Every once in a while, one comes across a press release that is so informative and well done, that it really stands out. I thought that NuLegacy Gold Corporation's (NUG:TSX.V; NULGF:OTCPK) press release of February 11 was one of the best I've read in a long, long time. However, it was also fairly technical in places. Therefore, I am writing this article to reiterate the important news, and to dumb down the technical jargon! To help me in the latter part of my mission, I had a lengthy conversation with NuLegacy's CEO James Anderson.

With US$ gold futures approaching a one-year high at US$1,332/oz, (investing.com), NuLegacy Gold's (TSX-V: NUG) / (OTCQX: NULGF) share price could start to gain some traction. Notice that Chairman Albert Matterbought 250,000 shares in the open market on February 13.

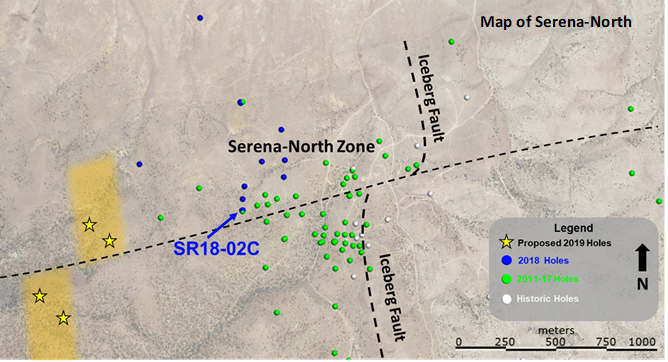

The highlight of the 2018 drill program was core hole SR18-02C, which returned 8.7m of 16.9 g/t gold and, importantly, it extended the Serna zone by 100m (330 ft) to the west. However, the title of the press release was "NuLegacy Transforms Red Hill," and not due to this terrific drill hole.

Ed Cope, NuLegacy's Director of Evaluations & Acquisitions, commented,

"This is a very significant result because anytime you get ½ ounce gold over 30 feet in a Carlin system, it suggests there was a robust hydrothermal system at work capable of producing a significant Carlin-type deposit. Our job, as exploration geologists, is to find the high-grade core of this deposit—and the transformational geologic work completed at the Red Hill property in 2018 will help us to achieve that goal."

NuLegacy Gold provided a review of its successful 2018, widely spaced fall/winter drill program on the large 108 sq km Red Hill property in the Cortez Trend of north central Nevada, and gave a brief preview of H1 2019 drilling. At the beginning of 2018, the company performed a massive re-logging of all 223 previous drill holes (54,000m) as well as reinterpreting previously collected geochemical and geophysical data.

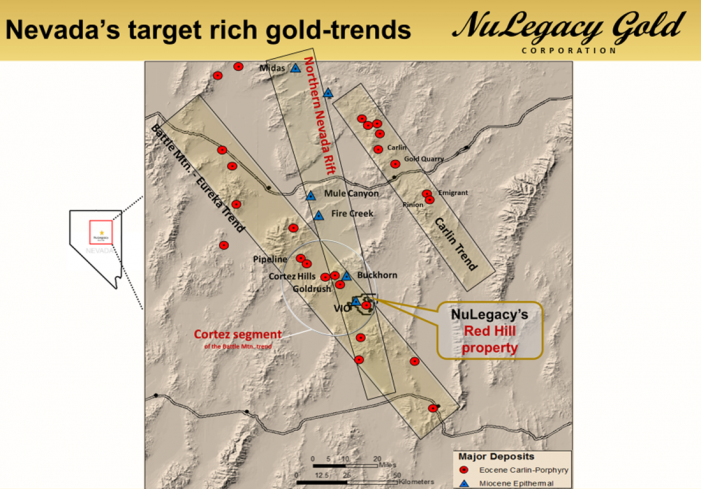

Management pointed out that they are fortunate to have the Northern Nevada Rift on the western portion of Red Hill, but that it has been a challenge, as the deposition of lava covers a lot of the gold mineralization that the company has been searching for and discovering.

In speaking with CEO James Anderson, I learned that the Northern Nevada Rift is an extremely large fissure in the mantle of the earth that extends ~30 miles south of NuLegacy's property, all the way north into Idaho. For millions of years, lava flowed from this fissure. That left a thick layer of basalt all over Nevada. This fact is important later on. (See map below.)

So, the basalt from the Northern Nevada Rift covers areas where NuLegacy is searching for gold. However, one opportunity is that the Northern Nevada Rift hosts significant gold-silver deposits in northern Nevada in close proximity to the Red Hill property. The blue triangles in the map depict epithermal gold deposits where the Northern Nevada Rift is prominent. NuLegacy's VIO zone on the western edge of the Red Hill property is one such area, where a younger, epithermal deposit may exist.

The map of Serena-North Iceberg zones below shows proposed follow-up drill holes west and southwest of SR18-02C, along with all holes drilled to date greater than 600 ft. depth (182 meters).

From the press release, "While subsequent drilling north and south of SR18-02C returned only anomalous gold values, NuLegacy's exploration team has since interpreted that higher grade gold mineralization should lie west and southwest of SR18-02C, as illustrated by the pale orange stars. The untested ground west of the Serena zone will be a focus for exploration drilling in early 2019."

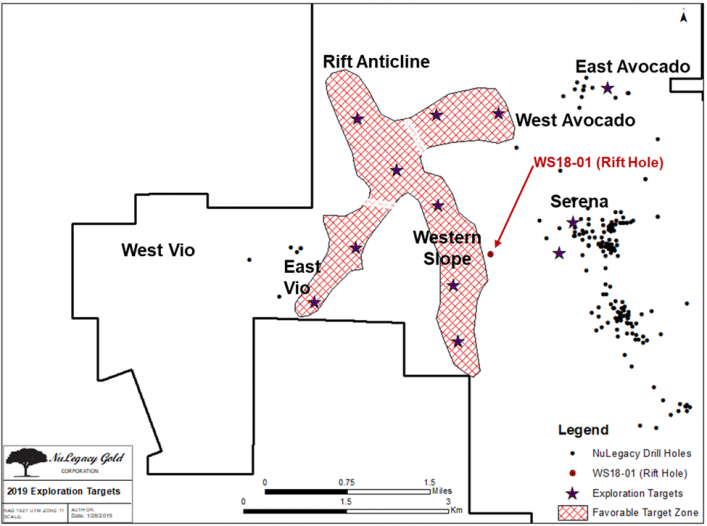

Why does management believe that they need to move significantly west for some of their next drill holes? It all comes down to hole # WS18-01, which returned nominal gold values, but was drilled far west of the Serena zone. The importance of this hole is that management found the same gold system 1,200m west of Serena. How do they know it's the same system? It has the same geology and is in the same Devonian Wenban 5 unit.

Hole WS18-01, which encountered the target host rocks at less than 1,000 feet, shows that the thickness of the basalt over NuLegacy's property is not as great as geologists previously thought. That means a greater portion of the Red Hill property is prospective for gold mineralization, because the company can drill in more spots knowing they will get through the basalt layer. Getting through the basalt does not guarantee success, but it offers more opportunities to find the right conditions; the highest-grade mineralization is still expected to come from the Devonian Wenban 5 Unit.

Chief Geologist Derick Unger commented,

"We stepped out significantly to the west in pursuit of the down dip origination of all the gold discovered near surface in the Iceberg and Serena zones. The narrow interval of albeit modest grade and the stratigraphy and geochemistry encountered in hole WS18-01 confirms the Carlin-style gold system continues this far west on the property and has a large footprint. For this hole to encounter our gold system 1,200 m (or 3,900 ft) west of the Serena zone is very important as it affirms that a significant, possibly major portion of Red Hill's Carlin-gold systems are covered up by the post-mineralization basalt flows (Miocene age)."

Follow up drilling will begin this spring after this data has been fully incorporated into NuLegacy's geological model and interpreted. The 2019 spring-summer phase 1 drilling plan contemplates an initial 8,700m (28,500 ft) in 20 holes.

For a listing of significant drill results reported in 2018 please follow this link.

Charles Weakly, who led the reinterpratation of all the drill data at the beginning of 2018 remarked, "We now know that all the ingredients—the correct host stratigraphy, the correct alteration package, the correct high & low angle structural components—exist on our Red Hill property. The three new target areas we identified under the basalt flows are exciting and have a good chance of leading us to the fire behind all the smoke [Iceberg and Serena zones] discovered to date."

CONCLUSION

The possibility of considerably more prospective (and easy to drill) areas on NuLegacy's 108 sq km property is exciting and significant. These are areas never drilled by NuLegacy or by anyone else. This year or next, there's a decent chance that NuLegacy will be acquired. In the end, the amount of drilling it will take to come up with a multi-million ounce deposit could be beyond the scope of NuLegacy's capabilities. However, larger companies, most notably Barrick Gold, should view this latest development with interest.

All of this good news at NuLegacy Gold (TSX-V: NUG) / (OTCQX: NULGF) is occurring at the same time that Barrick is continuing to do great things in Nevada. An executive at Barrick recently said,

"The Nevada assets, including Turquoise Ridge, are now being operated as a single complex, and we are already delivering efficiencies. Still in Nevada, the recent Fourmile discovery has now been combined with the nearby Goldrush in a single project which has the potential to become Barrick's next Tier One gold mine."

Fourmile recently delivered a maiden Inferred resource of 1.167 Mt @ 18.58 g/t. The newly combined Fourmile and Goldrush project is less than 7 km from NuLegacy's property.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

[NLINSERT]Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about NuLegacy Gold, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of NuLegacy Gold are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, NuLegacy Gold was an advertiser on [ER] and Peter Epstein owned shares in the Company. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Graphics provided by author.