As Avrupa Minerals Ltd. (AVU:TSX.V; AVPMF:OTC; 8AM:FSE) finalized the Definitive Agreement with MATSA, a 50:50 joint venture company of Mubadala Investment Company, a pioneering global investor, and Trafigura, one of the world's leading independent commodity trading and logistics houses, on November 20, 2019, exploration programs are being prepared now. As exciting times are ahead in 2020 for Avrupa after a quiet period, it is time to speak to CEO Paul Kuhn and hear all about why Avrupa is a potentially very interesting investment opportunity at these lows, although the MATSA JV is obviously sparking new interest in the story recently:

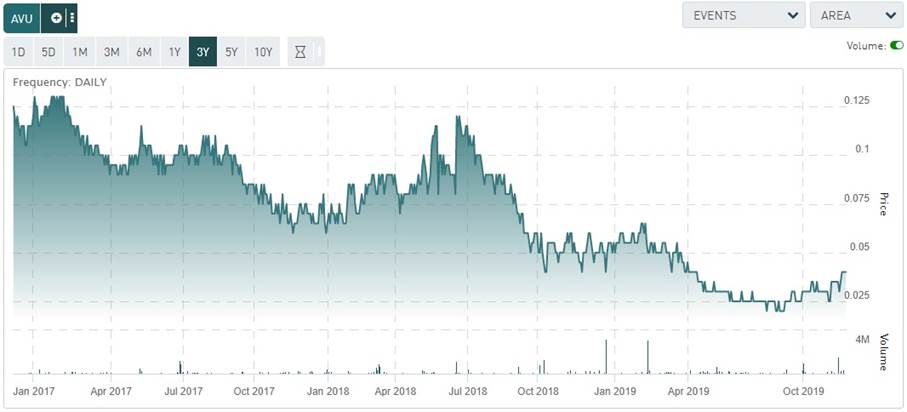

Share price; 3 year timeframe (Source Tmxmoney.com)

The Critical Investor: Hi, Paul, thanks for taking the time to do this interview. Let's have a look at some basics first. Will Avrupa concentrate on Alvalade, or will it be looking for other projects as well?

Paul Kuhn: You are most welcome, and I'm happy to give an update. Obviously we continue to concentrate on Alvalade, as we have done for years in the recent past. Besides this, we are also thinking about re-stocking and moving on to new possibilities, especially gold. There is a lot of potential in the Pyrite Belt of Portugal, mostly copper and zinc of course, but I think the market is also looking for us to generate gold prospects/possibilities, as gold is recovering nicely. This is our basic business: to generate new programs, upgrade them, then either JV or progress ourselves, depending on the geological and mineralogical merits.

TCI: Let's continue with some financials here. MATSA is paying Avrupa C$580k upon signing the DA and will pay C$145k for operating exploration programs in the first year; why is Avrupa raising more cash at the moment?

PK: Avrupa needs a bit of cash, to the tune of C$250k, to allow us to operate at the corporate level until the funds from MATSA can be transferred. The wording in the JV deal states that the C$580K will be supplied by MATSA upon issuance of the new Alvalade Experimental Exploitation License (EEL) by the Portuguese mining bureau (DGEG). We expect this issuance to occur late in Q1 2020. Until then, we need some funding to pay operating costs and costs associated with reviewing and possibly acquiring new projects.

CEO Paul Kuhn signing the MATSA JV agreement with representatives from Mubadala and Trafigura

TCI: At the Mines & Money conference in London we recently discussed this Exploitation License coming up for Alvalade, potentially in March 2020. Why do you think it could be granted by then?

PK: According to the Mining Laws in Portugal, there are two 45-day periods devoted to due diligence to be performed by the government concerning the license itself, and then concerning the areas covered by the license. The first 45 day period started at early November, there will be holidays and the government usually takes some time before it starts the second period. Once due diligence is completed, the government and Avrupa's Portuguese subsidiary, MAEPA, Lda., will finalize the actual contract, and then the license can be issued. Probably the fastest, most efficient timing will have the license issued by the beginning of March in my view. Both MAEPA and MATSA will continue to lobby the DGEG and the Secretary of State's office to issue this important license as quickly as possible.

TCI: Does the JV with MATSA contain a deadline for this EEL license?

PK: The license, when issued, provides for a three year-program with a two-year extension for a total of five years. We will try to get both the 51% earn-in and the 85% earn-in completed in those five years. They work fast and expediently, as demonstrated by their Magdalena discovery and subsequent production commencement in less than three years. Keep in mind that this is a 40 million ton (Mt) mine.

TCI: Is the drill program unchanged since our last update, when it was estimated at 4,000m?

PK: We have 1.2 million euros to work with in the first year. MATSA wants to do airborne geophysics and drilling. I expect more than 4,000 meters in the first year.

TCI: Is there a map available with targets for this program if available and to be disclosed, and a geological motivation for these targets? What are you planning to find out?

PK: These questions do come a bit too early. We have provided general maps in the past, in news releases and on the website. I expect that further planning will provide more information after the New Year.

TCI: Will there be an IP survey and/or MALM surveying in order to define targets?

PK: The new JV allows for a Technical Committee to oversee the project. Sometime after the New Year, we will meet to go over all available information to plan the program going forward. Geophysics will be more used in this program, I suspect, than in the past. MATSA has had excellent previous success utilizing geophysics for exploration purposes in the Pyrite Belt of Spain. This should not be too different in Portugal.

TCI: In London, we talked about MATSA also staking claims in Portugal close to the Lousal/Sesmarias claims. Will this be put into a different JV with Avrupa?

PK: MATSA has made three applications in southern Portugal. One is, indeed, located adjacent to the Alvalade Project. I think that there are some possible synergies with MATSA concerning their interests in the Pyrite Belt of Portugal, particularly close to the Alvalade Project.

TCI: When will drilling start on Alvalade (how soon after the EEL is granted), and how soon after this approximately will we see results being announced you think?

PK: Because there is some time allotted to us before the EEL is granted, we should have all of the necessary planning and preparation completed and ready to go before issuance. This is something I intend to work on after New Year's. We will, of course, announce the start-up of the drilling, and results will come after we review and sample the core. Hopefully this will be exciting news to report. But I think that we will have other possible newsworthy events in 2020. This could involve new projects, possible JVs elsewhere in the Pyrite Belt and/or Kosovo. There are a number of agendas and projects that we are considering. Getting a bit of funding, as noted earlier, will help in bridging the time gap to issuance of the Alvalade license.

TCI: Do you know anything about the tonnage targets MATSA has, if you can disclose?

PK: No, but I am sure they are looking for something in the order of their Magdalena discovery, 25–40 million tonnes of 1% copper or better. As you know, our 10 Lense could already be estimated to contain around 19–20 Mt at that average grade, so we believe the potential is there. Of course we would like to discover another Neves Corvo (190 Mt) or Aljustrel, our two models in the Portuguese Pyrite Belt.

TCI: What is their primary focus for target? How about Lousal, which still has a historical resource, if I'm correct?

PK: First up is our Sesmarias discovery. It is located only 6–7 km from Lousal, and may actually be part of the same system divided by a major fault zone. There is already at least one massive sulfide lens there, and could certainly have more. We have really only explored 700–800 meters of a 2,000-meter strike length of known mineralization. There are indications of extension to the north, as well, beyond the 2,000-meter mark.

We have bypassed Lousal in the past, but with this JV we intend to review the historical work and put together a plan of exploration to determine what is actually left in the old mine. Based on historical production records, we think that there could be 30–35 million tonnes of sulfide material remaining in the old mine. After Lousal, just 2 km to the north, is our Monte da Bela Vista stockwork zone discovery. It's all part of the same system, and could turn into a real district.

TCI: Do you know when MATSA will be satisfied enough to increase the JV to C$10 million as was a longstanding goal of yours?

PK: Continuation, as you might expect, will be determined by success, and this in turn can only be labeled as such by MATSA itself; they must see the potential as described earlier, or better. If, at the end of the first year, the results are good, then MATSA must decide to continue and then spend another 1.2 million euros over years two and three to get to the 51% level. Having said that, if things go really good, I would expect an accelerated work and funding schedule. There is a lot to do at Sesmarias, then Lousal, then MdBV. We have another 20–30 targets on the license, as well. If all continues to go well, we are fully carried to a production decision for MATSA to earn-in to 85%. That could very well amount to 30–40 million euros (=C$45–60 million) of NPV value for Avrupa.

TCI: As there is still the minority Slivovo interest in the background, could you explain the status of this at the moment?

PK: Our 10% interest has finally been diluted to a 2% NSR royalty. Our partner, Byrnecut International Ltd., is currently evaluating possibilities on how to move forward. They are working with the mining bureau of Kosovo (ICMM) on how to extend the life of the license to allow more exploration and resource delineation time. We are looking into the possiblity of further exploration in Kosovo, as it is still very much under-explored. We have another exploration license in the country and an application into the government for two attractive areas of national interest that have been under withdrawn status since we started work in Kosovo. We have lobbied strongly for access to these areas over the years, but they remain closed unfortunately. There are other areas of interest in the country, and we maintain a strong, proprietary database covering the country. Lots to do there, and we are looking for proper funding support from the interested exploration community.

TCI: We are coming to an end of this interview; do you have anything else of interest to mention for potential investors?

PK: We are looking to acquire attractive prospects in both Portugal and Kosovo, our main areas of exploration in Europe these days. There are a number of good possibilities in both. However, I am also scouring the continent for new gold ideas. Gold regained its popular status since the summer, and we think that a good gold prospect could help with investor awareness of our programs. I have several possibilities in mind. Notwithstanding this, my full focus is on getting the new, upgraded Alvalade license. This basically means to keep focused on the DGEG to get the license issued as soon as possible. Once we have accomplished that, I think Avrupa will be "off to the races."

TCI: Thank you very much, Paul, for your cooperation as always, and I believe Avrupa Minerals is setting up to be much more than a binary greenfield exploration JV, and MATSA is aware of this. As both you and me are significant shareholders, our interests are very much aligned, I'd say, and I'm looking forward to positive developments next year.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website, http://www.criticalinvestor.eu, and follow me on Seekingalpha.com, in order to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

[NLINSERT]Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Avrupa Minerals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.avrupaminerals.com and read the company's profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Streetwise Reports Disclosure:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own shares of Avrupa Minerals, a company mentioned in this article.

Charts and graphics provided by the author.