- Amazon Prime Air is mostly hot air.

- Working with regulators is the key to progress.

- Google and Drone Delivery Canada Corp. (FLT:TSX.V; TAKOF:OTCQB) are leading the charge.

- Early movers will own the flight paths.

I believe three important elements have contributed to Amazon's great success overall:

- Choice with a wide selection of goods;

- Prices that are very competitive with other online or brick-and-mortar stores;

- Delivery that is consistent and quite fast.

Kantar Consulting's 2018 report ranked Amazon at number three in sales among the top retailers, behind Walmart and Kroger, based on 2017 numbers. The Top 100 Retailers have changed very little over the past several years. Last year Amazon was No. 7, and the nine other retailers in the Top 10 remained the same. Five years ago, Amazon was in 11th place, and eight of the Top 10 retailers were the same as this year: Walmart, Kroger, Target, Costco, Home Depot, Walgreens, CVS and Lowe's. In 2008, that same solid eight held the top of the chart, while Amazon was ranked no. 25. Amazon is not far behind Kroger, and just might overtake it when the 2018 numbers are final.

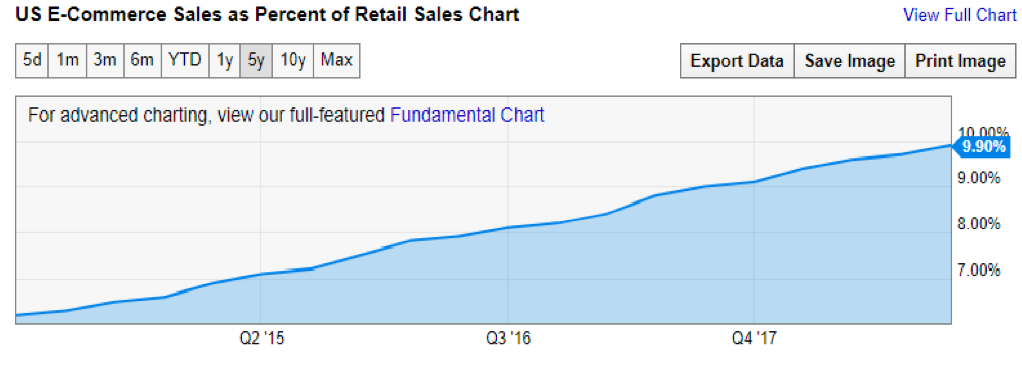

Amazon has been climbing steadily, and that is more impressive when you consider that only 9.1% of U.S. retail sales were online as of December 31, 2017, shown from ycharts.com (below). Amazon has been taking advantage of this trend and is no doubt a leader in e-commerce sales.

There is a new disruption on the way that will level off this graph in the next few years. We have come from "bricks and mortar" to "online" shopping, and the next wave of change I have dubbed "mobile shopping." Thanks to the higher power of smartphones, and better and higher speed networks, shoppers' mobile devices will allow them to experience both the online as well as bricks and mortar shopping experience at the same time. Shoppers will no longer have to sit in front of the computer screen at home to shop online. New companies that nobody has heard of will lead this charge—private companies like Heelo. Heelo has started to deploy its proximity marketing solutions and will likely be a top contender in this new category.

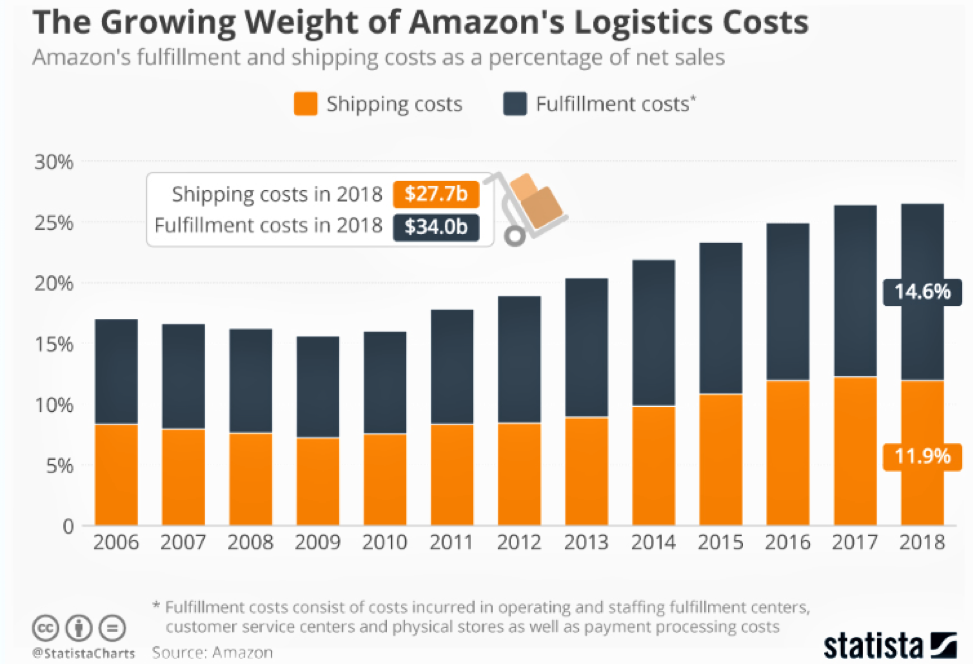

That aside, currently Amazon is a leader in e-commerce sales. However, it is struggling to keep its delivery costs under control. It is obvious from the chart below, from Statista, that Amazon's shipping and fulfillment costs have been rising steadily, from around 17% of net sales to over 25%.

These rising costs are a real challenge. Amazon is making progress with warehouse automation and gaining more control over its delivery process, but its approach with delivery drones has had a serious flaw from the onset.

On December 21, 2018, the Chicago Tribune reported that Amazon will lease 10 Boeing 767 planes, bringing its total fleet to 50, with the goal of getting orders to people faster and more reliably.

Amazon's fleet of planes is far smaller than that of UPS and FedEx, whose planes number in the hundreds But Amazon has pushed in recent years to close that gap, which will gain it more control over deliveries.

Amazon acquired Kiva Systems for $775 million back in 2012, and since then has been steadily investing in a robotic future. According to a September 2018 interview with Brad Porter, VP robotics at Amazon, there has been great progress: "Today we have more than 100,000 drive units deployed throughout our global fulfillment network. But many forget those aren't the only robots we have. We have deployed around 30 palletizer systems, and another popular robot you might see in our fulfillment centers is called RoboStow—a 6-ton robot that has the ability to move pallets of products up to 24 feet high and directly onto the larger drive units. "

One can find some good results with robotics and inventory management at Amazon, but when it comes to Amazon Prime Air, it is just talk and little results.

Amazon Prime Air is a conceptual drone-based delivery system that Amazon announced in 2013. From Amazon's website: "We're excited about Prime Air—a delivery system from Amazon designed to safely get packages to customers in 30 minutes or less using unmanned aerial vehicles, also called drones. Prime Air has great potential to enhance the services we already provide to millions of customers by providing rapid parcel delivery that will also increase the overall safety and efficiency of the transportation system."

As of January 2019, Amazon's latest update is that the company is working on a flight management system. "We will always prioritize safety first within our system," said Roth. "People both on the ground and in the air are the most important to protect. We're building a traffic management system with this as our guiding principle."

I call Amazon Prime Air "hot air"because I believe the company took the wrong approach. Flying drones is not just another technology that you can develop in any way you see fit to meet your plans or dreams. This is what Amazon has done—announcing how t wants to use drones, but forgetting the most important aspect. Flying delivery drones falls under the mandate of controlled airspace run by the FAA. This is the most heavily regulated industry on the planet, as it can take years just to get in-flight eating utensils approved.

Amazon's drones will have many more challenges as well. Drones have to make controlled landings in nicely spacious areas. City dwellers and those of you in blocks of flats are going to have some issues. Then there are obstacles such as telephone wires, people, birds and narrow streets. The lack of a private landing area is another issue. By the time you get down to the communal courtyard, chances are a drone-tracking crook will have commandeered your abandoned package.

Drones also have a performance-restricting flaw called battery life, which is a potential problem for the airborne devices. Amazon's debut drone features a 15-mile range. That's 7.5 miles there and the same back, so if you are not close to a distribution center, forget it. There are weight restrictions too, on what the drone can carry, and that is 5 pounds with Amazon's current drone.

Drone deliveries could really help cut Amazon's costs, but don't expect any airborne deliveries from Amazon in the next few years. This is re-enforced by the video on the company website, as it is just delivering to a couple of rural customers in the UK at this time.

While Amazon Prime Air is a long ways off from flying, Google and a small Canadian company are far more advanced, and could be a great blueprint for Amazon. Perhaps much easier for Amazon would be just to buy the small Canadian company and integrate it into what Amazon is working on.

Drone Delivery Canada (TAKOF): Market Cap US$147 Million

Not to confuse its name with the drones, I will call the company TAKOF.

TAKOF took a very different approach. Its first targets were more remote communities, where there were less obstacles to overcome. TAKOF's other approach is depot-to-depot deliveries. This made for simpler logistics, so the company could advance all aspects of the platform more quickly and cost effectively. In Canada, remote First Nations communities have a need for drone delivery services; it is not just a nice convenience. This also opens up government funding assistance to the benefit of these communities and TAKOF.

While Amazon is still working on a Flight Management System. TAKOF already has a working flight system (FLYTE) that encompass numerous levels of security, redundancy and resiliency. Utilizing industry-leading software, customization and patent-pending architecture, TAKOF has a group of applications that come together under an umbrella to provide a complete solution for the delivery industry. The flight systems cover all aspects of an unmanned aerial vehicle (UAV), from the operational component to the logistics integration. The operational platform, according to the company, includes "full operational guidance, route planning, geo-fencing, alerts, telemetry, maintenance, logs, full preventative maintenance scheduling and tracking." I saw a demo of this system at the company's office last year, and it was quite impressive. The company also tracks other aircraft with feeds from the relevant Flight Information Region.

TAKOF is integrating next-generation super materials into its drone designs, including graphene and carbon fiber. Its prototyping and design platform also utilizes 3-D printing systems to expedite concept designs that are patent-pending. TAKOF does not plan to be a drone manufacturer but will vend out manufacturing of its approved drone models as commercial demand increases.

TAKOF now has a fleet of four different capacity drones called:

- The Sparrow X1000, payload 5 kg, travel range 30 kilometers;

- The Robin X1400, payload 12 kg, travel range 60 kilometers, tethered delivery;

- The Falcon, payload 22.5 kg, travel range of 60 kilometers;

- The Condor, payload 180 kg, travel distance of 200 kilometers.

The Sparrow X1000 was the first drone that TAKOF developed, and was used for all its tests and certifications. It was the first cargo delivery drone of its kind to be accepted under the Transport Canada, Compliant UAS program in December 2017.

In June 2017, TAKOF was the first drone delivery company to achieve BVLOS flights under Transport Canada's oversight. The systems that were tested predominantly include TAKOF's proprietary FLYTE management system, its avoidance technology and communications platform. During the flights,TAKOF's Mission Control Centre in Toronto, 2,500 kilometers (2,500 km) away, successfully monitored and record telemetry in real time for each flight.

Robin X1400

In August 2018, Transport Canada granted TAKOF a SFOC (special flight operations certificate), approving the company to commence testing its Robin X1400 cargo delivery drone in Canadian skies. According to the company, the "Robin X1400 is fully integrated with Drone Delivery's proprietary Flyte management system and is capable of both larger payloads and greater flight ranges, of up to 60 kilometers."

In addition, the "Robin X1400 will utilize a state-of-the-art dual payload deployment system, which would allow both static and tethered cargo deployments. DDC believes the tethered deployment system is the future for delivery in urban settings. With the tethered solution, the drone never lands. It simply deploys its payload by tether while hovering above at a height of approximately 100 feet in the air," the company states in a press release.

The Falcon

TAKOF is leaping ahead of any competition with a new long-range and heavy-payload drone called the Falcon, with a lifting capability of 50 pounds of payload and a travel range of 60 km. TAKOF announced on Jan. 30, 2019, that it has commenced test flights in southern Ontario that have been approved by Transport Canada.

The Falcon has a wingspan of approximately 12 feet and is anticipated to travel 60 km at a speed of 50 km/hour. The multi-package payload compartment is designed to carry approximately 5 cubic feet of cargo and will be weather resistant.

"In response to market demand driven by the burgeoning e-commerce industry, our engineering team was given the task of building out our fleet of cargo drones to address the need for a multi-package payload compartment solution which is applicable in many different geographies. The Falcon is the newest edition to DDC's fleet and meets this particular niche which is being requested by DDC's customers," commented Tony Di Benedetto, company CEO.

The Condor

TAKOF announced its Condor on Feb. 19 this year. It has a payload capacity of 180 kilograms or 400 pounds, and a potential travel distance of up to 200 kilometers. The Condor pushes the limits in both cargo capacity and distances powered by a next-generation gas propulsion engine.

The Condor measures 22 feet long, 5.1 feet wide and 7 feet tall. It has a wing span of approximately 20 feet and is capable of vertical takeoff and landing. It is equipped with DDC's proprietary FLYTE management system, which is the same platform used in all of DDC's cargo delivery drones. This is also the same management system that was used in the fall of 2018, during the company's operations in Moosonee and Moose Factory, Ontario, in support of Transport Canada's Beyond Visual Line-of-Sight (BVLOS) pilot project.

DDC will be working closely with Transport Canada to secure the necessary approvals to begin flight testing the Condor in Q3 of 2019, according to the company.

On Dec. 5, 2018, TAKOF executed a commercial agreement with the Moose Cree First Nation to deploy its drone delivery technology platform with the Moose Cree First Nation communities of Moose Factory and Moosonee, Ontario, approximately 19 km south of James Bay.

TAKOF is permitted to commercially operate its drone delivery platform with its compliant Special Flight Operations Certificate (SFOC), which permits the company to conduct drone operations in all Canadian provinces and territories. TAKOF will start with the Sparrow drone, capable of a five-kilogram payload, to transport goods between the communities including letters, general parcels, medical supplies and other general necessities.

Financial terms of the agreement were CA$2.5 million for year one, with the potential to expand services in following years. TAKOF expects that revenues will begin to be received late in Q2/19, once federal funding is received by the Moose Cree First Nations. There are approximately one thousand remote communities in Canada, and, almost all face similar infrastructure and logistics challenges that contribute to a high cost of living. If TAKOF captures 10% of this market, it could equate to CA$250 million in annual revenue.

"We have worked closely with DDC for nearly two years and see the many benefits of DDC's Drone Delivery Technology to our community as well as many others like us. Where infrastructure is weak, or at times nonexistent or accessible, DDC's drone delivery platform is a valuable solution to connect remote communities and provide fast and efficient deliveries that were once not possible," commented Stan Kapashesit, director of economic development of the Moose Cree First Nation.

In many cases you can relate drone delivery to infrastructure. It can be far more efficient and cheaper than building bridges, roads, rail and commercial air deliveries. The remote communities market is only one segment of the overall total addressable market in Canada, but I see it as a logical place to start with drone deliveries in Canada, and in the remote areas of other countries.

In addition to Canada, TAKOF is working with other customers around the globe to license its FLYTE software and drone delivery technology. For example, TAKOF is collaborating with Toyota Tsusho Canada (trading affiliate of the Toyoto group of companies). Collectively, the two groups will look to commence flight testing and identify other international markets to deploy TAKOF's proprietary drone delivery platform as a transportation solution.

"This agreement with TTCI is expected to open international markets for us as a company," commented CEO Di Benedetto. "Working alongside a global industrial leader such as Toyota Tsusho also provides us quick access to a very extensive international global network and a breadth of commercial skills."

I recently met with TAKOF and asked Di Benedetto what puts his company ahead of the competition and those coming up the ranks? "Ron, we have developed a very unique solution which has been actively tested for a number of years, successfully executing thousands of flights. We are starting commercial operations this year, and 2019 is the year we move out of the lab and into the sky. We have signed commercial agreements with customers. Our capabilities now extend to 400-pound cargo capacity and flight distances in the hundreds of kilometers."

TAKOF just completed a CA$10.02 million oversubscribed financing at $1.20 per unit. The stock is currently trading below this price, and at the lowest level since the company got started in 2017. I believe it is excellent timing to take a position.

For Amazon and Google, drone delivery is not a material part of their business, so they do not divulge as much public information as TAKOF must do. That said, Alphabet Inc. (GOOGL) has been advancing dramatically with its drone delivery solution, and looks to be a major player in the field. This is some of what I could dig up on them.

Project Wing is an autonomous delivery drone service aiming to increase access to goods, reduce traffic congestion in cities, and help ease the CO2 emissions attributable to the transportation of goods, according to the company. Wing is also developing an unmanned traffic management platform that will allow unmanned aircraft to navigate around other drones, manned aircraft and other obstacles like trees, buildings and power lines. Light, energy-efficient design enables the drones to fly up to 20 km/hour, driven entirely by an all-electric power system with zero carbon emissions. The most recent drones can carry up to 5 pounds.

"Wing completed its first real-world deliveries in 2014 in rural Queensland, Australia, where it successfully transported a first-aid kit, candy bars, dog treats and water to farmers, "according to the company. Then, in September 2016, the team delivered burritos to students at Virginia Tech in what was, at the time, the largest and longest drone delivery test on U.S. soil. Since 2014, Project Wing has flown tens of thousands of flights and it has been refining its aircraft design and communications tools.

Wing started with a similar approach as TAKOF, focusing at first in rural areas of Australia. Most recently, it has completed hundreds of deliveries to the yards of several homes in the Australian Capital Territory and Queanbeyan regions of Australia. The goal is to determine how to find the best route to a home and how to find a safe delivery spot in the yard. "The Wing team is also learning how drone delivery might be useful in people's everyday lives by transporting meals, groceries, medicine, and even spare car parts in the event of a breakdown," according to the company.

"Wing's UTM platform is designed to support the growing drone industry by enabling a high volume of drones to share the skies and fly safely over people, around terrain and buildings, and near airports."

The company also states, "Wing is working with the Federal Aviation Administration (FAA) on the Low Altitude Authorization and Notification Capability (LAANC) system in the United States and with the Civil Aviation Safety Authority (CASA) in Australia to develop federated, industry-led solutions to safely integrate and manage drones in low-altitude airspace. Last May, the U.S. Department of Transportation selected Wing as one of ten teams to push the limits of drone technology in the Unmanned Aircraft Systems Integration Pilot Program."

Wing will also go commercial this year, with plans to launch its first European delivery service in Finland in the spring of 2019. Wing plans to start with a small service trial in the Helsinki area and hopes to expand as time progresses. The drones are quite small and can only carry 1.5 kilograms with a round-trip range of 20 kilometers. More detail can be found at www.wing.com.

Conclusion

We are not going to see hundreds of drones in cities delivering pizza and Amazon parcels for many, many years. Amazon is dreaming, or perhaps its strategy is to build a drone patent portfolio. Drone companies will have to establish a safety track record of tens of thousands of flights or more before aviation authorities will consider deliveries in densely populated areas.

Drone delivery will be a heavily regulated industry, like all of aviation. What most investors do not realize is that early movers such as TAKOF and Wing are going to establish drone flyways, where they have exclusive rights for their drones on those flight paths. That is going to add considerable value to these companies, like owning freight railways in the sky.

On a commercial basis it is ironic, because thousands of Amazon parcels will be delivered by drones from companies like TAKOF and Wing long before Amazon delivers its first one. Amazon and Google are not a very good play for investors to gain leverage to the disruptive drone technology, whereas a company like TAKOF provides great exposure here.

I expect TAKOF will be bought out by another major company in the delivery business, like FedEx, UPS, Amazon or Air Canada Cargo, to name a few. Alphabet could eventually spin out Wing with an initial public offering.

Ron Struthers founded Struthers' Resource Stock Report 23 years ago. The report covers senior and junior companies with ample trading liquidity. He started his Millennium Index of dividend stocks in 2003 - $1,000 invested then was worth over $4,000 end of 2014 and the index returned 26.8% in 2016. He retired from IBM after 30 years in customer service, systems and business analyst, also developing his own charting software. He has expertise in junior start-ups and was a co-founder of Paramount Gold and Silver.

[NLINSERT]Disclosure:

1) Ron Struthers: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Drone Delivery Canada. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company currently has a financial relationship with the following companies mentioned in this article: None. Additional disclosures below. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts and images provided by the author.

Struther's Resource Stock Report: All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.

(c) Copyright 2019, Struther's Resource Stock Report