With great apology, I am late with this week's missive largely due to the arrival of boating season and the fierce need to secure a new vehicle, which should have taken (only) two days but didn't. Having arrived at the marina on Friday evening, I expected a rather smooth transition as it was the first year in four that I asked our local service fellow to do all of the end-of-year maintenance, instead of me draining the lines and winterizing the water tank and changing the engine oil and all of those things I loved to do in my 40s but that have become a royal pain in the ass twenty years later. Call it "geezer-itus" or "baby-boomer angst," I agreed to let the local marina service group do all those debilitating tasks and simply threw them the keys while shouting "See ya next spring!"

I fully expecting a boat functioning this past weekend in exactly the condition in which it was functioning last October. Well, with great deference to Mr. Murphy and that obnoxious law named after him, my lovely little Freshwater Pearl was a mess of the highest and most irritating order, floors most foul, upholstery seams ripped, and obvious dings and dots from the reentry-to-the-water exercise. However, what really set me off was that my most-excellent winch-powered dinghy caddy was nonfunctional, and after five hours with limited workspace, I removed what I thought was the faulty part.

By this time, the Fido-beast has leapt off the boat and off the slip and, in an visceral reaction to my multitudinal "expletive deleteds," bounded off into the woods in search, I am sure, of a somewhat saner master—one who might never opt for such an horrific linguistic diatribe.

To be truthful, there is another reason I am late with the weekly missive. Alas, I am finding it increasingly difficult to come up with anything different, witty or interesting to write about. I feel like a CD player caught in a repetitive loop where a Robbie-the-Robot voice keeps saying: "Warning! Warning! Buy gold! Buy gold!" I almost want to throw myself, instead of the quote monitor, out of the ninth-floor window.

Here is the drill I have to go through to maintain my sanity as the average subscriber/investor peppers me with questions:

Investor: "Gold is trading really weird these days."

MJB: "It's rigged. Get over it."

Investor: "Silver looks cheap relative to gold. The ratio of silver to gold is just shy of 90!"

MJB: "Yeah, and until JP Morgan is prohibited from trading it, the ratio could see 120."

Investor: "Stocks should be correcting as the trade war has got to hurt earnings."

MJB: "What do earnings have to do with stock prices? You have 50 traders at the NY Fed under orders to support them so just buy the dips because the Fed has our backs."

Investor: "Gold mining stocks with new discoveries don't seem to attract the attention that they did back in the 2000–2011 period."

MJB: "Why should they? The Millennials could care less. If they drilled 90 meters of THC, they would care."

These types of conversations actually both frighten and disturb me because they are rife with a subtle dose of cynicism and a hefty dose of resignation. To wit, I am growing increasingly more cynical of our institutions and I have nearly resigned myself to a never-ending world of aberrant behaviors, all the product of this generational acceptance of government interventions and interference. The problem is that I can never accept these interventions. But the newer generations readily accept and, in fact, expect them, as if an entitlement bestowed upon them at birth. As we Baby Boomers age and lose power and relevance, adherence to the belief in the return of sound money and fiscal sanity is sadly a losing proposition.

On the weekend, I watched all three episodes of Grant Williams' brilliant interview ( https://www.realvision.com/) with the co-author of The Fourth Turning, Neil Howe, during which they discuss where we are in the generational cycle of the four "turnings"—high, awakening, unraveling and crisis. It came as no surprise that here in 2019, we are in the late stages of the "unraveling," where institutions are the increasing focus of distrust and where career and behavioral individualism is revered. These are all periods of cynicism and bad manners, when civic authority feels weak, social disorder feels pervasive, and the culture feels exhausted. An example of a Third Turning (unraveling) would be the Roaring Twenties, which led to the Stock Market Crash of '29 and the 1930s Great Depression.

There are at least ten terrific interchanges between Grant and Neil but the one that got me was where it is pointed out that we, as a race of humans, are in the transition between the Third and Fourth Turnings. It is, according to the theory advanced in the book, a period where if you are a late Boomer or early Gen Xer, you are having the most difficult time of your investing lives because you were trained/socialized/educated in a post-crisis period—the high. For us, this was the post-WWII rebirth, and for the next sixty years we have been applying skills and mindsets applicable to that period and to the Second Turning (awakening), both periods of prosperity and growth.

However, I would peg the beginning of the Third Turning (unraveling) at around 2000. Since then we have watched the Baby Boomers try to fight the inevitable arrival of the Third Turning—despite the dot.com crash in 2001, 9/11, the subprime meltdown in 2008, and more recently, the stock market bailout in late 2018, all classic examples of a generation trying desperately to preserve the status quo by way of increasingly desperate interventions.

In other words, Millennials and Echo Boomers are navigating with ease these days while the older generation, having resisted the arrival of a new generation of attitudes and changes, is watching old, tried-and-true methods of investing get dashed on the rocks of algobots, social media and government interference.

So, if any of you are wondering why I have trouble these days find ideas I think will interest you, there, in a nutshell, is the reason. I feel like many times I am talking to room full of ghosts, as in James Cameron's "Titanic," where at the end they were wandering through the halls of the sunken ship with flashbacks to pre-disaster moments of glory and grandeur. And talking to ghosts is anything but a healthy pastime.

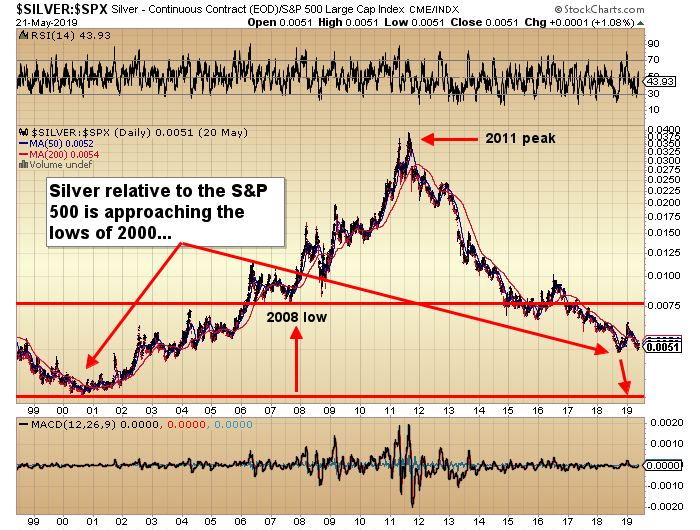

The two charts shown above are a vintage illustration of the apathy, desolation, abandonment and lethargy surrounding the gold and silver space. The other day I read one of those old e-mail blasts, in which we are offered "35 Reason to Own Gold NOW!" After reason #11, I threw it in the bin. It is all the same dialogue of "too much debt" and "fiscal insanity" and "Chinese demand" or “Indian demand," but I don't care whether it was Martian demand or Ballchinian ("Men in Black," 1997) supply, you (and I) have read it or heard it all before.

It is true that silver is cheap relative to the S&P, and it is also true that gold and silver mining shares are cheap relative to bullion, but that does not constitute causation in terms of a trading idea. In 2019, everyone is a trader operating in the Greater Fool Theory of causation. You buy something at any price because you just know there is some moron out there willing to buy it off you at a higher price. Earnings, trade wars, price/earnings ratios, etc. all mean absolutely squat today, and that is why in a Utopian world of "The Fed's Got Our Backs," gold and silver offer little in the way of utility. This is especially true in the "unraveling" stage, because the younger generations willing to take all the risk see little need for safe havens in a world of cannabis 30-baggers and the raging FANG stocks.

As I wrote about a few weeks back, there really is nothing dire about the technical picture for gold, but in saying that, I refer to the optics of the chart pattern only; the predictive nature of the chart pattern is nonexistent at best, and counterintuitive at its malevolent worst. Based upon the dramatic drop in open interest in the past few sessions, and since the end of the latest COT week last Tuesday, this upcoming COT report should have the Commercials rapidly covering the shorts they put on during that brief pop last week to above $1,300. Worst case scenario: a quick flush to the 200-daily moving average, at $1,258, at which point we back up the truck (but I doubt that happens). . .

The COT from last Friday simply confirmed what the open interest spike implied: The Commercial Cretins, in full view of regulators and justice departments, were allowed to offer several thousand contracts of phony gold to cap any hope of an advance at around $1,300—which are now being covered $30 lower. Generations of younger investors join the price management party and sell the rip, where by contrast, over in the S&P pit, they do the reverse because they have been trained to place wagers "with the house," where the odds of winning are undisputedly higher. Not to beat upon a deceased nag, but these constant and malodorous takedowns are again the reason why I find it sometimes difficult to write any words of encouragement. But at the same time, gold got pounded on Tuesday down under $1,270, yet the HUI managed to eke out a small gain despite gold's weakness, always a good sign in the near term.

I am now 100% long the JNUG at an average price of just under $7 (offside), and I own a 50% position in NUGT June $15 calls (also offside). But where I have been adding quite aggressively is through the unduly depressed shares of Getchell Gold Corp. (GTCH:CSE) (on-side), by way of the $0.15 unit, which is certainly preferable to paying $0.25, where it traded over 70,000 shares on Tuesday.

I have always held that full disclosure is a policy most appreciated by readers and subscribers so let it be known that I am a (paid) consultant to the company. And yes, I would like to generate some interest in this highly prospective exploration program, because resource delineation will be exciting but costly, in the event there is an initial discovery on this phase two program. As we all know, you must use the excitement of discovery momentum to finance at progressively higher prices. The problem with so many juniors these days is that they have all had to finance in the $0.05–$0.25 range, so when the discovery arrives, the excitement gets muted by the torrent of cheap paper hitting the bids. If any of you know a way to convince these privileged shareholders the wisdom of holding onto the cheap stock and, rather than selling it, buy more because you are simply "averaging up" into a value-add discovery, you should contact a ghost writer, then a publisher and wait for the book-signing events. Half the population of Vancouver would be lined up, from Granville and Howe to somewhere in the B.C. Interior.

So there you have it. I was actually able to assemble eleven paragraphs of quasi-literate, pseudo-intelligible commentary on the topic of "markets." I admire my fellow scribes, who are able to hyperbolize on the merits of gold and silver ownership without losing sleep and getting winded.

I also worship those who jumped ship and defected to the "Dark Side" of cannabis and artificial intelligence and crypto, notwithstanding the fact they are front-running momentum junkies with zero knowledge of the history of money. I am sick and tired of making excuses for my trading ideas, which are based on the tried-and-true moments in history when markets were free. They are today not free. They are corrupt.

The layers of dysfunction you feel every time you look at your month-end statement are synonymous with the layers of betrayal you feel when you look at the transition we are seeing in the leadership demographic. The old regime of the "First Turning" are now gone, and all that are left are people like me, who are astute analysts of the history of markets as I recall them. Pity those who are ignorant of the sands of the hourglass and the significance of history. They dwell in the House of Modern Glory, which shall soon be a fleeting memory.

We will have our day. Make no mistake.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

[NLINSERT]Disclosure:

1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Getchell Gold Corp. My company has a financial relationship with the following companies referred to in this article: Getchell Gold Corp. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp., a company mentioned in this article.

Charts courtesy of Michael Ballanger.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.