Rockridge Resources Ltd. (ROCK:TSX.V) is a new copper + base metals explorer, (25.4M shares outstanding, CA$6.5M market cap, CA$2M cash, CA$4.5M enterprise value EV) searching in Canadian jurisdictions. More specifically, the focus is base, green energy and battery metals, of which copper is all three! Not just any place in Canada, in world-class mining jurisdictions such as Saskatchewan. And, not just good jurisdictions, but in mining camps with significant past exploration, development or production in close proximity to key mining infrastructure.

Rockridge wants to avoid project risks like geopolitical, (lack of) infrastructure, security, skilled labor, community support, etc., so that it can better capture the anticipated upside in the price of copper, plus select other metals. For true copper bulls like Robert Friedland and Gianni Kovacevic, this isn't about US$3/pound ($US3/lb) copper going to US$3.5/lb by year-end. No, we're talking about a longer-term price of between US$4-US$6/lb., as soon as 2020 or 2021. In that scenario, if it transpires, you want to be in companiesexactlylike Rockridge Resources.

The Knife Lake Project in Saskatchewan

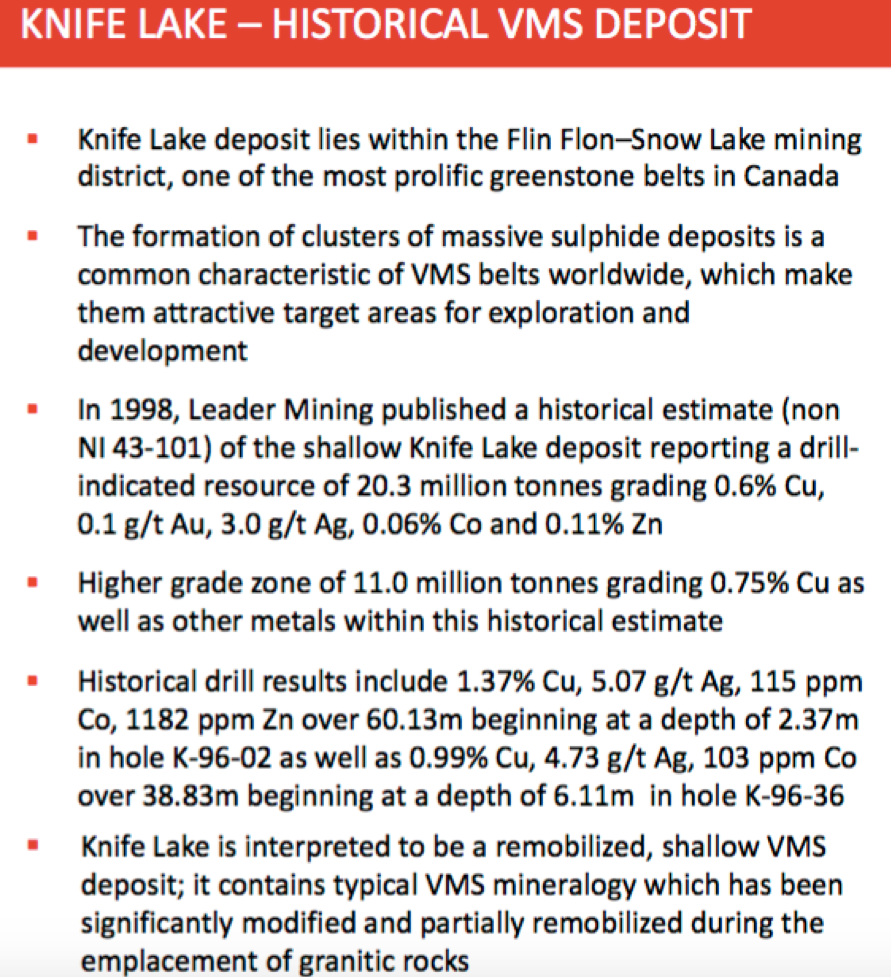

85,000 hectares (85,000 ha) is pretty damn big—see the green-shaded image above. Flagship project Knife Lake is the kind of asset Rockridge Resources wants to own. It's large, and in Saskatchewan, (ranked #3 of 84 global mining jurisdictions in the latest Fraser Institute Mining Survey). Over CA$1.6 billion has been invested into roads, rail, power and water infrastructure to facilitate rapid development of discoveries. In 1997, Leader Mining published a (non-NI-43-101-compliant) resource estimate on the shallow deposit. Twenty million tonnes (20 Mt) grading 0.6% copper, 0.1 grams per ton (g/t) gold, 3 g/t silver, 0.06% cobalt and 0.11% zinc. A high-grade zone contained 11 Mt at 0.75% copper. Historical drilling includes a hole with a 60-meter (60 m) intercept of 1.37% copper, 5.1 g/t silver, 115 ppm cobalt and 1,182 ppm zinc.

The -roject is within the world-famous Flin Flon-Snow Lake mining district, which contains a prolific volcanogenic massive sulfide (VMS) base metals belt. Management paid <half a penny/lb of copper and they believe there's tremendous exploration upside. The goal? High-grade discoveries in a mineralized belt that could host multiple deposits, as VMS-style zones often contain clusters of mineralized zones. Of course, the trick is finding them. No modern exploration, drilling or technology has been deployed at Knife Lake. It was discovered fifty years ago and last explored in the 1990s. Airborne geophysics, regional mapping and geochemistry was done. Management believes that modern geophysics, including high-resolution, deep-penetrating EM and drone mag surveys to cover large areas in detail, could make a big difference.

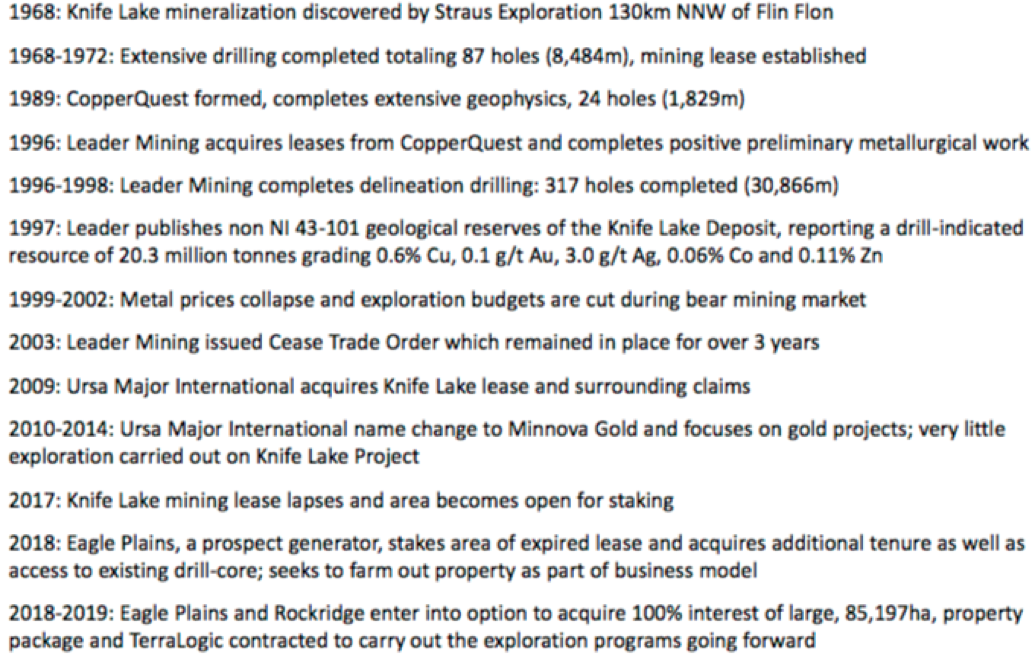

Knife Lake is an exciting project—it's open along a 4.5-kilometer (4.5 km) strike length and at depth. There has been a significant amount of historical drilling: 428 holes; 41,179 m (average 96.2 m). Most historical drilling barely scratched the surface, with relatively few holes reaching below 100 m. Of the holes that went deeper, several encountered mineralization at around 300 m. Between 1968-72, 87 holes were drilled, a total of 8,484 m, but there was no follow-up until nearly 20 years later, when 24 holes were drilled in 1989. Those holes were accompanied by extensive geophysics (with [now] 30-year-old technology).

Seven years later, Leader Mining took over and drilled 317 holes from 1996 to 1998. Leader must have thought the property was quite promising to drill that many holes. The only problem? Copper prices fell from roughly US$1.20/lb to US$0.70/lb during those two years! Even as the price swooned, Leader delivered a resource report in 1997, the highlights of which I described three paragraphs ago. Since the late 1990s there has been virtually no exploration carried out. Amazingly, in 2017, the Knife Lake project's mining lease lapsed. That enabled Rockridge to strike a deal with prospect generator Eagle Plains, the company that staked the newly available ground. Timing is everything: Leader Mining and others tried, but failed to develop this project due, in large part, to weak copper prices.

Copper Fundamentals Look Strong

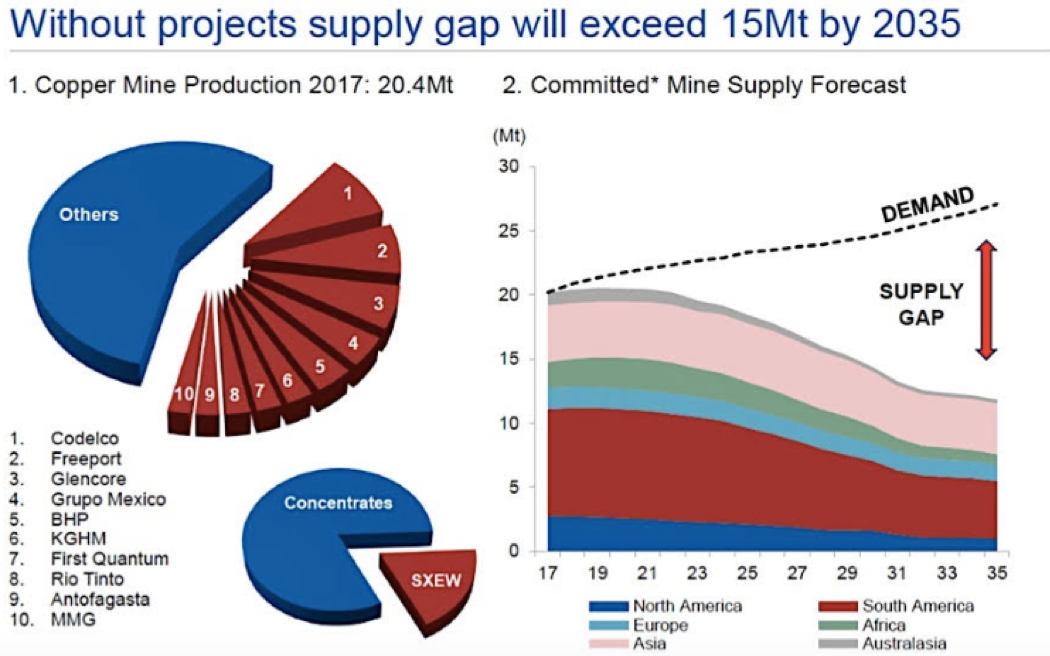

There haven't been many large, high-grade copper discoveries (in safe jurisdictions) this century. Over 200 copper mines currently in operation will reach the end of their lives before 2035. Most of the largest producing copper mines are several decades old; several date back well over 100 years into the 1800s!

Yet, exploration and development of new mines has been weak for the past decade and, globally, copper grades are in decline. The easy copper has been found and mined. New supply is not coming online fast enough to support the increasing global electrification of passenger and commercial transportation fleets, and the green energy revolution.

Any new power paradigm, anywhere in the world, requires a lot of copper. The switch to renewables like wind and solar, especially for larger installations, necessitates a lot of copper. Since 1900, copper consumption has increased by a strong 3.4% per year. Even an increase to a 4% or 4.5% CAGR (compound annual growth rate) in coming decades would be very significant off such a large base. An electronic vehicle (EV) uses 3-4x as much copper as a conventional internal combustion engine-powered vehicle. Global EV penetration is <2%; we all know where that's headed. It's a question of when, not if, penetration hits 10%, 20%, 30%. . .

Strong Management Team, Board and Advisors

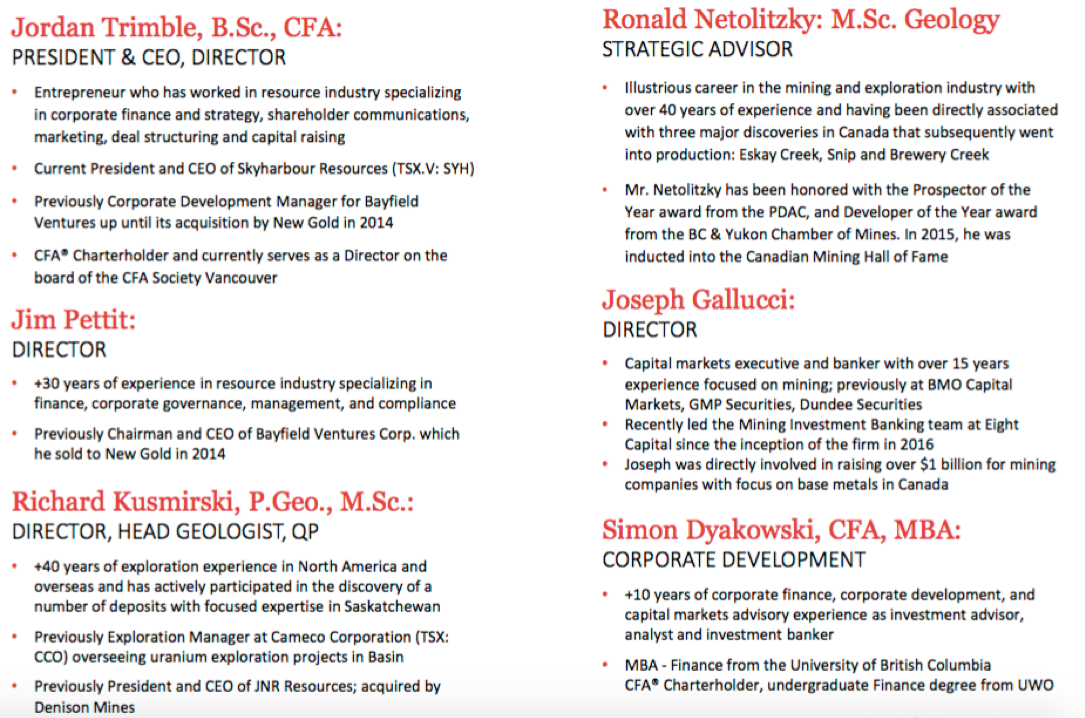

Management is optimistic about a (minimum) 1,000 m diamond drill program (8-10 holes) that started in March. Results should start coming this month. The drill campaign is more than fully funded, as the company has CA$2M in cash. Select management team and board members are shown below. I won't go into detail except to say two things. One: This is a top-notch team for a company with a CA$6.5M market cap, a CA$4.5M enterprise value! Two: Strategic advisor Ron Netolitzky has played a meaningful or leading role in three high-grade discoveries that became mines—Eskay Creek, Snip and Brewery Creek. He's in the Canadian Mining Hall of Fame. Best of all, Ron's a large shareholder in Rockridge. Regarding Knife Lake, Mr. Netolitzky commented,

"I am excited to work with management and the geological team at the newly formed and well-structured Rockridge Resources. I have worked in the area around the Knife Lake Project and believe there is robust discovery potential there which the Company plans to test with its upcoming drill program."

The ongoing drill program aims to fill in some gaps in the historical resource, twin some prior holes and to expand it. A new NI-43-101-compliant maiden mineral resource estimate is expected later this year. Importantly, there are also several prospective targets to explore for new discoveries. Since the team is drilling what they believe to be a remobilized VMS deposit, that means the main source of mineralization has yet to be discovered. And, as mentioned, these deposits frequently are found in clusters, so discovery potential is significant.

Conclusion

Rockridge Resources is also looking at new projects all over Canada. Although copper is the main focus, CEO Jordan Trimble and team will look at any property or project in a good jurisdiction, with access to key mining infrastructure, where they can apply the latest exploration technologies to revisit unexplored or under-explored areas. The company is cashed up and has a modest valuation. Near-term catalysts include drill results and a new resource report later this year. If copper prices move meaningfully higher, as more and more analysts, pundits, company management teams and consultants expect, a company like Rockridge Resources could be an excellent investment vehicle to capture substantial upside.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

[NLINSERT]Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], together, [ER] about Rockridge Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Rockridge Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions. At the time this article was posted, Peter Epstein owned no stock in Rockridge and the Company was an advertiser on [ER]. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Graphics provided by the author.