A few weeks ago, I published one of my more noteworthy missives entitled "The Time to Be Short (Again) Has Arrived," in which I advanced the notion that the level of the 200-day moving average for the S&P 500 (2,742) was about as good a level to exit the market, if long, or an opportunity to reestablish shorts, if flat. After a particularly profitable December, I went into the New Year 2019 cashed up and ready for another shorting opportunity in the S&P and Goldman Sachs. I decided to take a stab at a few SPY puts on Feb. 6, with the market at 2,738, and warned that a "2-day close above 2,750" was my stop-loss point.

It was a moderately good call, in that the S&P immediately tanked to 2,685 but has since reversed and in the absence of any tweets or e-mails or missives suggesting anything resembling "cover all shorts," I was officially stopped out of the S&P short on Friday morning on the opening at 2,761.

Prior to Monday's action, the S&P only had one closing above 2,750 (Feb. 13 at 2,753), spent most of Valentine's Day between 2,732 and 2,753, but then exploded due to positive trade news (meaning rumors to the positive). We sold the S&P at 2,738; we covered at 2,761; and now at 2,775, I am looking to reestablish the short on the S&P once the Relative Strength Index (RSI), now 69.01, moves into the 70s, which it should next week.

While the histograms appear somewhat subdued, the MACD indicator is now as wildly overbought as I have seen it in quite some time. While I was stopped out for a modest hit on Friday, like a pitbull on a bone I am looking to take another stab at the short side. I still consider this to be a textbook bear market rally, with a retest of the December lows in store before new highs are achieved in the second half of 2019. However, as I have been writing since the lows on Christmas Eve, the most powerful of all financial narcotics is "fear" (of missing out) which, along with its older brother "greed," is incubated in the most powerful meth lab in existence, the bear market rally.

Only time will tell whether the algobots' programming will agree with my assessment, but once thing is certain: this rally is one mother of an opium den of illusory hope and it is sucking a great many investors into that familiar "Fed's got our backs!" complacency.

The big story for me this week was not the manipulations and machinations of the price managers on Wall Street in rescuing the "Great Bull Market," but rather the abrupt about-face in the precious metals markets in the face of the capitulation of Jerome Powell and the global central bankers. Everyone is now rapidly abandoning the entire concept of "normalization," from the U.S. Federal Reserve to the European Central Bank to the People's Bank of China, as renewed stimuli are being discussed and introduced everywhere.

The chart below illustrates how gold responded to those gargantuan watershed shifts in monetary policy from 2009 to 2011, as the stock markets became the third mandate, joining maximum full employment and price stability on the docket. Gold was most certainly headed for a test of the $1,300 level last week when, in the face of a strong dollar, it did a one-eighty and headed back up, closing at $1,325 basis April.

For most of this frigid weekend, I have been pondering over the longer term implications of the Powell Policy shift in late December. The more I think about it, the more convinced I am of the likelihood of a sustained advance in gold and silver, mirroring their behaviors in the 2009-2011 period, which was the last time the bankers bailed out stocks. They bailed out the stock market again this past December because, I believe, Jerome Powell gazed into the crystal ball and saw the incredible degree of "financialization" of the global economies wreaking terminal havoc on the Western economies and panicked. What appeared in that ominous orb was not only massive layoffs in the financial industries, but wave after wave of rising populism with the gutted middle class pointing accusatory fingers at the "Davos Gang."

While declining stock markets and depleted portfolio values frighten the elite politico-banker classes in every country around the world, nothing (and I mean nothing) terrifies them more than the specter of the "madding crowd's ignoble strife," complete with torches, pitchforks and confiscatory tax policies designed to liberate the wealthy from their wealth and the governors from government. To the elitists, the working and shrinking middle classes are magnificent mirrors by which they can view and compare their enviable lots in life to that of the "deplorables" referred to by Hillary Clinton during the last American election. However, it is these very "deplorables" that are manning the guillotines of revolutionary change in the streets of France in a Millennial March toward a new world order and not the kind envisioned by the globalists and politico-banker class.

This anarchist sentiment bubbling to the surface of generational thinking comes as the cost of maintaining the current world order, and its suppressive employment policies rise to levels unbearable within the current economic system. To have 30% youth unemployment in countries such as Italy is unthinkable, but were it not for the wealth concentrated in the stock portfolios of the American politico-banker class, the same would be the case in America.

Which brings us right back to the late-December Powell "revelation" of just how significant stock markets are to the public mood and to the maintenance of the status quo so worshipped by the 1% that own 99% of everything around the world. "Balance sheet normalization" pales in importance to a marauding middle class seeking out revenge for the plight in which they find themselves. Adding a crashing stock market to crashing job opportunities and you arrive at bone-dry political tinder in advance of a flash fire of social disorder. That, in my view, was the horror that prompted the policy shift.

In summary, since the Fed Mandate now has three (instead of two) critical components, the recently added third one being "rising stock markets," I look to history and the 2009 fiscal policy initiative that created approximately $14 trillion in stimulus (credit) as the benchmark for the next two to five years. and the one singular event, rhyming with the 2009-2011 period, that will drive the gold price to all-time highs.

With that as a backdrop, what are the optimum actions to take over the short, intermediate, and long-term time horizons to adequately protect wealth from the erosion of purchasing power and depletion of living standards? In the short term, we must look to the intentions of the bullion bank traders, who have a distinct advantage over the rest of us by way of unlimited capital and regulatory sanctuary. The best window into their playbook remains the Commitment of Traders (COT) Report.

As for the COT, we are still weeks behind in the data. The COT week ended Jan. 22 marked the terminus of the pullback to $1,281.50, and included a 16,036-contract reduction in the Commercial Trader short position. The next move was straight north to the January peak at $1,331.10, at which point RSI got into the mid-70s and reversed. I sent everyone a chart of silver showing how many tops had occurred with RSI stretched into the 70s, and proceeded to exit all of my leveraged positions on Thursday, Jan. 31, which was followed the very next day by a two-week decline that ended exactly on Valentine's Day. What has caught my eye is that even with the lag in the COT data, it is obvious the narrowing of the position extremes between the Commercials and the Large Specs continues, just as it did last spring, but the price action is decisively different. Last year's rinse-and-repeat cycle saw a $140 drop in gold, as the Commercials went from 160,000 net shorts in May to over 40,000 net longs in August. In the six weeks we have seen a sharp reversal in the Large Spec holdings, as prices remain rangebound as opposed to collapsing, which spells "higher prices ahead."

The reversal day we got on Thursday set up the sharp (and unusual for a Friday) advance in gold late last week, so leveraged long positions such as the GLD, SLV, and JNUG calls should be bought—but only on weakness early this week. If I get a pop into the $1,335-1,345 range for gold, with RSI in the 70-80 range, I will use very tight stop losses on these positions. The long physical gold and silver positions and the junior exploration and development issues recommended in the 2019 Forecast Issue portfolio remain intact as intermediate and long-term holdings in anticipation of new highs in 2019.

Twitter is a useful tool in communicating actions to be taken and going "on record" with a call.

Accordingly, I sent out a tweet last Thursday at 11:17 a.m. with gold at $1,313.60 having roared back from a $1,305 low: "Looks like we are getting a positive outside reversal for gold (at least in the pit session) so I am buying back all of my leveraged positions (GLD April $125 calls/SLV April $13 calls) plus JNUG!"

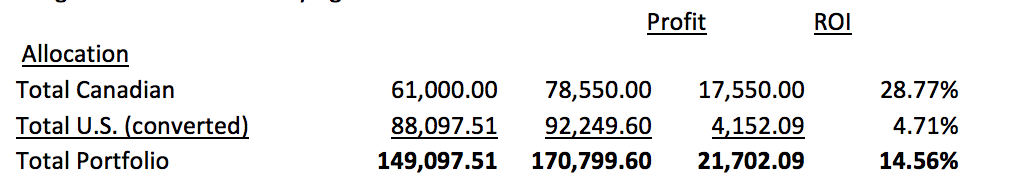

The GGMA 2019 Model Portfolio has been updated as of Friday, and has advanced 14.56% year to date (YTD), largely on the strength of the 10,000-share holding in Great Bear Resources Ltd. (GBR:TSX.V; GTBDF:OTC) purchased on Jan. 2 at $2.30. I purchased my first position in GBR in August at around $1.70, immediately after learning of its exciting gold discovery in Red Lake, Ontario. The Dixie Project is especially close to my heart because the first championship in my hockey career was while playing center ice for the Mississauga-based Dixie Beehives in 1969-1970. We won the Ontario Junior B Championship, defeating the likes of the Markham Waxers, Stratford Indians and Hamilton Mountain Bs. The Dixie organization holds a special place for me and now GBR's Dixie Project is doing the same.

With the S&P 500 enjoying the biggest percentage advance in years, having gained 10.72% YTD, the GGMA portfolio is outperforming it by a hefty 35.8% in the same time period, and it is the 65% gain in GBR that is carrying the load.

(This portion of my service is for paid subscribers only. Should you wish to subscribe to the GGM Advisory (GGMA), email me and I'll send you the details. [email protected])

Finally, and in closing, I wanted to thank all participants in the Getchell Gold Corp. (GTCH:CSE) financings during the 2017-2018 stretch for their patience and perseverance, now that the final verdict has been handed down by the Canadian Securities Exchange and Canada Depository Services. I must wait for Getchell to announce the results of the "tribunal" before making any detailed comments, but suffice it to say that I basically wasted eight weeks of my life trying to secure justice for my friends and colleagues.

Now that it is a fait accompli, I intimately know how the Gold Anti-Trust Action Committee's (GATA's) Bill Murphy and Chris Powell must be feeling after twenty-odd years of Herculean efforts in trying to secure justice for believers in the roles played by gold and silver in the quest for true price discovery and transparency in world markets. Getting shuttled back and forth between regulators and exchange officials and brokerage firm compliance departments, as Bill and Chris have been doing since the late '90s, enduring untold personal expense with not so much as a token retainer, has been a Nosferatu Nightmare for them both.

I am in the middle stages of writing my memoirs over the Getchell Affair, and when I am finally able to compare notes with Bill and Chris (and the late Jim Blanchard), I will reveal what I have learned about the people we think we trust in their execution of their duties. It is explosive material; it is enraging material; it is maddening material to the point of violence; and it evokes the finality of the knowledge and recognition of right versus wrong.

Some of the people in our world have been allowed to function within a platform bereft of the knowledge or appreciation if what exactly constitutes actions that transgress the moral compass. They choose to withdraw to the sanctuary of legal technicality and absolution, a tactic that my late father would never tolerate let alone condone. The GATA saga and the Getchell saga carry one thing in common: There is today no avenue of access available to anyone that seeks to recolonize the very core of the free market. Once you have all grasped the significance of this last statement, you will have earned the right to debate it.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Read what other experts are saying about:

Disclosure:

1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Getchell Gold. My company has a financial relationship with the following companies referred to in this article: Getchell Gold, Great Bear Resources. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Great Bear Resources. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp., a company mentioned in this article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp., a company mentioned in this article.

Charts courtesy of Michael Ballanger.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.