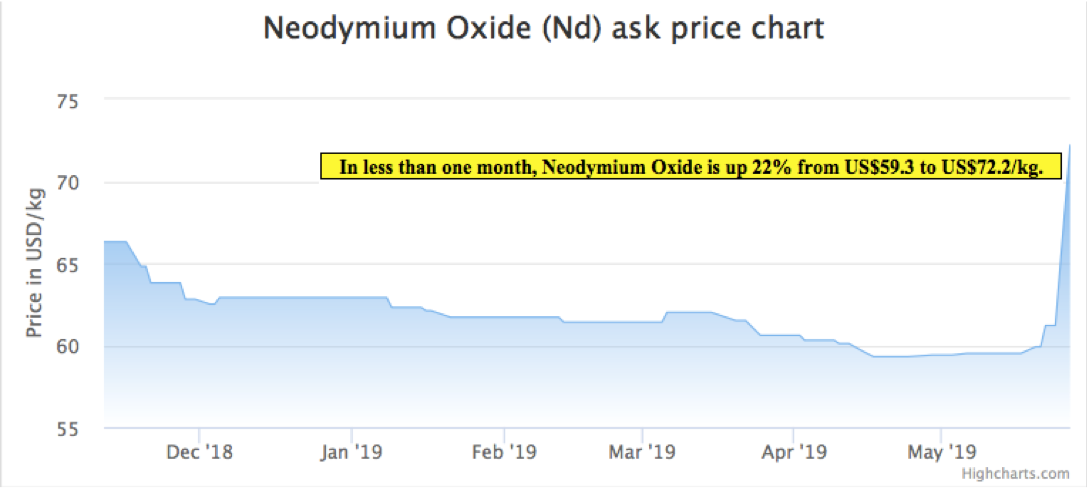

There has been quite a bit of ink spilled lately regarding the Chinese—U.S. standoff and possible implications for rare earth metals. Rick Mills of Ahead of the Herd has written the best articles that I've read so far. Many rare earth metals companies have seen their share prices increase, some substantially. Yet, we are probably still in the early innings of a long, drawn-out game. Of course, no one knows how this will end, but select rare earth (REE) prices have begun to move higher. For instance, light rare earth element (LREE) neodymium oxide (Nd) is up > 22% in just the past few weeks. As of Friday, May 24, prices of praseodymium-neodymium oxide stood at 330,000-340,000 yuan/tonne, up from 264,000 yuan/tonne the week prior, according to SMM. That's up 26% in a week.

From a Global Times article: "Why did the U.S. threaten to raise tariffs on essentially all remaining imports from China, while sparing rare earth metals? Without a reliable domestic supply, the U.S. must rely on China to supply industries of high strategic importance. China can raise prices of rare earth metals exported to the U.S. in response to higher tariffs on Chinese products. The U.S. decision to omit rare earths from the China tariff list shows how much the Country depends on these minerals. In the short term, U.S. users would not be able to find alternatives, so they would have to accept higher prices. China has various tools to influence prices, cutting the number of rare-earth mining licenses, raising market access standards for miners and reducing exports of primary rare-earth products."

In addition to rare earths being in the crosshairs, security of supply of cobalt is also being discussed by industry participants, government, and trade officials in the U.S. While less critical then the highest value rare earth metals, lithium and cobalt are important, especially for grid-scale energy storage Systems. Last week, execs from cobalt companies with projects in the U.S. and Canada met in Washington, D.C., to discuss cobalt's tortured supply chain. Supply is at grave risk due to ~65% of it coming from a single country in Africa. Politicians talking about cobalt supply is helpful in framing the rare earth metals situation. Evidence that the trade war is heating up can be seen in higher rare earth metals prices. It’s as simple as that, and we're seeing higher prices of select metals.

The biggest increases have come from dysprosium (Dy), Nd and praseodymium (Pr), up by 56%, 22% and 22%, respectively, from 2019 lows, as of May 27. These three metals just happen to be three of the most critical metals for national defense applications, and are widely used in super magnets and in other crucial high-tech fields. In many uses there are few, if any, substitutes. Rare earth metals juniors are catching a bid: Appia Energy Corp. (APAAF:OTCQB), GéoMégA Resources Inc. (GMA:TSX.V), Rainbow Rare Earths (RBW:LSE), Greenland Minerals & Energy Ltd. (GGG:ASX), Northern Minerals Ltd. (NTU:ASX) and Peak Resources Ltd. are up an average of 114% from 52-week lows.

Interestingly, three of the top six performers I mentioned are Australian-listed, an exchange that most readers (and me) rarely, if ever, trade on. There are not that many North American-listed REE stocks to choose from. And, many of the U.S and Canadian listed names have projects that require hundreds of millions of U.S. dollars in capex. Others that were exciting in the last REE bull market have metals that are no longer as highly prized. In 2010–2011, there might have been six to eight REEs worth owning. Today, only three to four rare earth metals are truly bankable for the long run.

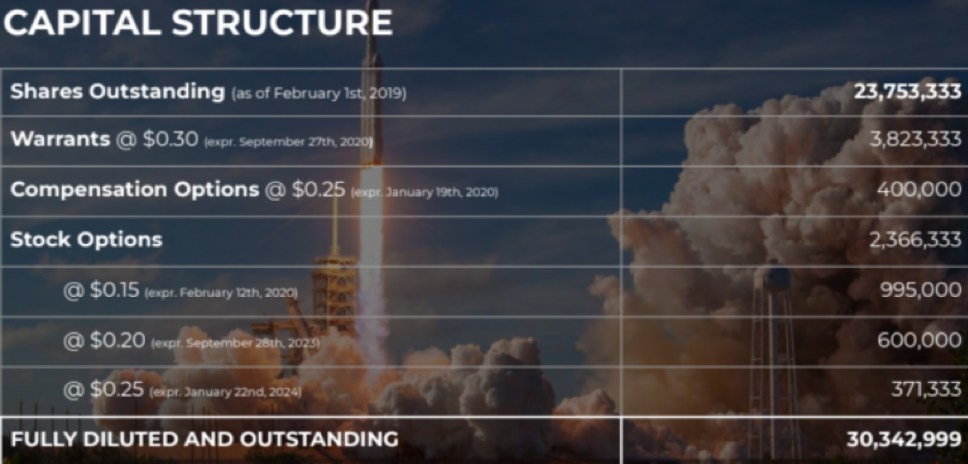

With that in mind, (wait for it; I have a stock idea to discuss) readers should want to invest in companies with LREE deposits, more specifically with deposits containing as much Pr, Nd and Dy as possible, and companies that have tight share structures so that if they move, the uptick could be very significant. Readers should look for companies with small market caps. Less money is being deployed into natural resource stocks, it's a lot easier to move a company with a market cap <CA$10 million ($10M) than >CA$100M. Finally, a strong management team and board are paramount.

Defense Metals Corp. (DEFN:TSX.V; DFMTF:OTC; 35D:FSEQB) has all of the attributes I mentioned and more. Earlier this year, the share price hit CA$0.30 on excitement over the uranium spot price climbing above US$29/pound (the company has promising Athabasca uranium assets), a great management team and a cheap valuation (only 24 million shares outstanding). Since then, the uranium price has settled to around US$24.5/pound and company news flow has been slower than hoped for. SGS Canada is performing a battery of tests and will write a number of important reports, mostly about metallurgy. SGS is working with a 30-tonne bulk sample from Defense Metals' Wicheeda deposit.

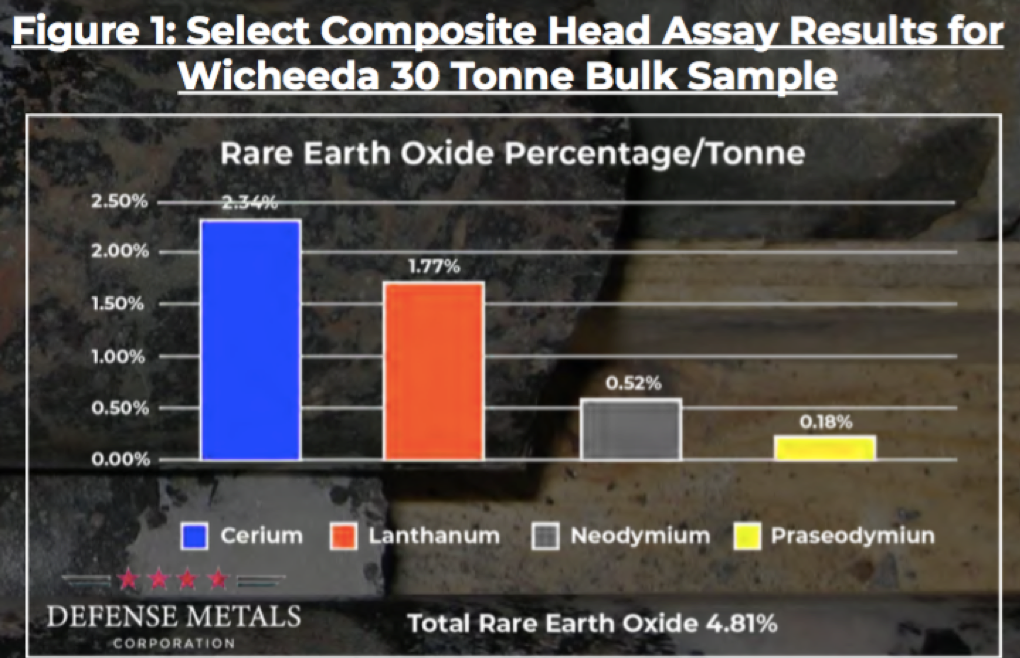

However, the management team, board and advisors are as strong as ever, and select light REE prices are increasing. Increasing prices? That's strange. Lithium, cobalt, vanadium, gold, silver, copper, zinc, lead, uranium—all down over the past month or longer. Marijuana (cannabis) prices are down as well! According to Mr. David Merriman of Roskill, "LREE projects have comparatively greater concentrations of lanthanum, cerium, praseodymium, neodymium and samarium, typically forming roughly 75%–99% of contained REEs in a deposit." Defense Metals has a LREE deposit with all five of those metals.

Defense Metals has two of just three or four rare earth metals that are absolutely critical to the global economy, and a few metals that are modestly to moderately important in enabling a growing middle class to continue moving to cities and buying their first smart phones and electric vehicles. The concentrations of Nd and Pr might seem low at well under 1%, but those metals trade at about US$70K/t. Compare that to ~US$35K/t for cobalt, ~US$18K/t for vanadium, ~US$12K/t for nickel and ~US$6K/t for copper.

One can't talk about China and the U.S. without discussing rare earth metals. If one talks about rare earth metals, the ones that come to mind are Nd, Pr and Dy. Earlier this year I asked Mr. Merriman about the dominance of select metals and, of course, China. He said:

"China leads in production of both mined rare earth products and refined rare earth compounds, with Chinese production accounting for 86% of global refined production in 2017. Rare earth production outside China is forecast to grow significantly through 2028 as numerous projects in Australia, Russia, the Americas and Africa come online. Demand for rare earth permanent magnets is forecast to show strong growth through 2028, which is expected to further distort rare earth demand ratios with Nd, Pr and Dy forming a greater proportion of total demand."

Management expects a lot more news flow in June than in April and May as SGS Canada completes additional metallurgical test work on the 1,780-hectare Wicheeda project bulk sample. The timing could hardly be better. If the company receives more positive news, a mini-pilot plant will be built to further advance and derisk a process flow sheet. Select head assay results for the 30-tonne bulk sample included 2.34% Ce oxide, 1.77% La oxide, 0.52% Nd oxide and 0.18% Pr oxide. Total LREO (light rare earth oxide) was 4.81%.

From a recent company press release:

"The results confirm, in conjunction with previous metallurgical head grades returned from smaller drill core samples, the presence of significant Pr values. . .The Company considers the results to have potential economic significance to the advancement of the Wicheeda Property given recent indicative LREE oxide prices and their potential impact on Wicheeda, which has been historically viewed as a cerium-lanthanum-neodymium deposit."

I look forward to news on this exciting LREE project. Wicheeda could be in small-scale commercial production relatively quickly, if the metallurgy is as good as management believes it might be. The project has much smaller upfront capex than many legacy projects around the world that are still on the drawing board. The reports and data from SGS should convey a tremendous amount of information about the potential feasibility of a mining operation. It's exciting times for REE & LREE juniors, especially so for Defense Metals Corp. shareholders.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

Read what other experts are saying about:

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Defense Metals Corp., including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Defense Metals Corp. are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Peter Epstein owned shares of Defense Metals and it was an advertiser on [ER].

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: Defense Metals. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this interview, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Defense Metals, a company mentioned in this article.

Graphics provided by author.