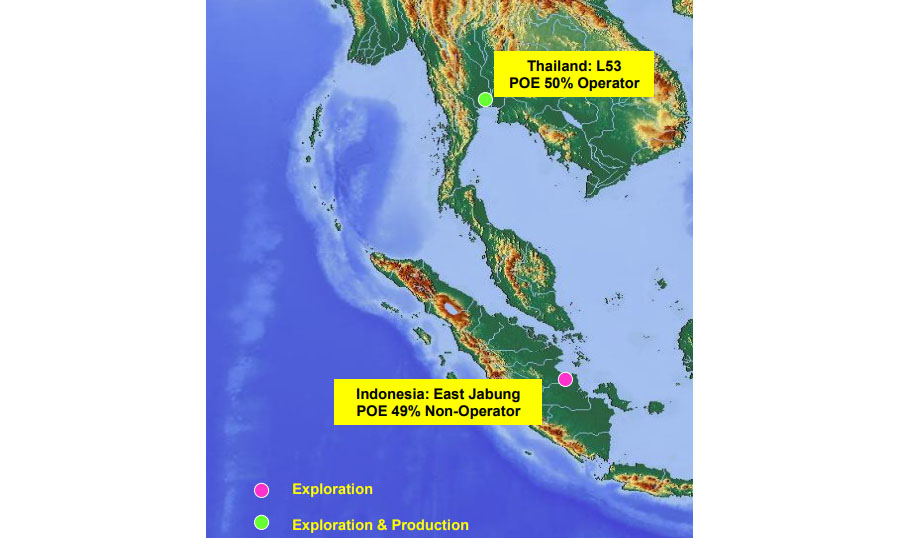

Pan Orient Energy Corp. (POE:TSX.V) is a simple story; it was clearly described in its Valentine's Day press release and the presentation on its website. Pan Orient has about ~70c CAD in cash per share and Thailand 2P reserve worth about ~70c CAD per share, and it is trading not far from it. Currently, POE is drilling two appraisal wells right now in Thailand. If successful, they can significantly increase the 2P reserve. Pan Orient is also planning to drill a few high impact exploration wells in Thailand in the second half of 2019. The bottom line is that by the end of 2019, the company could significantly increase the existing Thailand 2P reserve.

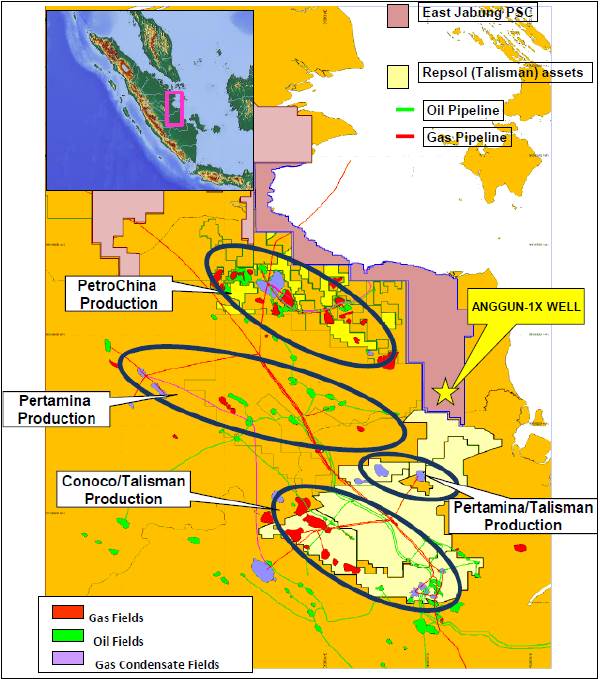

The big upside is the Indonesia drilling by its partner Repsol (50-50). Repsol just made huge discovery not far from the location it is going to drill in May–June. If it can repeat the success, POE's stock price will be in the double digits.

Historically, POE has done little marketing and promotion; its shares have been under the radar for years. Management consistently bought shares from the open market, sold assets and paid shareholders big dividends in past years. I am pretty sure Pan Orient will do it again if it makes any significant discoveries in Thailand or Indonesia this year. If you love promotion, this is not your type of stock. However, if you think it is more important for management to deliver shareholder value than to spend time and money promoting the stories over and over again, POE should be on top of your list.

Chen Lin manages a family fund and writes about it in the popular stock newsletter What Is Chen Buying? What Is Chen Selling?. While a doctoral candidate in aeronautical engineering at Princeton, Lin found his investment strategies were so profitable that he put his Ph.D. on the back burner. He employs a value-oriented approach and often demonstrates excellent market timing due to his exceptional technical analysis.

Read what other experts are saying about:

Disclosure:

1) Chen Lin: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Pan Orient Energy. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Pan Orient Energy. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Pan Orient Energy Corp., a company mentioned in this article.