On May 27th, Portofino Resources Inc. (POR:TSX.V; POT:FSE) announced initial sampling results at its Yergo lithium brine project that covers the entire Aparejos Salar in the Province of Catamarca, Argentina. Yergo is within 15 km of Neo Lithium's high-grade, PFS-stage 3Q project. Before getting to this important company news, a quick recap of Portofino.

Brief Overview of Portofino Resources

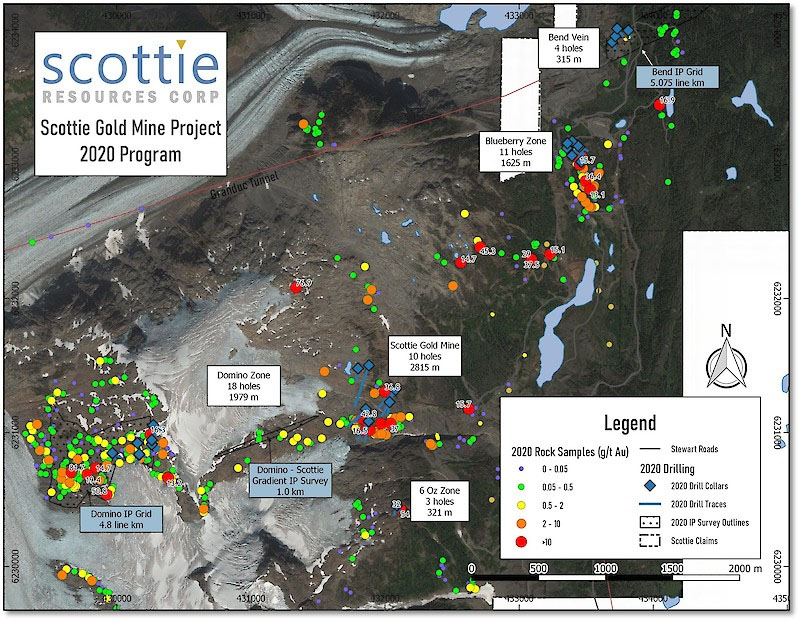

The company controls three projects in Catamarca, covering >8,600 hectares, via low-cost, four-year options. Through the end of 2020, total cash outlays are <$65K for all three projects. There are no work commitments or royalties. Portofino's most advanced (initial drilling this summer) asset is the 100%-controlled, 1,804-hectare Hombre Muerto West project. Close neighbors in the Hombre del Muerto Salar include Livent Corp. (formerly FMC), POSCO and Australian-listed Galaxy Resources. POSCO paid ~$375 million to Galaxy for 17,500 hectares in Catamarca province, that's ~$21,400/ha.

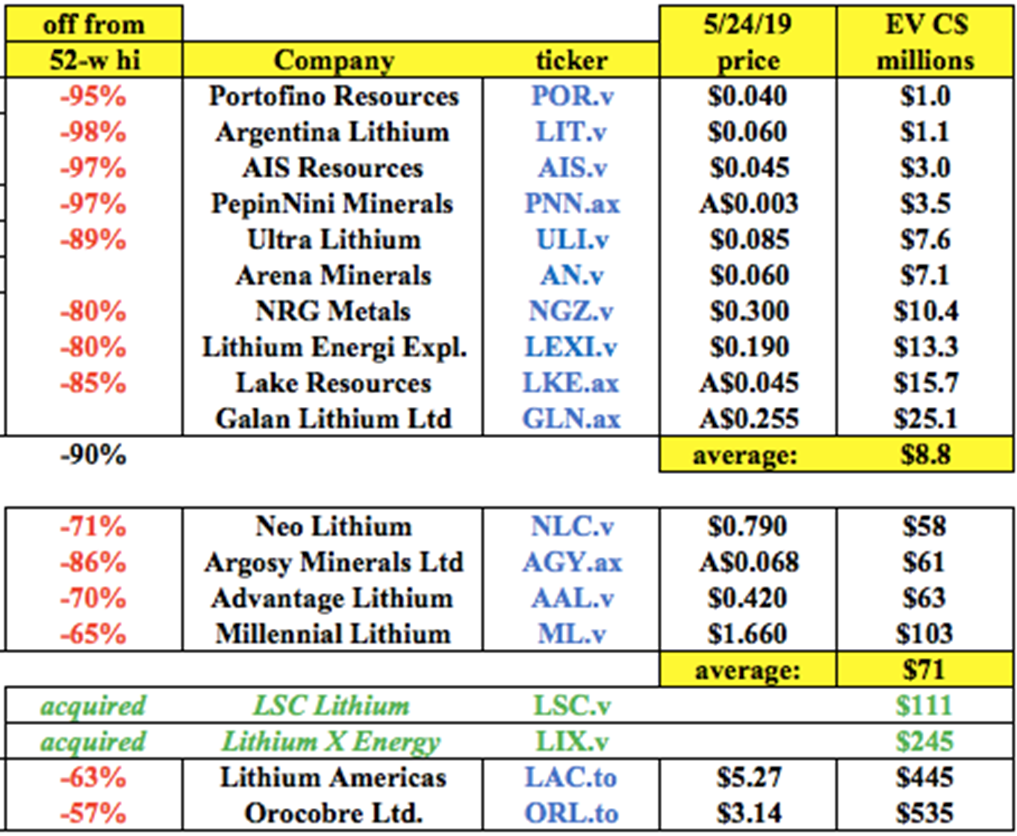

If POSCO, Galaxy, Livent Corp., Lithium Americas, Albemarle, SQM, Ganfeng, Orocobre Ltd. or smaller players like Neo Lithium, Millennial Lithium, Argosy Minerals, Advantage Lithium and Galan Lithium were to pay half of what POSCO paid (per hectare) for 1/3 of Portofino's 1,804 hectares in Hombre Muerto, that would equate to 6x the company's current market cap of C$1 million. As a reminder, of 18 surface samples taken at the Hombre Muerto West project last year, two were >1,000 mg/L Li, averaging 1,026 mg/L Li, four were >800 mg/L Li, averaging 935 mg/L Li and six were >700 mg/L Li, averaging 871 mg/L.

A Second Project, Named Project II, Looks Promising as Well….

Portofino can acquire 85% of Project II, which is 3,950 hectares in size and located 10 km from the Chile border (see map above) and 65 km northeast of Neo Lithium's 3Q project. Historical exploration work included near-surface brine samples that averaged 274 mg/L Li, with several in excess of 300 mg/L Li. Project II captures the whole salar, has relatively easy access, and has returned consistent surface / near-surface sampling results over a wide area. The Maricunga project (BFS completed) is located just across the Chile border. Maricunga is billed as the highest-grade undeveloped brine project in the Americas.

Last, but not Least, Yergo, Subject of the May 27th News

Portofino has the right to acquire a 100% interest in the 2,932 hectare Yergo lithium brine project. The property covers the entire Aparejos salar {see map above}. Earlier this year, surface and near-surface brine sampling and geological mapping were done. Twenty-two locations were sampled, returning values up to 373 mg/L Li and up to 8,001 mg/L Potassium ("K"). The sample sites averaged 224 mg/L Li, 4,878 mg/L K and 184 mg/L Magnesium ("Mg"). The average Mg:Li ratio of the 22 samples is a very low 0.8:1. Due to unusually high levels of water in the salar, 16 of the 22 samples were taken from the southeast portion of the salar. Those 16 samples averaged 278 mg/L Li, 6,091 mg/L K and 86 mg/L Mg. The average Mg:Li ratio of the 16 samples is extremely low at 0.4:1. Most projects in Argentina have Mg:Li ratios of 3.0 to 3.5 to 1.

According to the press release, one sample taken from the northwestern portion of the salar returned a value of 351 mg/L Li, indicating a potential area of elevated near-surface Li brines up to 3 km in length by 1-2 km in width. Additional sampling will be required to better test the central portions of the area. Management intends to complete additional sampling once surface waters have evaporated to allow for less-diluted brine samples. Due to the close proximity of the salars comprising Neo Lithium's 3Q Project and Portofino's Yergo project, geologists studying Yergo believe it's likely that they have similar geological histories and are similarly enriched in lithium and potassium.

David Tafel, Portofino's CEO stated:

"We are encouraged with these very good, initial lithium and potassium sample results combined with extremely low magnesium/lithium ratios. As soon as weather permits, our geological team will continue their exploration work to follow up on the potential surface extent of the mineralization."

Conclusion

Although the main event is drilling in June/July at Hombre Muerto West, these surface sample results from the Yergo project are certainly promising. Portofino is slowly but surely, without burning too much cash, advancing multiple projects. In a better battery metals market or a better lithium juniors market, I believe that the optionality embedded in Portofino's three projects would be valued higher. Perhaps a lot higher. A C$1 million market cap is a cheap entry point to see a few drill holes in one of the best lithium enriched salars on the planet. A proven salar with long-term existing production and advanced-staged development projects underway.

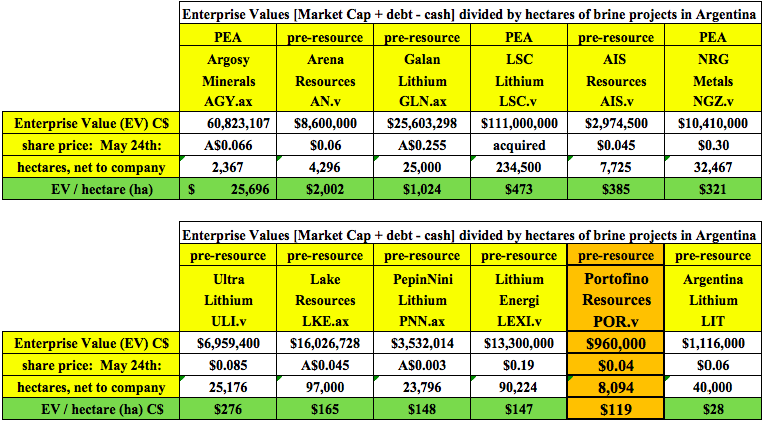

The following chart is another look at relative valuation. I calculated each company's Enterprise Value per hectare. Portofino is the second cheapest by this measure. To be fair, this is not the best metric, because not all hectares are of equal quality, or equally far advanced. For instance, some of the companies below have Preliminary Economic Assessments ("PEAs") on select projects. However, I believe that Portofino's three projects have the potential to be company-makers (it's easy to be a company-maker when your market cap is C$1 million). By contrast, some of the companies below have projects and greenfield properties in provinces or salars that have shown poor or mediocre drill results. Mediocre doesn't make the grade in this market!

To be clear, Portofino Resources (TSX-V: POR) is a very high risk investment opportunity; it has not drilled a single hole yet. But several of the companies listed above have properties in less attractive salars, have experienced drilling problems, reported unimpressive grades, narrow brine intervals or announced small resources. One company reported a resource of just 66,000 tonnes of Indicated & Inferred lithium carbonate! Portofino could end up with mediocre drill results, or run into problems, but with a market cap of just C$1 million, it might be worth taking drilling risk for the possibility of good, or very good, drill results, and perhaps a better lithium junior market later this year.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

[NLINSERT]Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Portofino Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Portofino Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Peter Epstein owned shares of Portofino Resources and Portofino was an advertiser on [ER].

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Graphics provided by author.