Maurice Jackson: Today, we will highlight an exciting value proposition in the prolific Stillwater district of Montana, which is known for high grade palladium, platinum, gold, nickel, copper and cobalt. Joining us today is Michael Rowley, the president and CEO of Group Ten Metals Inc. (PGE:TSX.V; PGEZF:OTCQB; 5D32:FSE).

We have some very intriguing news to share with audience members, but before we begin, sir, for someone new to the story, please introduce Group Ten Metals and the opportunity the company presents to the market.

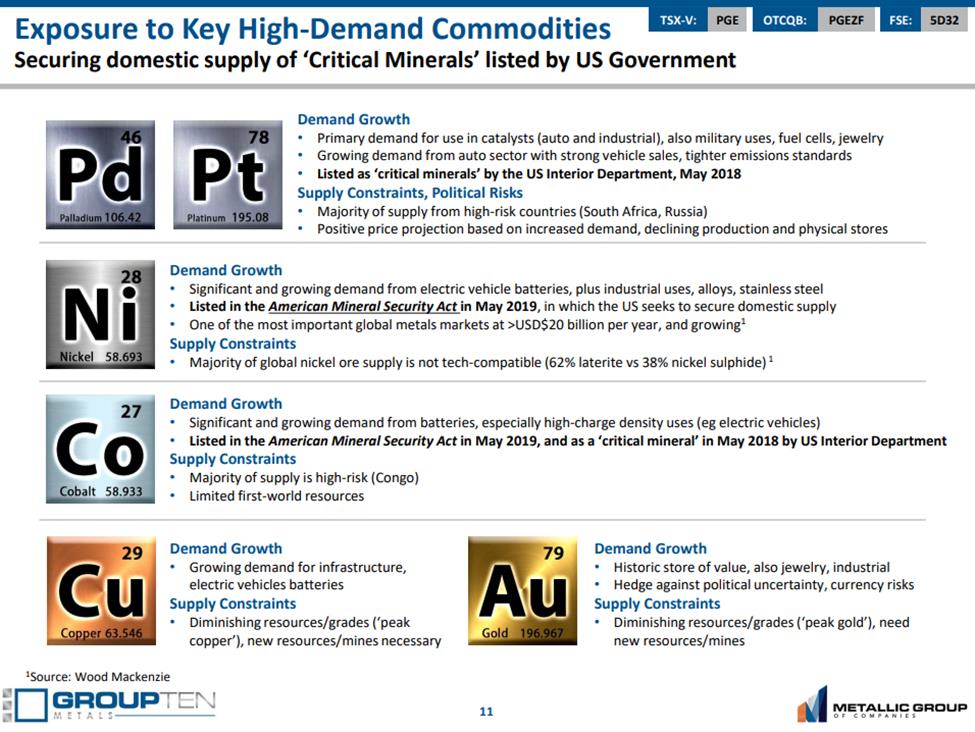

Michael Rowley: Group Ten Metals is a growth-stage exploration company. We are pre-resource, resource however, as we will touch on in our conversation today, we are now modeling our first formal mineral resources at our most advanced target areas, and that's based on the quality of the database that we have with the project plus our drilling in 2019. We were actively acquiring high-quality, district-scale projects throughout the bear market cycle, and that has led us now to have 100% interest in three assets in North America that adjoin some of the best deposits and mines of their type and share geology with them. These are focused on palladium, platinum, nickel, copper, cobalt and also gold.

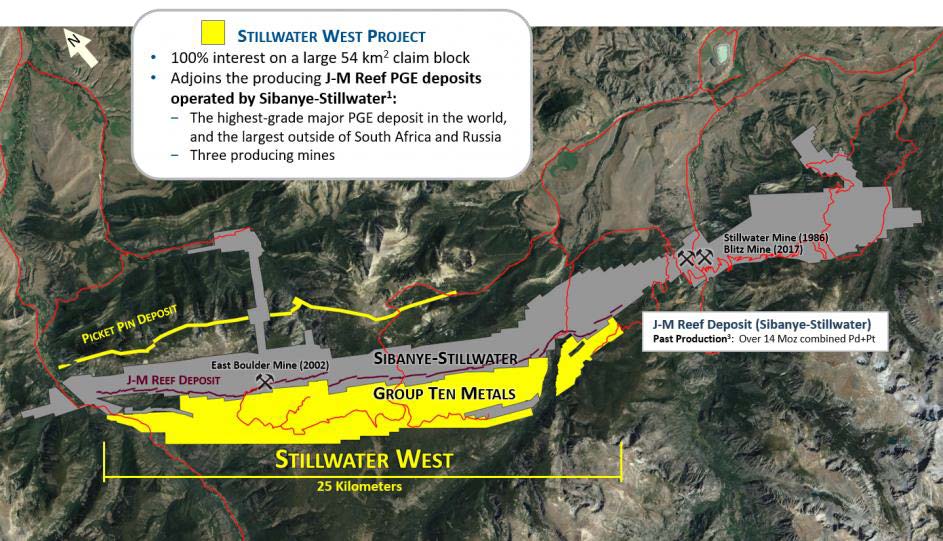

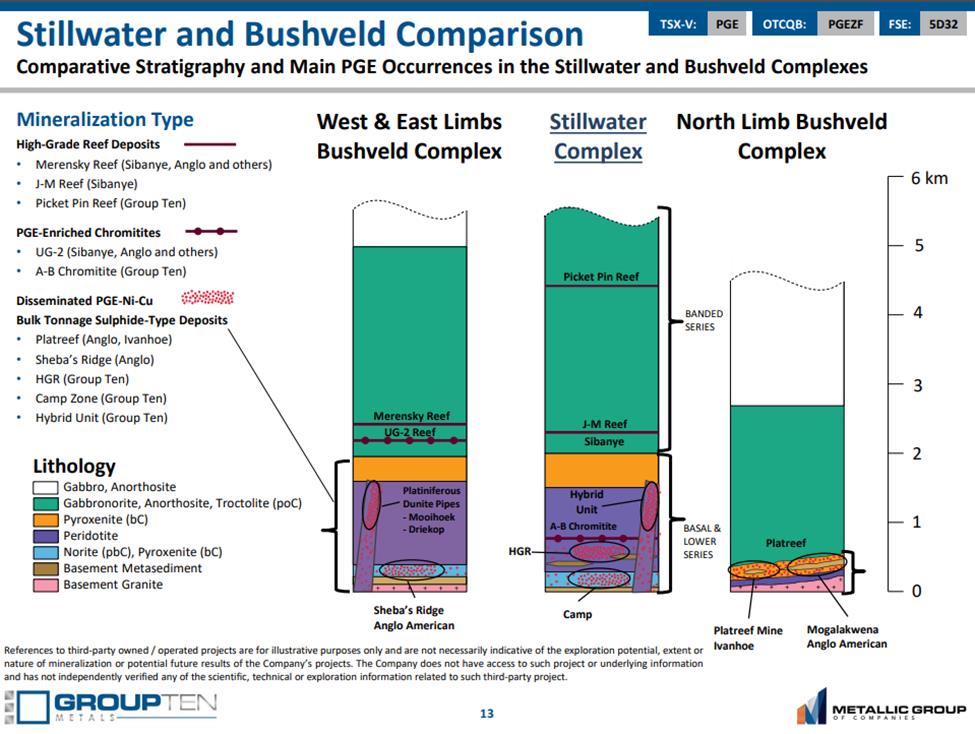

Our most recent acquisition is the Stillwater West project, and it quickly became our flagship as we were able to acquire half of one of the absolute best districts for palladium in the world. We did this in 2017, just before Sibanye Gold Ltd. (SBGL:NYSE) completed their purchase of the adjacent Stillwater mines for US$2.2 billion. Essentially, at Stillwater, we're the first to consolidate the district and bring in a world-class team to systematically explore the lower and basal portion of the Stillwater Complex for these Platreef-style deposits. We're bringing a model in from South Africa here, and it's bulk-mineable platinum group metals (PGMs) with nickel and copper of a type that you find in the north limb of the Bushveld Complex in South Africa.

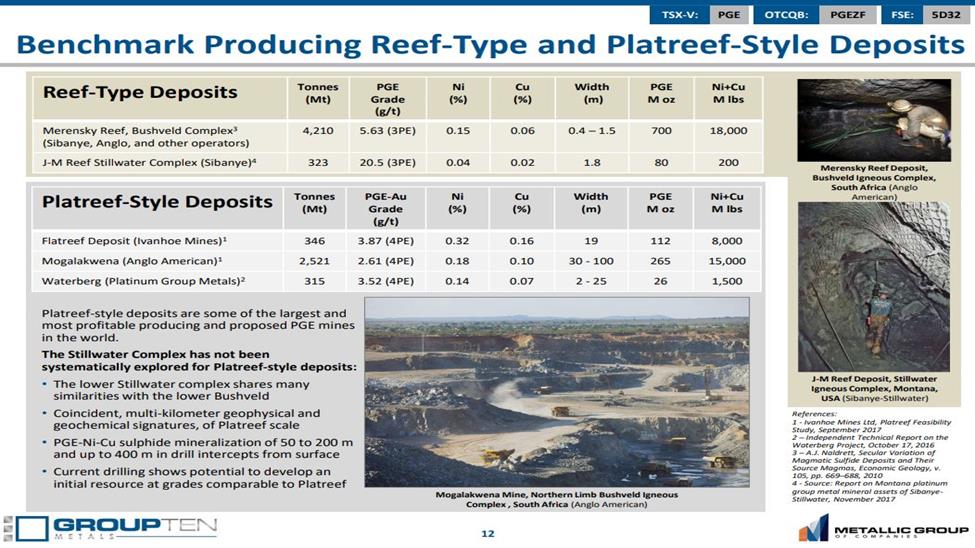

The Platreef as a district has over 400 million ounces of platinum group metals, tens of billions of pounds of copper and nickel, and it hosts one of the absolute best mines in the world, full stop: Anglo American Platinum Ltd.'s (AMS:JSE) Mogalakwena mine, which is a 265 million-ounce platinum group nickel-copper mine. It produces platinum group elements (PGEs) below about $300 an ounce right now, and has a multidecade mine life—it's a fantastic deposit and operation.

Right beside that in the Platreef district, you've got Ivanhoe Mines Ltd.'s (IVN:TSX; IVPAF:OTCQX) Platreef Mine, which is 112 million ounces, and that's soon to be in production. And then on the north end of the Platreef, you've got Platinum Group Metals' Waterberg project, which is the baby in the district with 26 million ounces of PGEs. These are staggering numbers, and if they were gold deposits, maybe they would get more attention. They're wonderful deposits.

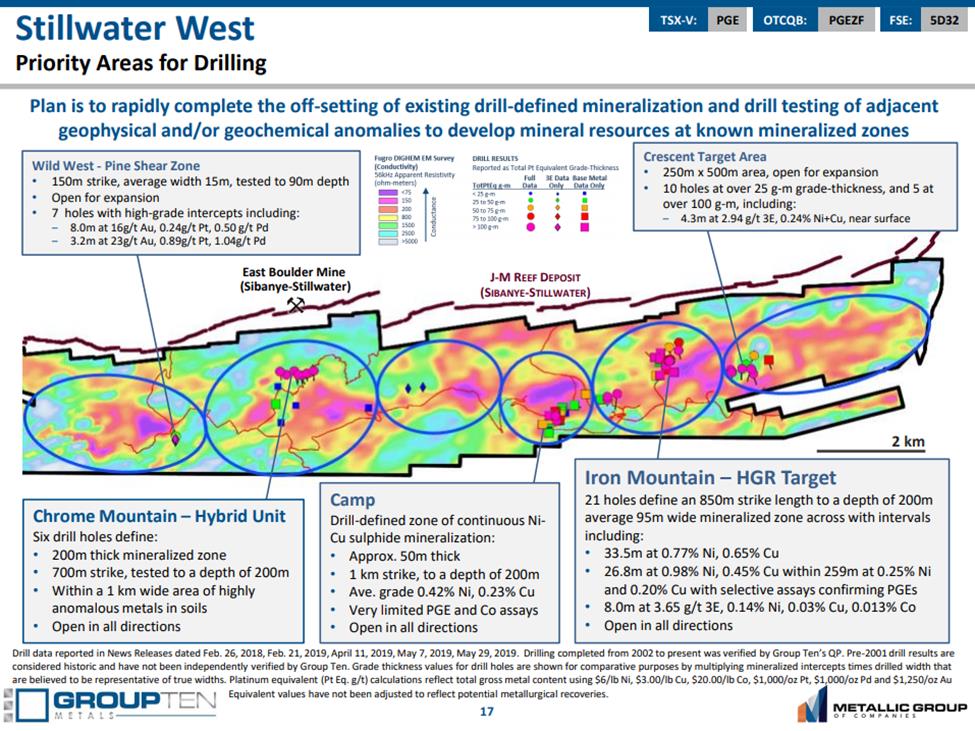

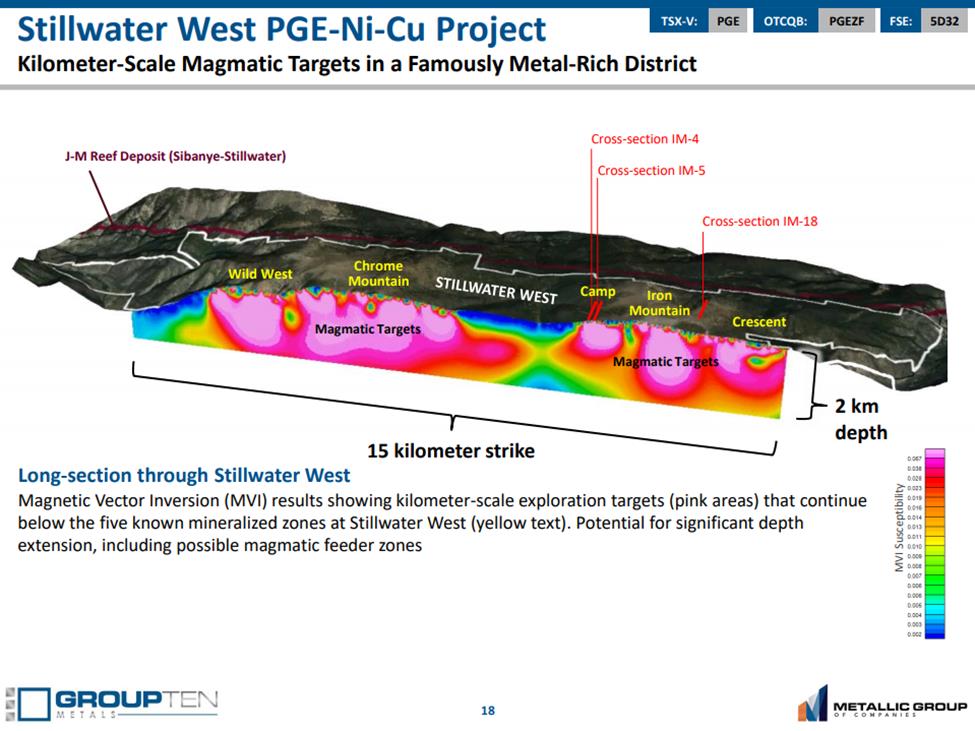

Based on the known parallels between the Stillwater and Bushveld system, our target at Stillwater are those Platreef-style deposits: tens to hundreds of meters thick and kilometers in length in the lower and basal portions of the layered Stillwater Complex. We have a terrific database and our work to date, including our 2019 drill program, has confirmed that that potential is real.

We also have two other assets—high-grade gold in Ontario and platinum group nickel-copper in the Yukon. Like Stillwater, we have 100% interest in all of these district-scale projects. We bought them during the bear market cycle and we have low carrying costs on them. We are looking to divest those noncore assets, being the Ontario and Yukon projects, when the right deals present themselves.

Maurice Jackson: It's a truly unique value preposition that Group Ten Metals presents to the market. Let me ask you this here: palladium and rhodium are at historical highs. How does this fit into the narrative for the shareholders of Group Ten Metals?

Michael Rowley: Palladium is central to our story. We are, of course, beside the highest-grade palladium mines in the world. The Stillwater mines run 17 grams per ton of combined PGEs, palladium-rich, and are 80 million ounces in size and open actually at those values. It's a fantastic district to be in for palladium. It's also one of our two biggest values in our part of the system in Stillwater, nickel being the other.

Rhodium is a valuable co-product that we are one of few in the world to have, and we're just now going to get some assays out to look at that potential in more detail. It's also worth noting that the U.S. has listed some of these metals as being strategic, and of course, we're in the U.S. at a time when the U.S. is looking to secure domestic supplies of these commodities.

Maurice Jackson: Speaking of nickel, we had an opportunity to interview Brent Cook (click here) last month, and he's really excited about nickel. Germane to the value proposition of Group Ten Metals is nickel, which may be the big elephant in the room that prospective shareholders may be overlooking. Michael, how does a $8–$9 nickel price impact the value proposition of the company's flagship Stillwater West project?

Michael Rowley: Nickel is definitely of interest to the market, and perhaps more to the majors that we are in discussion with than with the retail audience to date, but as you've seen from our results, we have excellent grades and lengths of nickel sulfide in our core, and we're now planning to expand on that by stepping away from the past work and going after the potential we really see.

In terms of nickel prices, we have not put economics around our developing resources yet, but we know that we have nickel sulfide, which is, of course, the technical-grade/battery-grade nickel, and we've got long lengths of it. We're blessed with some really good metallurgical testing that was done by AMAX in the Camp target area in the 1970s, which shows the production of good quality nickel sulfide concentrates using conventional flotation techniques, including the recovery of the platinum group elements. So, we expect that nickel will continue to share the lead with palladium as a big value driver at Stillwater and that it will be recoverable, as well.

Maurice Jackson: In 2019, Group Ten Metals conducted an exploration program focusing on five priority target areas to test their proof of concept, and the results are coming in. Take us to the Iron Mountain target area, and what can you share with us regarding platinum and nickel intercepts?

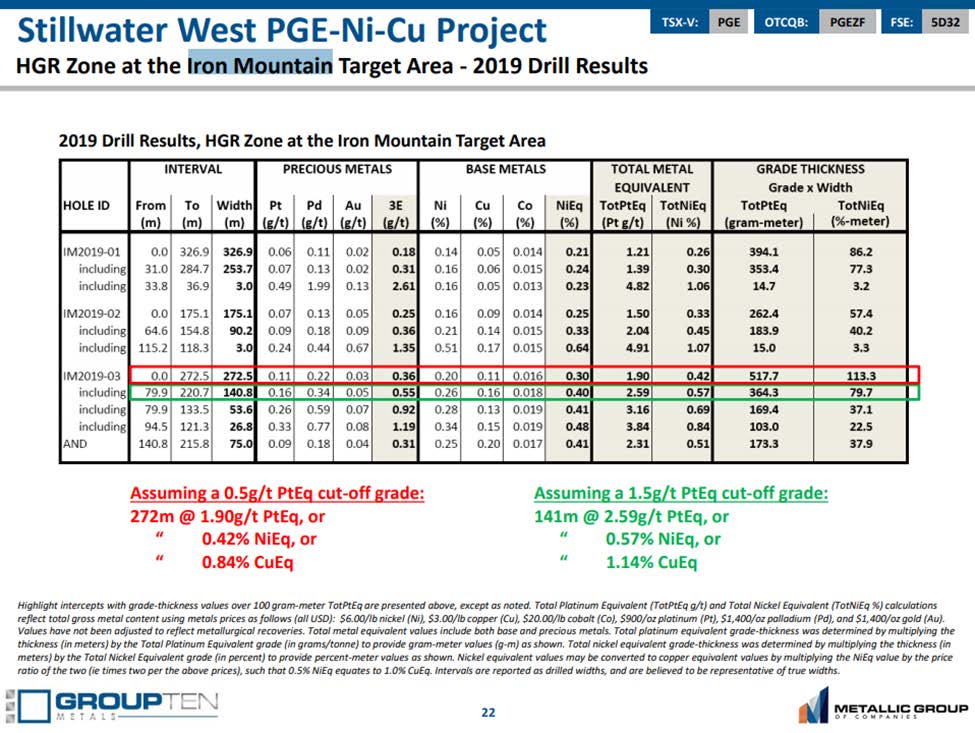

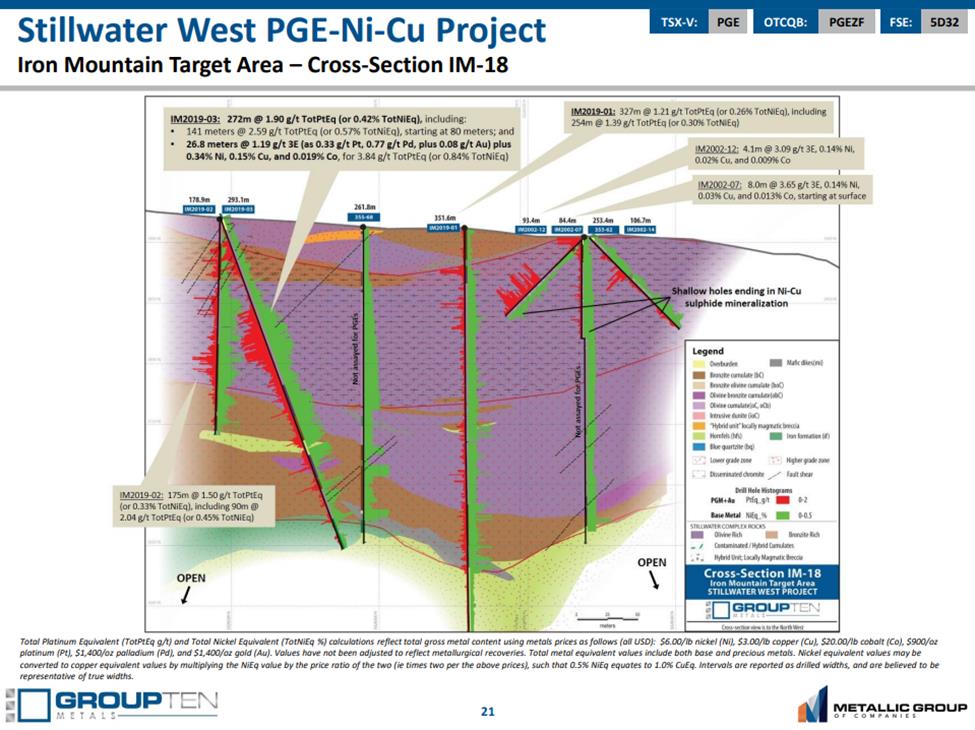

Michael Rowley: We did our first drill program on the ground in 2019. We drilled at the Iron Mountain target area and also at Camp, and we reworked past core from a further three target areas, as well. At Iron Mountain, we drilled three holes. This was an important proof of concept for us. We proved that the Platreef potential is real. We hit long lengths of copper-nickel sulfide mineralization. The hit that we highlighted in the news release was hole IM-2019-03, which returned 272 meters at 1.9 grams platinum equivalent per ton, and that's at a half gram platinum cut- off, so that's a fantastic intercept, and it speaks to the sheer amount of metal and the size of this system at Stillwater.

If you apply a 1.5-gram platinum cutoff, perhaps in a more selective underground mining scenario, that intercept becomes 141 meters at 2.6 grams platinum equivalent. So again, really good metal tenors. Within that, you've got 27 meters that's running 1.2 grams 3E, 0.77 grams of that palladium, so that's a nice long intercept with palladium value plus copper and nickel. And that is the Platreef model that we're chasing here: tens to hundreds of meters thick, kilometers in length,0.3–0.4% nickel, 0.1–0.2% copper, and then a gram or two of PGEs on top of that. Very minable grade, and that's the target at Stillwater.

We confirmed that at Iron Mountain, and in addition to confirming the model, we expanded the mineralized zones very nicely. It's open at depth, and it's open along strike as well. It informs the block models that we are now developing internally and will become our maiden resources at three of these target areas.

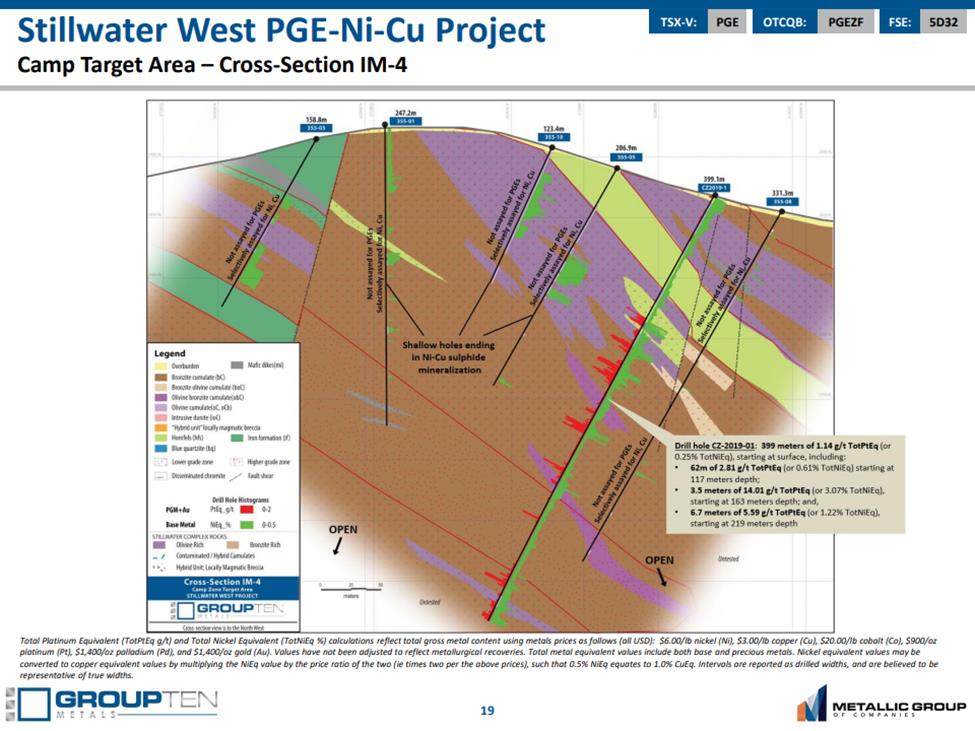

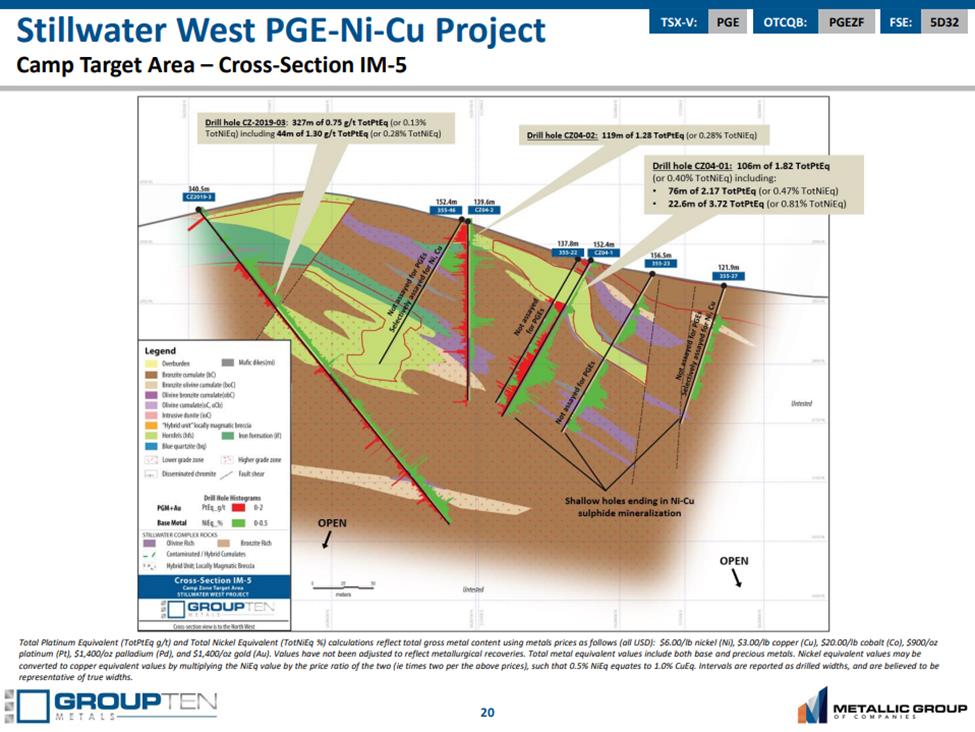

Maurice Jackson: Take us to the Camp Target Area, where Group Ten just announced continuous mineralization of palladium, platinum, gold, nickel, copper and cobalt from surface. Please provide us with the highlights coming from the Camp target area.

Michael Rowley: Similar to Iron Mountain, we confirmed the concept and proved the Platreef potential and delivered some really nice intercepts. Again, the lengths are there, quantity of mineralization, and then the grade within these intervals. It's confirming the Platreef potential, again, tens to hundreds of meters in thickness, kilometers, and scale.

At Camp Zone, the mineralization was perhaps chunkier. We're seeing it bunched, which is kind of interesting, and in particular, 3.5 meters running, 3.5 grams 3E with 1.5% nickel within a broader intercept that you mentioned, 399 meters running 1.1 grams platinum equivalent. This is good stuff. Like Iron Mountain, we greatly expanded the mineralized zone. We actually overturned some of the earlier thinking about the area and opened up that whole area to the south for mineralized potential and room to expand.

Maurice Jackson: In relation to proximity, how close are the Iron Mountain and Camp target areas from one another?

Michael Rowley: These are about a kilometer apart. Iron Mountain is about a kilometer east of Camp, and they're just two of a total of eight Platreef target areas that we have across the 25 kilometer-wide project.

Maurice Jackson: Michael, how did the results from both of these press releases compare among Group Ten's peers?

Michael Rowley: Our peers are breeding like rabbits these days, aren't they? We're seeing a lot of interest in the palladium space. A few of those have real potential, and some of them, frankly, looked kind of opportunistic, at least on first blush.

In terms of comparing, it's important to note that we have 100% interests on all our projects, including Stillwater West, and a number of our peers are still completing expensive earn-ins on theirs.

Second point would be scale. The potential for scale and grade at Stillwater West is fantastic. We barely scratched the surface there. The fact that we've been able to accomplish what we have to date, working for past core and past drill pads, is quite remarkable and speaks to the potential there. As you know, we're working to table our maiden resources, and we're working those up now in our block models. In 2020, we'll move away from the past work and test the conductive highs that we've identified. You've seen that in our news releases, and we can really go after this Platreef model at Stillwater.

Maurice Jackson: Moving on to future news flow, what can we expect to hear from Group Ten Metals in the coming weeks?

Michael Rowley: Continued 2019 exploration results, including drill results from Chrome Mountain, where we re-assayed and re-logged past core and advanced our block model and developing resource. Plus, we completed some geological sampling and mapping work at Chrome Mountain. We did a soil survey across the western third of the property, and those results will be out in the next couple of weeks. Rhodium assays we now have in progress. We are going to do a news release to summarize past metallurgical results, and then, of course, announcing our plans for 2020 and the great things we have in store for the project. I will also make an announcement about our Kluane and Ontario projects, and of course, if we complete any deals, we'll announce those as they become available.

Maurice Jackson: In our last interview, we discussed a rock sample of rhodium grading almost six grams per ton, and the price of rhodium has doubled since October to $11,200. Can we expect to hear about more rhodium assays from Group Ten?

Michael Rowley: Those are in the lab now, and we look forward to reporting them in the coming weeks.

Maurice Jackson: Sir, allow me to congratulate Group Ten Metals on your successes, and in particular, on the company's proof of concept. How does the success from the proof of concept position the company for 2020?

Michael Rowley: It should be a very exciting year. We have proven the Platreef potential based on the past work and the past drill pads as complemented by our drill work in 2019, and then in 2020, we can move beyond that past work, and really go after this and what we see is there. It's important to note that the past work—we have 28,000 meters of core in the database, 12,000 meters in the core shack, plus our 2019 work—was done for different target commodities and different geologic targets over several decades. So, it should be a very formative and significant year for us as we step away from that and really go after what we see is there. The scale potential is fantastic, and of course, we have a supportive platinum group, especially palladium and rhodium, market and nickel as well.

Maurice Jackson: Speaking of drilling, you need to have permitting. Sir, can you confirm that Group Ten has been approved for permitting on some 40-plus drill pads?

Michael Rowley: Yes, we are indeed in very good shape with permits for 2020. In fact, it's a multiyear permit. I believe the current permit's for 45 pads, and we have some unused pads from past years, so we're now over 50 drill pads. Good to go, and that will assist us in really going after the potential that we see at Stillwater.

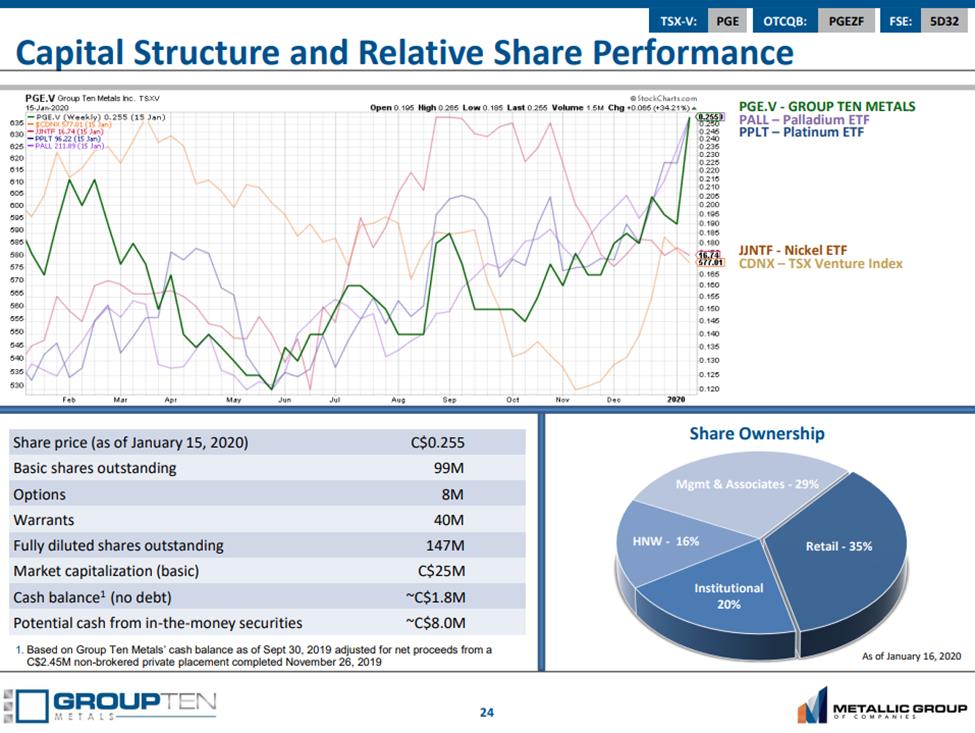

Maurice Jackson: Switching gears, Mr. Rowley, please provide us with an update on the capital structure of Group Ten Metals.

Michael Rowley: We're about a hundred million shares outstanding, and we have a number of warrants. In fact, all options and warrants are now in the money, which gives us access to up to $8 million. About$2 million of that is expected here in the month of February, as the last of the warrants from three years ago are coming in. Those are coming in nicely now and that, combined with the almost $2 million in the treasury right there, it gives us visibility to $4 million by early March, plus additional as the later tranches of warrants come in. We look to be in very good shape in terms of market structure and capitalization. Current market cap: CA$28 million.

Maurice Jackson: Speaking of being in good shape, when we last interviewed, the stock price was $0.14. Anyone listening to this interview, if you would have taken a position in Group Ten Metals, your position would have more than doubled. What can you share with us regarding the company's enthusiasm regarding the stock price considering that you have warrants out there?

Michael Rowley: It's brilliant timing. We took the ticker PGE four years ago, and we've suddenly got a PGE bull market, and we happened to be in probably the best district in the Western Hemisphere for exactly those metals. It's a perfect storm, and we did really good groundwork 2017–2018, we drilled in 2019, and really set the stage, proved the concept. Now, as we just discussed, we're permitted and well-funded for 2020 and beyond, so it's an exciting time, and we expect to add a lot more value.

Maurice Jackson: In closing, what keeps you up at night that we don't know about?

Michael Rowley: I think it's interesting to comment on conditions in South Africa. The CEO of Sibanye, Neal Froneman, just recently gave an interview in which he commented on what's going on in South Africa and how hard it is to operate a mine for a variety of reasons and his desire to expand further outside of South Africa. This is, of course, the guy who took Sibanye, a South African gold producer, and completed six or eight deals in six or eight years, including buying Stillwater to emerge as the world's biggest platinum producer.

He makes clear that he's looking for further acquisitions in the Americas in particular, and he also is interested in technology metals—battery metals, which is music to our ears. There's a greater movement there from South Africa as well since we saw Impala Platinum Holdings Ltd. (IMP:JSE) buy North American Palladium, the only other primary PGE mine in North America, just recently for $1 billion. I think that trend of South African wealth diversifying out of South Africa is an exciting one and could be very significant for Group Ten in the coming years.

Maurice Jackson: Last question, sir. What did I forget to ask?

Michael Rowley: Well, we should probably touch on the non-core assets, which as we mentioned the Yukon and Ontario projects are effectively up for sale at this point so that we can focus better on Stillwater.

These are terrific assets, high-grade gold in Ontario. We adjoin Treasury Metals Inc. (TML:TSX: TSRMF:OTCBB), who are now permitted to build a mill, and First Mining Gold Corp.'s (FF:TSX) Goldlund Project, which is an excellent high-grade gold project, 4 million ounces high-grade gold in the district. I think there's very real potential to get value there perhaps in a gold producing venture that we're not getting any recognition for in the market right now.

And our Kluane assets: We adjoin the largest undeveloped PGE nickel-copper project in the world, and I know that Nickel Creek Platinum (NCPCF:OTC.MKTS) is going sideways at the moment, but I think we can expect more from that district and the potential there. The interest in PGEs should certainly drive potential acquisitions of our Spy and Ultra project, for example. I look forward to updating on those as deal come forward.

Maurice Jackson: Sir, for someone readers to that want to get more information on Group Ten Metals, please share the website address.

Michael Rowley: The website is www.grouptenmetals.com.

Maurice Jackson: As a reminder, Group Ten Metal trades on the (TSX.V: PGE | OTCQB: PGEZF). For direct inquiries, please contact Chris Ackerman at (604) 357-4790, ext. 1; he may also be reached at [email protected].

As a reminder, Group Ten Metals a sponsor of Proven and Probable, and we are proud shareholders for the virtues conveyed in today's interview. Before you make your next bullion purchase, make sure you call me. I'm a licensed representative for Miles Franklin Precious Metals Investments, where we provide a number of options to expand your precious metals portfolio from physical delivery, offshore depositories, precious metal IRAs and private blockchain distributed ledger technology. Call me directly at (855) 505-1900 or you may email [email protected].

Finally, please subscribe to www.provenandprobable.com where we provide mining insights and bullion sales. Subscription is free.

Michael Rowley of Group Ten Metals, thank you for joining us today on Proven and Probable.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

[NLINSERT]Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Group Ten Metals. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Group Ten Metals is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Group Ten Metals. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Group Ten Metals. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own shares of Group Ten Metals, a company mentioned in this article.

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.