If you are smart enough to remember how to fall off a bicycle, you qualify as wise enough to be buying shares in Calibre Mining Corp. (CXB:TSX.V; CXBMF:OTC.MKTS). It's that easy.

B2Gold Corp. (BTG:NYSE; BTO:TSX; B2G:NSX), run by Clive Johnson, is a $4 billion company. They had two gold mines in Nicaragua but have transitioned to mining in Africa and the Far East. Johnson is not above trying to maximize value for his shareholders, so when the decision was made to focus on larger mines in Africa, he looked around for a suitable junior to take over the existing production assets in Nicaragua. There was such a junior right in their own backyard and a deal was cut.

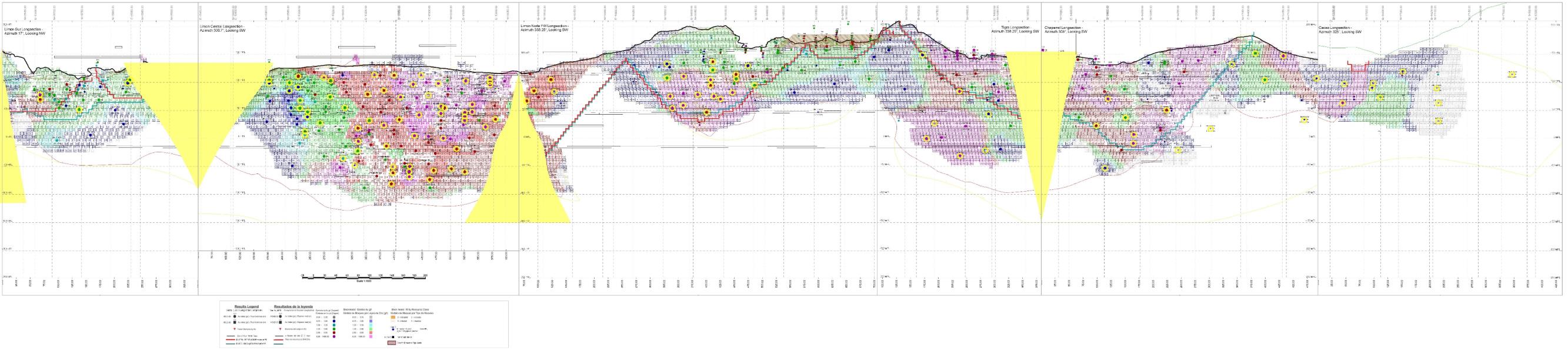

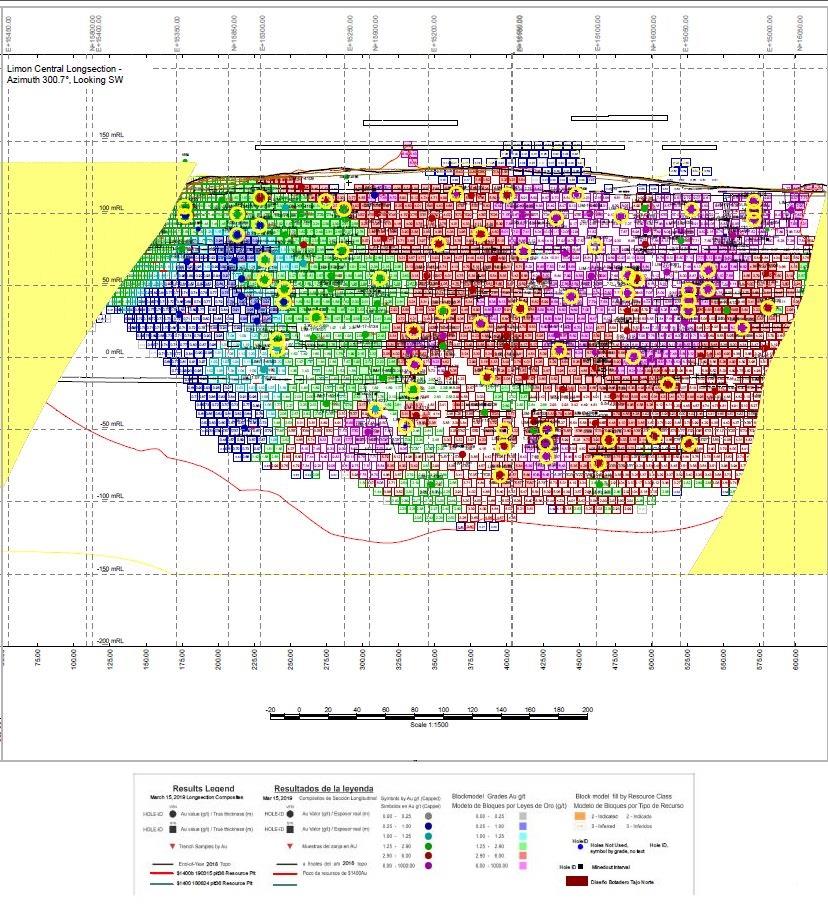

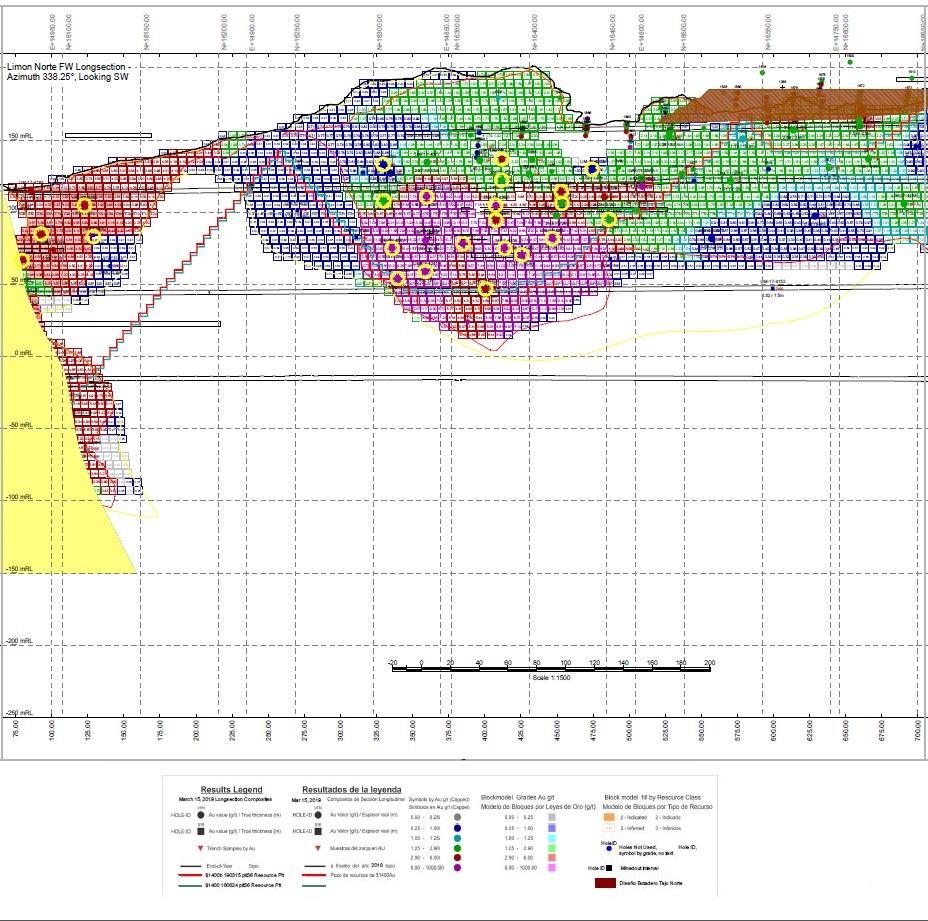

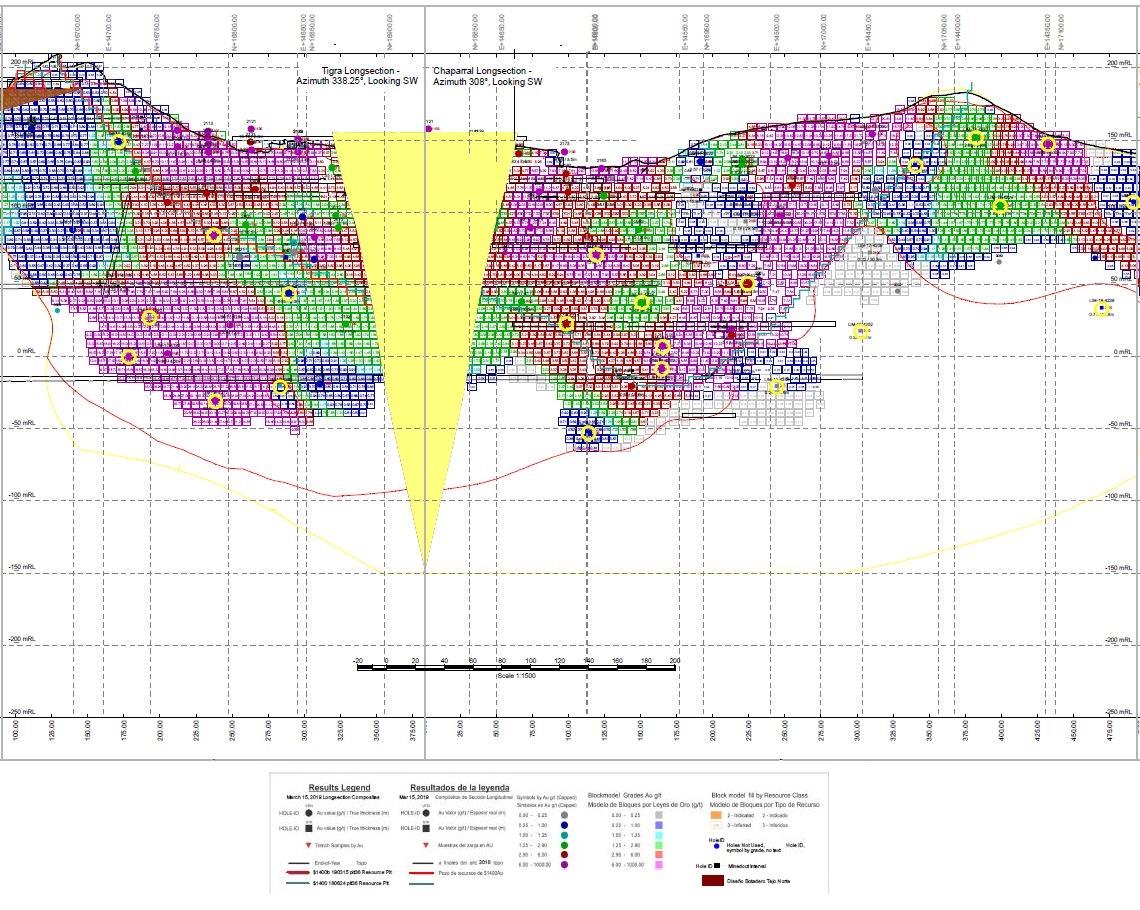

Essentially B2 is selling the El Limon gold mine with a 500,000 TPA (tonnes per annum) mill with a partial Q4 guidance of 14,000–17,000 ounces with an AISC (all-in sustaining cost) of US$950–$990, and the La Libertad gold mine with a 2.2 million TPA mill with a partial Q4 guidance of 17,000¬–20,000 ounces, showing an AISC of $930–$960, for about US$100 million in cash and shares. The new owner of the two mines and a couple of extra projects with potential is named Calibre Mining, with a ten-year history of exploration in Nicaragua.

The deal makes a ton of sense for both companies. B2 has operating mines in Mali producing about 425,000 ounces of gold a year, another gold mine in the Philippines doing about 205,000 ounces a year, and yet another in Namibia showing production of about 170,000 ounces of gold a year.

While their two existing mines in Nicaragua built the structure for B2, total production of about 140,000 to 150,000 ounces wasn't enough to move the needle for shareholders.

For Calibre, it gives them the opportunity to move into the lower reaches of being a mid-tier producer with a lot of exploration potential. For investors, it gives a chance to pick up a company with existing producing mines, and about $75,000,000 above and beyond AISC yearly. This is a good deal for everyone and as easy as falling off a bike.

The potential for a revaluation of the shares is giant. At the issue price of $0.60 a share for the deal on a peer basis, Calibre has a 300% potential move higher, and on gold resources, has a 200% potential move higher. While B2 could have kept the mines and operated them themselves, they have a large potential for expanding what they will get for the mines in total, and for Calibre and investors, it really looks like a slam dunk for higher prices.

The company has hit the ground running. On Oct. 31, Calibre announced some great drill intercepts from both mines.

Calibre is cheap, and while I believe mining shares will generally decline into the tax-loss silly season, the current valuation is absurd. They had to have a lot price to attract money from major investors to do the deal, but the deal has been done and the stock is going higher if gold is steady, a lot higher if gold actually goes up, and will at least stay where it is if gold goes down.

I had a chance to participate in the financing and I took a lot higher position than I have for any stock in years. I love this deal. Calibre is an advertiser, I bellied up to the bar in the financing and I am biased. Do your own due diligence.

By the way, they have done an excellent job on the presentation. Read it.

Calibre Mining Corp.

CXB-T $.75 (Oct 31, 2019)

CXBMF-OTCBB 310.3 million shares

Calibre Mining website.

Bob Moriarty founded 321gold.com, with his late wife, Barbara Moriarty, more than 16 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 832 missions in Vietnam. He holds 14 international aviation records.

[NLINSERT]Disclosure:

1) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Calibre Mining Corp. Calibre Mining Corp. is an advertiser on 321gold. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.