After raising C$0.87 million in October of last year, Blue Sky Uranium Corp. (BSK:TSX.V; BKUCF:OTC) has been busy defining drill targets on its fully owned Amarillo Grande Uranium Vanadium project in Rio Negro, Argentina. An 8 kilometer long IP survey has been completed, which identified a 5 km long anomaly 20 km north of the Ivana deposit. The next step will be a reverse circulation (RC) drill program to hit the typical near-surface mineralization. Management is looking to increase the resource towards a district scaled size, being redox type, which regularly relates to very large deposits, and which in turn will likely improve 2019 PEA economics further. Speaking of which, as a reminder at a relatively (industry wide) low base case uranium oxide (O3O8) price of US$50/lb U3O8, the after-tax NPV8 of Ivana is US$135.2 million and the internal rate of return (IRR) is 29.3%.

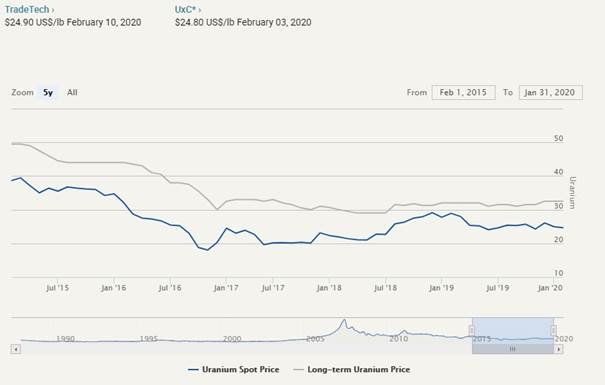

These are very decent numbers as most competitors use US$60-65/lb U3O8 for their base cases. Initial capex is US$128.05 million, and the all-in sustaining costs (AISC) net of vanadium credits are just US18.27/lb U3O8. This AISC is amongst the lowest in the industry. However, keep in mind that the entire project is not economic at this time as the long term (or also called contract) uranium oxide price is US$32/lb U3O8, as can be seen at this chart, which can be found as always on the website of Cameco:

There has been some volatility around the Section 232 Petition in the summer of last year, but this has been subsiding ever since, and uranium seems to be back to side-ranging for the foreseeable future. Everybody is waiting for utilities to start contract buying, but the reality is that nobody knows when this will happen. It can be at the end of this year, it can be in two or three years. As a reminder, the situation in Argentina itself is a case of importing all uranium; there is no domestic production. The beauty of this is that Argentina somehow is forced to pay up much more than the international contract prices, and this situation continues until this day. Therefore if Blue Sky Uranium manages to develop this project into commercial production, it could be eligible as single producer for an interesting premium, somewhere between international contract pricing and Argentinean pricing. So fundamentally the case for Blue Sky is very robust, as it is less dependent on lower, international uranium pricing, and it needs a lower base case price than most other development projects.

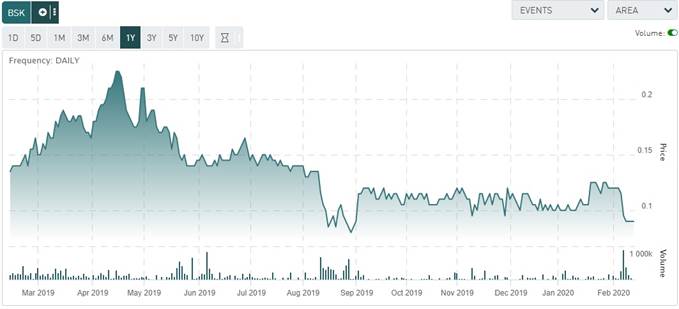

In the meantime, the only thing Blue Sky Uranium can do is diligently developing and growing its project as large and profitable as possible, as it is one of the most economic and leveraged uranium plays in the industry. As this can take a while, it seems that recently certain investors are rotating out of Blue Sky into other opportunities, which could be gold mining related, for example, as the one mining subsector that is popular at the moment:

Standing at a current market cap of just C$10.8 million, having a NPV8 that is C$180 million or about 17 times bigger, I view this as a long-term investment opportunity, and considered it also an interesting moment to catch up with President and CEO Nikolaos Cacos.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

The Critical Investor (TCI): Thank you for taking the time for this interview. I noticed your latest news release about the adoption of an advance notice policy regarding the nomination of directors. Why did Blue Sky Uranium need this policy in your view? Could you explain to me how it can be approved and effective at the moment according to the news release, but also still needs to be ratified at the next annual general meeting (AGM) later this year?

Nikolaos Cacos (NC): The adoption of the advanced notice policy ensures that shareholders have ample notice to assess and decide on which directors to vote for at AGMs. It prevents directors from being nominated at the last minute. This policy is good corporate management in favor of the shareholders at large.

TCI: I also noticed the application to extend 7.5 million warrants, set to expire on February 28, 2020, to February 28, 2022. This doesn't happen too often, usually companies let them expire. Could you explain to me why you made the application? There are 53.6 million warrants in total, does this mean you will apply for more warrants in the future if they appear to expire without being in the money?

NC: These warrants are priced at $0.35 and, if exercised, would bring in over $2.6 million. It's like a built in private placement. Hopefully, with drilling underway on our project, the market would look upon the results favorably and bring these warrants "in the money." As for other warrants, we will decide on a case by case as to whether to grant an extension.

TCI: As the latest financing in October raised C$0.87 million, could you tell us what the burn rate is of Blue Sky Uranium, and the cash position?

NC: We have a very low overhead burn rate, but with drilling underway, we could see up to $2 million spent over three to four months.

TCI: Do you have plans to do another cap raise, and if so when is this scheduled approximately?

NC: We will have to raise some additional funds in the next few weeks.

TCI: Speaking of spending cash, could you elaborate a bit more on the current exploration program at Ivana Central, North and West targets as for example the completed IP survey and the ongoing sampling?

NC: These are very exciting targets. The results published to date indicate very similar geological signatures as we saw at the early stages of our Ivana deposit, including some decent uranium values.

TCI: Could you compare the results of this early stage exploration to the same stage exploration you did at the Ivana deposit, and how do they compare?

NC: By now, we have a very good understanding of the geological controls and the model of the Ivana deposit. This is why we are very excited at the prospect of drill testing these targets, as they represent the potential to significantly add resources to our existing deposit.

TCI: How about your plans to do RC drilling on Ivana Central, North and West targets, as stated in the December 4, 2019, news release, and indicated in the latest presentation? RC drilling is set to start in Q1, 2020 according to this document. Where and when do you want to drill, how many holes (still 4,500 meters?), and what is your budget for this?

NC: We will indeed drill 4,500 meters in Q1, representing approximately 100 holes.

TCI: When can we expect results?

NC: Approximately mid-March 2020.

TCI: When can we expect a resource, if drilling proves to be successful of course?

NC: After we receive all the results from our drill program, we would assess whether they are sufficient to warrant a new resource calculation. If positive, then by end of Q2, I would expect we could have an updated resource.

TCI: Do you have a timeline in mind for the start of permitting and a Pre-Feasibility Study (PFS)?

NC: We would like to embark on a PFS study by end of Q2 or beginning of Q3.

TCI: As we discussed the project, let's talk a bit about the metals involved. What is your take on the uranium market for the medium and long term?

NC: We remain very bullish on the price of uranium. There is a supply shortage that is forecast by some very prestigious analysts. Uranium is also being touted as a clean energy fuel by some very smart and influential persons like Bill Gates and Patrick Moore (founder of Greenpeace).

TCI: What about vanadium? It retraced from the top around US$27/lb down to US$7-8 at the moment, as it seems that niobium has been replacing vanadium in rebar steel. Now that vanadium prices are low, a reversal of this development could be occurring, in my view.

NC: I feel that the price of vanadium will very much mimic the demand for steel. As the economies expand, especially China, we will see the demand for vanadium continue to rise.

TCI: Now that vanadium prices are down, did you look at ways to improve the met work, which was already successful? Maybe there are other ways to optimize economics besides growing the resource and potentially find higher grades?

NC: I always view metallurgy like a Rubik's Cube—one needs to continuously refine the methodology until the optimal solution is found. Yes, especially in light of our potential PFS studies, we will be re-visiting the metallurgy of our project.

TCI: Regarding Argentina, we discussed the new president Alberto Fernandez in my last update. It seemed to be quite a positive development, as he was planning on initiating a new Ministry of Mines. Could you tell the audience what the current status is on this initiative, and how things are going on the side of Argentinian politics for mining?

NC: From the discussions that we have had with the new government to date, we remain very optimistic that the strong support for mining remains. We look forward to having further discussions with them during the upcoming PDAC convention.

TCI: On a closing note, is there anything you want to mention or discuss, as you feel it could be important for investors?

NC: Yes. Blue Sky represents one of the newest uranium/vanadium discoveries out there. The preliminary economic study that we completed demonstrates that Ivana can potentially have some very advantageous economics. The current drill program will demonstrate the expansion potential of Ivana. With some good drill results, Amarillo Grande will be well under way to realizing its potential to rank amongst the largest and most economic uranium projects on the globe. That represents truly a one in a million opportunity for investors.

TCI: Thank you for your time, Niko. Investors should be completely up to date again, and I will follow Blue Sky Uranium with interest during 2020, looking forward to drill results and hopefully an updated and increased resource, and the commencing of the PFS.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website http://www.criticalinvestor.eu to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

[NLINSERT]Disclaimer:

The author is not a registered investment advisor, and has a long position in this stock. Blue Sky Uranium is a sponsoring company. All facts are to be checked by the reader. For more information go to www.blueskyuranium.com and read the company's profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Streetwise Reports Disclosure:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts and graphics provided by the author.