Many of you are probably already aware that 5G is about to become one of the next Big Things, and that many stocks associated with it are going to find themselves being levitated into a gigantic bubble.

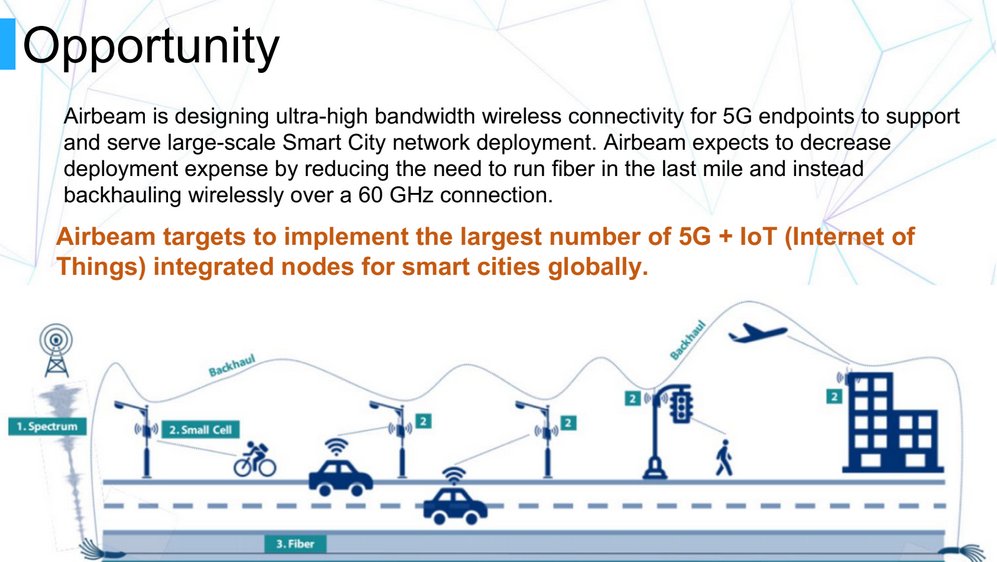

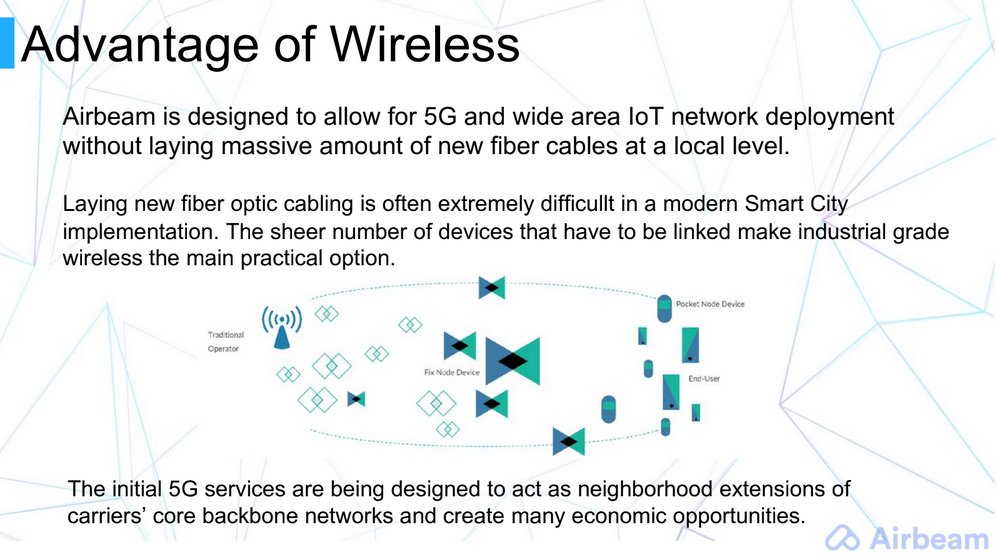

Blockchain Holdings is thus an interesting find, for, despite the name it is in effect a 5G stock and what makes it interesting is that Airbeam 60Ghz Holdings, in which it has acquired a 34% stake via its 100%-owned subsidiary Wishland Properties, has developed a 5G capable wifi technology that eliminates the need for costly fiber optic cable infrastructure. Just a couple of weeks ago it was announced that Blockchain Holdings Ltd. has confirmed the closing of Airbeam 60Ghz Holdings Ltd.'s acquisition of 5G-focused wireless technology from a major publicly listed United States semiconductor manufacturer and notably included in the purchase are millions of sale-ready chipsets ready to be shipped to customers, a backlog of orders to long-standing clients and a road map offering rapid growth potential. This is obviously something that is going to be very big indeed, and while critics might fairly claim that the intensity of 5G signals will fry people's brains, there is a always a bright side, which is that if you can't sleep at night because of being agitated by the powerful 5G beam coming from a post outside your bedroom, at least you will be able to stumble downstairs and watch high definition movies without any risk of interruption—until that is the wife stumbles downstairs too because she can't sleep either.

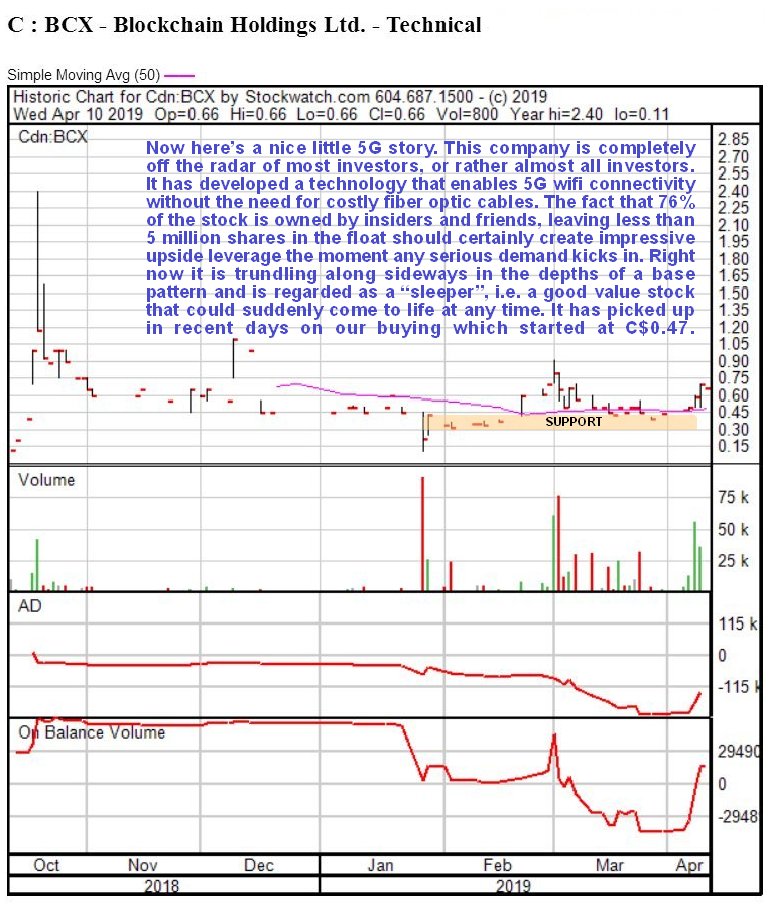

Click on chart to pop-up a larger, clearer version.

Because of what Airbeam is doing and has developed, the upside potential of Blockchain Holdings' stock is clearly HUGE, so how does it look now? Unknown and unloved are probably the best terms to describe it, a true "sleeper"—a far cry from how it could look in the future with investors foaming at the mouth and climbing over each other trying to buy stocks like this and bidding it higher and higher on massive volume. On its latest 6-month chart we can see that it is trundling along sideways within the depths of a base pattern, but the fact that 76% of its stock is owned by family and friends, leaving less than 5 million shares in the float, means that if any serious demand kicks in the stock could explode higher. The spike that occurred back last October should give you an idea of what it is capable of, and that was on a relatively modest pickup in demand. It is thus classified as a sleeper—a stock that is completely off the radar of all but a handful of investors, and so trading quietly at a low level, but has the potential to really come to life fast if it suddenly gets discovered.

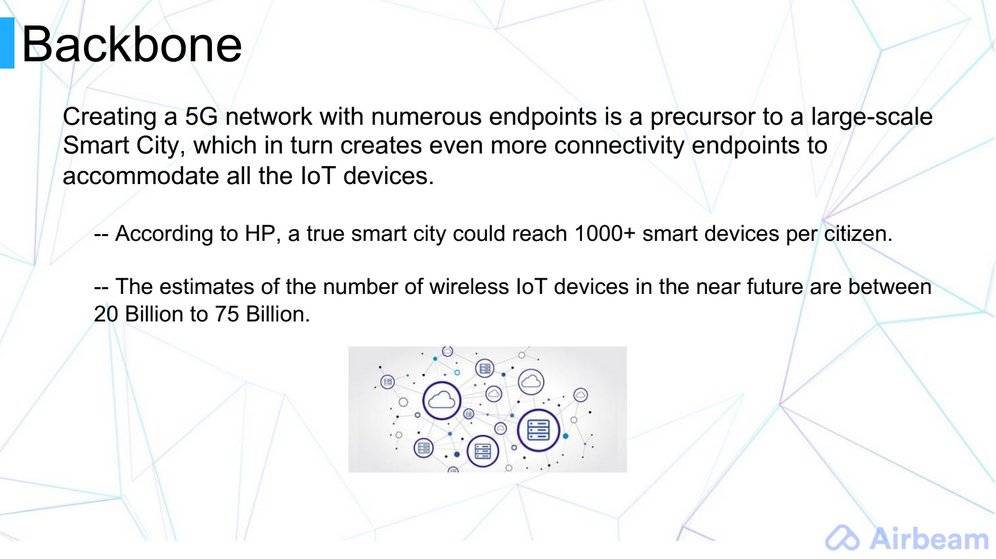

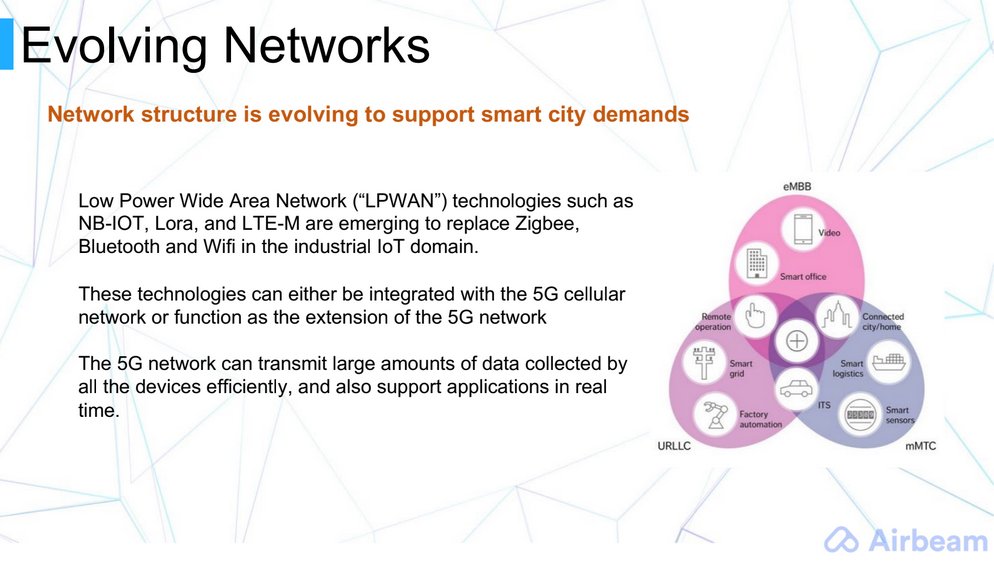

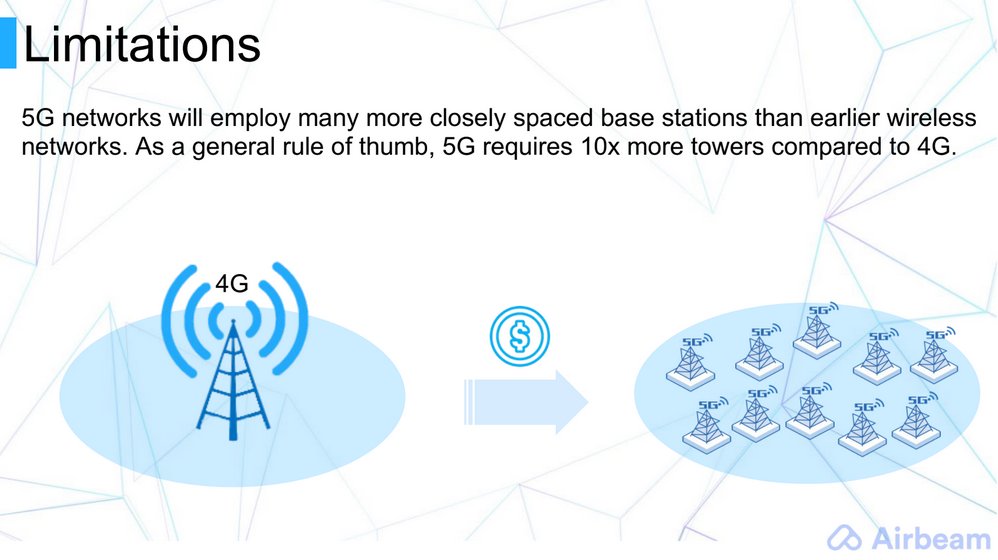

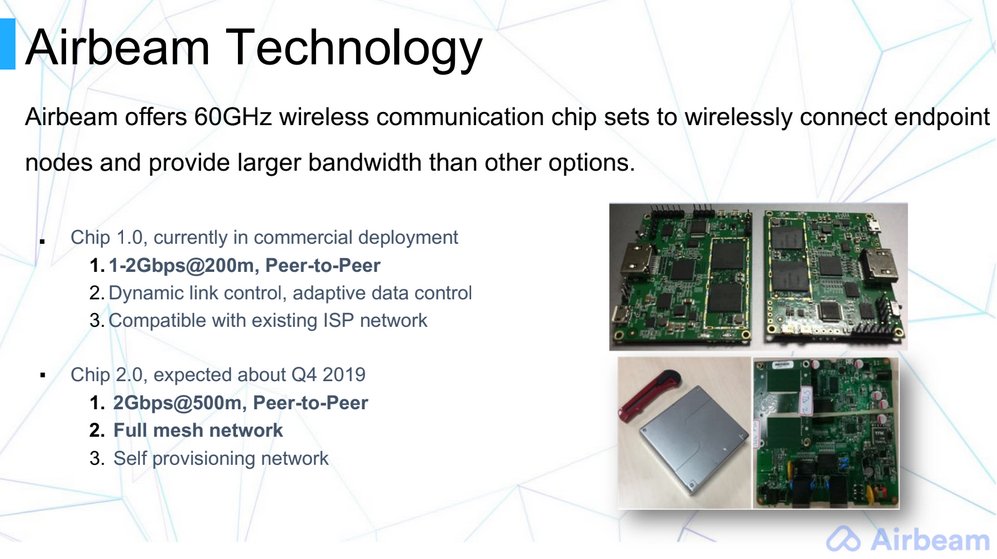

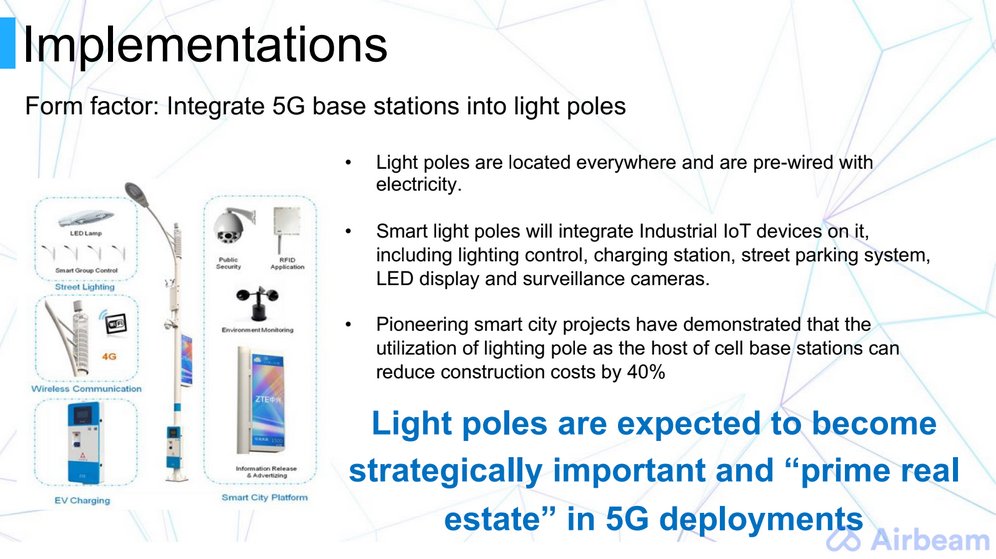

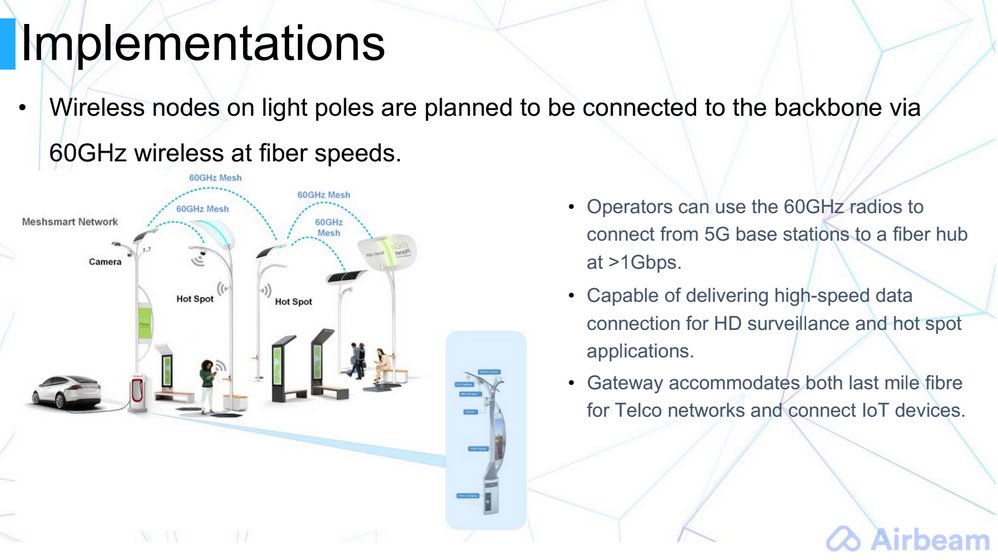

For those of us who only have a hazy understanding of what 5G is and the problems involved in its implementation, Airbeam 60Ghz Holdings has produced a very clear and succinct presentation from which the following illuminating slides have been lifted. They explain that the main challenge in implementation is that, because 5G uses very high frequencies which is what enables the huge bandwidth, much higher than the existing 4G, the signal decays in strength very rapidly with distance, which is what makes a lot of small micro base stations necessary. This could mean big construction costs, but costs can be reduced very significantly by mounting the transmitters on existing infrastructure, such as lamp posts that line most streets. Another key point that these slides make is that Airbeam is way ahead of the competition because it has an exclusive contract with a semiconductor company to purchase the WiGig and Wireless HD product lines, which come with a significant inventory of chips and purchase orders from existing customers. Here are the slides in correct order, but note that there are more in the company's presentation.

Blockchain Holdings is therefore recommended as a speculative "sleeper" with huge upside potential. We first bought it on the 7th of this month, when it was recommended at C$0.495 ($0.368). The stock trades in light but improving volumes on the US OTC market.

Blockchain Holdings website.

Blockchain Holdings Ltd, BCX.CSX, UTOLF on OTC, trading at C$0.66, $0.437 at 11.15 am EDT on 10th April 2019.

Originally posted on CliveMaund.com at 11.30 am EDT on 10th April 19.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

[NLINSERT]Disclosure:

1) Clive Maund: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. CliveMaund.com disclosures below. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Blockchain Holdings Ltd. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports (including members of their household) own securities of Blockchain Holdings, a company mentioned in this article.

Charts and graphics provided by the author.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.