I have been looking for a very good junior palladium stock, and I believe this is the best one out there for potential enormous gains. But before I get to that, it is important to have a look at the palladium market, because this bull market is much different than the last one.

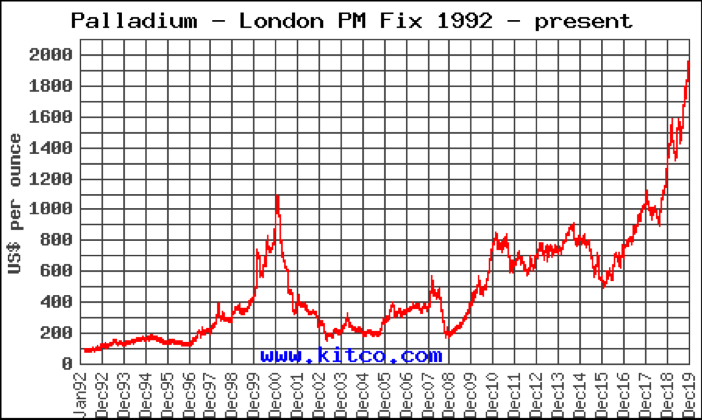

The one from 1997 to 2000 was about three years' long, and then palladium dropped, giving up most of the gains in less than a year. There was a nice bump up from the 2008 crisis and then the price traded sideways for several years. The price bottomed at the end of 2015 with the severe bear market in precious metals.

Since then the price has been going steadily higher, with a major break out in 2016. This bull market is not going to end anytime soon for the reasons I will show you in the next couple pages.

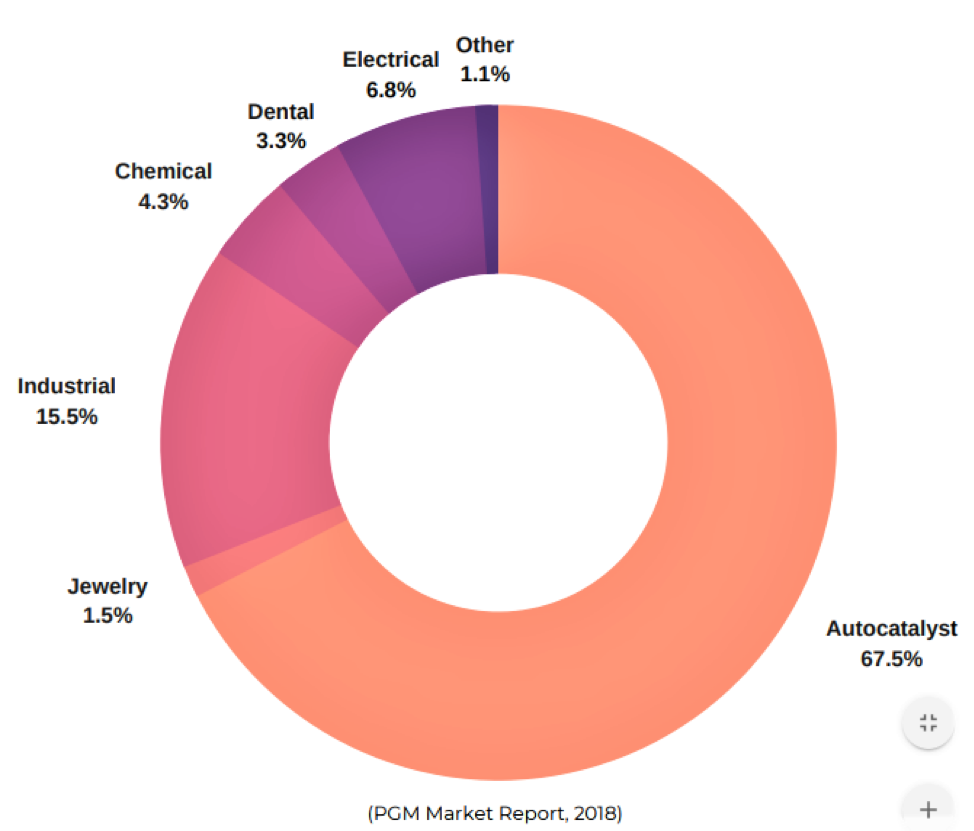

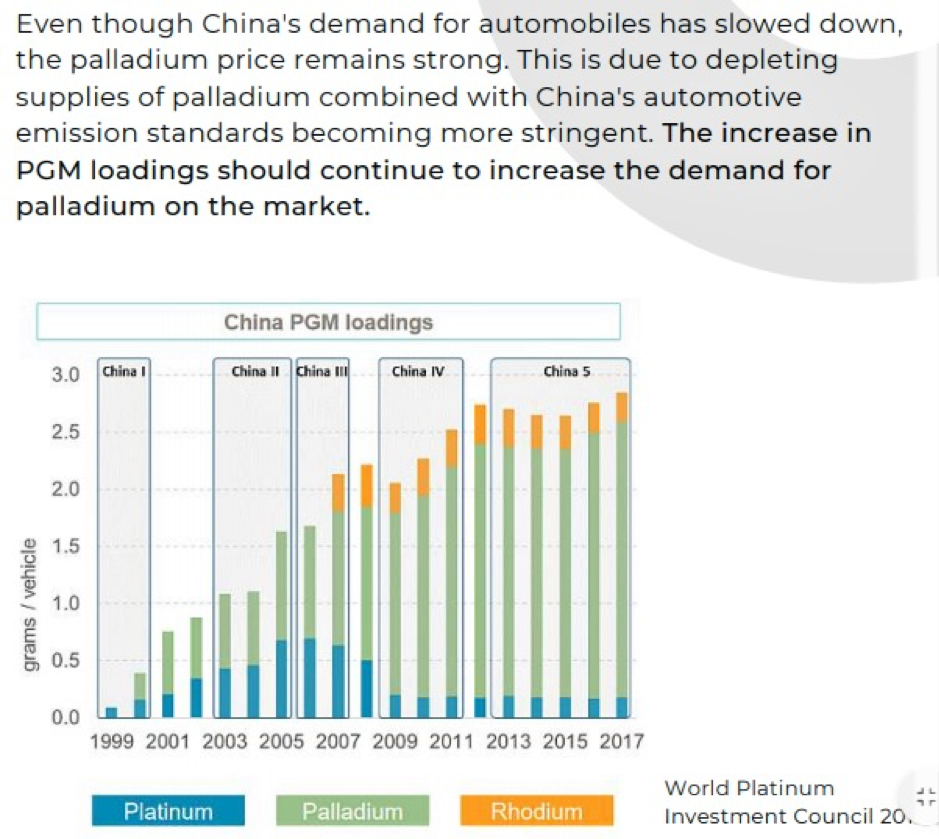

Palladium is mostly used in the auto industry for pollution control with catalytic converters. Electric vehicles will be a long time coming to replace any significant amount of gasoline/diesel-driven vehicles. Meanwhile, pollution standards are being tightened that will keep demand high. China has been gobbling up palladium since their China 5 pollution standards took effect in 2013. China 6 will now be coming into effect, which will increase loads per vehicle of palladium. Many analysts have been commenting that China has been secretly stockpiling the metal and is driving prices.

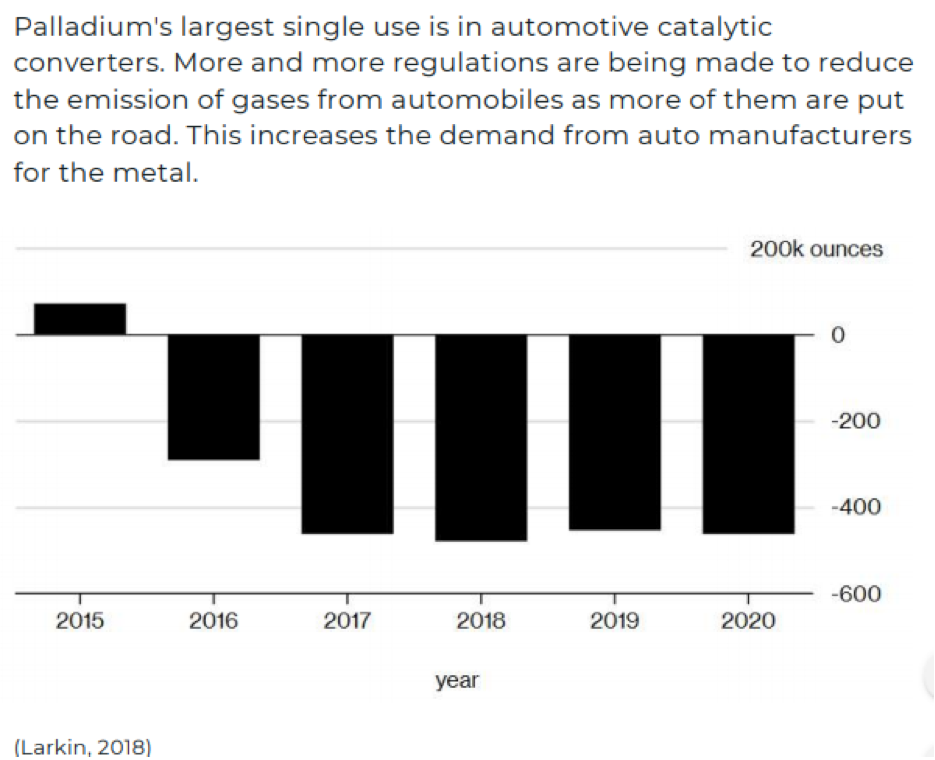

There is no doubt the demand will remain strong, but the real story is on the supply side and I have more detail.

This next graphic illustrates the supply deficit since 2016.

It is obvious to see the increase demand from China as pollution regulations are tightened. They are now moving to China 6.

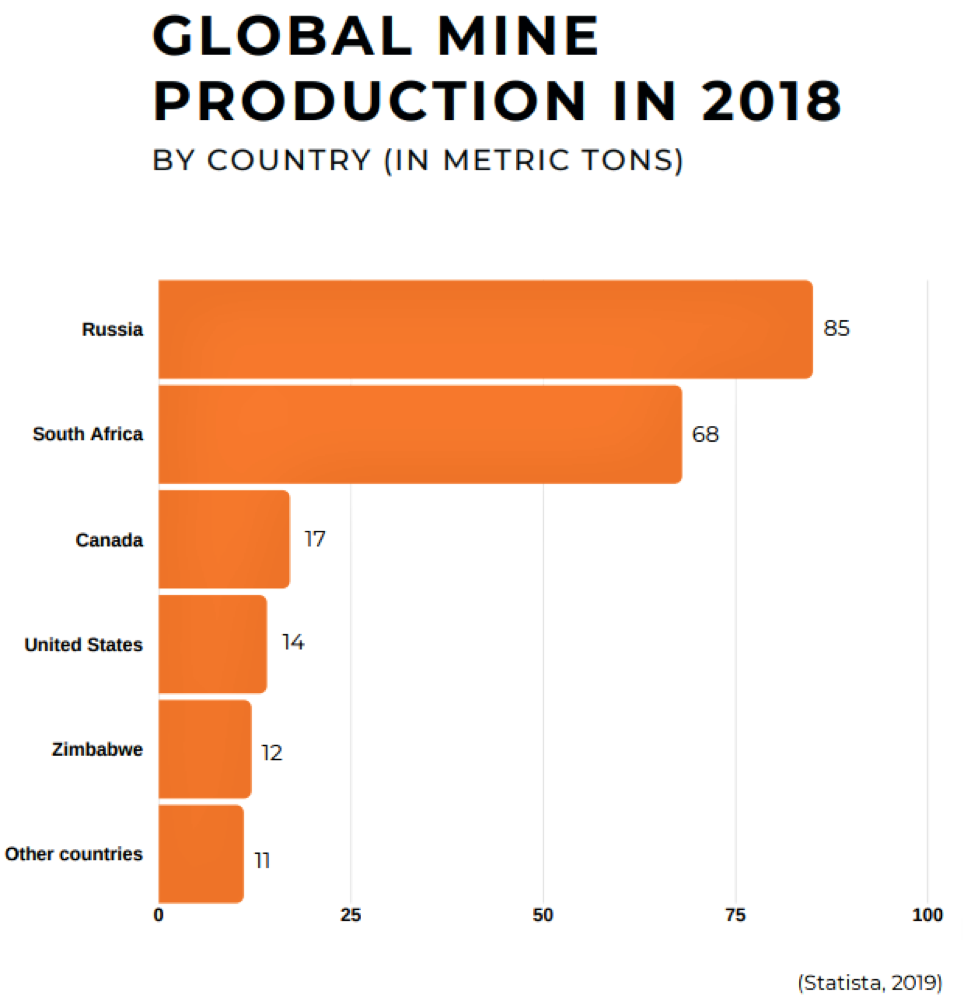

This next graphic of global mine production is very important because palladium supply is in very unstable regions.

The Russia supply from Norilsk Nickel has always been quite stable and is of no concern, but as investors we cannot really participate there. South Africa is the other big producer and that country is becoming very unstable. More worrisome is that is where all the future reserves are.

The world's largest platinum group metals (PGM) reserves are in South Africa, precisely in the Bushveld Complex (in the central-northern part of the country), which alone accounts for about 50% of the world's palladium resources. But overall South Africa has reserves of 63 million kilograms, which represent over 91% of the worldwide availability.

South African (SA) mines have always been plagued with labor issues, strikes and high costs. To make matters worse the country is now facing an energy crisis, with rolling blackouts shutting down mines. The country will probably become much more unstable, with unemployment hitting 10-year highs. Half the youth are unemployed, and the company that provides 95% of the electricity (when it can) is reporting record financial losses. This is a country teetering on the brink of chaos, which will likely be very disruptive to PGM mine supply.

With all the issues in SA, Sibanye Gold Ltd. (SBGL:NYSE) began diversifying out of the country and acquired the Stillwater PGM mine in the U.S. That used to be my favorite stock to play palladium bull markets. However, they jumped right back into the fray, acquiring Lonmin in late 2019, a struggling SA PGM producer. They promptly cut 5,000 jobs at the mine and it now appears Sibanye is moving more into PGMs from gold. The stock has done well with the rising palladium price, but at these stock prices and a move back to SA, it has become too risky.

Canada is the third largest producing country, so is an obvious place to look. A lot of the palladium production comes from major miners in the Sudbury nickel/copper complex as a byproduct. Obviously this is a good area to look, and there was an excellent investor proxy play there for investors called North American Palladium, which was operating the Lac des Iles palladium mine. Unfortunately for us investors, it was bought out last year by SA producer Implats.

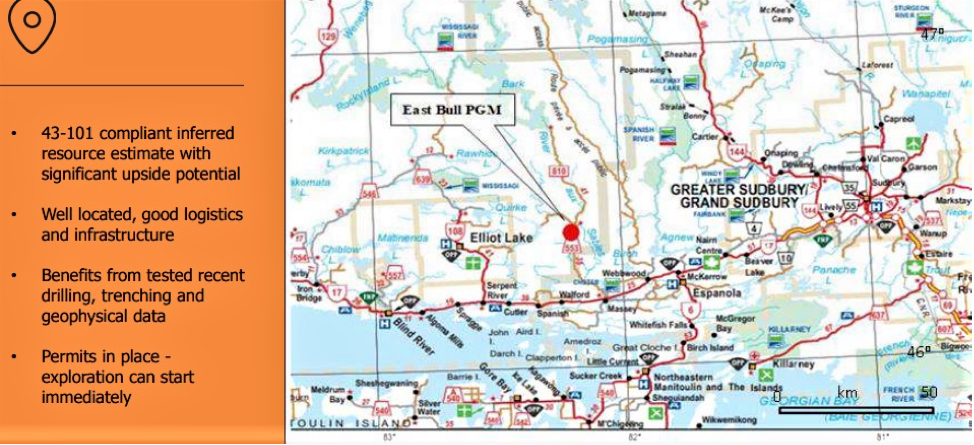

The area had a number of discoveries back in the last bull market, around the year 2000, and I visited a number of those projects back then. I believe the best one is a junior company that just changed its name to Canadian Palladium Resources Inc. (BULL:CSE; DCNNF:OTCQB) (from 21C Metals), and they acquired the East Bull project last year.

East Bull was drilled by Freewest Resources Canada Inc. (FWR:TSX.V) and Mustang Minerals (now Grid Metals Corp. (GRDM: TSX.V) back in the 2000 era and now has a NI43-101-compliant, 523,000-ounce palladium resource. A private company, Pavey Ark Minerals, had the property, and in 2017 they twinned old drill holes and completed the work to bring the project to 43-101 standards. Canadian Palladium acquired a 100% option on the project last February. What makes it very appealing now is that the stock got whacked down in price in the poor junior market of late 2019.

Canadian Palladium

Recent Price: $0.14

52-week trading range: $0.06 to $0.265

Shares outstanding: 64.5 million approx.

All warrants and options are at $0.30 cents and higher

What I consider one of the most important highlights is the company is run by Wayne Tisdale. In the last 10 years he has advanced three juniors and sold them for large profits for his shareholders. He helped finance and advance the Rainy River project and sold it to NewGold in 2013 for $310 million. He developed US Cobalt and in 2018 sold it to First Cobalt Corp. (FCC:TSX.V; FTSSF:OTCQX; FCC:ASX) in a transaction worth about $150 million, to his shareholders' delight. Going back further, he helped finance oil and gas company Ryland Oil, which was bought out by Crescent Point Energy Corp. (CPG:TSX) in 2010 for a $121.8 million valuation.

Mr. Tisdale has a keen eye for finding projects that can quickly be advanced further to make them prime acquisition targets. Canadian Palladium only has a market value now of less than $10 million, and I have no doubt that Mr. Tisdale is going to do it again, and advance East Bull and sell it for hundreds of millions.

Highlights:

- Company run by Wayne Tisdale

- Low market valuation—CA$18 per ounce

- East Bull with NI43-101-compliant, 523,000-ounce palladium resource

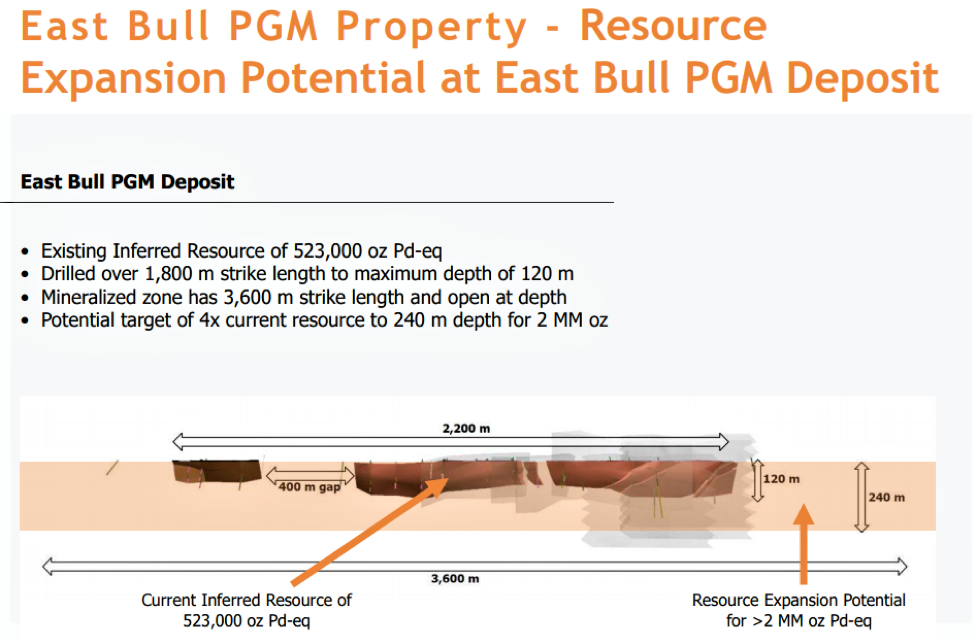

- East Bull can easily be expanded to depth and along strike

- Widely spaced drilling only needs infill drilling to upgrade resource

- Over 2 million ounce potential

- Close to Sudbury complex where ore can be processed

Management Highlights (from the company website)

Wayne Tisdale, CEO, has 40 years of experience in investing, financing and consulting to private and public companies in the areas of mining, oil and gas, and agriculture. He runs his own merchant bank and sits on the board of a number of private and public companies. Over his career, Mr. Tisdale has raised over $2 billion of both equity and debt financing, and has been instrumental in founding several highly successful companies, including Rainy River Resources (purchased by Newgold) and Ryland Oil Corp. (purchased by Crescent Point). Most recently, Mr. Tisdale was integral to the successful sale of US Cobalt to First Cobalt Corp., creating a post-transaction cobalt company valued at almost $400 million.

Michelle Gahagan, chair and director, has been a director of Canadian Palladium since January, 2011. Ms. Gahagan is currently a director of Moovly Media Inc, (MVY:TSX.V) and Versus Systems Inc. (VS:CSE). Prior to her involvement in merchant banking, Ms. Gahagan graduated from Queens University Law School and practiced corporate law for 20 years. Ms. Gahagan has extensive experience advising companies with respect to international tax-driven structures, mergers and acquisitions. Ms. Gahagan has successfully completed the Investment Management Certificate course offered by the Financial Conduct Authority (UK). Most recently, Ms. Gahagan was integral to the successful sale of US Cobalt to First Cobalt Corp.

Garry Clark, director, is a geologist (P Geo) with over 30 years of mineral exploration experience and has held various geological positions with a number of public mining companies. Mr. Clark has extensive experience in managing large-scale exploration and development programs internationally, including in Asia and North America, and has worked extensively in the Hemlo and Wawa districts. He is the executive director of the Ontario Prospectors Association (OPA) and currently serves on the Minister of Mines Mining Act Advisory Committee. Most recently, Mr. Clark was integral to the successful sale of US Cobalt to First Cobalt Corp.

Paul McGuigan, consultant, is a professional geoscientist with 42 years of international experience in economic geology and mineral exploration management, spanning grassroots exploration through to mine feasibility studies and mining operations. Early in his career, he was employed by IBM Canada Ltd., Geological Survey of Canada, Pechiney Ugine Kuhlmann, Imperial Oil, and Esso Minerals Canada. For the last thirty years, Mr. McGuigan has led several consulting and junior mining companies, operating in West Africa, the Middle East, the Southwest Pacific and all of North and South America. His geological expertise includes iron oxide-copper-gold (IOCG), volcanogenic massive sulphides, epithermal gold, porphyry Cu-Au, and residual & alluvial gold, platinum and diamond deposits.

Projects—East Bull

In the 1999–2000 period, Freewest drilled 27 holes for a total of 2,902 meters (2,902m) and carried out extensive surface trenching on present claim 4272475. Work by Mustang on the eastern part of the property (claim 1227910) included 11 drill holes for a total of 1,766m. The work by Freewest and Mustang forms the majority of the data for the current resource estimate. The company has copies of Freewest and Mustang logs, sample records and assay certificates for trenches and drill holes.

Additionally, Pavey Ark has reviewed and resampled drill core from the 27 BQ and NQ holes from the Freewest drilling program. Pavey Ark's exploration results in 2017 included:

- hole EB17-01 that intersected 12.0 m at 2.87 g/t PGM+Au, 0.23% Cu and 0.13% Ni, and

- hole EB17-03 that intersected 7.0 m of 3.21 g/t PGM+Au, 0.16% Cu and 0.07% Ni.

In 2019, BULL completed their initial exploration program at East Bull and reported results Sept. 17, 2019. The following is from the company press release:

"These are highlights from the first sampling program on the East Bull palladium project and field program on the Agnew Lake project: The East Bull property hosts an Inferred resource of 11.1 million tons at 1.46 grams per tonne palladium equivalent (Pd eq) for a total estimate of 523,000 ounces of Pd eq.

"The grab sampling and mapping of the East Bay palladium mineralization has allowed BULL to determine locations to channel sample. The sampling focused on selecting sample locations that were not previously documented. The sampling and mapping were successful in defining areas of the mineralization that when channel sampled will provide economic mineralized intercepts that will increase confidence of the mineral resource. The channel samples will also allow definition of areas of higher-grade palladium that could to direct BULL to potential starter pit locations. The channel sample is a continuous sample cut using a diamond bladed rock saw:

- "Seventy-three grab samples were selected to help identify the palladium-bearing rock types of the mineralized trend. Grab samples are used to determine the presence mineralization and may not be indicative of the overall grade of the zone.

- Sampling successfully defined locations for channel sampling and the higher grades could indicate potential zones within the mineralized zone for higher-grade starter pits.

- Range of palladium assay sample results (1,000 ppb is equivalent to 1.0 grams per tonne).

"Number of samples Range palladium (ppb)

8 Below detection limit

29 less than 100

17 101 to 500

5 501 to 1,000

5 1,001 to 2,000

6 2,001 to 4,000

3 4,001 to 6,569

"This is the same as g/t, so 6 samples ran 2 to 4 g/t palladium. Geological mapping and review of the Freewest diamond drilling in 2000 indicates the northeast-trending faults are composed of multi-intrusions of mafic to diabase dikes. Left lateral movement on the dikes is measured to be up to 100 metres. This graphic gives a good snap shot of the current resource and expansion potential, Mineralization starts at surface and the system appears to be about 30 meters wide. This would be an open pit operation."

Agnew Lake property (also from company resources)

"The Agnew Lake property was acquired in July 2017 after discussions with the company's advisers and review of the Ontario government geological database. It is located 80 kilometers west of Sudbury, Ontario, home of Glencore and Vale's Canadian nickel-copper-platinum-group-elements mining and smelting operations.

"The Agnew Lake property comprises over 260 claims (about 6,000 hectares) and is part of the larger East Bull Lake-Agnew Lake mafic-ultramafic complex. The company believes this acquisition will position it to be one of the larger non-producing palladium explorers in North America.

"The Agnew Lake magmas have major element compositions that are very similar to the model parent liquids proposed for the mafic portions of the Stillwater and Bushveld complexes. The Agnew intrusion and the East Bull Lake intrusion are also considered to host significant PGE-Cu-Ni mineralization in marginal rock units (Peck & James, 1990; Peck et al., 1993a, 1993b, 1995; Vogel et al., 1997)."

In late 2017, BULL completed some initial work on this project. Review of historical data indicated that various palladium-platinum showings were acquired within the staked area. A two-week prospecting and grab sampling program was completed to assess the locations and grade of the various showings. A total of 58 samples have been submitted to the lab."

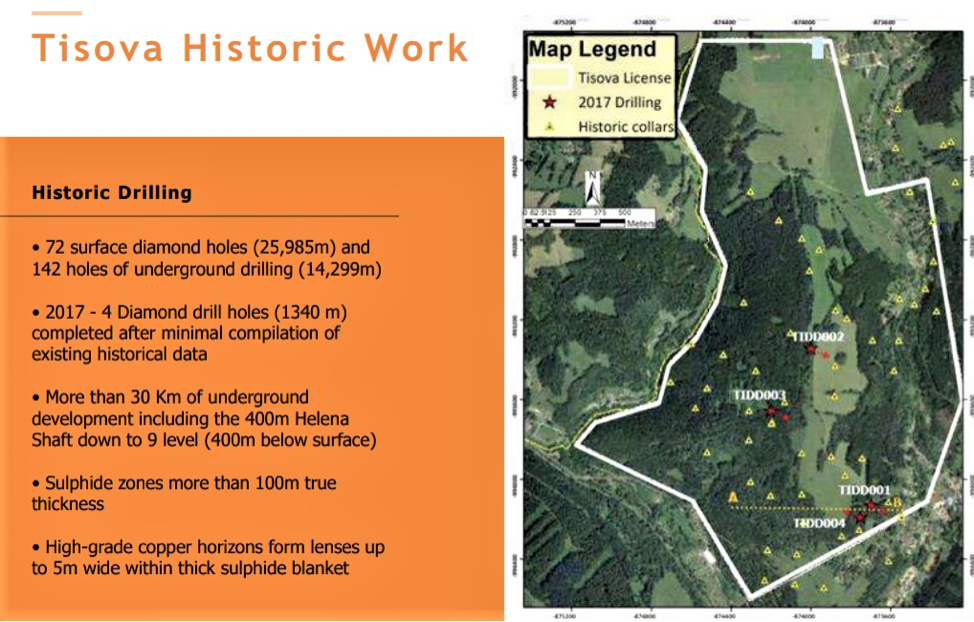

Tisova Copper/Cobalt project, Czech Republic & Germany

BULL has a third advanced project, the 15,928-hectare Tisova project. It is not the focus now, but just might end up being Mr. Tisdale's fifth sale down the road some day. Here is a graphic of the historical work; more info can be found on the company presentation.

Financial

Last financial statements show just over $400,000 cash. The last financing was $2.8 million done at $0.18 per unit in a May 2018 placement, and included a 24-month $0.30 warrant. The company will have to raise more funding and I do not see any problem with that. When the stock gets over $0.30 they could have substantial financing with warrant exercise.

Summary

A recent update on palladium by TD Securities highlights tightening emission controls, and South Africa as I have explained, is risky, but most interesting is lack of speculative trading positions. TD comments positions held by traders are below average. This rally has room to move and if excessive speculation builds the stock could go way higher.

Regardless whether palladium is $1,200 or $2,000 per ounce, palladium discoveries and deposits will be worth premium valuations, especially in stable jurisdictions. The potential for discoveries in South Africa is very good, but the political risks are rising.

BULL has a lot more going for it besides the bull market in palladium (nice pun). Wayne Tisdale has been successful financing and increasing value of properties and dealing them off for large profits. I believe he will do it again, and he also has a loyal following of shareholders from his past success. BULL just acquired the property last year and there has been little exploration and no drilling, so it has been under the radar. The discovery is on surface, so will be cheap to mine, and is close to the Sudbury complex where refiners can recover PGMs. There are a couple other palladium exploration plays in Canada, but they are mostly old, stale stories, and I believe none have the short-term potential that the East Bull project has.

Currently the 523,000-ounce palladium resource is valued at a mere CA$18 per ounce, which is very low. Part of the reason is that the resource is only Inferred. If drilling success starts to prove larger potential and the resource gets move up to the measured and indicated category it could easily be valued at $300 to $500 per ounce.

The only exploration news from last year was sample results that came out last September, just when the junior market started heading south. The stock made a decent move higher, then just drifted lower until a typical year-end bottom. Last week the stock broke above the downtrend line when it hit $0.12 on good volume. I expect this move will take the stock to at least the $0.20 resistance area. The project has year-round access and the winter is a good time to drill. If we get that news, the stock could more easily break above the $0.20 resistance level.

Ron Struthers founded Struthers' Resource Stock Report 23 years ago. The report covers senior and junior companies with ample trading liquidity. He started his Millennium Index of dividend stocks in 2003 - $1,000 invested then was worth over $4,000 end of 2014 and the index returned 26.8% in 2016. He retired from IBM after 30 years in customer service, systems and business analyst, also developing his own charting software. He has expertise in junior start-ups and was a co-founder of Paramount Gold and Silver.

[NLINSERT]Disclosure:

1) Ron Struthers: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Canadian Palladium. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company currently has a financial relationship with the following companies mentioned in this article: Canadian Palladium is an advertiser at playstocks.net. Additional disclosures below. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts and images provided by the author.

Author's Disclosures: Copyright 2020, Struthers' Resource Stock Report. All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.