"Never trust anything a banker (broker) tells you."—former billionaire (now millionaire)

Here is a news flash: I am sick to death of The Fed, unelected demigods that rarely, if ever, had to meet payroll. I am also completely disgusted with this unholy "Divine Right of Banks" to hold sway with politicians, gaining total control over the purchasing power of my savings (currency units) by way of an ordained edict giving them the right to manufacture any and all amounts of said currency units (debt) with nary a shred of governance.

I am further revolted by this all-encompassing blanket of regulatory malfeasance that condones and, in fact, encourages behaviors by C-suite officials, politicians and bankers in direct violation of securities laws. I refer to the practices of interventions (e.g., the Dec. 24, 2018, call by Treasury Secretary Steve Mnuchin for a meeting of the Working Group on Capital Markets"), manipulations ("tweets" designed to trigger software-generated reactions (President Trump, Elon Musk), and fraud (JP Morgan's securities violations and RICO indictment). Lastly, this malevolent seepage of an innate sense of entitlement across the civilized world now threatens the foundation, support beams and roofs of the democratic system and along with it, free market capitalism, a phrase whose meaning Larry Kudlow would be wise to revisit.

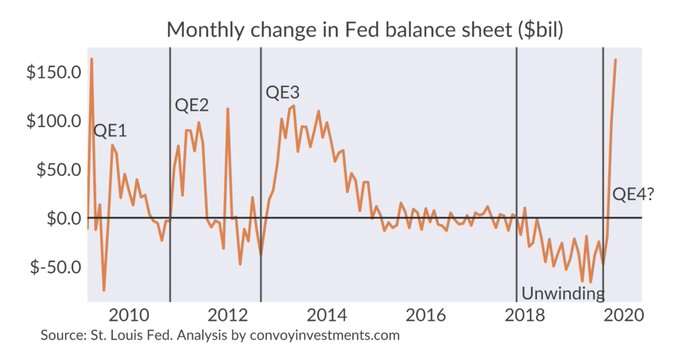

In contract law, "due consideration" is that thing that allows a transaction to occur. It might be labor or a product or even advice, but essentially, it is a rules-based tenet that prevents theft. I cannot take something that is yours without you agreeing to that which I offer in trade. Last week, Fed chairman Jerome Powell explained the rules of the 2020 financial landscape by confirming to us all that "balance sheet normalization," the implementation of which caused a20% meltdown in the S&P last year, is now, to borrow a phrase from Ebenezer Scrooge, ". . .an undigested bit of beef, a blot of mustard, a crumb of cheese, a fragment of an underdone potato." In its place, we can now celebrate massive bloating of the Fed balance sheet, along with annual deficits to the order of $1.7 trillion.

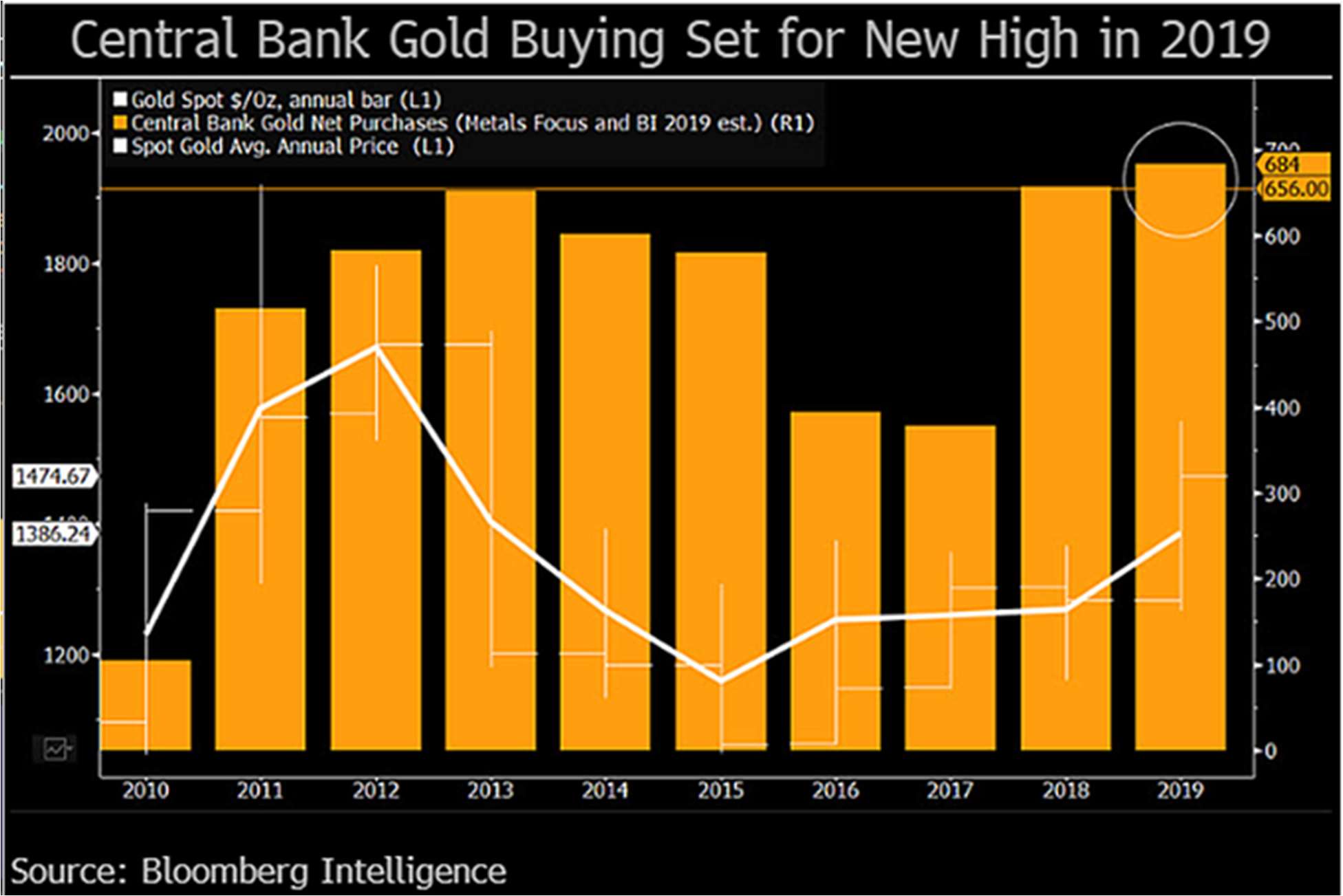

In response, stocks began to slide, and precious metals began to rise, as the olfactory senses detected the imminent return of that elusive beast, inflation. It is said that inflation has been "muted" in the U.S. by way of cheap foreign goods (China) and subdued wage inflation. Mr. Powell told us, in his "prepared remarks," that he and his co-conspirators are going to let the economy "run hot" for a while to allow Middle America to play "catch-up" in the disparity game of chance they are now playing with reckless abandon. The problem, my dear readers is that "inflation is like toothpaste; once it's out you can hardly get it back in again" (Karl Otto Puhl).

What Chairman Powell meant to say is that Fed policies that have been engineering, promoting and cheerleading monetary asset inflation (all banker collateral, including stocks, bonds, and real estate) are now being back-burnered in favor of wage inflation (the income earned by the average Joe). News Flash #2: This policy "initiative" has no foundation in economic theory; it is a response to a societal trend whereby the disenfranchised segment of "The American Dream" is beginning to spiral out of control, with aberrant behaviors now more the norm than the isolated.

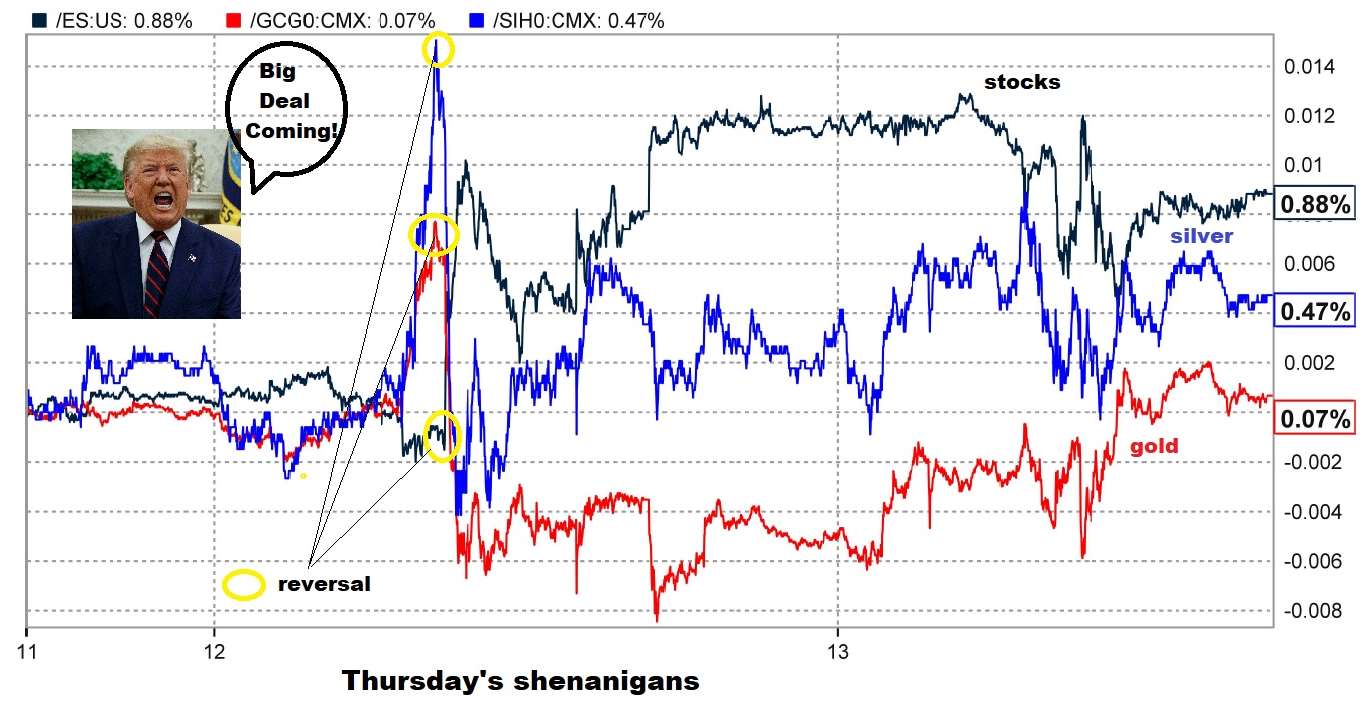

However, as minutes and seconds elapsed after the Powell Pronouncement, gold and silver began to escalate, with stock prices moving sharply lower. At this point, out of the blue and without explanation nor reason, Donald Trump fired off a tweet that was immediately absorbed by thousands upon thousands of pattern-recognition software word cloud analyzing "algobots," stating emphatically that he is on the verge of signing a "BIG DEAL" with China that the markets "will love."

As can be seen from the chart below, gold, silver and stocks all reversed and by the end of the day, the Dow had advanced over 200 points and all the beautiful gains in gold and silver had evaporated. All because a "China deal" tweet by Donald Trump, the fiftieth such market-moving utterance of 2019, spooked the algos into action, a manipulative trick well known and faithfully employed by the current Administration and its market co-managers.

When we decide to enter markets, we are told that manipulation is a violation of securities bylaws and an indictable offense. You can go to J-A-I-L for even attempting to influence markets by "spoofing" (stacking bids or offerings with phony orders never intended to be executed). Similarly, releasing false or misleading corporate or economic data is an action in violation of the rules as well. How the current POTUS can engage in such fraudulent behavior is astonishing; he has been calling for a China trade "deal" since 2018 and each and every time, the stock market rallied. Elon Musk was sanctioned for tweeting out that he was about to do Tesla deal at prices way above the current market, which also turned out to be a pile of horse manure designed to fry the shorts (which it did).

Now, "in the end," you will say, "markets will revert to the norm and ignore the tweeting and spoofing and fraud," because you believe these are "free markets." News Flash #3: These are not, in any way, shape or form, free markets. These are the most compromised, corrupt entities in the world and until order is restored, they are as dangerous as a Cambodia mine field in the fog after a fifth of bourbon at midnight. And that restoration means jail time for violators—period.

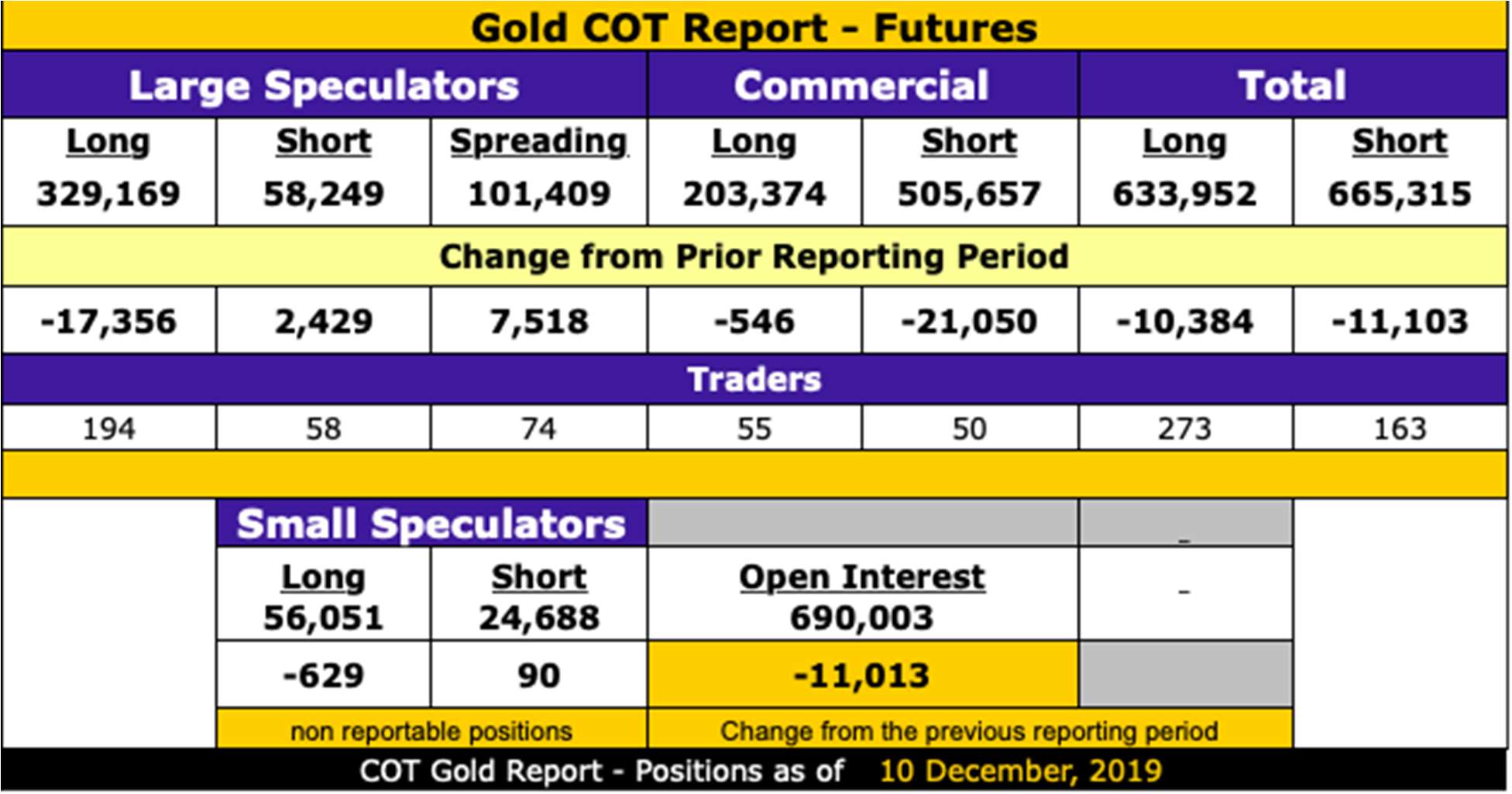

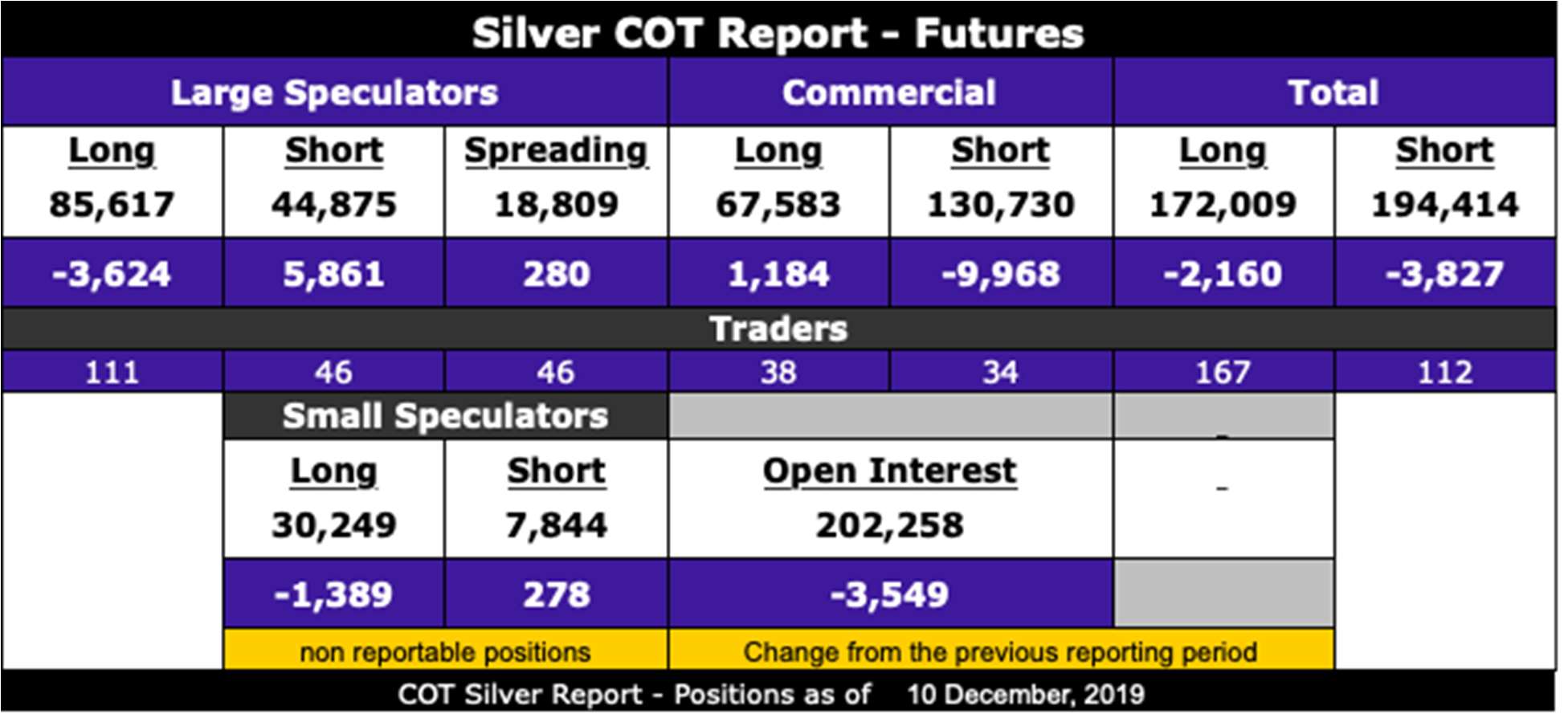

Nevertheless, for the week ended Dec. 13, the precious metals ended higher with the COT report, indicating good news for gold and great news for silver.

You can see that the weakness in early December triggered long liquidation by the Large Specs, accompanied by the usual reactionary short covering by the Commercials (bullion bank behemoths), along with the expected drawdown in open interest. While the strength this week will have prompted the reverse, the gold COT was positive and bodes well for a strong close for 2019.

The silver COT was a shocker; the Commercials took full advantage of the big drop in early December, which came after First Notice Day (to my surprise and chagrin), and covered a massive 9,968 shorts, as well as adding 1,184 new longs representing 55,745,000 ounces of phony, never-to-be-delivered, "silver" with a fantasy-world notional value of US$947,665,000.

These bullion bank traders can whip around nearly a billion dollars' worth of illusionary silver, materially impacting the livelihoods of mine laborers, pension fund managers, jewelers and solar energy dealers without as much as a whimper from the Securities and Exchange Commission, the U.S. Commodity Futures Trading Commission or the U.S. Department of Justice. However, it is what it is, and with silver ending the week higher, it remains my numero uno investment theme for 2020, as it was for the latter half of 2019.

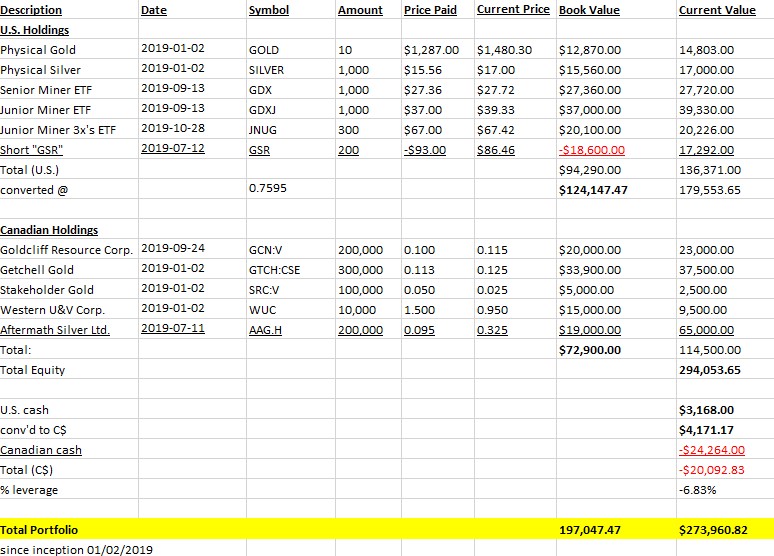

In fact, it was silver options, futures and miners (as well as the Great Bear Resources Ltd. [GBR:TSX.V; GTBDF:OTCQX] trade, of course) that were responsible for the 273% advance in the GGMA portfolio, originally constructed in January 2019 and presented in the 2019 Forecast Issue. The silver market remains in a declining pennant formation, but with last week's action, has clearly launched an assault on the downtrend line drawn off the Sept. 4 top (which I was lucky enough to have identified to the day back in late August).

I have identified the 200-day moving average (dma) at US$16.26 as the line-in-the-sand for short-term trading positions but certainly the actions on Thursday and Friday are encouraging.

Turning to the GGMA portfolio, I am keeping the U.S. holdings intact going into the New Year but may take down the 3x-leveraged Junior Miner (JNUG), which is back into the black after going red almost immediately after acquisition. The original portfolio was purchased on Jan. 3, 2019, with CA$100,000, and with trades, additions and deletions, now resides at $294,053, with a CA$24,264 margin position, leaving total equity at CA$273,960. A return of 2.73 times original invested capital is both spectacular and unusual and was the product of some fortuitous positions taken in silver calls, Great Bear Resources (since sold) and Aftermath Silver Ltd. (AAG:TSX.V) (still holding and looking to add).

(As a bookkeeping note, the "Short GSR" position shows a red (negative) book value because it is a short sale andthe only way I could get it to jibe with the overall portfolio is to format it as such.)

As for the individual names, the Canadian dollar allocation is comprised of exclusively junior mining deals comprised of five exploration/development companies, all of which save one (Stakeholder Gold Corp. [SRC:TSX.V]) are sitting with established resources of either gold, silver or uranium. I am reviewing the SRC position closely but being a disappointment (verging on hallucinogenic flop), it is too small a holding to sell but providing zero impetus to buy. My top pick for 2019 was originally Great Bear, but has since been replaced with Aftermath Silver to close out the year.

Looking out to 2020, the forecast issue is in the oven, with a sneak peek available as to possible changes to the portfolio through my "2019 tax-Loss list," where I have identified six companies floating in and around the 52-week low list being buffeted by wave after wave of tax-loss selling. (E-mail me at the address shown below on the contact card to receive a complimentary copy: [email protected].)

As much as I remain a staunch precious metals bull, I don't think valuations here in late 2019 are as compelling as they were in August 2018 or April 2019. Those two entry points came off Daily Sentiment Index (DSI) readings of <10% bulls, whereas today we are about 60%. By contrast, zinc, uranium and cannabis now reside in the low end of the sentiment spectrum and without debating their merit, the "no-brainer" aspect of precious metals investment is arguable.

I hope to have the "2020 Forecast Issue" ready for launch by next weekend but will await the end-of-month marks to finalize the 2019 portfolio return and to insert acquisitions points for the new names.

I am bidding for a few of the beaten-down weed stocks as this is being typed, so as a teaser, have a look at these two charts. One year ago, the cryptocurrency deals were the most reviled, hated, scorned-upon group of companies in all of the deal world. One year later, a new dartboard group is taking the heat—cannabis. Look at the January–July performance of Bitcoin. From tax-loss trough at US$3,180 to mid-July peak at US$11,778, speculators made 2.7 times their money. I see a similar pattern unfolding for the weed stocks.

Fido is sleeping quite contentedly beneath my desk now and in the kitchen, I hear the machinations of oven doors and beaters, fruitcakes and Jolly Dollies being conjured up for seasonal consumption. Fido was banished to the woodshed yesterday for getting his nose into the safe in which I keep my coins and certificates and cash. It seems that Fido has the same regard for my savings as does Fed Chairman Jerome Powell. . .

Bad Fido!

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Read what other experts are saying about:

Disclosure:

1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Aftermath Silver, Stakeholder Gold, Goldcliff Resources, Getchell Gold, Western Uranium and Vanadium. My company has a financial relationship with the following companies referred to in this article: Aftermath Silver. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Great Bear Resources, Goldcliff. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Aftermath Silver and Western Uranium and Vanadium. Please click here for more information. Within the last six months, an affiliate of Streetwise Reports has disseminated information about the private placement of the following companies mentioned in this article: Aftermath.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Aftermath Silver, Goldcliff, Getchell, Western Uranium and Vanadium and Stakeholder Gold, companies mentioned in this article.

Charts provided by the author.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.