Medical device developer and manufacturer Medtronic Inc. (MDT:NYSE) today announced financial results for its first quarter of fiscal year 2020, which ended July 26, 2019.

In Q1/20, the company reported that worldwide revenue increased 1.5% to $7.493 billion versus $7.384 billion in Q1/19. GAAP net income and diluted EPS in Q1/20 were $864 million and $0.64, respectively, and Q1/20 non-GAAP net income and non-GAAP diluted EPS were $1.703 billion and $1.26, respectively, increases of 6% and 8%.

U.S. revenue in Q1/20 increased 1.4% over Q1/19 to $3.918 billion. Non-U.S. developed market revenue in Q1/20 decreased by 1.2% from Q1/19 to $2.377 billion. Emerging market revenue of $1.198 billion which represented 16% of company revenue increased 7.5% as reported and 12.5% percent on a constant currency basis.

Mr. Omar Ishrak, Medtronic's chairman and CEO, stated, "Medtronic had a solid first quarter, delivering revenue growth, operating margin expansion, and adjusted EPS growth all ahead of expectations...It's a good start to our fiscal year."

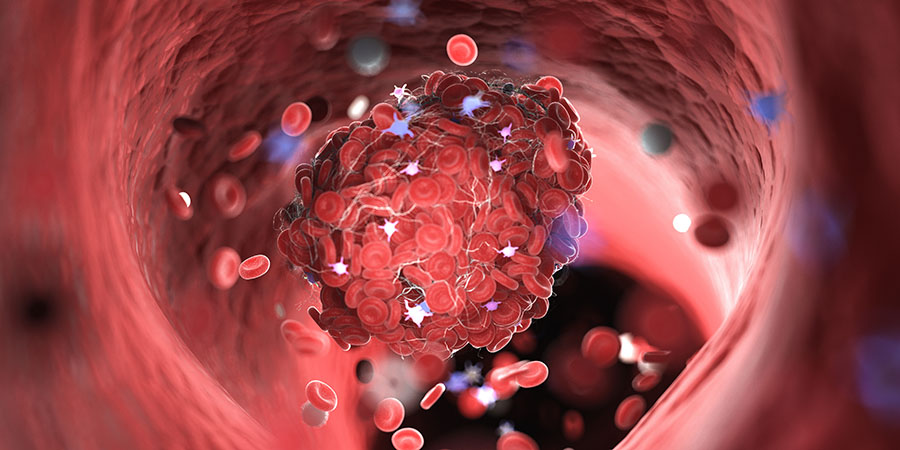

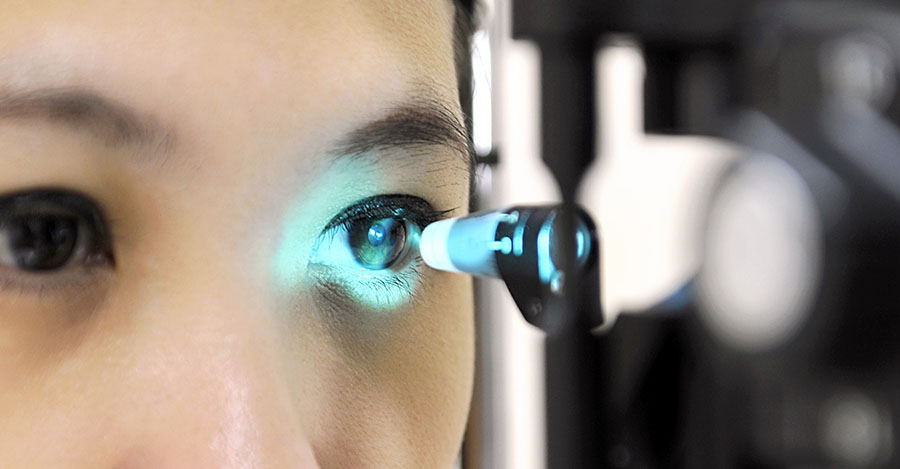

Further breakdown by business segments shows that for Q1/20, the Cardiac and Vascular Group reported revenue of $2.790 billion, a 0.70% decrease from Q1/19. For the same corresponding periods the Minimally Invasive Therapies Group reported revenue of $2.100 billion, a 2.3% increase, the Restorative Therapies Group reported revenue of $2.012 billion, a 3.2 % increase, and the Diabetes Group posted revenue of $592 million, a 3.5 % increase.

The company reiterated its revenue growth guidance and raised its EPS guidance for FY/20. Medtronic stated it continues to expect revenue growth in FY/20 of approximately 4.0% on an organic basis and increased its FY/20 diluted non-GAAP EPS guidance to $5.54–5.60, up from the prior estimated range of $5.44–5.50.

Ishrak stated, "As a result of our first quarter outperformance and confidence in our outlook, we are raising our full year EPS guidance...We're excited about what lies ahead, as we expect the investments we've made in our pipeline to begin to pay off with multiple pipeline catalysts, accelerating revenue growth, and value creation for our shareholders."

Medtronic is headquartered in Dublin, Ireland, and indicates that it is among the world's largest medical technology, services and solutions companies, focusing on alleviating pain, restoring health and extending life for millions of people globally. The company employs more than 90,000 people worldwide, serving physicians, hospitals and patients in more than 150 countries. The firm operates in four business segments: Cardiac and Vascular Group, Minimally Invasive Technologies Group, Restorative Therapies Group and Diabetes Group.

MDT shares opened today at $107.98 (+$3.80, +3.65%) over the previous day's close of $104.18. This morning shares reached an all-time intraday high price of $109.70 and have traded between $106.82 and $109.70. At present, the stock is priced at $108.51 (+$4.33, +4.16%).

[NLINSERT]Disclosure:

1) Stephen Hytha compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.