Here is what I wrote at 7:00 a.m. Friday morning with the S&P futures called down 10 points:

"There are certain times in one's trading career when despite all of the planets appearing to be aligned in one's favor, a large asteroid comes along and spoils the symmetry and perfection of the set-up. Despite 68.42% of the last 38 quad witching week Fridays being followed by down weeks, this week appears to be going out with a modest gain, thus violating the odds and confirming the random walk theory of stock market investing."

Well, wait just a moment!

That was before Mr. Market was smacked in the face by an inverted yield curve "excuse" and a torrent of destructive economic reports out of Europe and Asia. Lest we otherwise forget that stocks have been on an intravenous tube filled with Fed adrenalin (from now on to be referred to as "Fed-renalin") complete with stock-friendly bulletins, interviews, press conferences and, of course, appearances before Congress designed to bolster the wealth-effect impact of rising global stock exchanges. The net result going into Friday was an absurdly overbought market screaming higher in the face of a weakening macro environment, as bond yields have been flashing for some time now with the S&P losing 54.17 points and settling DOWN on the post-quadruple-witching week. The streak continues.

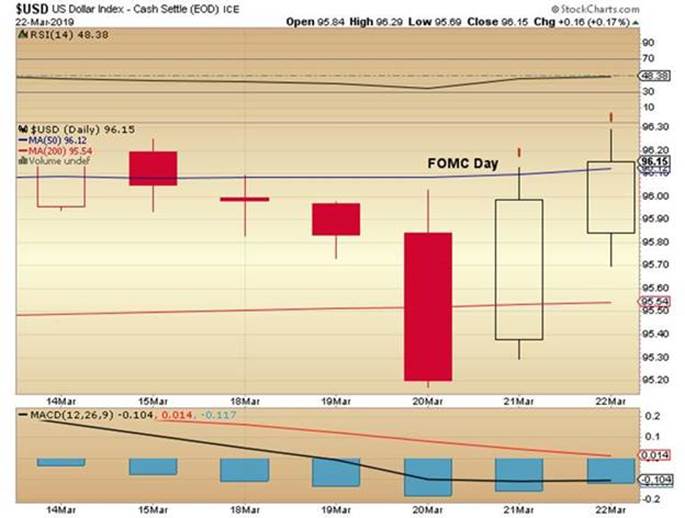

Nevertheless, I had been operating on the assumption that end-of-quarter rebalancing was drawing flows into the market and creating an illusory bullish undertone to what I deem a frightfully overvalued and increasingly dangerous market. The Fed's "pivot" was exemplified this week by the removal of any and all thoughts of rate hikes in 2019 during the Tuesday-Wednesday FOMC Gong Show, with Jerome Powell doing his utmost to confirm what the market has already figured out: that he and his colleagues are clueless as to the accuracy and effectiveness of the "dot plots" or "models" or "Fed forecasts." As I tweeted out last week along with a picture of a crystal ball, "What exactly was it that the Fed saw in its crystal ball back in December?" Answer: It couldn't have been good.

Notwithstanding the fact that I felt as if I were "the loneliest man in the world" after Thursday's S&P spike to 2,860 and was about a hair's breadth away from calling in a month's supply of adult Pampers, I held my SPXS calls and my Goldman Squid and SPY puts and watched the positions skate from the penalty box to center ice (arms raised) making this a particularly rewarding and relief-filled weekend. I have a sadistic but well-earned loathing for Goldman, as I still find it unconscionable that a company in the business of handling people's wealth could actually design a financial product that was designed to self-destruct and then allowing one client to short it while selling it to other CLIENTS, in size, and with an obscene payout rate.

It is not unlike the Canadian Securities Exchange ("the CSE") announcing that a merger was completed (when it wasn't), open the shares for trading (when they shouldn't have), and then change the rules to cover up their mistake(s) (which were many). You have to bang your forehead on a bedpost to wake yourself up from what you are sure is a nasty nightmare. Unfortunately, the regulators just offer a wink and a nod and business simply continues.

In Classical Mythology, the goddess of Divine Retribution, known as Nemesis, was responsible for wreaking havoc on the lives of those that committed unpunished sins and one look at the GS chart during the past six months confirms that she has pointed her trident at the infamous Vampire Squid. I think that even if there is no eventual retest of the Christmas Eve lows at 2,351, there is a distinct possibility that GS could in fact see new lows beneath $151.70. The financial sector is acting horribly as banks cannot and do not lend in an inverted yield curve environment and that is because they cannot make money borrowing short (expensively) and lending long (cheaply) and as to underwriting revenues, the Squid will have a tough time while the Malaysian government tries to collect a few billion dollars in fees disgustingly overcharged as the bankers were ripping them off. Having closed just below $189, the upside gap created into the January earning report is now an air pocket of downside trajectory with the $176.50 level as a ridge of possible support. If that fails, the 52-week lows would be squarely in my crosshairs and a new truck in my dreams, complete with Confederate flags in the back window and a gun rack behind the cab. (Puh-leeeze make it so…)

Over to gold, I was fearful that the metals and miners were due for a Fed-renalin-charged crash late week as the alogbots went berserk Thursday and Friday and interpreted the Powell remarks as "dollar-bullish," although the economic abyss that Europe has becoming might have more to do with the en masse vacating of the euro rather than anything American. To have German yields go negative for the first time ever is like a U-Boat torpedo launched into the European bond markets so that may explain how "no more rate hikes EVER!" is dollar-bullish. Nonetheless, gold (and to a far-lesser degree silver) managed to eke out a solid week with the close at $1,313.40 for roughly a $10 gain on the week.

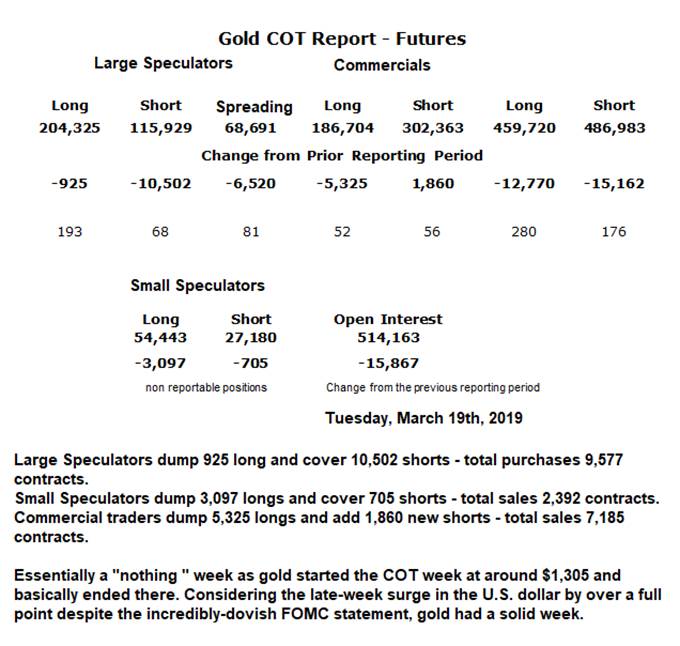

The Friday COT was a non-event with minor position-squaring and no real evidence of any sort of watershed event in the cards. The two gold miner leveraged ETF's (NUGT and JNUG) scratched out weekly gains but most importantly, at the end of Friday's 54.17 point drop in the S&P, the HUI added 0.65% and the NUGT, the leveraged proxy for the senior gold miners, had a 1.02% gain despite a thorough and complete breadth collapse in the stock markets. The JNUG sold off mildly but that was symptomatic of its status as the JUNIOR miner ETF and since the small caps got monkey-hammered on Friday, a little weakness in the gold juniors was not a disaster.

However, when the miners are able to shrug off their "common stocks" designation and instead take on "precious metals" linkage, it is an encouraging development and one not seen in many years. Of course, it had to continue and not be a one-off aberration that is my constant fear but let's just take it as a "win" and proceed onward.

Looking out to this coming week, I need desperately to see the gold-to-silver ratio (GTSR) begin a descent from the current 85-plus level. Until it gets into the 70s, I will be a cautious bull and will be watching the RSI and MACD levels closely for any sign of froth. Right now the DSI and RSI are neutral, which means there is ample room for gold to retest the $1,350-1,370 price-capping level (no such thing as the term "overhead resistance" in the Crimex gold pit) but unless silver joins the party with the proverbial glass of cooperative champagne, my leveraged longs in gold, silver and the miner ETFs will be thrown overboard faster than a seaman's effluent bucket in stormy seas, and probably at or close to the recent highs.

Finally, as I spoke of in my last missive (Aging in the New World of Managed Markets), I spoke about the difficulties one encounters when attempting to draw upon past experience in dealing with a specific trade set-up due to the existence of buyers and sellers created for the sole purpose of price management. It is my contention that the only data upon which one may currently rely are those which expose the presence of these malevolent forces that not only cap and support prices but also create technical conditions designed to attract not only the public but also large professional managers relying on antiquated or misleading data.

Obviously the precious metals markets are deemed vital to national security in their anti-dollar utility but with the recent Fed pivot to uber-dovishness, it is easy to see today how transparent the need to support the stock markets has become and for this reason, the dual mandate of the Fed has morphed from "price stability" and "maximum full employment" to a triple mandate which today includes "rising equity prices."

With the vast majority of Americans unable to support themselves in their retirement years without family or government assistance, it is apparent that politicians have taken Ben Bernanke's "dollars falling from helicopters" (hence the "Helicopter Ben" moniker) analogy directly to heart and actually implemented it. However, they have attempted and may indeed have been successful in convincing the aging American public that the helicopter dropping dollars as a life support for the economy has actually taken the shape and form of the U.S stock markets.

American investors of all ages can gaze through the window of history just how many times the "invisible hand" has stepped in and stick-saved the NASDAQ or the S&P at or near support while the economic data is in direct contradiction to the official pronouncements from the current administration or the Fed governors. The price managers are saying "Go ahead. Just stick your retirement savings into the stock market and we'll look after it for you!" and to say that it creates a moral hazard is understatement; to deny it is a head-in-the-sand attitude that invites the attention of that wicked goddess of Divine Retribution.

So, when you are invited to a podcast where the moderator goes to great lengths to show you how a current market set-up resembles (or doesn't) similar bullish set-ups from the past fifty or so years, it is important to remember that data used by the moderator is also accessible to the price managers. Furthermore, it is entirely possible that the data have been altered by those very price managers to create an illusory bullish effect designed to influence the decisions of millions of investors. You must ask yourselves why in the thick of a trade war and amid a policy of "balance sheet normalization" and "quantitative tightening," stocks declined 20% to Christmas Eve, fully telegraphed by the collapsing yield curve in mid-2018, and then magically embarked on a levitation unparalleled in stock market history.

The Christmas 2018 Mnuchin-Trump-Powell stock market intervention wasn't even subtle; it was flagrant and in-your-face hypocritical to the very mention of the phrase "free market capitalism." Accordingly, I urge all of you to trust nothing and question everything when it comes to the "data" and trade as though Big Brother is watching your every move because nothing is as it appears. To believe such is to discover the true secret of wealth preservation and peace of mind.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

[NLINSERT]Disclosure:

1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Goldman Sachs. My company has a financial relationship with the following companies referred to in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts courtesy of Michael Ballanger.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.