Maurice Jackson: Joining us today is Michael Rowley, the president and CEO of Group Ten Metals Inc. (PGE:TSX.V; PGEZF:OTC), which is exploring for platinum, palladium, nickel, copper and cobalt in the Stillwater district of Montana.

Mr. Rowley, we have some exciting developments to discuss for current and perspective shareholders, but before we begin, for someone new to the story, who is Group Ten Metals and what is the thesis you're attempting to prove?

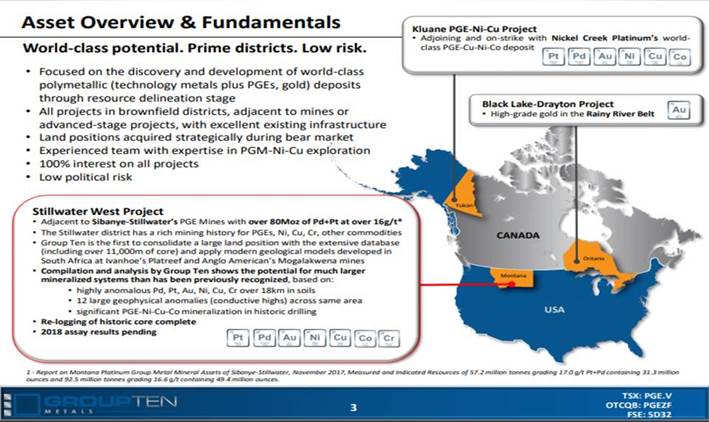

Michael Rowley: Group Ten Metals is a growth stage company, focused on PGM, platinum group metals, plus nickel, copper, also cobalt, the so-called technology battery metals. We have polymetallic deposits as these things occur together; we're focused primarily at the Stillwater West Project in Montana. We also have assets in the Yukon and a gold project in Ontario.

Maurice Jackson: Group Ten Metals just issued a press release announcing a new discovery hybrid zone and some targets at the Stillwater West. Multi-layered question, sir, can you update us on the Stillwater West, expand on the findings, and tell us what they mean moving forward?

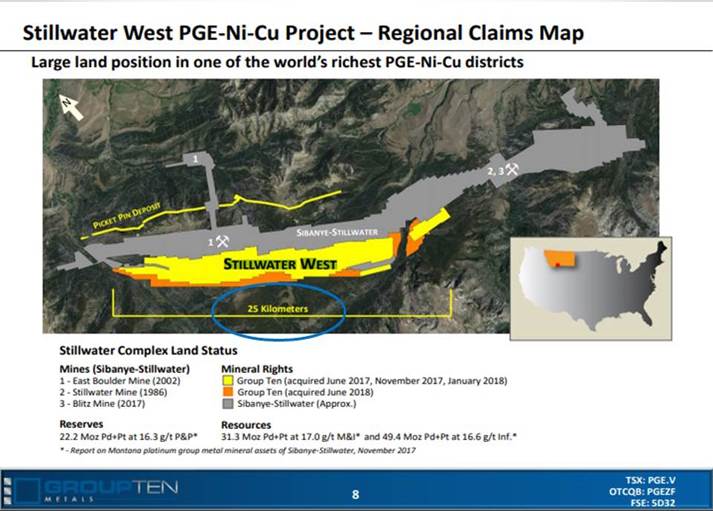

Michael Rowley: Stillwater West is our newest project; we made our first acquisition there in 2017. It's a remarkable land position and database in a truly world-class district. The Stillwater name, the district is synonymous with the richest palladium, platinum mines in the world, a staggering 90 million ounces in past production and current reserves producing from three mines at over half an ounce per ton, 16 grams per ton.

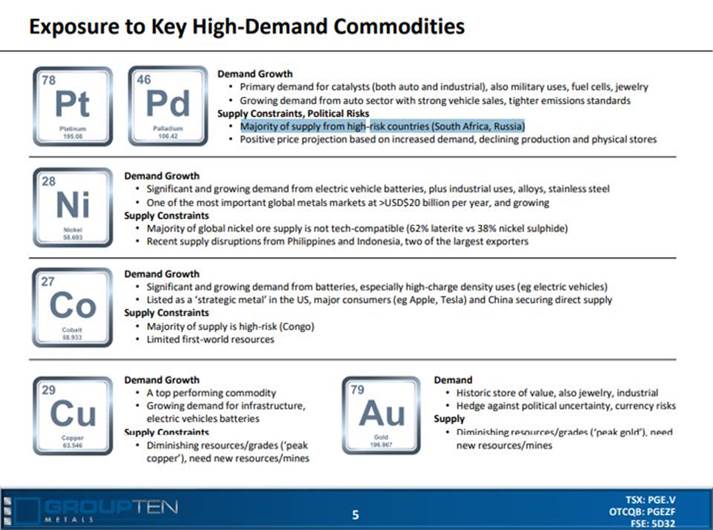

It's platinum and palladium rich; palladium, of course, is very significant right now given that palladium is challenging gold as the most valuable precious metal. We are above and below Stillwater in this layered system and because of that we have not only the same potential for palladium and platinum, platinum group metals in general, but we also get to expand our target to these truly polymetallic things including nickel, copper, cobalt, palladium. We recently added to that list, also, rhodium, and we have some significant gold.

This is truly elephant country. It's the biggest PGM deposit outside of South Africa and Russia and, of course, it was bought by Sibanye our neighbor for $2.2 billion in 2017. So we're the only other player in the district. It's a fantastic place to be, we're very excited.

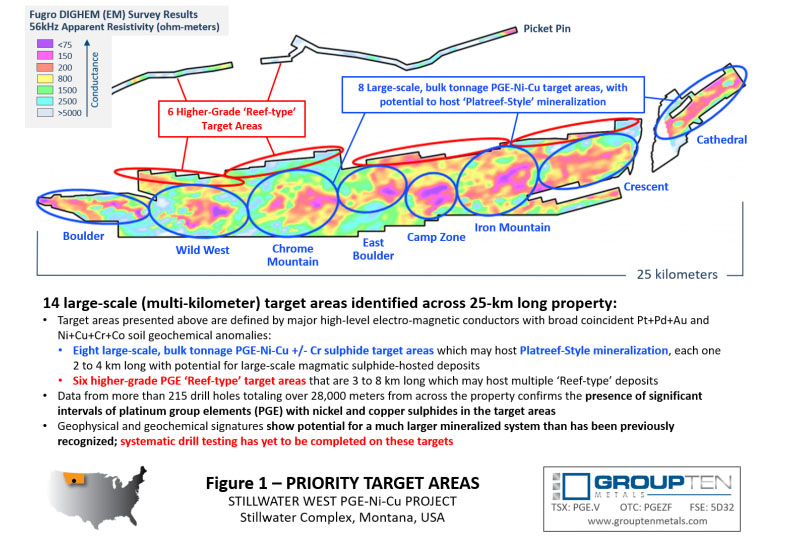

You brought up the most recent news release, December 17. The Hybrid Zone is one of our targets in the Chrome mountain area and an exciting new discovery. We mention up to 150 meters of mineralized intervals there in this new style of mineralization. What's exciting is this has never been recognized in camp before and it ties into the Bushveld Complex of South Africa and, despite the known similarities between these districts, Stillwater has never been examined systematically for that potential.

So in a nutshell, we are taking the lessons learned at the Mogalakwena Mine and Ivanhoe's Platreef project and applying them to the similar geology in Montana Stillwater in a way that nobody's done before. I guess final point to wrap that up is the team that we've attracted includes a number of renowned experts on this type of deposit, but most recently David Broughton of Ivanhoe, so we've actually attracted expertise and talent of a world caliber on the project.

Maurice Jackson: Can you further expand on the new 14 target areas?

Michael Rowley: We have as a result of our efforts in 2018, being our first season on the ground, we've identified 14 target areas in Stillwater West, six of them fit the high-grade PGE reef type targets that the district is known for, in particular our neighbor Stillwater Sibanye Mines. However, 8 of the 14 targets are these newer Platreef style targets where we see potential for large-scale bulk-mineable disseminated sulfide mineralization of the types seen on the Platreef District of South Africa, and that's in the basal zones and the lower ultramafic series in Stillwater.

And that's the greater potential we see there for these hundred million ounce style PGE nickel/copper deposits, also cobalt actually, at Stillwater, and news flow will be ongoing in the coming weeks and months as we reveal the results of our work in 2018, and our plans for 2019.

Maurice Jackson: And what are the target commodities at the Stillwater?

Michael Rowley: It's a true polymetallic system; the district itself is known for having the highest-grade palladium platinum lines in the world, and that is the three operating Stillwater mines that were bought by Sibanye in 2017, in our part of the district, in the lower part you can also add to that list gold, cobalt, and chrome are significant and we are recently finding indications of potentially significant vanadium and rhodium, you can add to that list as well.

So this suite of commodities, in particular the palladium, in light of what palladium is doing in the markets these days, positions Group Ten as one of very few options in terms of PGE investment opportunity for investors, especially if one included geography in that, being that we are outside of South Africa and Russia, in North America.

Maurice Jackson: Sir, what is the next unanswered question for Group Ten Metals, when should we expect results, and what determines success?

Michael Rowley: Good questions, news flow will be ongoing in the coming weeks, assays are coming in as we speak, we're entering them into our models and planning our strategy around that, so we're excited by what we see. I think the most exciting aspect of news is going to be the results of re-logging and modeling the more than 12,000 meters of core that we have in our possession, as we said earlier, no one has brought this land position together with the South African Platreef models, along with this physical core, so bringing these things together, and for the first time looking at this district systematically for the potential for these styles of deposits. It's very exciting and I think the first quarter of 2019 you'll see some very interesting news releases and materials along that line.

We will be at the major trade shows, we'll have core on display at the January shows in Vancouver, and we'll be at the PDAC in Toronto in March as well, and we look forward to seeing anybody and everybody there.

Maurice Jackson: Sir, we've covered the good, what keeps you up at tight that we don't know about?

Michael Rowley: Well, frankly, our share price isn't where I'd like it to be and I don't think it reflects the potential of the company, that is of course seasonal and the juniors (miners) do generally get hit harder this time of year, however, gold has held up very nicely, and other commodities are following it, and the majors have moved up nicely. So I think we can expect a good rebound in 2019 from the mining sector, and from the juniors, and then, of course, there was also our own work, especially Stillwater I think will get some nice life, in addition to the rising tide, that floats all boats.

Maurice Jackson: Finally, what did I forget to ask?

Michael Rowley: Well, it's not that you forgot to ask, but let's revisit and touch on something we've talked about before, the fact that 75% of the world's PGM metals come out of South Africa—this has been written up very well recently by the CMP group out of New York—a lot of those mines are facing closures, they've been underfunded for years, and this is expected to drive the platinum price substantially into the year 2020.

Palladium, of course, is already up and platinum is expected to follow. It's worth noting, perhaps, that those are reef mines, they're deep, they're hot, they're expensive, they're dangerous, the mines of a Platreef, north of the Bushveld, are our current model with Stillwater, and those are highly economic and they keep producing, and that's what we expect to bring to Stillwater for everyone's benefit.

Maurice Jackson: Mr. Rowley for someone listening that wants to get more information on Group Ten Metals, what is the website address?

Michael Rowley: Website is grouptenmetals.com.

Maurice Jackson: And as a reminder, Group Ten Metals trades on the TXS.V:PGE, and on the OTCQB:PGEZF; for direct inquiries please contact Chris Ackerman at 604-357-4790 extension 1, or email [email protected], as reminder Group Ten Metals is a sponsor of Proven and Probable, and we are proud shareholders for the virtues conveyed into today's interview. Last but not least, please visit our website www.provenandprobable.com where we interview the most respected names in the natural resource space. You may reach us at [email protected].

Michael Rowley of Group Ten Metals, thank you for joining us today on Proven and Probable.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

[NLINSERT]Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Group Ten Metals. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Group Ten Metals is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.