Usually the standard modus operandi for juniors doing a financing revolves around three things if they can get the money: take it, take it and take it. Golden Arrow Resources Corp. (GRG:TSX.V; GARWF:OTCQB; G6A:FSE) realized that raising the money in very negative sentiment in Q4, 2018, with tax loss selling projected to have significant impact last year for most companies and probably dragging along everything with it until mid-December, wasn't the smartest thing to do. The share price was walked down by interested parties at the time, and management got requests for lower and lower unit prices, but they weren't with their backs against the wall, so they decided to wait and cancelled the financing. The 25% owners of the Puna JV with operator SSR Mining Inc. (SSRM:NASDAQ), based on the ramping up open-pit Chinchillas Mine and the almost depleted Pirquitas Mine in the Jujuy province in Argentina, hoped for better times around the corner.

And sure enough, things started to turn in January, and Golden Arrow launched another attempt on February 12 at a slightly lower unit price of C$0.30 (was C$0.35). Golden Arrow closed the first tranche of the non-brokered private placement through the issuance of 11,051,611 units (common share plus full 2-year warrant @C$0.40) for gross proceeds of $3,315,483 on February 22, 2019. On March 5, 2019, it closed the second tranche through the issuance of 1,290,367 units for gross proceeds of $387,110. Finally, the company closed the third and final tranche of 3,462,034 units for gross proceeds of $1,038,610 on March 22. In total, Golden Arrow issued 15,804,012 units for gross proceeds of $4,741,203 in this round. Despite the full warrant (would have loved to see a half warrant), in my view C$4.74 million is a very decent result these days for a junior producer with a small market cap of about C$30 million.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise

A part of this placement was arranged through finders, and for the last tranche, finder's fees of $6,650.70 were paid in cash to parties at arm's length to the company. In addition, 22,169 non-transferable finder's warrants are being issued. Each finder's warrant entitles a finder to purchase one common share at a price of $0.40 per share for two years from the date of issue, expiring on March 21, 2021. In total for this private placement (PP), finder's fees of $60,090.73 were paid and 196,302 finder warrants were issued. According to management, this accounts for a percentage of 7% in cash and 7% in warrants. The proceeds of the financing will be used for general working capital.

Golden Arrow Resources has, after the closing of the recent financing, C$7 million in cash at the moment according to management, and no long-term (LT) debt. As a reminder, the company has been drawing down from a short-term US$10 million credit facility with JV partner SSR Mining, confined to Puna capex obligations, with an interest rate of US base rate plus 10% and a final maturity date of December 31, 2020. Management confirmed to me that they will make a final payment of C$2.3 million in March, and hereby will have completed the mandatory capex payment obligations.

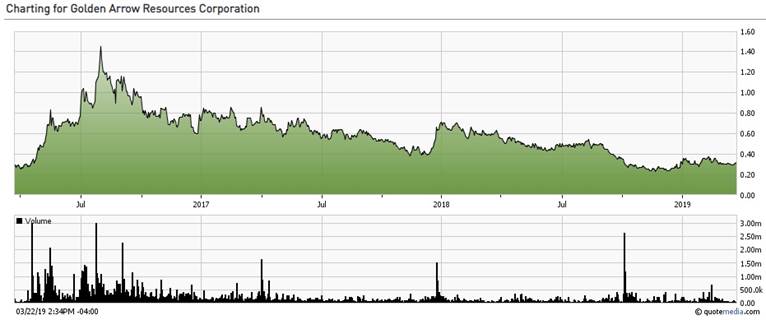

As of March 26, Golden Arrow Resources has a share price of C$0.295 and a market cap of C$34.74 million, with 117.77 million shares outstanding, and fully diluted 131.3 million. All options and warrants are out of the money at the moment. The average daily volume has come down from almost 300k shares but is still a liquid 100,064 shares.

Share price GRG.V, 3 year period (Source: tmxmoney.com)

The worst is behind Golden Arrow it seems, as a combination of negative sentiment, upcoming tax loss selling, lower metal prices and an upcoming private placement weighed heavy on the share price in the last quarter of 2018. As the company has paid off its share of capex for Puna, it can concentrate now on receiving growing cash flow from the ramping-up operation at Puna, as a bonus hoping for a rising silver price, and repaying short-term credit facility before year-end of next year. Let's have a quick look at the production figures and forecast of Puna now.

Highlights from SSR Mining's news release dated January 15th, 2019, include (figures are on 100% basis):

- "In 2018, Puna Operations produced a total of 3.7M ounces of silver, 8.8M pounds of zinc and 3.1M pounds of lead. Silver sold for the year totaled 3.8M ounces."

- "In December ore was sourced exclusively from Chinchillas and achieved a 3,605 tonnes per day milling rate."

- "Puna is expected to produce between 6.0 and 7.0M ounces of silver at cash costs of between $8.00 and $10.00 per payable silver ounce sold."

- "As previously announced, the completion of certain Chinchillas project infrastructure carries over into 2019 with remaining investment of approximately $9 million expected to be incurred in the first quarter. The project remains on budget."

The Chinchillas PFS uses a mine plan based on 4,000 tpd throughput, so the Puna operation is already close to reaching this. As a reminder, the nameplate capacity of the Pirquitas plant is 5,000 tpd, and represents one of the options to meaningfully increase cash flow. The total production of 3.7 Moz Ag is according to plan and exactly the midpoint of the SSR forecast of 3–4.4 Moz Ag for 2018, as the processing of Pirquitas stockpiles was expected to bring in around 1 Moz Ag per quarter, and this came to an end in November 2019, when the switch to just Chinchillas ore was made. Net earnings to Golden Arrow were marginal as cash costs of stockpile processing were predominantly above the current silver price. When Chinchillas is fully operational, I expect cash costs to go down considerably.

As a reminder, the PFS outlines an average annual production during an 8-year life of mine (LOM) at a 4,000 tpd throughput of 6.1 Moz Ag, 35M lb Pb and 12.3M lb Zn, which is 8.4 Moz AgEq. This is based on 81 Moz AgEq reserves. As the total resource stands at 203 Moz AgEq, and nameplate capacity of the Pirquitas plant is 5,000 tpd, there are options to increase the life of mine and revenues/cash flow. With a 5,000 tpd throughput, annual production could go to 10–10.5 Moz AgEq. Adding 40 Moz AgEq by converting Chinchillas resources is another option, and besides this there is the Pirquitas high-grade underground resource, which could add another 10 Moz AgEq when developed. With this expansion scenario, the life of mine could increase to 12 years.

The jury is still out in Argentina about the proposal to impose temporary new taxes on exports, to the tune of 12%, on top of the current corporate tax of 30% (which has just been lowered from the long-lasting 35% this year). As mentioned in my last article, for example, Yamana has expressed great difficulties with it; this would have serious impact on foreign mining investments again, and also negatively impacts the Chinchillas NPV. The PFS has been based on the old corporate tax of 35%, so the net effect on economics would be a 7% tax increase. According to my models, this would result in a 12–15% decrease of post-tax NPV.

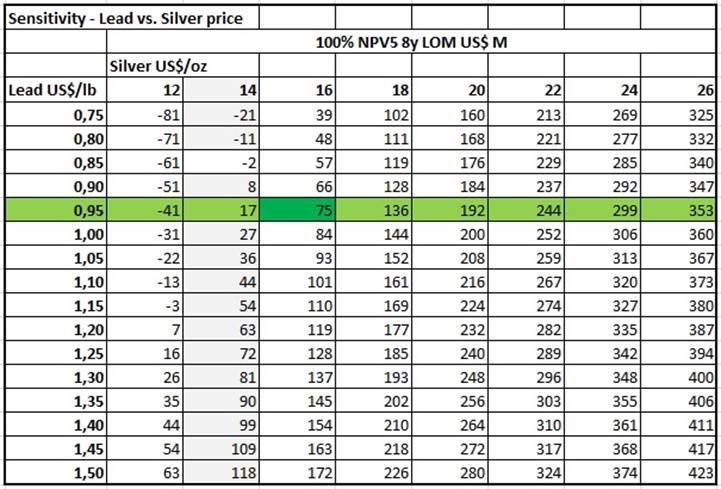

As this proposal still is a proposal, and a vehemently opposed one by mining companies operating in the country, it seems appropriate to show the sensitivities again without the additional taxes. I changed the green colored cells, as the silver and lead prices have increased since my last article on the company. As can be seen, a positive NPV is arising slowly now, so a valuation doesn't have to be solely extrapolated from break up values and exploration projects anymore.

An 8-year base case scenario leads towards the following hypothetical sensitivity table:

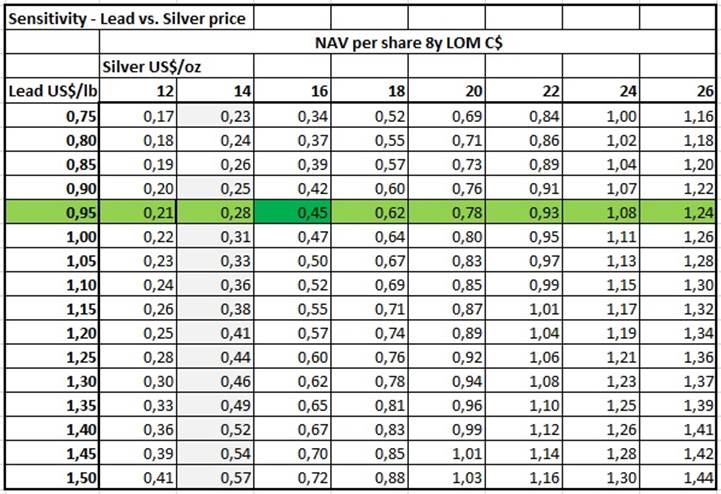

This results in the following hypothetical NAVs per share, on a 25% basis and 117.77 million shares:

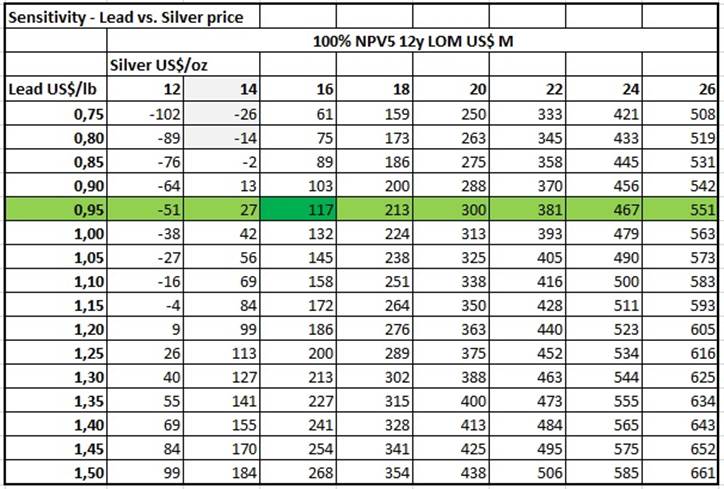

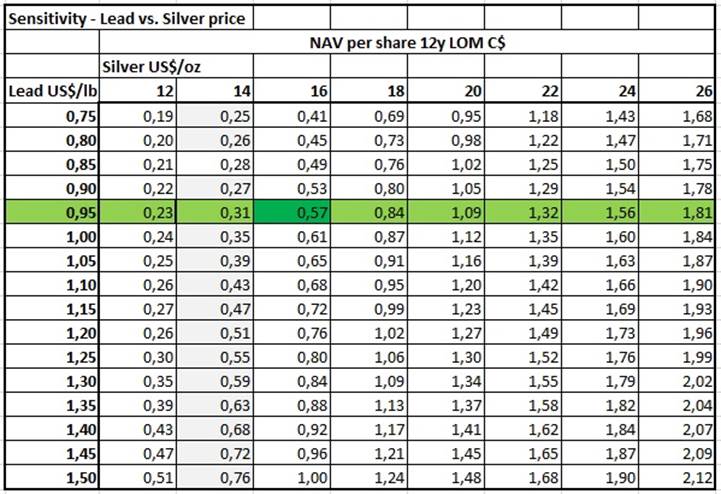

Silver has relatively more leverage on the NPV and NAV per share, being the majority of revenues of course. For the expanded 12 year scenario, this generated these two hypothetical tables:

And:

It will be clear why there is a lot of potential for share price upside for Golden Arrow, as the expansion scenario shouldn't cost a great deal, as the plant is already functional at 5,000 tpd if desired. Besides the underground development it would mainly be an increase in total opex, as open-pit mining increases by 20%. Even better would be increasing metal prices, of course. But first up is the ramping up of Chinchillas to the 8y scenario at 4,000 tpd, let's see if SSR can make this work flawlessly within a short timeframe. I have no doubt about this as its reputation as operators is very robust, and recoveries so far have been excellent.

As Golden Arrow Resources is also quite busy to launch New Golden Explorations as its exploration spin-out, I was wondering what its plans would be regarding timelines of listing it, acquiring new assets and planning exploration programs. Management had this to say about these subjects: "A spin-out is being considered but market conditions will need to improve first. We are on the hunt for good advanced properties and are looking forward to plan our programs for the new Chilean acquisitions."

Conclusion

Golden Arrow did the right thing not to raise at any price, but wait out the hard times, as it rightfully anticipated better times around the corner. It had to throw in full warrants, but it raised no less than C$4.74 million, which is considerable for a small junior in any circumstances. Besides this, dilution will still be limited as the total share count will be 117.77 million shares outstanding, which is not much for a producer, courtesy of the JV with SSR Mining, of course. I am curious to see what part of cash flow comes the way of Golden Arrow Resources, based on a NAV per share basis things might look good. For the record, I didn't sell any shares in order to participate in the last round of financing to get warrants, but bought more in the third tranche as it is my conviction silver play, which has some catching up to do compared to others these days. In my view cash flows could very well take care of this.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website http://www.criticalinvestor.eu to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

Disclaimer:

The author is not a registered investment advisor, currently has a long position in this stock, and Golden Arrow Resources is a sponsoring company. All facts are to be checked by the reader. For more information go to www.goldenarrowresources.com and read the company's profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Streetwise Reports Disclosure:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: Golden Arrow Resources. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Golden Arrow Resources, a company mentioned in this article.

Charts and graphics provided by the author.