Prime Mining Corp. (PRYM:TSX.V) has picked up an existing gold mine in Sinaloa, Mexico with a production history going to the 18th Century. Guadalupe de los Reyes is estimated to have produced 500,000 to 600,000 ounces of gold and 40 million ounces of silver. Prime is buying the project for $6 million and a 1% NSR. The 6300 square km property comes with a 43-101 resource of 535,000 ounces of gold and over 10 million ounces of silver. To date only 40% of the project has been explored.

When I talked to management at Prime they told me of their plans for going into production on a small scale within two years at a low capital expense. I'm hoping they change their minds. Their plan calls for a low cost heap leach with production of somewhere in the 60,000 to 70,000 ounce per year range.

The project was bought from Vista Gold who spent in excess of $20 million on exploration. It lies in a nest of half a dozen other similar mines in the area including Minera Alamos, First Majestic, McEwen Mining and Chesapeake.

Mining companies love heap leach systems because they are cheap to set up and mine. While the recovery leaves something to be desired, the low capex can turn a low-grade mine, well, into a gold mine. But heap leach is suitable only for low-grade ore. Some of the material Prime is reporting is out of the range for a heap leach.

Here's why.

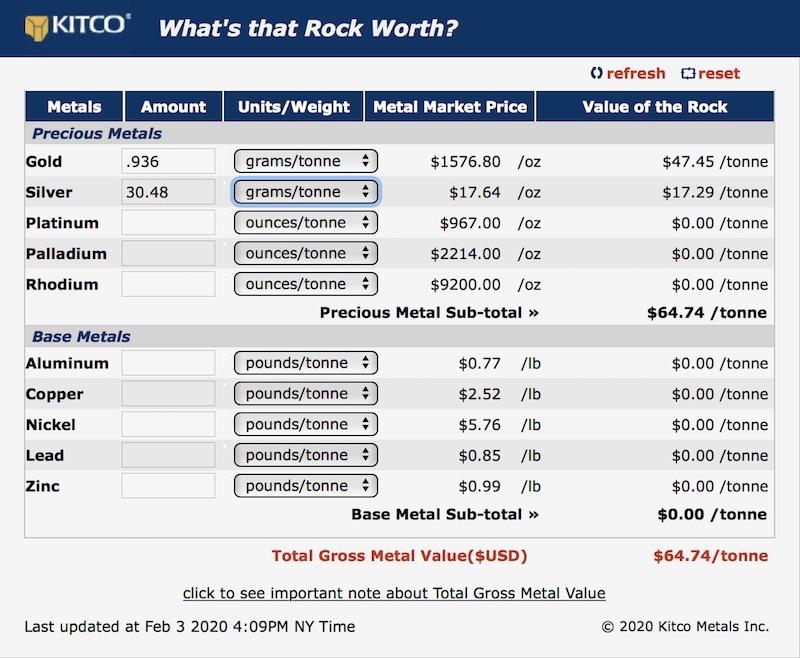

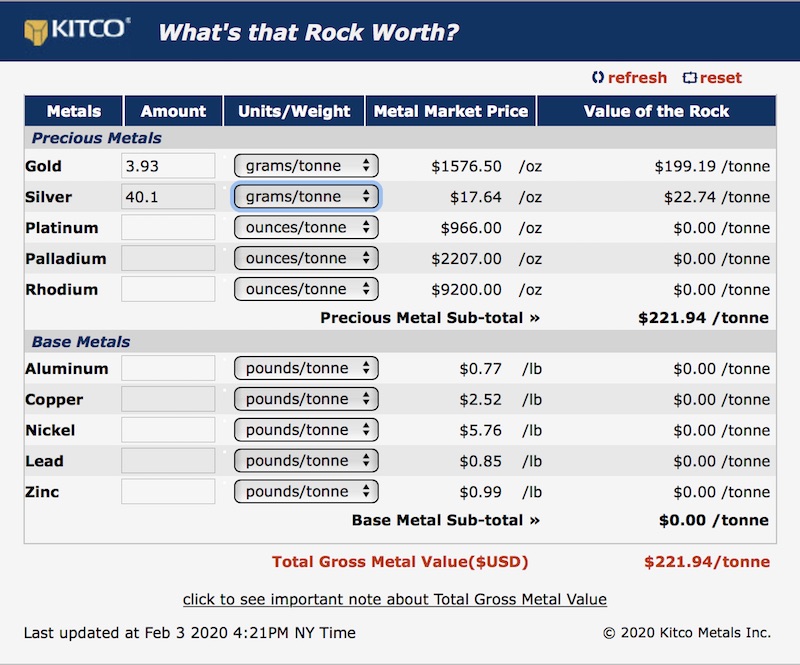

In their presentation Prime talks about "potential" to optimize gold recovery to over 76% and silver to over 24%. In their recent press release they give numbers for surface samples. One of the best, from Zapote Central showed 30 meters of 3.93 g/t gold and 40.1 g/t Ag. If you assume (and notice that the word makes an ass out of U and me) they manage to accomplish their potential to optimize gold and silver recovery. If you take 24% of 3.93 and 76% of 40.1 grams of silver, by their own numbers they are leaving 0.935 g/t Au and 30.48 g/t Ag on the heap leach pad due to the inefficiency of heap leach pads. That's $65 rock and anyone in Mexico would love to start off with metal values that high.

In short, heap leach pads are cheap but when you have higher grade ore as Prime seems to be finding, you lose a lot of money by not building a mill. Heap leach pads are great for $50 rock. I've seen mines that had all in costs of under $8 a ton. But when you start off with $222 a ton rock, it pretty much demands you build a mill even if it costs more.

There is another even more practical reason for changing the plan that management is now contemplating. Their current business plan calls for production of 60,000–70,000 ounces of gold a year by 2022. But in this market investors just don't give a damn or a cent for anyone producing under the magic number of 100,000 ounces a year. It's like selling diamonds. A 1.00 carat stone is worth 25–50% more than a 0.98 carat stone even if you can't possibly see any difference. Investors demand 100,000 ounces a year. You either give it to them or you pay a giant premium for not delivering what the market wants to see.

If it were me, I would make the priority to increase the resource by 50–100% and build a mill with much better recovery rates than the 76% for gold and 24% for silver. This market demands a certain business model and from what I was told, management I think is going down the wrong path. They should either do it right or not do it at all. They bought the project at a great price. They have cash in the bank and are releasing a current up to date 43-101 shortly. At today's price of the shares, the company is only getting $30 an ounce for resources in USD. Their peers who surround them are doing a lot better than that.

This is a new deal only put together in the last six months. Management is just now getting their feet on the ground. But their silver resource alone would justify the entire market cap. They have money and times are improving for the junior sector.

Prime is an advertiser. I have bought shares in their coming out private placement so naturally I am biased. Please do your own due diligence.

Prime Mining

PRYM-V $0.43 (Feb 04, 2020)

PRMNF-OTCQB 59.1 million shares

Prime Mining Website.

Bob Moriarty founded 321gold.com, with his late wife, Barbara Moriarty, more than 16 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 832 missions in Vietnam. He holds 14 international aviation records.

[NLINSERT]Disclosure:

1) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Prime Mining. My company has a financial relationship with the following companies mentioned in this article: Prime Mining is an advertiser on 321 Gold. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.