"ZeroHedge" from Wikipedia: In September 2009, news reports identified Daniel Ivandjiiski, a Bulgarian-born,[d] U.S.-educated,[e] former hedge-fund trader, who was barred from the securities industry in September 2008 for earning USD 780 from an insider trade by FINRA,[14] as the founder of the site, and reported that "Tyler Durden" was a pseudonym for Ivandjiiski.[3][15][16]FINRA rulings show Ivandjiiski worked for 3 years at New York investment bank, Jefferies & Co.,[17] as well a number of hedge funds, the last of which was Wexford Capital LLC, a fund led by former Goldman Sachs traders.[18] One female site contributor, who spoke to New York magazine in an interview arranged by Ivandjiiski, said "up to 40" people could post under the "Tyler Durden" pseudonym.[3]

I first learned of ZeroHedge after reading a post about gold in mid-2009 and was immediately drawn to its uncanny ability to unmask the malodorous bile that emanates from the Wall Street Spin Machines led by the Wall Street Journal and CNBC. In the early days, ZH was a refreshing must-read every morning and every evening as they were able to scan and re-post some great breaking stories related to the markets or people within the markets with the bad actors and self-promoters such as Bill Ackman and Dennis Gartman frequently called out for either reputational gaffes or outright bad market calls.

However, over the years, as banner ads clogged the sight with alarming frequency causing great annoyance, the site has, in my mind, devolved into the "National Inquirer" of financial sites, persistently seeking out and spewing forth opinions on markets which are at once and always a) anti-Wall Street b) bearish c) pro-Gold and d) revisionist. The trouble with frequenting these kinds of sites for financial insights is that they carry a constantly tainted and totally biased viewpoint on those asset classes they choose to own and/or promote. Take the recent market meltdown this past December. In the days leading up to the Christmas Eve nadir in prices, they ran no fewer than three dozen stories from "guest contributors" that warned of an impending financial holocaust that would render all financial assets worthless and that one had better "sell everything not nailed down" to avoid one's personal financial calamity. "Load up on gold!" was the esteemed advice from every corner of the ZH blog site just as they were screaming from gilded rooftops at the precious metals top in 2011.

Now, notwithstanding that I happen to AGREE with that advice (on gold) and am a well-documented skeptic on the veracity of this credit-fueled, counterfeit-money-driven "economic boom" that is being enjoyed and celebrated by less than 2% of the global population, I have grown to beware the "ZeroHedge Trap" of making ANY investment and trading decisions after reading one of their perennial purveyors of doom-and-gloom propaganda engineered to attract site "hits," estimated to have grown from about 1.6 million per month in 2009 to 40 million per month, a record for the period ended January 1, 2019.

Financial turmoil sells doom-laden websites and as we note, those in full panic mode were turning to Tyler Durden the Panic-Pumper when indeed they should have been counting sugar plums with CNBC's permabull team lead by Cramer or Pisani or Melissa Lee. Much as I hated the obvious intervention and fraudulent criminality of the Fed/Treasury-induced stock market recovery in the post-Christmas period, I swore to ignore the celebratory grave-dancing by the ZH crowd in favor of trusting both the charts and my instincts and sent out a Boxing Day note stating that "The time to be short (stocks) has passed" and true to form and content, I have been riding out the current 245-point pop in the S&P 500 with zero shorts and significant exposure to gold and ample cash reserves to once again try to pick the top of this current dead-cat bounce with Goldman Sachs once again in my profit-driven crosshairs.

Before I open myself up to the wrath of the ZeroHedge nation, let it be known that I still take great glee in reading them ridicule one of the ego-driven, "Rockstar" money managers that just detonated his book or the billionaire Internet leviathan that just got caught tweeting pictures of his genitalia to a mistress, but what I will do after reading such dross is turn off the computer and simply laugh while refraining from joining the blood-lust and diving into a limit-position purchase of Amazon put options. Just as listening to Jim Cramer telling you back in 2008 that Bear Stearns was "fine" (it wasn't) and that Lehman Bros. could never be allowed to tank (it did) was wrong advice to follow, the same can be said for blindly believing that the world is coming to an end with the same guy screaming it in 2008 echoing his identical forecast from December 2018.

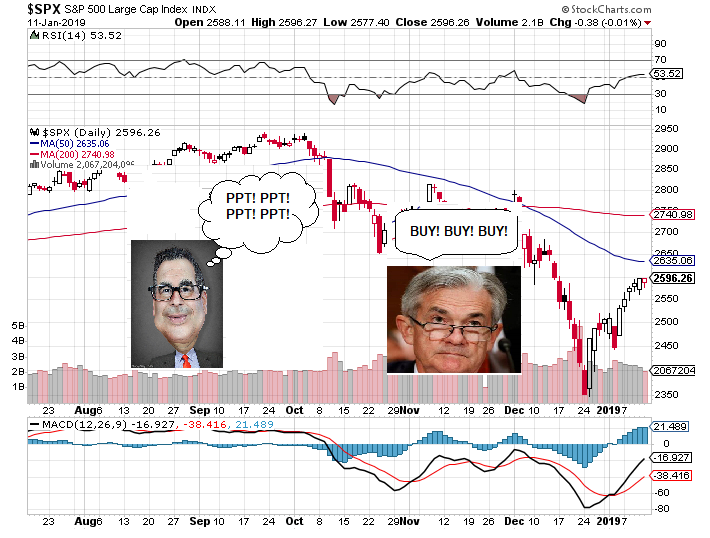

As to markets, with the first real week of trading now completed, it should be known that statistically, 2019 is shaping up to be a positive year. Advanced indicators such as the Santa Claus Rally (up 1.3%) and now the First Five Day Rule (up 2.7%) are suggesting that there is an 80% probability that the next eleven months will see positive returns. To be sure, the global economy is indeed rolling over with higher interest rates and trade wars taking their toll but the numbers going back to 1950 state that even if January rolls over and heads down for the month, there is still a 70% probability that 2019 will be up. The ZH teeth-gnashers and the Peter Schiffs of the world will cringe at such a thought but as I stated above, I changed my bearish mindset on the Sunday before Christmas when the blogosphere was ablaze with the revelation that Screamin' Stevie Mnuchin was calling a meeting of The Working Group in Capital Markets, the Ronald Reagan invention of the 1980s designed to PROTECT against and PREVENT PLUNGES in stock domestic stock markets (otherwise known as the "Plunge Protection Team" or "PPT"). I learned a great many years ago that whenever a treasury official or a Fed Chairman speaks, you listen—better still, you ACT. I did listen and I did act. Mnuchin told us that "policy" was going to rescue the damage Jay Powell had wreaked and then the following Friday, he and Grandma Yellen came out and spewed dove feathers all over the stage and poof!—plates and silverware were on the table and everything was set. Stocks have gone on a tear to the upside and life in the world of the CNBC Fast Money team has returned to rapturous relief.

"We can now invest with confidence that the new boss is, in fact, the same as the old boss. Risk is dead. BTFD." - Stephanie Pomboy

The Fed is "grovelling to whiny investors." – Danielle DiMartino

"What starts on Wall Street, rarely stays on Wall Street – Scott Anderson (in reference to $4.5 trillion in wealth destruction due to the Q4 market bloodbath)

"They know NOTHING…" – Jim Cramer in 2008 (referencing the Fed)

"I got one client left and that's me—and I'm lookin' for a new broker." – Anonymous stockbroker in December 2018.

"Plus ca change, plus c'est la meme chose. (the more things change, the more they remain the same)" – Jean-Baptiste Alphonse Karr

Straying back to the ZH crowd, I honestly cannot find fault with their cynical view of the likelihood of an impending recovery. After all, if I sold advertising that was absorbed through osmosis to a legion of 40 million agnostic viewers as they read post after post of terror-inspiring sensationalist gloom, I would be livid that my world, so very perfect in its creation during the tumultuous months of November and December, could go from the penthouse to the outhouse at the utterances of two overtly corrupted personas in the form of Stevie Mnuchin and Jerome Powell. Just when I was SO CERTAIN that my gloom-site was going to 100 million page-views in January, the interventionists went to work and destroyed any shred of that dream becoming a reality. According and unsurprisingly, the frequency of bearish articles has intensified in an "I'll show the bastards!" frenzy of fear-inspiring stories so blatant that the top-of-the-page guest blogs are entitled "The Black Swan So Ugly No One Will Talk About It…", "The U.S. Will Go Broke. The Case For Gold" and "Gold: Higher, Then Lower, then Skyward."

The top story running all through Friday was "Something Biblical is Approaching: Here Are the Scenarios Of The Collapse" while the charts I was reviewing say nothing of "impending doom" to me but rather suggest a "Déjà vu" of sorts, not unlike a replay of March 2009 or the days and weeks after 9/11. The "invisible hand" saving stocks and capping gold and silver is undeniably present and has been since Boxing Day, and while the gloom-and-doom purveyors want the walls to come crumbling down NOW, I suspect that the financial asset Armageddon they so desperately crave may be a tad off and beyond the immediate horizon giving way to accelerated occurrences of doom-laden ZH commentary and contradictory CNBC cheerleading.

The bottom line is that the two faces shown above are the ones that will control stock prices as we move forward and there is nothing new in the zoo that makes this post-crash period any different than recent post-crash periods in the aftermath of the creation of the PPT and policy-driven interventions sanctioned and endorsed in 1988.

Get over it.

Gold prices are actually in great shape with $1,30-1,310 resistance still dogging us and while RSI looks "OK," we have an interesting contradiction in that the moving averages (50 and 200 day) are approaching the all-omnipotent "Golden Cross" while the MACD is soon completing a negative rollover. You can see from the chart beside us that gold went through a negative "Death Cross" back in July when the 50-dma broke below the 200-dma resulting in the summer swoon from $1,300 to $1,167 but it was preceded by the MACD doing the same. Today we have the same setup for MACD but not the same for the moving averages. We could see a retracement in the MACD below the zero line with gold moving sideways and if we get a quick recovery, the moving average envelope may indeed give us what we want. It is too early to tell right now so I have taken profits on the silver call options and banked the cash but still hold the GLD April $120 calls (from $3.20 in November) with GLD at $121.80 (and the calls at $4.10).

My strategy will be to continue to use the U.S. dollar index as my chart guide because the algobots are no longer glued to the widely touted (and plagiarized) meme that the yuan-gold peg is controlling the U.S. dollar price because that "flaveur-du-jour" dissipated in December. It seems that the yen-gold correlation (as opposed to "peg") has taken the front seat but it simply seems to me that the DXI is the one driving the bus.

As a tip-off, look for the $1,280 level for gold to be your very short-term stop-loss and while I doubt that the $1,250 level is in play, those GLD April calls would check back to our cost base if the GLD has a $1.00 drop (which equates to $10 per ounce gold). I will not risk a close below $3.50 for the April $120s. (Note: While they are on the 2019 portfolio books at $4.50, most of us paid $3.00-$3.35 as per GGMA Issue November 17th when first mentioned but if the MACD rollover wins out over the Golden Cross, we jettison all leveraged positions and live to fight another day.)

The TSX Venture Exchange holds the distinction as being the worst-performing exchange in the Western world and despite all the carnage last year in 2018, the TSX Venture Exchange closed down 34.5% versus gold down a mere 1.7% and the S&P 500 down 5.2%. Many of the corporate issuers domiciled on Canada's National Financial Embarrassment were down 90–95% and while most of those were residing in the crypto space, there were enough weed and mining dogs to fill a small arena. While there are countless cases of skullduggery on the TSXV, most of the major headaches are brought about by incompetence rather than fraud the likes of which contribute to one very ugly result.

Nevertheless, the TSXV's competitor exchange, the Canadian Stock Exchange or "CSE" is just as suspect and after the Getchell Gold Corp. (GTCH:CSE) fiasco in December, there is no doubt in my mind that what is needed is for a few of the graybeards to come back from retirement and take control of these exchanges from the kids currently running them. The problem lies in this new-found and totally unwarranted sense of entitlement carried into the workplace that is an extension of the university system where everyone is entitled to a "happy and safe outcome" where graduating marks matter not while "effort" and "sincerity" replace "accountability" and "hard work."

When I was a rookie broker in the late 1970s, if you screwed up and sold 5,000 shares when you should have only sold 2,500 shares, the exchange didn't halt trading in the issue and launch an "investigation" to see how the trading error could find a "resolution"; you informed your trader that you screwed up the trade and he went out and bought it back charging your commission account with any trading losses. End of story. Furthermore, if a client brought in a certificate for 100,000 shares of Rectal Gas, you sent the certificate to head office where there was a battery of staff checking the CUSIP and ISN numbers, the signatures, and the funny little patterns on the cert to determine whether or not it was in "good form." If it was, they notified the broker and he notified the client and it was sold. If, however, the shares were sold in advance and they came back bogus (i.e., not in "good form") the trade was reversed and the broker was liable for any loss.

In today's world, the CSE actually halted trading in Getchell Gold because certain shares were sold in error after the December 3rd re-opening and rather than simply ordering the broker to cover the errors, they halted GTCH putting 87.3% of the shareholder base (the Buena Vista Gold investors from pre-merger times whose shares were ALL in "good form") in a position of huge disadvantage in order to make the offending parties "safe" from financial hardship as the exchange and the Canada Depository Services and the CSE moving to find a nice, non-offensive "solution" to the "problem."

Now, if this was all a complete out-of-thin-air surprise to all parties, one could understand the rationale behind a trading halt, but the offending parties were notified of changes in their ownership by way of a press release on November 13, 2018, AFTER a Special Meeting of Shareholders was called and AFTER it was posted on SEDAR. The offending parties all knew full well that their accounts were sitting with a magical six-times-too-many number of GTCH shares than there should have been when it re-opened for trading on December 3, but as can be seen from the Net House Summary data, 1.588 million shares were sold and while certainly not all were erroneous trades, it is my bet the vast majority were pre-merger shareholders thinking that they had just won a mini-lottery and rushed to dump the paper just as fast as they could.

You wonder, pray tell, how I know this? It is because I owned those very shares that were to be affected and through series of emails back and forth with GTCH management, the CSE, and the transfer agent, I was the only person voicing any concern over the discrepancy. However, did I go out and try to sell my shares because there were more than there should be in the account? Of course not, because I had read the proxy circular telling me that I was going to have one-sixth as many shares when the merger was completed. Since it is my responsibility to know my holdings and the broker's responsibility to check to ensure that all securities are in "good form" prior to sale, I did nothing. In fact, I BOUGHT more GTCH under $0.20 when it re-opened.

Now, just when you thought this story couldn't get any worse, I sent emails explaining to the "involved parties" how to rectify the situation and further warned that if a bulletin was issued to the brokers announcing the retroactive rollback, they would erroneously include ALL Getchell shares, including the ones that were issued in "good form." Well (you guessed it), they issued the bulletin, and EVERYTHING got cut back. Purchases made after December 3 and PAID for also got affected and as it stands here on January 12, 2019, in six days, it will be a full month since the shares were halted for the second time and many of the share positions are still completely screwed up because somebody arbitrarily determined that a "solution" to make it "go away" could be found by halting the stock. Insanity and incompetence of the highest order prevails…

What is maddening for me is that many friends and followers of my writings are participants in the Getchell/Buena Vista Gold story by way of private placements made in 2017 and 2018 and it has been a long grind for many of us awaiting the liquidity event and listing process. Furthermore, the technical team including mining engineer Bill Wagener (CEO/Chairman) and Q.P. Tim Master, who have done a superb job with the assembly of the land package, aeromagnetic, IP and gravity surveys, and subsequent RC drilling program, are now at the mercy of the Exchange and the Regulators in the funding campaign for the spring core drilling program at Hot Springs Peak. The damage to the reputational capital of this outstanding project cannot be measured in dollars but what is certain are two very important facts:

Ø The GTCH share price opened in the $0.55-0.60 range and had it not been for 23 million shares sitting in accounts that should have been only 3.6 million shares sitting in accounts, it would never have traded down to $0.145 prior to the second halt.

Ø When it re-opens, I estimate that over two-thirds of the sales were in error, leaving a short position of approximately 1 million shares. These shares will need to be bought back and with new buyers showing up smelling blood and a significant reduction in the available float, there is a good chance that we see a rapid recovery and possible squeeze in the price.

Now, with the current market cap of < $5 million, GTCH is undervalued for a couple of reasons but the main thrust is that there are six projects covering a wide expanse in the highly prospective North Central Nevada district, the upside potential is substantial. Four RC holes are pending assays and reconnaissance work from land to the south of HSP has more data to be reported and rumored to be quite positive.

If anyone at the CSE, the CDS, IIROC or all of the member brokerage firms are reading this, please put your heads together and try not to worry too much about the shareholders that had their illegal mini-lottery win taken back but rather focus your empathy on the shareholders that wrote cheques and financed the Nevada project with hard-earned, after-tax dollars and whose share positions are currently corrupted and whose much-deserved liquidity event has been taken away. In an era of entitlement and populist sympathies, it is well past the time for a re-focus on the welfare of those that took the risk in a difficult market who have been shafted beyond belief and without the benefit of lubrication let alone empathy.

What About the Juniors?

So here we are moving into the latter half of the first month of 2019 and two of the junior explorcos we have been following (and own at higher prices) are in the proverbial gutter, in need of both sponsorship and cash. Stakeholder Gold Corp. (SRC:TSX.V) and Canuc Resources Corp. (CDA:TSX.V) are both back under a dime with the original excitement "gold in the Yukon" (SRC) and "silver in Mexico" (CDA) now fragments of their distant pasts. While they both resisted the temptation to change their foci to crypto or weed or battery metals, only SRC has remained true to its mission statement (gold exploration) while Canuc has veered off in the quest for hydrocarbons in Saskatchewan. Western Uranium & Vanadium Corp. (WUC:CSE; WSTRF:OTCQX) is in good shape financially but has pulled back 55% from its 2018 high achieved when all of the uranium stocks got that terrific but much-maligned jolt in the late summer-early fall last year. I remains extremely bullish on this name on the basis of valuation as its Sunday Mine Complex remains a highly accretive asset for anyone with the vision (and money) to get involved. As for Getchell Gold, despite the absurdity of the events of December/early January (mentioned earlier), the company is fully funded with approximately $700,000 in working capital and a pile of warrants in the $0.40–0.52 range that should be in play once the storm has passed and the terrific share structure and shareholder profile is allowed to help levitate the stock price. What I have to keep forcing myself to remember is that all of these junior explorcos are commodity-price-driven "story stocks" and when those gargantuan pools of investment capital finally move to the precious metals space, it won't take more than a smattering of capital spilling over into the explorcos in order to vault them to a 5–10 times premium from current price levels.

When the 2008 Great Financial Bailout ended in March 2009, we financed a little junior called Explor Resources with $0.19-unit deal and watched it scream to $1.50 within twelve months. Tinka Resources was dead in the water in late 2009 at $0.10 per share and after the markets healed and silver took out $20 per ounce, we funded it with $1.3 million and two years later it was at $0.75, ultimately peaking at $1.25 in 2013. There are dozens and dozens of stories that mirror the Explor/Tinka experiences and what is infinitely bankable is any junior with proven resources in a commodity that is "hot" will see a sharp advance in its share price (i.e., uranium/vanadium last summer) perfectly correlated to the underlying metal's price movement. I have included the juniors in the portfolio because of the incredible leverage contained in a penny stock entry level and when coupled with a new discovery in a "hot" commodity (or region), the upside is remarkable. The well-run junior explorcos with solid management/exploration teams ALWAYS come raging back to life when markets heal up and aided and abetted by a precious metals tailwind of rapidly rising prices, the companies that are well located in proven gold-bearing regions (like Nevada and the Yukon) will attract speculative capital once again. This chart of the TSX Venture shows what happens to the explorcos when commodities turn as they did in 2002.

Given that the current market environment has sentiment levels well above the "stark panic" of late December, it is astounding that the safe haven trades so popular in Q4/2018 have remained relatively buoyant but investors are still reeling over the October-December portfolio destruction that occurred and are looking to avoid further erosion in 2019. If the FANGS and the weed deals fail to perform by the end of January, I see a further decline setting in. Furthermore, it is interesting that it was the crash in cryptocurrencies in Q1/2018 that was the lead indicator for the popping of the speculative mania and just last week, the bear market rally that propelled BTC back above $4,000 ended with a thud down to $3,642. If BTC takes out $3,000 before month end, I would be willing to wager on a re-test of S&P 2,351 shortly thereafter.

Trading ideas for the week include bidding for select junior explorcos including GTCH when it re-opens; looking for an entry into the UVXY and the volatility trade; and replacing the SLV April $13 calls sold on January 4 at $1.95 that have retraced under $1.80. Goldman Sachs is in the crosshairs again, too.

Stay tuned…

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

[NLINSERT]Disclosure:

1) Michael J. Ballanger: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Getchell Gold Corp., Stakeholder Gold, Western Uranium & Vanadium Corp. and Canuc Resources. My company has a financial relationship with the following companies referred to in this article: Getchell Gold Corp. and Western Uranium & Vanadium Corp. My firm no longer does consulting work for Stakeholder Gold. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Western Uranium and Vanadium. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp., Western Uranium & Vanadium Corp., Canuc Resources and Stakeholder Gold, companies mentioned in this article.

Charts courtesy of Michael Ballanger.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.