Editor's note: An earlier version of this article stated that a processing plant would not be necessary. Although eCobalt will not be building a full hydromet facility, it may still build a processing facility. We apologize for the error.

Over the past few years, the cobalt market has been volatile, but demand is expected to increase as the element is a necessary component in the rechargeable battery and renewable energy sectors. Much of the world's production comes from the Democratic Republic of the Congo, where issues such as corruption, child labor and pollution have many manufacturers looking for alternative sources.

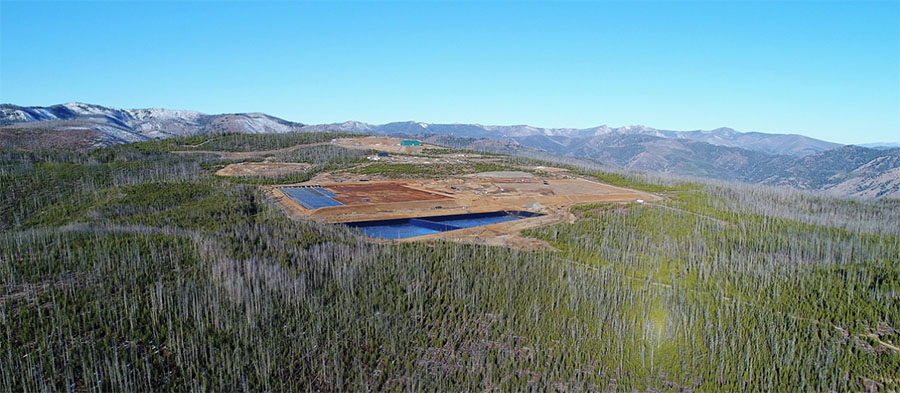

eCobalt Solutions Inc.'s (ECS:TSX; ECSIF:OTCQX; ECO:FSE) Idaho Cobalt Project (ICP) is the only near-term environmentally permitted primary cobalt project in the U.S. It's 100% owned by eCobalt's wholly owned subsidiary, Formation Capital Corporation.

Located in the Idaho Cobalt Belt, "the ICP has the potential to become a reliable and transparent source of cobalt in the face of rapidly growing demand for the metal," the company declared.

Michael Callahan assumed leadership of the company in late 2018 as President and CEO.

"We see the sentiment around battery materials correcting in 2019 and this optimized feasibility study as a potential re-rating opportunity for the company." - Eric Zaunscherb, Canaccord Genuity

"When I joined the company late last year, my main priority was to determine how to maximize the greatest value from the Idaho Cobalt Project while minimizing technical risk, and to advance the project to production as quickly as possible," Callahan stated. "Although the cobalt market has been quite volatile over the last 12-plus months, the importance of this commodity in the impending electric vehicle revolution has not waned. Prices for cobalt are still expected to strengthen beyond 2020, aligning well with when we expect our product to reach the market. Within this market context, the viability of the ICP remains strong, and so we must deliver a plan that fully maximizes the project's potential today and well into the future."

"One of the things that's important to me," Callahan told Streetwise Reports, "is taking a fresh approach and making sure we design and build a project that has the best chance of surviving all the price cycles, because if you don't survive the downturn, you won't be around to benefit from the high price cycle."

"We challenged ourselves to develop a production plan with less risk and lower costs," Callahan noted. "The result of this work demonstrated that the incremental cost of retrofitting the mill to process more tonnage is supported by considerably stronger economies of scale while having no expected impact on the approved Plan of Operations. This plan would allow us to produce more cobalt earlier, thereby increasing cash flows at the beginning of the mine life, improving payback and overall project economics."

The company noted that the plan would increase the targeted production rate to 1,200 tons per day (tpd), a 50% increase from the earlier 800 tpd plan, producing a cobalt concentrate.

"One of the advantages we have," Callahan told Streetwise Reports, "is that we will be the next cobalt company to come into production, and it's production in the United States, ethically sourced in a safe, clean jurisdiction. We have a fairly high profile right now."

"We have been able to put into place a high-caliber technical team over the last three to six months with proven experience building mines and operating world-class assets," Callahan explained. "Being able to attract that kind of talent speaks to the interest in and importance of the project."

"We're stepping into that next phase of development moving toward being a producing mining company," he noted.

Eric Zaunscherb, an analyst with Canaccord Genuity, follows eCobalt. In a January 7 report, he wrote, "The company is working on an optimized feasibility study and has identified an opportunity to increase its targeted production rate by 50% from 800tpd to 1,200tpd. . .We consider the implied economic improvements positive. . .we see the sentiment around battery materials correcting in 2019 and this optimized feasibility study as a potential re-rating opportunity for the company. "

Canaccord Genuity has a Speculative Buy rating on eCobalt and a target price of CA$0.90. Shares are currently trading at around CA$0.47.

eCobalt currently has around 160 million shares outstanding, 189 million fully diluted; Dundee Corp. owns 10.3% of the shares. eCobalt has zero debt, $14.7 million in working capital, and $18.3 million in cash and equivalents, as of September 30, 2018.

Disclosure:

1) Nikia Wade compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: eCobalt Solutions. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Disclosures from Canaccord Genuity, eCobalt Solutions Inc., Flash Update, January 7, 2019

Analyst Certification: Each authoring analyst of Canaccord Genuity whose name appears on the front page of this research hereby certifies that (i) the recommendations and opinions expressed in this research accurately reflect the authoring analystís personal, independent and objective views about any and all of the designated investments or relevant issuers discussed herein that are within such authoring analystís coverage universe and (ii) no part of the authoring analystís compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed by the authoring analyst in the research.

Analysts employed outside the US are not registered as research analysts with FINRA. These analysts may not be associated persons of Canaccord Genuity Inc. and therefore may not be subject to the FINRA Rule 2241 and NYSE Rule 472 restrictions on communications with a subject company, public appearances and trading securities held by a research analyst account.

Required Company-Specific Disclosures (as of date of this publication):

eCobalt Solutions Inc. currently is, or in the past 12 months was, a client of Canaccord Genuity or its affiliated companies. During this period, Canaccord Genuity or its affiliated companies provided investment banking services to eCobalt Solutions Inc.

In the past 12 months, Canaccord Genuity or its affiliated companies have received compensation for Investment Banking services from eCobalt Solutions Inc.

Canaccord Genuity or one or more of its affiliated companies intend to seek or expect to receive compensation for Investment Banking services from eCobalt Solutions Inc. in the next three months.

Disclosures are available here.