I've been watching this company for nearly two years. There have been ups and downs, a lot of excitement and some disappointments, but the management team at Aston Bay Holdings Ltd. (BAY:TSX.V; ATBHF:OTCQB) is superb—no one can argue that fact.

And, the market for natural resource stocks has been awful. Anyone disagree? In looking across several sectors—battery, precious and base metals—I would say that Aston Bay's shares are in the bottom quartile of performance over the past year. Nothing to brag about, but it could certainly be worse.

As a single-asset play in a high-cost exploration jurisdiction (Nunavut, Canada), this was (and still is) a highly speculative investment opportunity. However, Aston Bay is now a two project company, and its second project is in the much cheaper to operate and faster-moving location of Virginia in the U.S.). In Virginia, one of the company's primary targets is gold, which just so happens to be performing extremely well. As I write this, gold is up over US$100 per ounce (US$100/oz) in June alone, and touched US$1,395/oz (a 15-month high) earlier this morning (June 20). Yet, Aston's market cap is just CA$6.5 million (CA$6.5M = US$5M). Now could be a good time to take a closer look at the company.

This interview is more focused on the newer asset in the U.S., a property that's in the process of being greatly expanded and had very recent high-grade drill results. The team wants to educate the market about this exciting project. However, CEO Thomas Ullrich remains quite bullish on Nunavut, he just needs to stretch his exploration dollars and spend wisely. Deep drilling is simply not an option (too expensive) unless Aston finds a partner. But if other metals follow the gold price higher, finding a partner could become a lot easier.

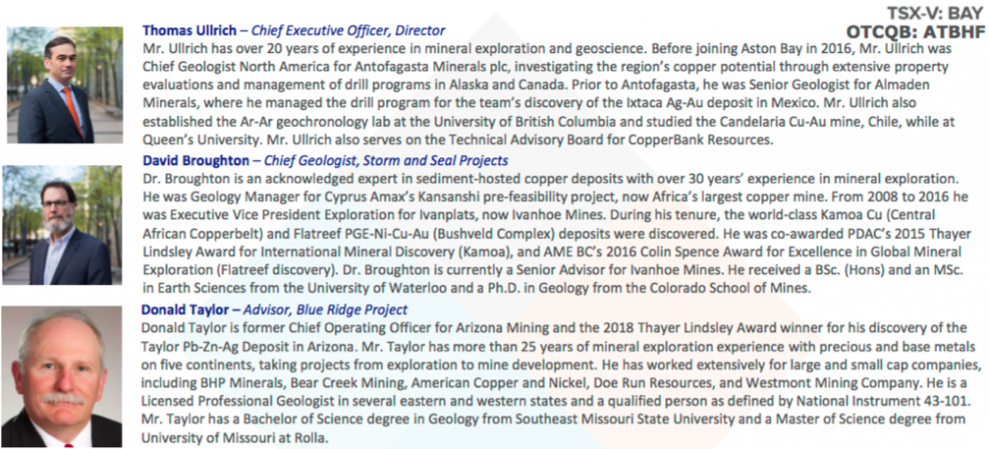

Without further preamble, here is my exclusive interview with Thomas Ullrich, a man with over 20 years' experience in mineral exploration and geoscience, CEO and a director of Aston Bay.

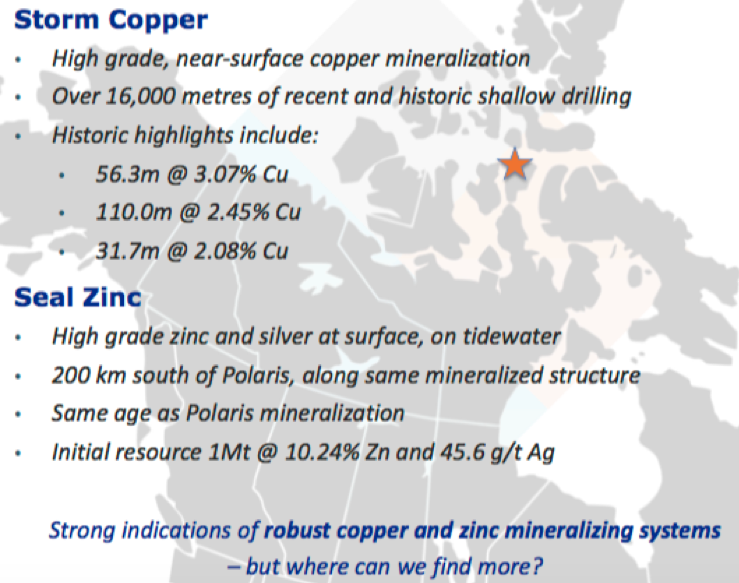

Peter Epstein: In looking at your new June corporate presentation, I see near-surface hits of 56m @3.06% copper (Cu), 110m @2.45% Cu in Nunavut. . .What could possibly be wrong?

Thomas Ullrich: There's nothing wrong with that! These hits are a clear indication of a very robust copper mineralizing system at our Storm Copper project in Nunavut. The system is equally robust for zinc, as can be seen in the 1 million tonne Inferred resource of over 10% zinc at our Seal Zinc project to the west. We have two locations where mineralization pokes through to surface, over top of over 2,000 meters of flat-lying sedimentary rock beds.

The thesis here is that metal-bearing fluids moving through faults can potentially deposit very significant amounts of copper and zinc in permeable sedimentary layers. The combination of a robust mineralizing system and a thick package of rock with permeable layers increases our confidence that a significant deposit might have been formed. However, since the rocks are flat-lying, most of the potentially mineralized layers are hidden. The only way to find them is to drill.

But drilling is expensive, so smart targeting is critical. Geophysics can help "see" into the subsurface to improve the odds, but it's not simple. We have some large gravity anomalies that may correspond to metal deposition in areas predicted by our geological model. That combination of a robust ore-forming system, predictive geological model and supporting geophysical anomalies is very compelling.

The gravity geophysical method, however, does not give a good read on the depth of the anomalies. The targets might be too deep to reach by drill. Since the window for economic drilling here is 500 meters (550 m), we need to do additional geophysical work to confirm that the attractive gravity anomalies are within 500 m of surface.

Peter Epstein: What would you say to a shareholder who's underwater and upset about how the Aston Bay project in Nunavut is playing out?

Thomas Ullrich: I own 2.5 million shares of BAY, all bought in the open market or in private placements, and I'm underwater myself. Each year, we have advanced our Nunavut project to offer the potential for very significant rewards. Last season we swung for the fences with our drill program, as we told investors we would, and that potential for a home run drove the share price up. We hit copper and zinc, but not the "home run" the market wanted.

Discoveries are rarely made on the first drill program—ask Dave Broughton how many tries it took to find Kamoa. We still strongly believe that the Nunavut project has the potential for significant discovery, and we're demonstrating this with successful exploration. Over the past few months, I've added 1 million shares to my personal holdings.

Peter Epstein: With so many cheap mining projects around the world, why did your team choose the Blue Ridge project in Virginia as your company's second major asset?

Thomas Ullrich: Cheap mining properties are usually cheap for obvious reasons. The Virginia projects are very different; they were unrecognized and overlooked, so they're undervalued. The Blue Ridge Mining project has an excellent pedigree, created from Arizona Mining founder Don Taylor's private company. Don brings decades of experience working in Virginia, and the critical relationships required to get things done.

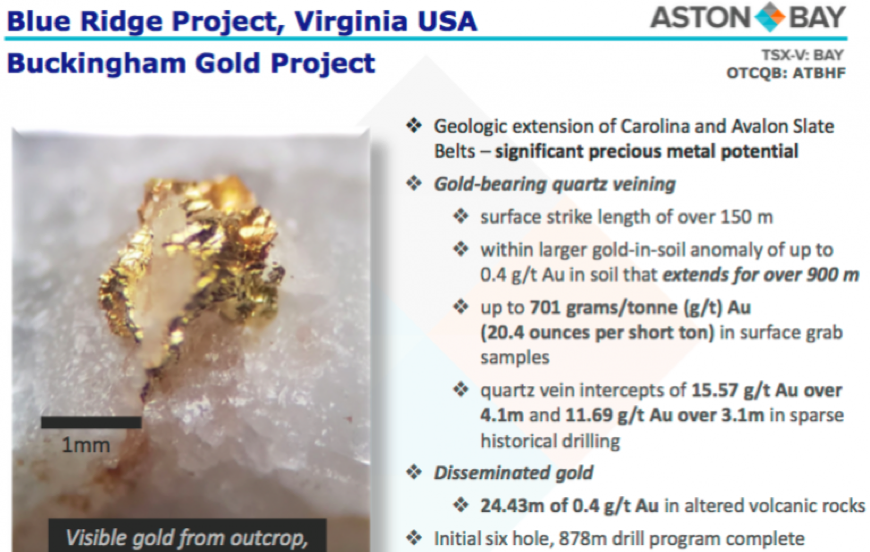

The area is highly prospective for both base and precious metals, home to mineralized belts that contain the base metal deposits of the Copper Basin, and the Haile Gold Mine, but little explored due to the deep weathering and lack of outcrop. Not only are the Blue Ridge projects undervalued, they are a great match for Aston Bay; they fit right into our base metals exploration wheelhouse. The Blue Ridge projects significantly expand upon our core competency with a tremendous gold story.

Dave Broughton, the team and I have all had success with precious metals. Just as important, all the heavy lifting has been done on these projects, with early-stage exploration completed. We're at the drill-ready stage. Virginia, as a "fee simple" jurisdiction, allows us to drill without any permitting required. This allows us to act quickly, getting us to a discovery faster.

Great projects, ready to drill, in a place where you can drill right away (and in a jurisdiction where you can have faith that you can mine and subsequently repatriate your profit). It's an exciting project and a substantial value-add to Aston Bay.

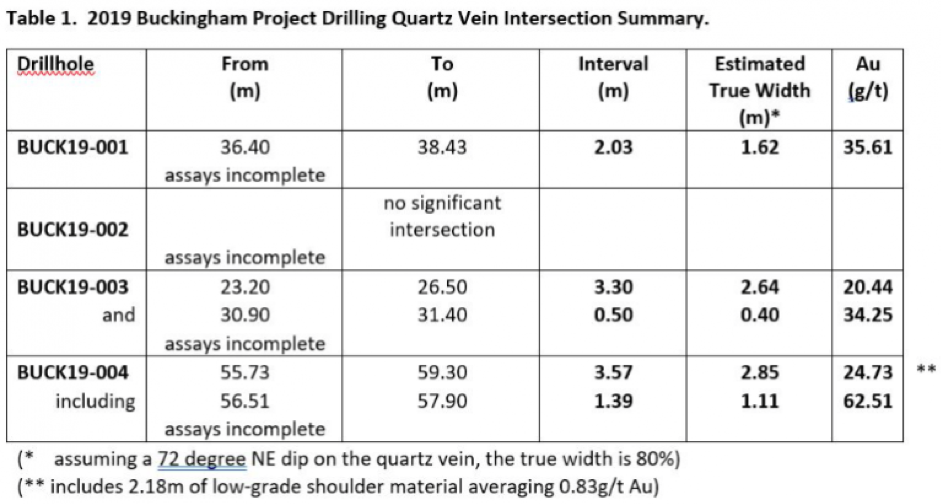

Peter Epstein: Please explain your view on the results of four drill holes reported in early June. [Note: BAY shares were down nearly 40% on the day of the announcement].

Thomas Ullrich: The results were very encouraging. High-grade gold in quartz veining at surface on private land in a great jurisdiction. This is just the start, we are still waiting on assays from the surrounding rock that may contain significant disseminated gold, like they are now mining at the Haile Gold Mine just 200 miles to the south, a roughly 5M-ounce resource.

Even more encouraging, we have only drilled a very small portion of the land, (where the quartz vein sticks out of the ground). However, this sits within a much larger gold-in-soil anomaly with values of up to 0.4 g/t gold. These are strong results so far, and we believe more positive results are coming out of this program, and future programs, as we step out along strike. We will work to better educate the market on this topic in upcoming news releases.

Peter Epstein: You said in a recent interview that Aston Bay can move quickly, and at low cost, in central Virginia. Cheap and easy compared to what?

Thomas Ullrich: Base and precious metals exploration activities are unregulated in Virginia under what is termed a fee simple jurisdiction for property rights, the maximum aggregate of rights available. Operationally, this means that we can explore, drill and even conduct small scale mining without any permitting required when we have agreements with the timber companies that own prospective grounds.

So, it's easy and quick to get started without waiting for permits or consultations—quick because the preliminary geological work has already been completed (and Don Taylor has been chewing on the targets for years), and easy and low cost because the timber farms have an extensive road network for truck and track-mounted drill access.

It doesn't get cheaper and easier, particularly when compared to most areas that have at least one of the "frictions" of exploration, such as drill permitting, land use permits, water use permits, local consultation requirements, access agreements, road building permits, camp building helicopter support, fuel supply lines, etc. . . .the list goes on. We have none of those here in Virginia.

At our Buckingham Gold project, the drill drove right up to the pad just three weeks after signing the land agreement. That was our first drill program in the U.S., so we expect to be even quicker for subsequent programs. The all-in costs for that small program will be less than CA$200/m. We expect we can reduce that figure for future programs.

Peter Epstein: Can you talk about your team's thoughts on what an enlarged Blue Ridge or Buckingham Gold deposit could potentially contain?

Thomas Ullrich: We will be signing agreements to explore over 11,000 acres of private land in Virginia, looking for base metals (copper, zinc, cobalt) and gold. We feel the property has the potential to host undiscovered belts of base metal deposits, similar to Ducktown and other 10 million-ton-plus deposits of the Copper Basin mined in the early 1900s.

For precious metals, we already have high-grade gold in quartz veins at surface and shallow subsurface at our Buckingham Gold project, and we're awaiting results for potential disseminated gold mineralization in the surrounding rock. At the Haile Gold Mine 200 miles to the south, OceanaGold Corp. (OGC:TSX; OGC:ASX) is mining similar styles of mineralization from a 5 M-ounce resource. It's early days, but these are the targets we're aiming for.

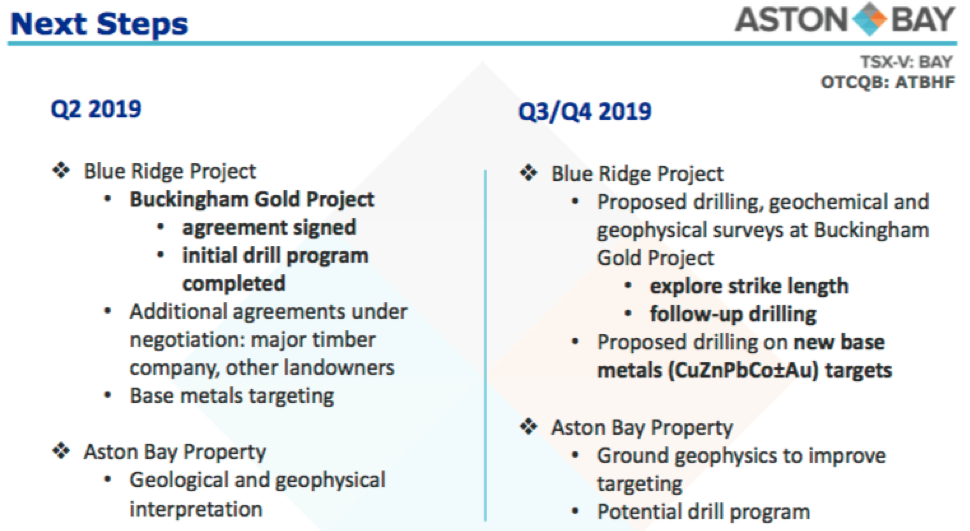

Peter Epstein: Although we touched on a lot of things, to sum up, what are the near-term catalysts for Aston Bay?

Thomas Ullrich: The remaining results for our Buckingham Gold project should be out in the next few weeks. Soon we will sign a definitive agreement for the much larger parcel of ground covered by our letter of intent with a major forestry company. We will be able to place what is currently a high-grade, albeit currently small gold project, within the context of a much larger gold-in-soil anomaly. Then, we will develop targets and start step-out drilling to see how big the Buckingham Gold project could be.

There's potential for additional gold deposits and near drill-ready copper-zinc deposits on forestry company ground and in other areas in Virginia, where we are currently in advanced land agreement negotiations. In Nunavut, we hope to complete a modest (low-cost) ground geophysics program that could yield compelling targets for large, high-grade copper and zinc deposits. With the 'new' Aston Bay we have a steady flow of exploration and drilling on projects that we believe have the potential for significant discovery in two of the best jurisdictions in the world.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

[NLINSERT]Peter Epstein's Disclosures: The content of this interview is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Aston Bay, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Aston Bay are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this interview was posted, Peter Epstein owned shares in Aston Bay, and it was an advertiser on [ER].

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Graphics provided by the author.