Golden Arrow Resources Corp. (GRG:TSX.V; GARWF:OTCQB; G6A:FSE) recently came out with some pretty interesting news on its Indiana gold project in Chile. The company managed to amend the definitive agreement with the property owner, Mineria Activa (MSA), a Chilean private equity investment management firm focused on exploration to production-stage assets in mining. Golden Arrow now has the right to earn 100% of Indiana over a 74-month period, expiring in December 2024, and the total cost of US$15.1 million has not changed.

However, the payment of US$1 million due to the end of 2019 was reduced to US$150,000, and the subsequent payment of US$2 million due in one year is reduced to US$200,000. Another great advantage is moving US$7 million of the total US$15 million payment obligation for the 25% MSA interest during production after a production decision, meaning that MSA will be bearing execution risk now. This is obviously a great advantage to have as hard dollar commitments have been scaled back significantly this way, and that money can be spent at exploration.

I was interested in the fact that this agreement could be adjusted so considerably after a relatively short period of time, during what seems to be the first innings of a new precious bull market. After asking VP Exploration and Development Brian McEwen a number of questions about this, he had the following insights to share:

"Indiana is a narrow vein project with very good potential for expansion of resources, and when you include the possibility of adding ounces from surrounding prospects of very interesting targets. The difficulty in projects like this the cost of proving up resources. It is very expensive to drill it off to the required spacing to meet 43-101 standards. Given this point we went back to Mineria Activa (the vendor) and said we are willing to honor our total commitment to pay $15 million for the project, but with a different strategy of initially drilling off enough to prove up a feasible operation and then making the payments out of cash flow.

"At first they were not interested in this option as it means they need to accept some of the mining risk, which before they did not. We presented a staged plan with the possibility of obtaining a mining partner and said we would start right away with mobilizing a drill this month. Mineria Activa are reasonable partners and accepted the proposal. This is all very good for GRG as we now have two years to prove up a workable plan requiring minimal vendor payments. We also now earn 100% of the project, where before Mineria Activa had the option to maintain a 25% interest."

On my follow up question of what really changed, as the needed dense grid spacing was probably apparent from the start, both for GRG and the vendor, Brian answered:

"We went back to square one with the drill hole data and questioned some of the interpretations, mostly this had to do with the size and extent of the high-grade ore shoots. This needs to be tested. At the same time, we had the idea that if we can delineate high-grade ore shoots with enough certainty, why not start to mine them and create cash flow. If we can do this, we can pay the vendor without having to raise money in the market. At the same time, we can be expanding our resources in the area. This idea of mining first, pay second was presented to Mineria Activa and after a period of negotiations, we came up with a new deal."

So, it probably boiled down to the fact that geologists can only do so much due diligence for an agreement, and when an exploration program is being set up, they go much deeper into the available data, and can run into unexpected conclusions. After this I asked Brian if he has a good idea of staging in their new plan for Indiana now. He stated:

"Staging now is:

- Define high grade tonnage in ore shoots through initial 2,500m program for approximately 160K ounces<

- Test resource potential to support a 400tpd operation for an extended period

- Complete engineering studies to show feasibility of plan

- Find a local partner, with proven mining experience (talking to several groups now)

- Construction

- Mining

- Pay vendor out of cash flow

- Continue to grow resource/reserve"

This fits in nicely with the company's originally stated plans: a minimum 2,500 meter drill program in 2020 and a further minimum 2,500 meter drill program and commencement of preliminary engineering studies before the end of 2021. The company will commence a 2,500 meter drill program in the first quarter of this year to confirm and further delineate high-grade mineralization prior to planning additional drilling and commencing engineering studies. First results are expected sometime early in Q2.

The company still has 1.045 million shares of SSR Mining (SSRM.TO), worth C$24.22 million at the moment (January 20, 2020), after having sold 200,000 shares of the original 1,245,580 shares received from SSR Mining as part compensation for the sale of the 25% interest in the Puna operation. The four-month hold period for the SSR shares ended at January 18, 2020, so the company probably sold the 200k shares as soon as possible. The sale netted the company C$4.5 million, which means Golden Arrow has about C$5 million in the treasury at the moment, and is fully funded for their 2020 exploration programs. According to management, the company has sufficient cash and cash equivalents to be able to take the Indiana project to PFS stage, and a market financing would only be considered if Golden Arrow shares were trading considerably higher.

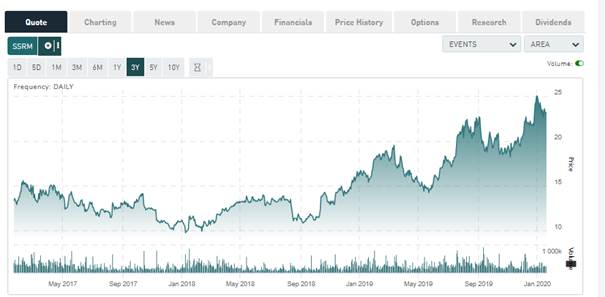

When looking at the chart of SSR Mining, it can be seen why these shares are a great and liquid asset to have, as the company is performing very well and is profiting perfectly of the increasing precious metals prices for the last six months:

Share price SSRM.TO; 3 year time frame (Source tmxmoney.com)

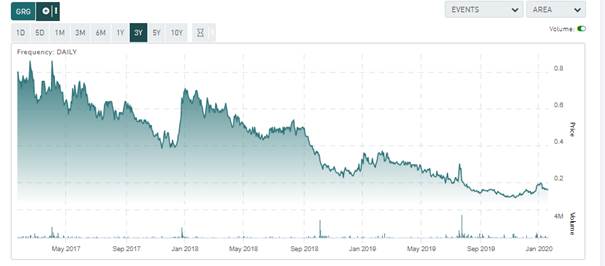

Golden Arrow has been trading the other way around, as its hands were tied most of 2019 and the timing of the much discussed, forced sale of Puna couldn't have been more unfortunate, but this is all behind us now, and Golden Arrow seems to have bottomed now:

Share price GRG.V; 3 year time frame (Source tmxmoney.com)

The company has, of course, more projects than just the Indiana project, and I was wondering if more information has become available at this moment. Not so much, according to management, regarding the Tierra Dorada project; the upcoming drill program is slated to start in Q2.

The Flecha de Oro project in Argentina has surface mapping and sampling underway and will be followed by detailed mapping and trenching in Q1/Q2. Further results will be announced in Q1.

Conclusion

I view the renegotiation of the Indiana Project deal as a very important one, as upcoming obligations in the first two years are limited to a minimum, but on the other hand the company gets a realistic opportunity to retain a 100% ownership of a very interesting project going into production. As the company is fully funded and still has about C$24 million in SSR Mining shares, which is a very good operator in my view and has exceptional leverage to rising precious metal prices, they don't have to worry about cash now for a very long time. Together with its other exploration programs going on in Paraguay and Chile, Golden Arrow seems to be fully recovered and ready to profit from a potential new precious metals bull market.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website, http://www.criticalinvestor.eu in order to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

[NLINSERT]Disclaimer:

The author is not a registered investment advisor, currently has a long position in this stock, and Golden Arrow Resources is a sponsoring company. All facts are to be checked by the reader. For more information go to www.goldenarrowresources.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Streetwise Reports Disclosure:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own shares of Golden Arrow Resources, a company mentioned in this article.

Charts and graphics provided by the author.