Kerr Mines Inc. (KER:TSX; KERMF:OTC; 7AZ1:FRA) just announced that its phase 2 resource expansion plan designed to extend mine life at its flagship Copperstone Mine in Arizona will begin in mid-January. The company also noted that it is "progressing with environmental and operating permit modifications and continuing with advanced metallurgical testing."

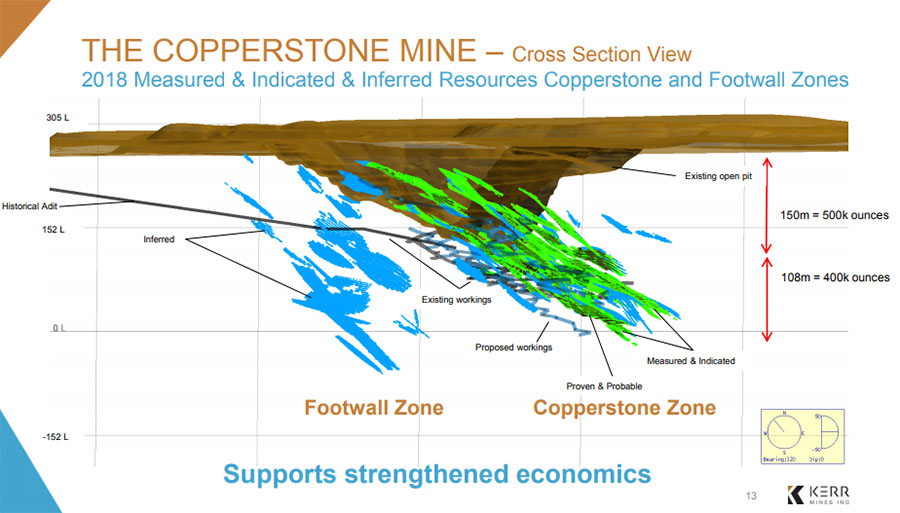

CEO Claudio Ciavarella stated that Copperstone is a "relatively simple and straightforward project, which includes 420,000 ounces of gold with 175,000 ounces in reserve."

Currently, there's a 4.5-year mine life, but the company expects to extend this to 8–10 years in the near term through the drilling program. According to Kerr Mines, the 15,000-meter underground resource expansion program will "culminate in Q3 2019 with an updated Resource Statement and Reserve Study intended to increase the 38,000 gold ounce per annum mine life by 3–4 years to total of 8 years."

The exploration drilling is to add "new resources and in-fill drilling for the purposes of converting existing resources to higher classification and potential inclusion into reserves," the company stated.

The majority of the drilling will be done in the C and D zones of the Copperstone Zone. The company anticipates publishing an updated resource statement in the third quarter of 2019.

In addition, the company will be completing minor modifications to existing permits that are on hand to take advantage of upsides uncovered in the NI 43-101 engineering study that was published in the second quarter of 2018. The company noted that it expects to receive the modifications by the end of this quarter.

Furthermore, the company is in process of completing additional metallurgical testing to validate the 95% recovery rates as published in the NI 43-101 study.

As an additional aspect of the metallurgical testing, Kerr Mines noted that it is evaluating an opportunity to monetize copper by-product that is present in the orebody. If the economics prove to be positive, the company will then consider an additional investment of approximately US$3.5 million in a process known as sulfidization, acidification, recycling, and thickening (SART). If all pans out, management expects a year or two turnaround on the investment, expecting to add approximately US$2 million annually to the company's bottom line as a result of additional revenue and trimming of operation costs.

Financing

Kerr Mines announced in late November that it had arranged a $25-million senior secured project financing from Sprott Private Resource Lending.

Management noted at the time that it intends to use the funds for the development and production of gold at the Copperstone Mine.

CEO Ciavarella expressed three main benefits, "First, it's very favorable financing in terms of the market. Second, the transaction is operationally structured in line with our own plans and how we want to move the Copperstone Mine project forward. Third, there's tremendous flexibility in terms of executing growth strategies over the next few years."

Instead of taking the $25 million in lump sum, the company stated the deal is split into two separate phases.

"The proposed financing has been structured to be completed and advanced in two main phases, with an initial phase of $4 million."

As a function of the first part, there's a $2-million note and a $2-million gold loan included in the Sprott financing. "The note will bear interest at a rate of 9% per annum payable semi-annually and matures on May 31, 2020," according to the agreement.

At any time (prior to the maturity), the company can convert the note into common shares at a conversion price of CA$0.16 per share. The company also has the option to redeem the note at any time by "paying the outstanding principal amount in cash, or with the agreement of the holder, in shares of the company, together with interest payable to maturity."

The gold loan, on the other hand, can be paid back in cash "based on a notional amount of 2,160 oz of gold priced at the greater of $1,200 and the spot price of gold one day prior to maturity. The Gold Loan will mature on May 31, 2020, provided that it will be consolidated into the Phase 2 financing if completed prior to maturity."

The company announced the closing of its $2 million note with Sprott Funding the end of November.

"We have taken another very important step forward in the execution of our strategy and development plans for the Copperstone Gold Mine. This financing will allow the company to commence a resource expansion program and complete key elements of progressing the Copperstone Mine back into production" stated Ciavarella.

$20-Million-Plus Facility

In late Q2/19, Kerr plans to launch phase 2, tackling the $21-million financing to advance the project to production. It will be an 8-month process ending in 2020. The loan for the facility is repayable 48 months after closing.

Ciavarella says that the phase 2 program will be focused on advancing the Copperstone Mine back to production. The use of the capital will be allocated to three primary areas: ordering mining equipment, the construction of plant modifications and additional mine development.

By Q4/19, the company plans to begin mining, and it anticipates gold production by Q1/20.

Other Catalysts

Aside from the Sprott Lending financing, the company also closed a private placement the tail-end of November 2018.

According to a recent company release, Kerr Mines completed the offering consisting of 21,239,409 shares of the company at a price of CA$0.14, for total gross proceeds of CA$2,973,517.

Kerr shares currently sit at CA$0.14 and the company has a market capitalization of approximately CA$38 million.

Read what other experts are saying about:

Disclosure:

1) Nikia Wade compiled this article for Streetwise Reports LLC and provides services to Streetwise reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Kerr Mines. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Kerr Mines, a company mentioned in this article.