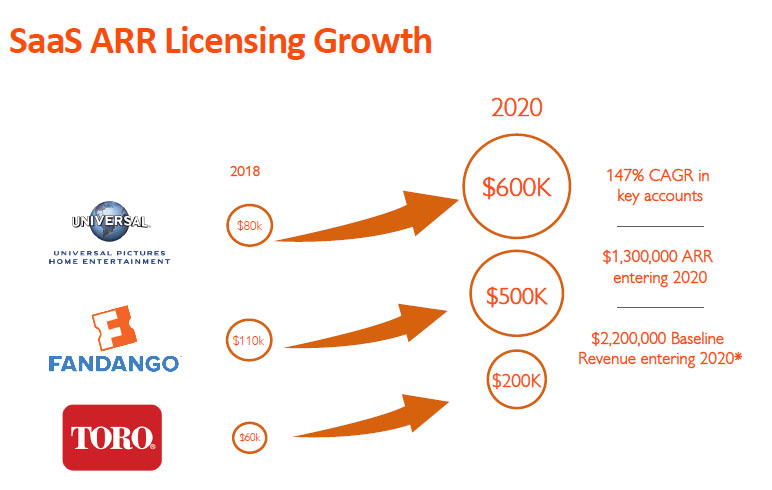

Datable Technology Corp. (DAC:TSX.V; TTMZF:USOTC), a company that develops online consumer loyalty and reward programs, is now benefiting from the loyalty of its own big-brand name customer base. Longer-term clients such as Universal Pictures, Fandango and Toro are renewing and upsizing their contracts to the point where the company already has visibility to more than double its top line revenue from $1.5 million in 2019 (with a notable 70% gross margin) to "at least $3 million" for 2020, according to management. Entertainment giant Universal significantly upped its activity with a 2020 commitment of $720,000 announced February 25. Meanwhile more powerhouses such as Red Bull and Proctor and Gamble are also signing on. The bottom line is that the company is now trading at a lowly $2.8 million market cap, which is below anticipated revenue for this year. At just four pennies a share, this is a cheap, cheap stock. Recent opinion was that it was either going to die on the vine or bounce back from here. Given these renewed contracts, I'd say we're looking at the latter. This graphic of the top three customers from DAC's recent presentation supports this:

"Right now, our valuation is under $3 million because last year we didn't show any growth in our sales," says Chairman and large shareholder Kim Oishi. "Now, after a couple of years of using our software, our biggest customers are all upsizing such and we're very confident that we will reach a revenue growth of more than 100% this year. That's based on the fact that we already have $1.8 million signed this year, after doing approximately $1.5 million last year, which would indicate we're on track to do more than $3 million this year. With 70% gross margins we are pushing to be cash flow positive by the second half of the year and don't expect to ever look back." Oishi makes this comment after the company landed yet another recent win, for a $200,000 contract with a leading turf landscape maintenance company announced February 19.

"The surge in upside volume in recent days is viewed as a positive sign." - Clive Maund

Typically, Software as a Service (SaaS) based companies like Datable, that are showing recurring revenue growth, are trading at multiples of revenues, therefore—buying alert—Datable is now trading at less than one times revenue for this year. "Many SaaS companies trade at between 5 to 10 times revenue," says Oishi. "At the lower end of market multiples, we'd be at 5X revenue, which would value Datable at a $15 million market capitalization," he adds, "with just our existing SaaS product. We are working preparing to launch new products with industry partners based on the consumer data that we collect using Platform3, our core technology."

As Oishi plainly put it, the catalysts for the share price will be the reporting over the next few quarters and as the company announces the upsizing of these deals with more big brands such as Proctor and Gamble and Red Bull. "Our existing clients include 24 leading consumer brands that used our software last year and virtually all of them have come back and said they're going to do business with us this year."

"The big driver is our software license revenues, which generate a gross margin of over 70%—when combined with our lower margin services, our consolidated gross margin is about 70%. A growing percentage of our license revenues, which are expected to more than double this year, are recurring SaaS revenues from major brands, mostly in the U.S. (85% U.S. to 15% Canadian)." These are not exactly no-name companies either; other loyal customers also shown on the Datable deck include:

Datable is a provider of digital and social media consumer engagement, data mining and loyalty solutions. The company's core product is Platform3, a Software-as-a-Service consumer marketing platform that enables consumer packaged goods companies and consumer brands to engage consumers and influence purchasing decisions through their mobile devices and online. The process is largely centered around online coupons and codes, which can be redeemed for future products, thus building loyalty. . .and collecting data. Consumers are also rewarded for their own recommendations and endorsements. "After all, what's better than getting a recommendation amongst 'friends'?" says Oishi.

"Our proprietary software has been proven to be valuable for the big brands," say Oishi. "And we're developing new products around the data that we collect from consumers. We are establishing launch partners who've agreed to work with us to build a database of opt-in consumer data, which Datable then owns. Our customers are leading brands that have large budgets to buy access to customers and will pay a premium for access to consumers where we have deep purchasing, behavioral and demographic data."

He reflects on the share price history: "Our stock price is low because we announced new products last year and it's taken longer to get the partnerships organized, and because sales growth in 2019 was low as our major customers renewed agreements at the same levels as the previous year. We now we have partnerships on track and we're ready to launch, and our customers have upsized based on growing confidence in our value proposition."

Based on the company's press release dated February 5, 2020, and the confidence of management, it's expected that Datable will soon be releasing news regarding significant software license upsizing and partnerships for FlexxiShop, the new consumer data business.

With these recent developments, stock charter Clive Maund pointed out on Feb.11, "With the price still below a falling 200-day moving average technically it remains in a bear market. However, it is now so cheap that either it goes up or its goes bust, and with the company's fundamental situation improving rapidly it is a fair bet that it will do the former, which is also suggested by the rising trend of its volume indicators, and in light of all this the surge in upside volume in recent days is viewed as a positive sign."

Indeed, this prophecy is already taking fruition with recent trading reaching highs of $0.45, a 50% gain from $0.03 and volumes jumping into the millions. With this momentum just starting, it's best to be jumping in sooner than later before the stock sprints ahead of you.

DAC.V as of February 21, 2020:

The Dollars Are in the Data

If knowledge is power, then when it comes to online consumer targeting, big data is pure gold. That why Datable uses a rewards-based model to entice consumers to willingly fork over their personal information, their likes and dislikes, and expose their related buying activity. Datable has found a means of collecting consumer data in targeted markets, then feeding back reward opportunities to customers in these markets who, in turn, convert data into revenues for Datable clients. Its clientele includes recognized brands such as Universal Pictures, Kellogg's, Toro and Arm & Hammer who are looking for digital strategies beyond the traditional, and ineffective, "spray and pray" method of spamming consumers. But there's an even bigger picture.

Over the years, Datable has discovered that big-brand Fortune 500 companies don't necessarily want to own the data, they'd rather rent it. What's exciting at this juncture is that Datable has found a means of tweaking its SaaS recurring revenue model to a "per transaction" system similar to larger, more established competitors and beat them at their own game by consolidating data and distributing it through multiple social media channels.

Companies such as Universal Studios are ideally suited for a rewards-based retargeting model. After all they can provide great rewards such as discounts on video, or a visit to the studio. They've deployed Datable's Platform3 to motivate, track and reward purchasing while collecting data for enhanced targeting. In the past year Datable has implemented 31 programs for 24 well-recognized name brands for clients past and present that include an eclectic mix: Mars, Rubbermaid, Doritos, Windex, Playtex, Kellogg's, Bridgestone.

For techies out there, Datable's Platform3 has all the right stuff: a cloud-based SaaS model for ease of implementation and high margin recurring revenues. Machine learning and artificial intelligence (AI) automates data mining and retargeting, and data protection is enabled via the latest cryptography. Since 2014, about $6.5 million has been invested in research developing Platform3 to serve a digital advertising market targeting consumers worth $160 billion annually in the U.S. alone (WPP Digital Ad Growth).

After a successful public launch in 2016, the company drove 80% top line growth in 2017 to $1.2 million in revenues. Under the current model, Datable grew this to $1.4 million in 2018 with 64% of its revenue from repeat customers with a trend toward larger and longer-term licenses. However, after a near flat lining in 2019 to $1.5 million, with a 70% gross margin the company has finally hit its stride, with clear visibility to $3 million plus.

In terms of share structure, of the approximately 70 million shares issued, Oishi holds close to 8.5 million shares and the company CEO, Robert Craig, holds about 5.5 million, owning close to 20%, so they are aligned with shareholders. There are about 35 million warrants (weighted average at $0.17) and 5 million options (average $0.11) that will raise over $4 million upon exercise.

With this structure and acceleration in sales, there is clear visibility to a leveraged upside for Datable's "pennies from heaven."

Knox Henderson is a journalist and capital markets communications consultant. He has advised for a broad range of small cap companies in the resource, life sciences and technology sectors for more than 25 years.

[NLINSERT]Disclosure:

1) Knox Henderson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: Datable. My company has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Datable Technology. Please click here for more information. An affiliate of Streetwise Reports is conducting a digital media marketing campaign for this article on behalf of Datable. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Datable, a company mentioned in this article.

Additional disclosures

Clive Maund does not own shares of Datable Technology and neither he nor his company has a financial relationship with the company.