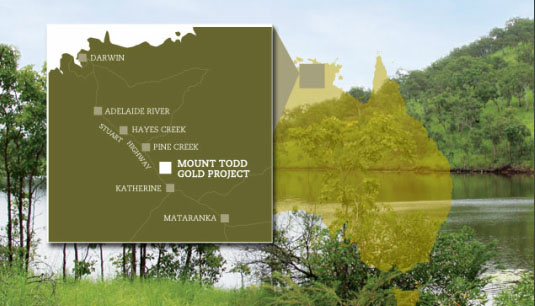

Vista Gold Corp. (VGZ:NYSE.MKT; VGZ:TSX) announced in a news release the results of an updated preliminary feasibility study (PFS) for its Mt Todd gold project in Northern Territory, Australia.

The revised plan incorporates recent metallurgical optimization test work, a redesign of the fine grinding circuit, revisions of the construction and ramp-up schedule and a thorough review of all aspects of the project. All of this resulted in greater forecasted gold recovery and increased estimated gold production at Mt Todd.

"We believe the PFS has substantially derisked Mt Todd," President and CEO Frederick Earnest said in the release. "The metallurgical programs and process area design changes completed by Vista over the past months have confirmed our belief that Mt Todd can achieve excellent anticipated gold recoveries within an attractive operating cost profile."

Specifically, for this 50,000 tons per day mine with a projected 13-year mine life, the PFS outlines a base case of an after-tax NPV5% of $823 million and an internal rate of return (IRR) of 23.4% at a $1,350 per ounce ($1,350/oz) gold price and a $0.70=AU$1 exchange rate.

At the current, and higher, gold price of $1,500/oz and an exchange rate of $0.685=AU$1, the after-tax NPV5% is an estimated $1.15 billion and the IRR an estimated 30.3%.

Production, improved over the previous PFS, is projected to be 413,400 oz of gold per year over the life of the project. This would include an average annual production of about 495,100 oz of gold during the first five years of commercial operation.

As for costs, an estimated $826 million would be needed upfront. Then over the course of the mine life, the average cash cost would be about $645/oz and the average all-in sustaining cost roughly $746/oz.

Now, with the updated PFS completed, Vista will begin looking for a partner to co-develop Mt Todd. "We are prepared to hold the project until a time when the value of the project appropriately rewards shareholders," Earnest added.

[NLINSERT]Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this interview, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Vista Gold, a company mentioned in this article.