In recent days the Fed has made it plain that it is prepared to buy anything and everything to prevent imminent total collapse, and you don't have to join many dots to see that this will extend to buying stocks. It's not that hard for them—all they have to do is enter a few keystrokes, add a few 0s and it's sorted—and as Gregory Mannarino repeatedly points out, the more debt they issue the more powerful they become.

Right now sentiment is "end of the world" negative, and any positive development will be enough to trigger a gargantuan, self-feeding, short-covering rally. Gold's huge recovery is a sign that this may be about to start.

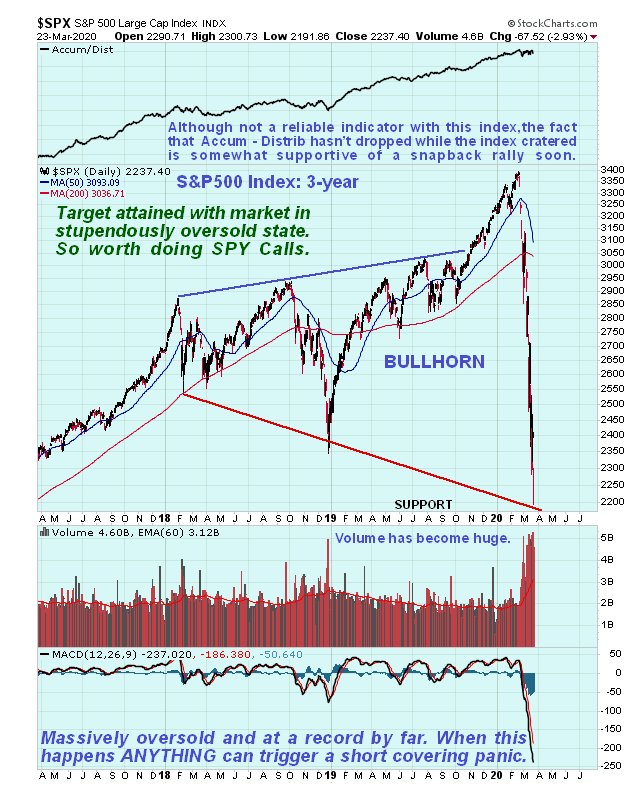

It is, therefore, most interesting to observe on our 3-year chart that the S&P500 index has just hit our long-held target at the bottom of its giant bullhorn pattern, and it has done so with the market in a stupendously oversold condition—at a record, by far.

The conditions are therefore believed to be ripe for a screaming, short-covering rally, and the only question is whether it happens immediately or after some volatile zigzagging around in the vicinity of these lows. Action in gold suggests that it will happen almost immediately. Anything that causes a shift in investor perception could trigger it, and once it starts it could be unstoppable for a while, as shorts race for cover.

The conclusion to all this is that this may be an excellent time to "put our best foot forward" and do calls in the broad market, for which purpose we can use the S&P500 proxy (SPY), whose chart is shown below for the same time frame. On this occasion it may be worth doing the trade in reasonable size, but again, don't go overboard and bet the farm.

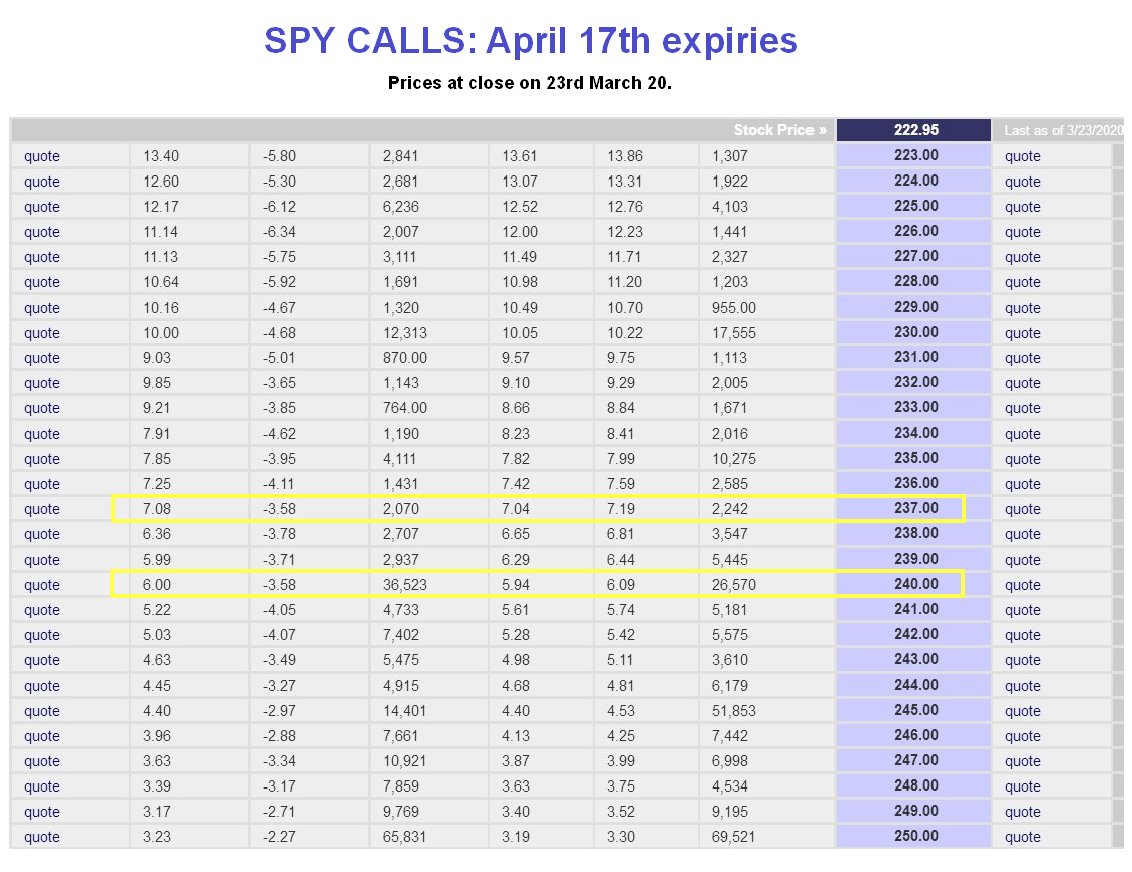

Look at it this this way—there is considered to be 50% chance of a sudden, scorching, snapback rally, and if it works, the options we are looking will rise about fourfold or more. The whole thing could burn out and reverse to the downside again quickly, but by that time we will be out, if things go to plan.

Just because the market rallies here or soon won't mean the bear market is over. Although the rally could happen immediately, it might be preceded by some base-building, which is why we should go out a few weeks with the options.

An SPY March 17 expiry options table is shown below, and you can choose any series to suit yourself, if interested. A couple of suggestions have been highlighted on it.

Table courtesy of bigcharts.com

With futures showing the Dow set to open up about 930 points, it may be best to buy some soon after the open, and then wait for an intraday dip to do more, bearing in mind that there may not be a dip.

End of update. Posted on clivemaund.com at 9:20 a.m. EDT on March 24, 2020.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

[NLINSERT]Disclosure:

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts provided by the author.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.