From his office in Vancouver, British Columbia, Jordan Trimble oversees the operation of Skyharbour Resources Ltd.'s (SYH:TSX.V; SYHBF:OTCQB) uranium assets in Saskatchewan's Athabasca Basin—the world's most reliable source of high-grade yellow metal.

The uranium market has lain largely fallow in the aftermath of Fukushima as reactors shut down and uranium prices tumbled from $70/lb to a nadir of $17.75/lb. Scores of juniors bankrupted; majors closed highly productive mines to await more propitious days, meaning the ability to mine uranium profitably. In commodity markets, patience is a virtue since what goes down must come up as economic forces equilibrate supply and demand.

Spot market prices for uranium are nudging toward $30, but experts agree that cost-effective mining of the heavy metal globally awaits a price of more than $50/lb.

In an interview with Streetwise Reports, Trimble listed several reasons why Skyharbour Resources chose to take advantage of the downturn in uranium prices by acquiring high-quality Athabasca Basin projects at bargain basement values.

"During the next decade, global electricity consumption is predicted to rise by 76%. If we are serious about limiting greenhouse gases, then generating carbon-free electricity with nuclear reactors is a must," Trimble said.

"What's the point of driving a Tesla if you are fueling it with electricity generated from burning coal?"

Trimble explained that the low cost of production in uranium-rich regions such as Kazakhstan has caused the U.S. nuclear reactor industry to import the fuel, further extending the dormancy of the North American uranium mining sector.

But demand is clearly poised to rocket up. "Right now, there are 448 operable reactors, 57 under construction and over 500 ordered, planned and proposed," Trimble said. "China is leading the charge, with India and other developing countries building apace. The United States currently has 98 reactors to fuel, and a climate-aware energy policy will dictate building more plants on the road to energy self-reliance."

Trimble points out, "Historically, approximately 80% of uranium market trading has been done though long-term contracts, many of which are terming out and will have to be renegotiated at new prices and terms." That means that previously "covered supply" will become "uncovered" and nuclear utilities will be forced back to the market to purchase uranium. "As global energy producers compete to contract for long-term sources, global prices will be forced to equilibrate to the increasing demand for clean, baseload, reliable and affordable energy," he remarked.

There is another game-changer in the works. The Trump administration is currently reviewing the still-secret conclusions of a Section 232 Department of Commerce (DOC) investigation into whether Kazakhstan, Russia and Uzbekistan are flooding the U.S. market with ultra-cheap, state-subsidized uranium product. Energy Fuels and UR Energy are seeking price relief in the form of a quota system that would require U.S. utilities to purchase 25% of their U3O8 from domestic producers, which amounts to approximately 12 million pounds of U3O8.

"There are obvious national security implications posed by an addiction to uranium produced in countries that are not U.S. allies," Trimble said.

How would 232 quotas protecting U.S. mining potentially help a Canadian company?

Trimble explained, "The DOC investigation has pushed American nuclear utilities to the sidelines effectively forcing the largest buyer of uranium globally out of the market recently. Once there is some clarity for U.S. utilities on this matter, they will be back in the market, which should help to drive higher uranium prices. Furthermore, the reality of the situation is that if the quota is mandated, it could take six years for U.S. producers to ramp up production, not to mention that if it's deemed a national security concern to rely so heavily on Russia and Russian satellite countries to provide a large portion of the uranium that fuels one in five homes in the U.S., who stands to potentially benefit? Canada can be that dependable source of long-term supply from a reliable ally."

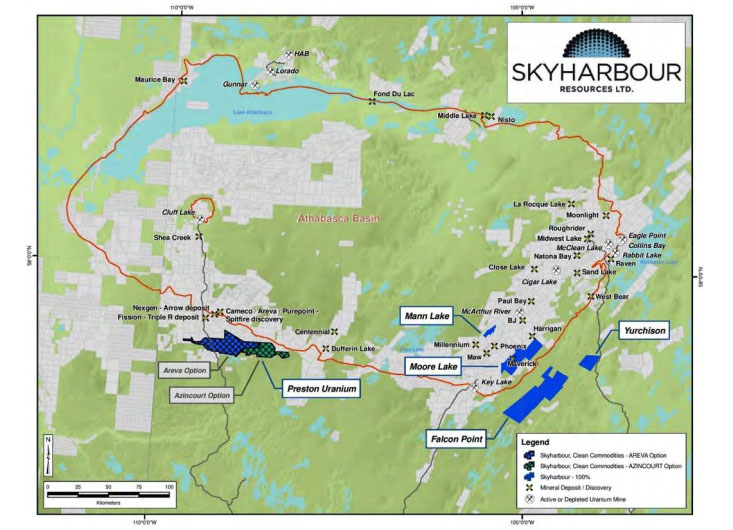

Skyharbour Resources acquired its six Athabasca Basin uranium projects with just over $4 million in cash and stock. Skyharbour Resources owns 100% of its flagship, high-grade Moore Uranium Project, completing an earn-in with Denison Mines Corp. (TSX:DML; NYSE.MKT:DNN) in August 2018. Denison is a large strategic shareholder of Skyharbour's, and its President and CEO David Cates sits on Skyharbour's Board of Directors. Moore, located on the southeastern edge of the Athabasca Basin, consists of 12 contiguous claims totaling 35,705 hectares. Over CA$40 million has been invested in 140,000 meters of diamond drilling with over 380 holes. The primary focus is the high-grade and relatively shallow Maverick Zone.

Skyharbour Resources reports that upcoming company catalysts for 2019 include additional drill results as well as a maiden mineral resource estimate at the Moore project. The Main Maverick Zone is confirmed to be high-grade with a highlight results of 6.0% U3O8 over 5.9m including 20.8% U3O8 over 1.5m in hole ML-199. Furthermore, Trimble stated, "only 2 kilometers of the 4 kilometer Maverick corridor have been systematically drill tested, leaving robust discovery potential along strike as well as at depth in the underlying basement rocks where notable recent high-grade discoveries have been made like NexGen Energy’s Arrow Deposit and Fission Uranium’s Triple R Deposit. Skyharbour is looking to emulate the success of these other companies by drilling for basement-hosted, high-grade uranium mineralization at Moore."

Industry experts at Caesars Report are impressed that Skyharbour Resources has strategic partners to shoulder exploration costs to advance the company’s secondary projects—a strategy known as "prospect generation." In March 2017, Skyharbour partnered with other companies to explore its Preston and East Preston projects on the west side of the Athabasca Basin.

Skyharbour signed two agreements—one with Orano Canada Inc. (an industry leader and France's largest uranium mining company), another with Azincourt Energy—to option up to 70% of the Preston and East Preston projects for $11.5 million in total project consideration. That amount includes $9.8 million in exploration expenditures and $1.7 million in cash payments over six years as well as shares of Azincourt.

Management and other key shareholders hold over 40% of Skyharbour's shares. These investors include Denison Mines Corp., Marin Katusa and the KCR Fund, Extract Capital, Paul Matysek, Sachem Cove Partners, OTP Fund Management Ltd. and Doug Casey.

Trimble observed, "The herd has been culled from over 500 publicly listed uranium companies in 2007 to less than 40 active companies today. We are well positioned as one of the few remaining to take advantage of a rising uranium market with our dual-pronged strategy of making new high-grade uranium discoveries in addition to prospect generation in one of the most prolific uranium camps in the world."

Read what other experts are saying about:

Disclosure:

1) Peter Byrne compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Skyharbour Resources and Energy Fuels. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Skyharbour Resources, a company mentioned in this article.

Additional disclosures from Caesars Report:

Disclosure: Skyharbour Resources is a sponsoring company. We have a long position.