ParcelPal Technology Inc. (PKG:CSE) is an interesting company because it is setting up to do to the package delivery industry (FedEx, UPS, et al.) what Uber did to the taxi industry. Where FedEx and UPS are big lumbering companies with expensive infrastructure, ParcelPal is light and relatively fleet of foot, using economies of scale and flexibility to give it the edge.

Following are some key features of the company's business model that are making it successful:

- It uses the Uber model, which provides flexibility for employees and cost savings;

- It is building the business city by city, and is already operating in Vancouver, Calgary and Saskatoon, and heading east;

- The business is scalable according to location;

- It has developed the capability to deliver multiple orders to an address at once, unlike companies such as FedEx and UPS;

- The company has created an app advising of products to be delivered, which will, of course, appeal to younger consumers;

- The company will act as a sales front for Amazon.

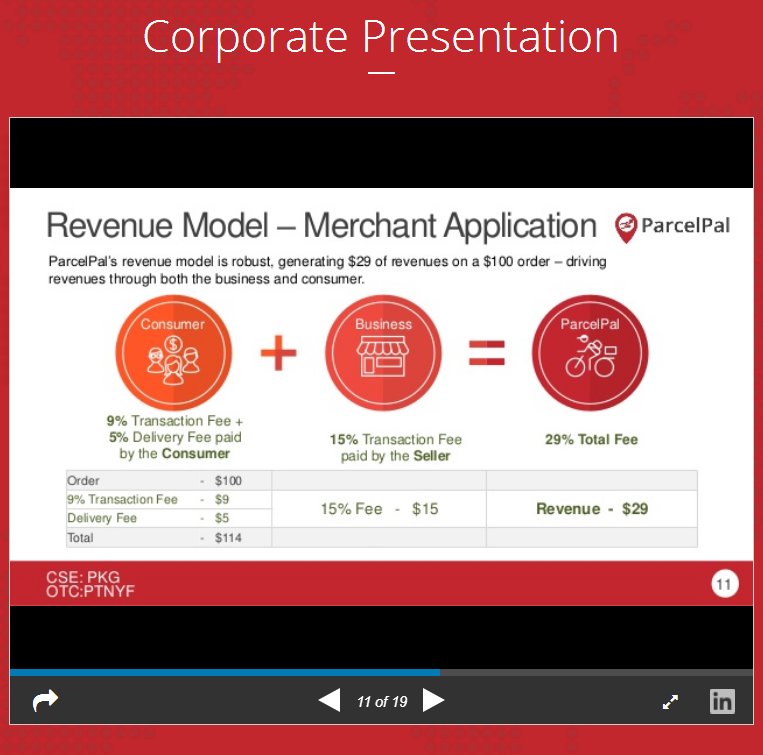

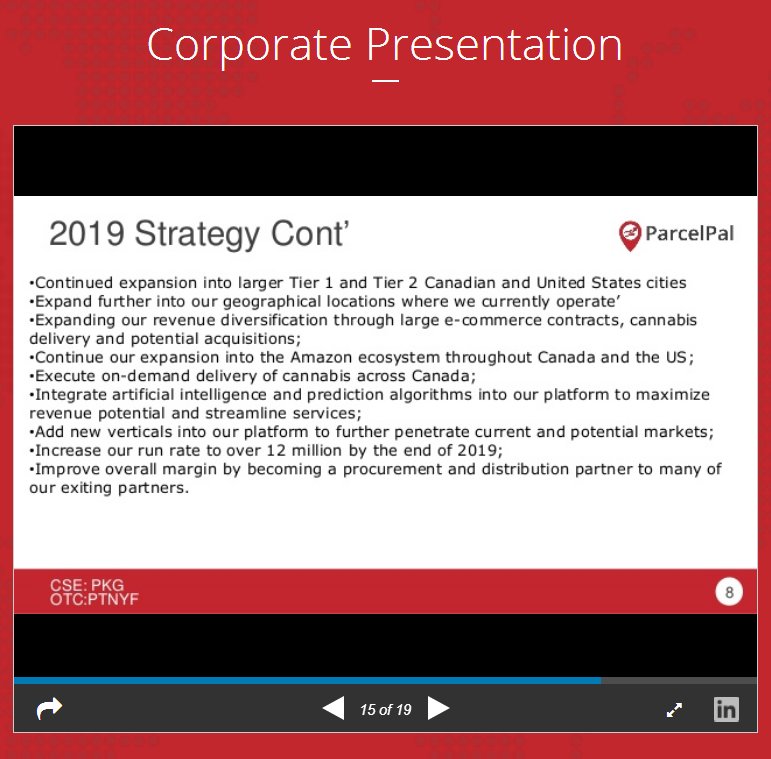

There is an interesting presentation on the company's website, which you can view by scrolling down this page. Here are a couple of slides from it:

Now we will review the charts for the stock.

Starting with the 3-year chart we see the price history so far is rather messy, with an overall neutral to slightly higher trend, within which steep rallies have been followed by reactions of longer duration. Right now, after turning higher again, it looks like it is getting ready to make another run at the resistance toward the highs, with the possibility of it breaking out to new highs. We will next examine recent action in more detail on a shorter-term chart.

On the 6-month chart, the first point to note is that the volume dieback as the price dropped back last fall is viewed as a positive sign. It shows there was no great weight of selling driving it lower.

In recent months it looks like a cup-and-handle base has formed, with the handle of the pattern developing beneath a clear line of resistance. While the handle boundary shown on the chart suggests it must break one way or the other soon, it should here be noted that this handle boundary is provisional; it could continue for some time and become more rectangular in shape. Failure of the support shown would be short-term bearish and thus construed as a sell signal, so stops should be placed beneath this support.

The action of recent days, where the stock tried to break higher on good volume but got beaten back by supply (resistance), is interpreted as bullish and implies that it will likely succeed in breaking out soon. This breakout attempt, which we classify as a preliminary breakout, has drained off some of the overhanging supply and is thus a help. Moving averages are in increasingly positive alignment that is supportive of a breakout soon, which would quickly lead to a bullish cross of the main averages.

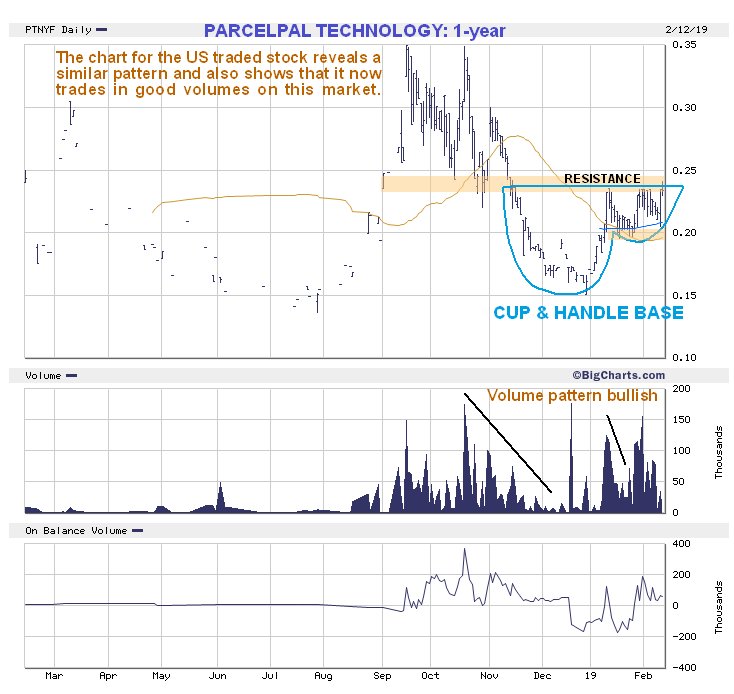

The 1-year chart for the U.S.-traded stock shows a similar pattern and also reveals that it now trades in good volumes on this market, where the volume pattern is decidedly bullish (strong volume of rallies, light volume on declines).

Conclusion

ParcelPal looks like an immediate buy here, with a breakout leading to a possibly strong run. Important: Do not confuse this stock with another stock with the same code but on the NYSE, which is Packaging Corp. of America. If placing a stop, suggested point is CA$0.248.

ParcelPal Technology website

ParcelPal Technology Inc., PKG.CSX, trading at CA$0.28 , $0.22 at 12 noon on Feb 15.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

[NLINSERT]Disclosure:

1) Clive Maund: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. CliveMaund.com disclosures below. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with ParcelPal. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of ParcelPal, a company mentioned in this article.

Charts provided by the author.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.