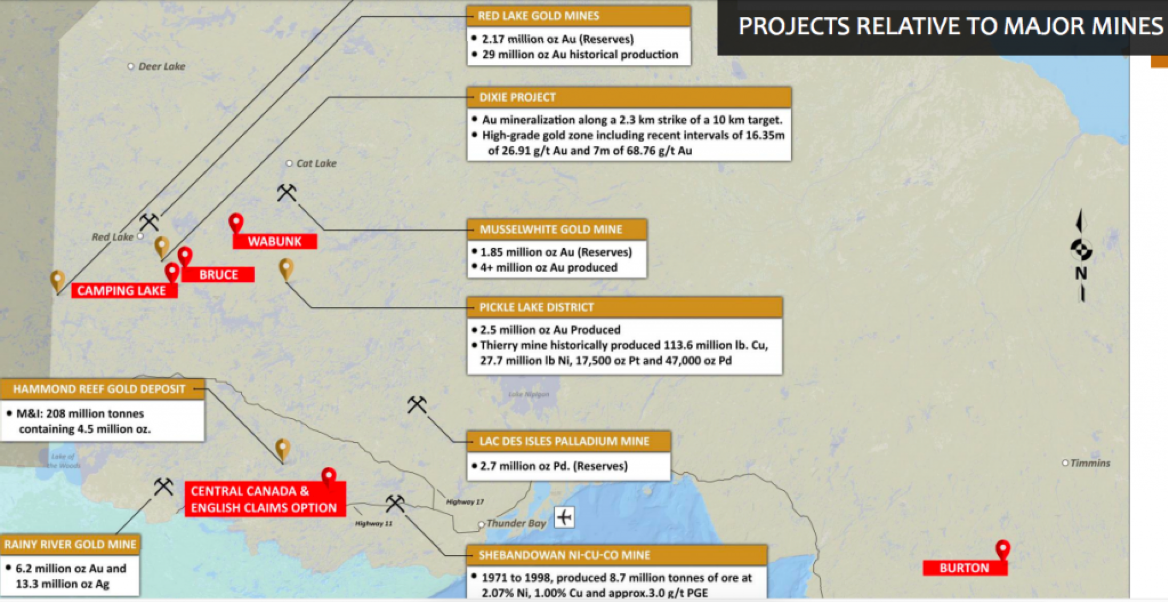

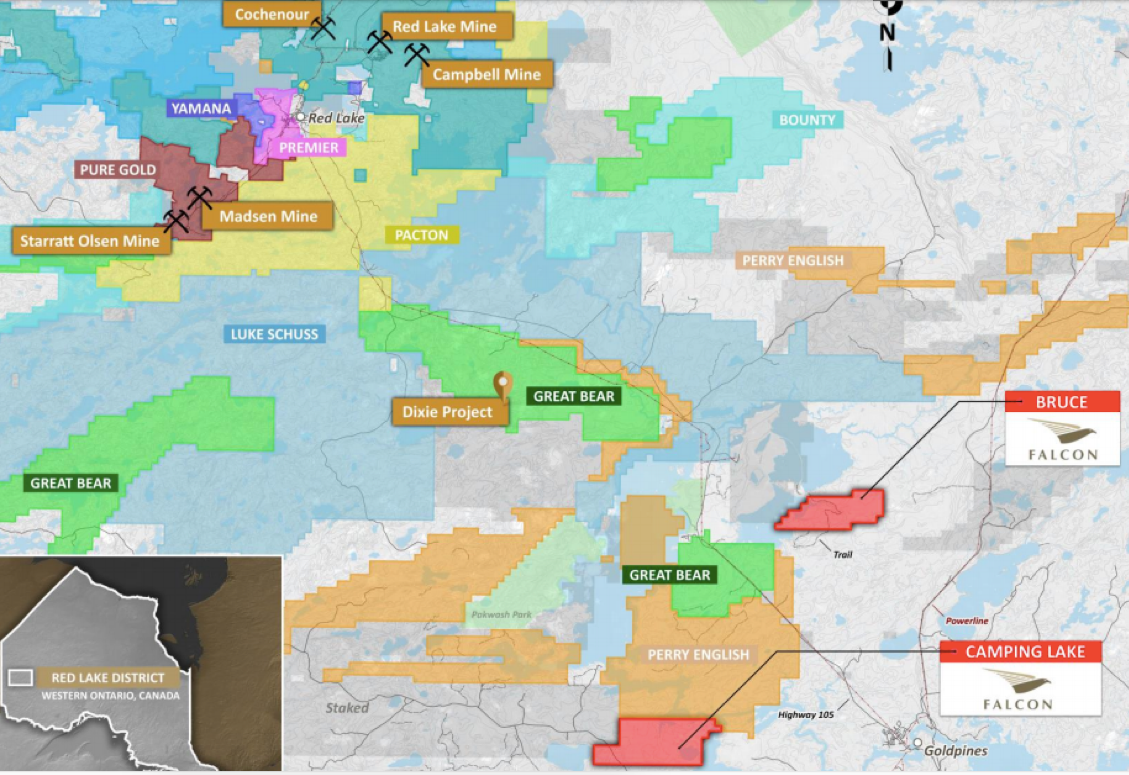

Karim Rayani: Falcon is a Canadian mineral exploration company focused on generating, acquiring and exploring high-grade opportunities in the Americas. Our Ontario, Canada, projects include the Central Canada gold project, the Wabunk Bay gold/base metals project in Red Lake, the Bruce and Camping Lake gold projects, also in Red Lake, and a 49% interest in the Burton gold property with Iamgold.

The company is focused on high-grade acquisitions [with] a lengthy history of mining, where we can generate results rapidly and cost effectively, using modern exploration methods, to update, enhance or introduce new NI-43-101-compliant mineral resource estimates. We have five Canadian projects at the moment.

PE: Can you tell us about Falcon's management team, board & corporate advisors?

KR: Falcon is led by a seasoned team of mining execs. I stepped in as CEO about nine months ago and am the largest shareholder. I've been a financier for the past 15 years, focused on domestic and international exploration projects. We have assembled a world-class team that has had tremendous success in the mining sector.

Tookie Angus needs no introduction: He's the former head of global mining group Fasken Martineau. For the past 40 years, Mr. Angus has focused on structuring and financing significant international exploration, development and mining ventures. He has had a long string of successes. Tookie's a lawyer by trade and will be very valuable to us as we advance our Central Canada project.

On the geological side, top-shelf former Rio Tinto and Anglo American geologist Ian Graham is overseeing the planning of our exploration programs. Mr. Graham is an accomplished mining executive with over 20 years' international experience exploring for and developing mineral deposits. He has vast experience in bringing projects to scale and seeing things that others don't. Ian is ideally suited to be overseeing our data.

PE: You mentioned several promising properties/projects. Which are the top two priorities for 2020?

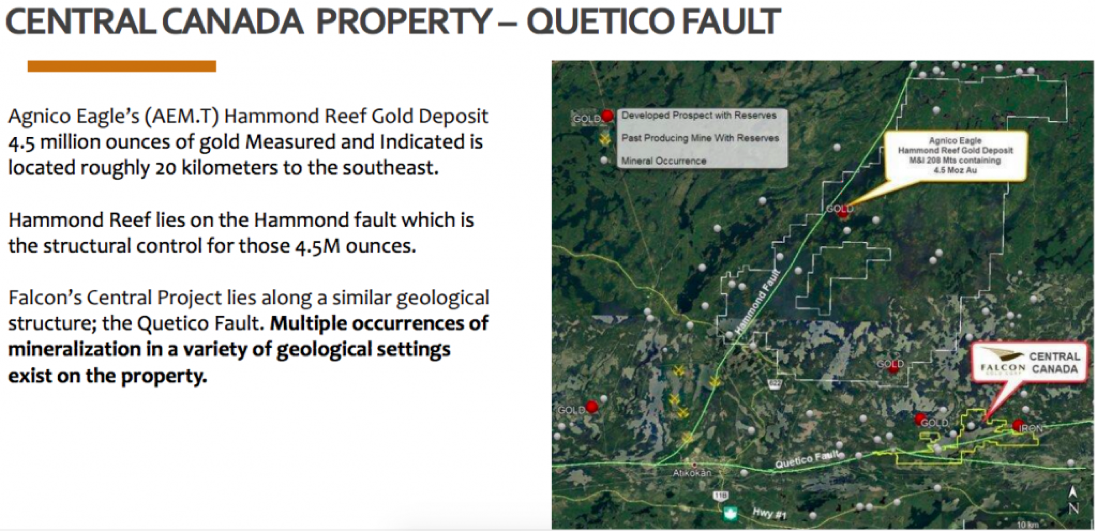

KR: Central Canada is Falcon's flagship project. It's 20 kilometers on a parallel system to Agnico Eagle Mines Ltd.'s (AEM:TSX; AEM:NYSE) Hammond Reef deposit in Northwest Ontario. They have a 4.5-million-ounce [Measured and Indicated] gold resource. The Hammond Fault is the structural corridor for those ounces.

Our project is on the Quetico fault, a similarly major structure in its own right. We have been successful in closing two joint ventures (JVs); in one we still hold a 49% interest, with IAMGOLD Corp. (IMG:TSX; IAG:NYSE) holding 51%. It's a testament to our ability to source projects and package them without overly diluting shareholders.

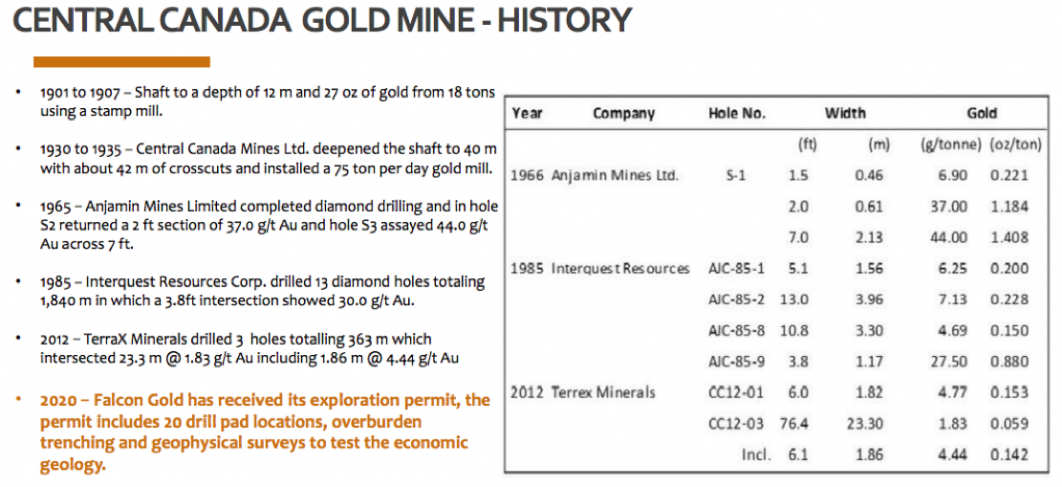

PE: Please give us more detail about the considerable amount of historical work that has been done on your Central Canada project.

KR: Gold mineralization can be traced widely across the Central Canada property. More recent drilling by Interquest Resources Corp. intersected over one meter at ~30 grams per tonne (g/t) gold in diamond drill core. In 2012, TerraX Minerals (now Gold Terra Resource Corp. [YGT:TSX.V; TRXXF:OTC; TXO:FRANKFURT]) hit 23.3 meters (23.3m) of 1.83 g/t gold.

Trenching work in 2011 indicated significant gold mineralization to the south of the historic Sapawe gold mine, where the operator sampled up to 6.7 g/t gold. Significant gold mineralization of up to 24 g/t has also been identified in the halo of the original Sapawe mine.

PE: Explain the English Claims option. How important is this option?

KR: The English Claims tie directly onto the Central ground. There are some very rich gold targets that we will be going after. Readers should note, only a small percentage of the property has been explored in any meaningful way.

PE: How far do you think that you will have to advance the Central Canada project before a strategic investor might want to invest in it?

KR: We think interest from strategic investors could come as soon as this year. Our objective is to start drilling right away, as we have received our drill permit. We are confident that we will come back with strong results from twinning historical high-grade holes.

We will update historical and new data into a NI-43-101-compliant resource. Upon completion of the twining of historical holes, infill drilling and testing the deposit at depth, we expect to get an indicative scope of the size and economic potential of the project.

PE: You have farmed out your Camping Lake property, retaining a small net smelter return (NSR). Could this asset still move the needle for Falcon Gold if your farm-out partner has success?

KR: Either way, Falcon is in a very good position. We still have a 49% economic interest once International Montoro Resources (IMT:TSX.V) spends $300,000 in the ground. They can opt for an additional 24% for a one-time payment to us of $500,000. At that point we would retain a 25% percent interest in the project plus a 0.5% NSR. So yes, we absolutely still have skin in the game here.

PE: No doubt your team likes northern Ontario quite a bit. What makes it a great place to explore, and potentially develop mining projects?

KR: We are in one of the best jurisdictions for mining, period. The amount of success in this area is quite profound. Great Bear Resources Ltd. (GBR:TSX.V; GTBDF:OTCQX) has had tremendous success. We are surrounded by multimillion-ounce deposits. The political environment could not be better. The area is prospective for both high-grade gold and base metals. The regional infrastructure is outstanding.

PE: Although there have been, and continue to be, notable success stories in the Red Lake mining district, why hasn't the area become even more busy, with gold recently touching US$1,700/ounce, and now at about US$1,650/ounce?

KR: The sector has been beaten up. It's only relatively recently that some of these companies have seen an influx of capital. Whenever there is a discovery there is a flow of money. Larger companies are paying dividends and reporting record revenues. In order to compete, we will need to see a further spike in the price of gold for the junior miners to gain real momentum. With current world events effecting the markets, it's not a matter of if, but when, gold prices move even higher.

PE: How do you plan on funding your exploration programs?

KR: The company is currently fully funded for 1,000 meters of drilling. Could we use more money? Yes, of course. But we're raising funds only when those dollars are used for drills turning. I'm committed to doing the work while preserving our cash and protecting the capital structure. That means no dilutive financings.

PE: There seems to be support for a strong gold price through at least the U.S. presidential election in November. What are your thoughts on gold?

KR: I don't think there has been a better time to have exposure to precious metals. I have always been a gold bug, and we're seeing near record highs since 2013. With inflation and global stimulus packages kicking in, I believe it's only a matter of time before a wave of investment capital flows into our sector.

PE: Where do you stand with regard to acquiring new assets or farming out existing assets?

KR: Falcon's flagship asset is our Central Canada project, but we are also focused on generating revenue through royalties and acquiring additional assets. It's the only real way to set us apart and generate long-term shareholder value. We hope to be able to announce the addition of one or two new projects in coming months, so your readers should keep Falcon Gold on their watch lists!

PE: Thank you, Karim. There is a lot going on at Falcon Gold. I truly look forward to updates on the company this spring and summer.

Greg Nolan's latest masterpiece on Equity.Guru

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

[NLINSERT]Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed below.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: Gold Terra and Great Bear Resources. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this interview, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Gold Terra Resource Corp., a company mentioned in this article.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Falcon Gold, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Portofino Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Epstein Research [ER] has no prior or existing relationship with Falcon Gold, but is pursuing a marketing relationship. Readers should consider this interview to be biased in favor of Falcon Gold. At the time this interview was posted, Peter Epstein of [ER] owned no shares of Falcon Gold.