This month, Standard Lithium Ltd. (SLL:TSX.V; STLHF:OTCQX) is targeted to switch on a relatively large-scale, proof-of-concept lithium extraction Demonstration Plant in southern Arkansas. If all goes reasonably as planned, it should take just a few months to prove the company's proposed operational flow sheet. Then, management believes a final JV agreement with Lanxess Corp. will be signed.

CEO Robert Mintak commented,

"We're making chemical products, not merely extracting a raw commodity. We're doing sophisticated chemistry to produce a chemical that goes into batteries. It's a high-end product." GM [recently] announced they were going to build a $2.3 billion factory in Ohio to make lithium batteries. The industry is only going in one direction. We're at the point where we're going to be the U.S. hub for it. It's the next energy revolution and El Dorado [Arkansas] will play a part in it….

….The key element is our growing partnership with German specialty chemicals giant Lanxess, a company with 73 chemical plants around the world employing tens of thousands. They have extensive and sophisticated sales networks to sell specialty chemical products. That's a critical part of the whole story."

Significant vote of confidence in Standard Lithium's JV project

On October 30, Standard Lithium Ltd. (TSXV: SLL) (OTCQX: STLHF) obtained a C$5 million five-year loan, at just 3% interest from strategic partner Lanxess. The loan is convertible into 6,251,250 common shares, with 3,125,625 three-year warrants attached. The warrant strike price is C$1.20 (shares were at C$0.68 at the time of announcement). Please see the press release for further details.

These are very favorable terms; Standard effectively raised capital at a premium to market at a time when most lithium juniors can't raise capital at all. The warrants were struck at a 76.5% premium to the October 30 share price. In the end, Lanxess will potentially own 6,251,250 + 3,125,625 = 9,376,875 shares in Standard Lithium, paying an average price of ~C$0.93.

Assuming the new warrants get exercised, the company would have roughly 97.5 million shares outstanding and would have raised a total of $8.75 millin. Therefore, the pro forma Enterprise Value (EV) [market cap + debt – cash] with shares currently at C 0.91 is about C$82 million.

Compare that figure to Standard Lithium's interest in the after-tax NPV of 30% x C$1.336 billion = C$400 million. Standard is trading at 20% of its 30% share of the after-tax NPV. Under certain circumstances, Standard's interest in the project and its economics can be increased from 30% to up to 40%.

The loan represents another important milestone and clear vote of confidence in Standard Lithium, the JV project in southern Arkansas, and a very impressive management and technical teams led by Robert Mintak and Dr. Andy Robinson. For the past year, I've been saying that the company should be able to reach commercial production with fairly minimal equity dilution. This news is a meaningful step in the right direction.

If Lanxess is willing to invest today, at PEA-stage, with dismal lithium market sentiment, I imagine they might be willing to invest again in 2020 or 2021. That, or be a cornerstone order in future capital raises. This is on top of Lanxess' expected commitment to line up 100% of project financing. Commercial production is expected to commence in 2022 with full phase 1 production of 9,700 tonnes Lithium Carbonate Equivalent (LCE)/year (2,910 tonnes LCE net to Standard) reached in 2023.

Use of proceeds will further advance the company's Demonstration Plant (DP). When fully commissioned, the DP will continuously process an input "tail-brine" flow of ~50 gallons per minute. That's an annualized production rate of 100–150 tonnes of LCE. The DP is assembled on-site; commissioning started in December.

Above is a recent picture of the DP.

As can be seen, it's a fairly significant structure. Notice the pick-up trucks on the left and the UFO in the upper left corner! The facility is purpose-built to be scaled-up to commercial design capacity of 9,700 tonnes LCE/year in phase 1 production, targeted to start in 2022, and be fully ramped up in 2023.

The DP showcases Standard's proprietary LiSTR technology that uses a solid sorbent material to selectively extract lithium. The environmentally friendly process eliminates the need for evaporation ponds and reduces processing time from 12–18 months to a matter of hours, while, at the same time, greatly increasing lithium recovery rates.

Although a run-rate of 100-150 tonnes LCE/year is not much by commercial standards, it's impressive as far as pilot plants go. Finished lithium products will be used internally for testing, and, more importantly, will provide Lanxess proof of concept for its final investment decision.

Two years and C$20 million…

Standard could now be just two years from initial production of lithium products. In addition, the amount of additional equity capital required to reach that critical point could be only C$20 million.

If true, the company is pretty far along in having meaningfully de-risked the project. Remember, funding is the #1 challenge these days facing battery metals juniors. Standard Lithium appears to have the funding piece of the puzzle largely in place.

As readers of my articles and interviews know, there are a number of lithium brine projects in Argentina and Chile. Several in Argentina were expected to reach first production in 2021 or 2022. On average, I estimate those projects have been pushed back 18–24 months due to a lack of funding, and more recently, uncertainty around a critical presidential election (the less mining-friendly candidate won) and social unrest/protests in Chile.

Even more recently, a mid-December ruling by a Chilean environmental court upholding claims of excessive water use by SQM seriously threatens its expansion plans in 2020 and beyond.

Perhaps half of the projects on the drawing board, (PEA-stage or further advanced) 2–4 years ago are no longer serious contenders. By NOT falling behind, Standard has caught up to Lithium Triangle projects, and could be in production ahead of the pack. This is very important. The early-to-mid 2020s will be a very good time to be in production, a time when global demand for lithium could finally take off.

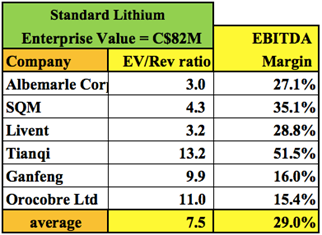

Lithium producers trading on average at 7.5x Revenue

In the chart below, one can see that a sample of lithium producers is trading at an average EV to trailing 12-month revenue multiple of 7.5x. Eighteen months ago it was closer to 10x. Although Standard Lithium is not yet in production and will never be a giant like SQM or Albemarle, one can imagine what an indicative valuation might look like.

Readers should take note of EBITDA margins among producers, averaging 29%. Haircutting the assumed margin in Standard's PEA by one-third to be conservative still results in a healthy 45% operating EBITDA margin.

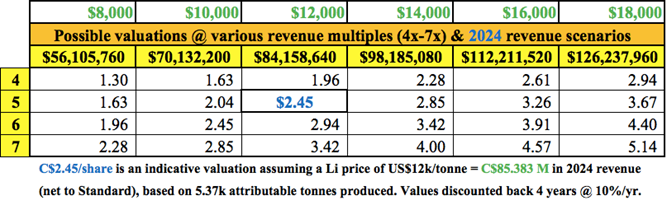

How much revenue (net to Standard Lithium) might be possible upon achievement of phases 1 and 2? The chart below shows revenue scenarios for 2024 (after phases 1 and 2 are fully online). According to its spring 2019 prospectus filing, Standard will own at least 30% of project economics and perhaps up to 40%, depending on various factors that have not been made public.

In working on a broad, indicative valuation range, I assume 20 million shares get issued between now and year-end for a pro forma total of ~117,500,000. And, I discount indicative per-share valuations back 4 years at a 10%/year discount factor.

As can be seen, the range of per-share values is wide; from C$1.30 to C$5.14. I, of course, don't know where the share price is headed, but using this chart for illustrative purposes makes me feel pretty good about the possibilities. Note, the current share price is C$0.91.

At a 5x EV/2024 revenue multiple—on revenue from selling lithium @ US$12,000/tonne—the indicative per-share value discounted back four years is C$2.45.

Conclusion

Given that Standard Lithium's (TSX-V:SLL) / (OTCQX:STLHF) JV project is well on its way to being fully funded with the technical and financial support of giant specialty chemicals conglomerate Lanxess, and given that a third-party PEA has demonstrated robust project economics, Standard Lithium is arguably more de-risked than the market is giving it credit for. Near-term catalysts, most notably the operation of the DP, will provide ongoing news flow.

In 2020–21 management will be tweaking the DP, sending out lithium product samples and working on a Pre-Feasibility Study. Market sentiment for lithium is at multi-year lows. Now might be a great time to be looking at lithium juniors, some of which could see a considerable bounce back in their share price along with lithium prices.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

[NLINSERT]Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed below.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Standard Lithium, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Standard Lithium are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this interview was posted, Peter Epstein owned shares of Standard Lithium, and the Company was an advertiser on [ER].

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.