1. Introduction

As Avrupa Minerals Ltd. (AVU:TSX.V; AVPMF:OTC: 8AM:FSE) was experiencing delays in finalizing its option agreement on its Portuguese projects with a major copper producer, time was running out on one of its most important claims. A certain amount of exploration work had to be completed on its flagship project Alvalade by the end of 2018, so Avrupa decided to raise the necessary cash on its own, in order to initiate the intended drill program. Although the share price resides at all time low levels, which means dilution is at its worst, the amount and share structure allow for this, and this is actually a blessing in disguise in my view. It is the first time that Avrupa, always a classic, full-on prospect generator, turns towards a hybrid prospector generator model, instead of relying on JV partner paying for most of the expenses.

The classic prospect generator model is a relatively risk- and dilution-free way of operating exploration projects, but on the other hand a prospect generator needs a very successful discovery before investors reward it with substantial share price appreciation, and most of the time the agenda of the majority JV partner isn't aligned with the minority junior and its shareholders. On top of that it is often very difficult to determine the value of a minority share of such a project as it is controlled and defined (internal resource estimates, studies, etc.) by an outside party. With Alvito coming back and Alvalade being drilled now, Avrupa outright owns 100% of both projects, and gets to benefit in full when drilling provides positive outcomes.

If this is the case, the company might raise more money at hopefully higher share prices, and advance things even further by itself. Personally I prefer this scenario as it provides the possibility for a real multi-bagger, considering the current market cap and share structure. This hybrid prospect generator model with some self financing of flagship projects was also the very reason for me to finally start covering Avrupa, as I am not a big fan of pure-play prospect generators, considering reasons mentioned above. In this analysis I will discuss the potential of its projects, and potential impact on valuation if things go as planned.

All presented tables are my own material, unless stated otherwise.

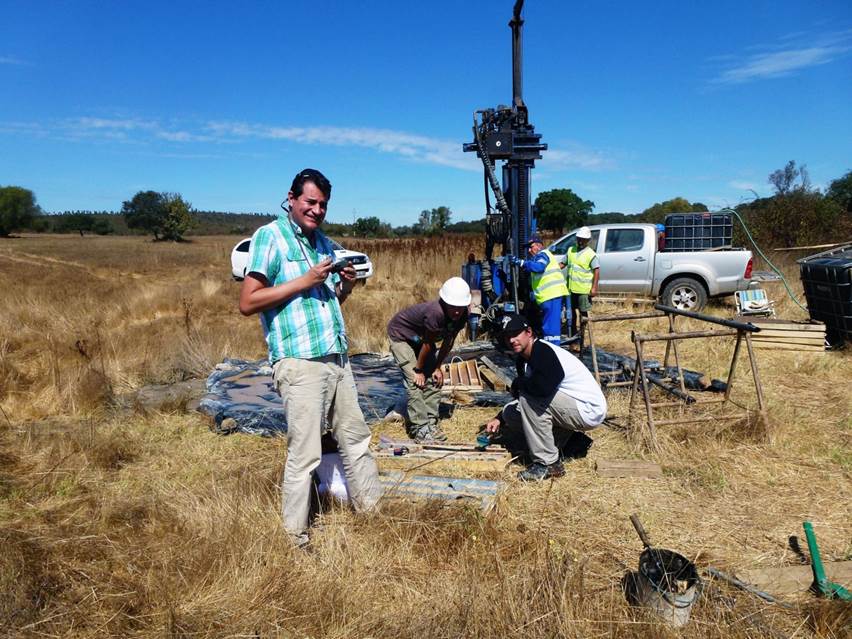

All pictures are company material, unless stated otherwise.

All currencies are in U.S. dollars, unless stated otherwise.

2. The company

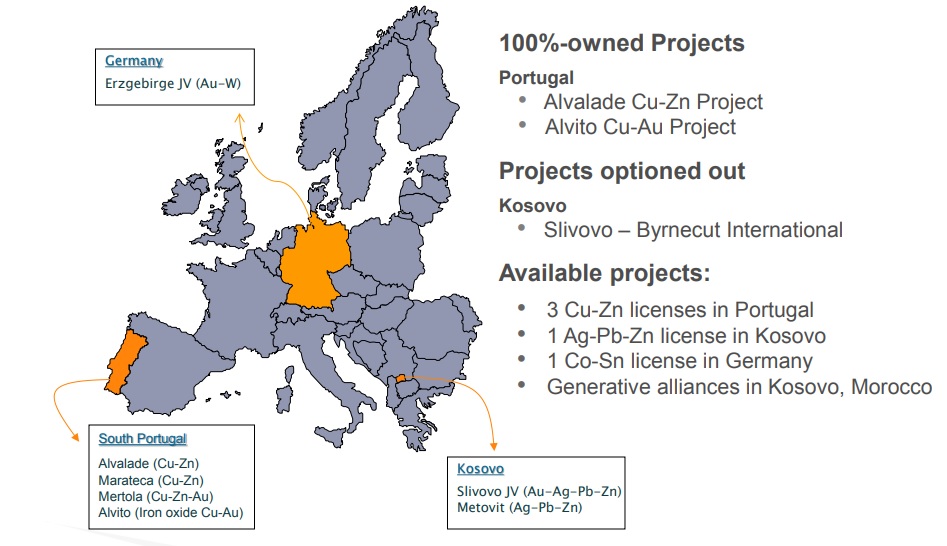

Avrupa Minerals is a Canadian exploration and development company focused on creating shareholder value through advancing base metal projects in Europe. The company model is a modified prospect generator model, as management decided to finance and drill its flagship project, Alvalade, itself. Avrupa's most important projects, Alvalade and Alvito, are located in south Portugal. Alvalade is located in the prospective Iberian Pyrite Belt (IPB), the largest iron/copper/zinc massive sulfide belt in the world. The Alvito Project is located in the adjacent Ossa Morena Zone, and the target there is an iron oxide-copper-gold deposit.

The company has two more projects in Portugal, which ranks 11 out of 91 for the Policy Perception Index (PPI) according to the most recent Fraser Institute Survey of Mining Companies. The PPI is the most important figure of this survey, as it indicates the mining friendliness of a jurisdiction, which encompasses corruption, permitting, speed of administrative processing, politics, local sentiment, etc. Besides Portugal, Avrupa also has two exploration projects in Kosovo and one in Germany, and has reviewed a few Moroccan copper prospects.

The management team has industry veteran CEO Paul Kuhn at the helm, who, as a geologist, has several decades of experience ranging from exploration to production. He has been exploring for gold, silver, base metals, uranium and phosphate, and has been involved in several significant discoveries, including polymetallic, gold and copper-gold deposits in Turkey, of which the most significant ones were Tac, Corak and Cöpler (now owned by Alacer Gold). Kuhn was also the CEO of the former owner of the Portuguese projects now owned by Avrupa, and came over in 2010 when Avrupa bought these projects.

Another key figure is Executive Chairman Mark Brown who founded Avrupa Minerals in 2008, as president of Pacific Opportunity Capital, his family fund, which is basically an incubator for many junior mining companies. Its most successful exit was Rare Element Resources. Brown was the CFO of Miramar Mining and Eldorado Gold before he joined his father, John Brown, to build out Pacific Opportunity Capital. He is the largest shareholder with 13.4 million shares (13% of O/S) and regularly supports the stock at lows.

Avrupa Minerals has its main listing on the main board of the TSX Venture, where it's trading with AVU.V as its ticker symbol. With an average volume of about 101,524 shares per day, the company's trading pattern is reasonably liquid at the moment, and I expect this to improve when drilling results will start to come in during Q1, 2019.

The company currently has 93.8 million shares outstanding (fully diluted 152.1 million), 41 million warrants (the majority is due @C$0.15 or more, of which 23.6 million warrants are expiring on July 4, 2019, and July 12, 2020) and several option series to the tune of 7.3 million options in total, the majority priced at C$0.10 and expiring from July 15, 2020 onwards. Avrupa sports a tiny market capitalization of C$5.16 million based on the December 21 share price of C$0.055. The company is basically controlled by management, as 46% is held closely by management, Board of Directors and insiders. When the current C$1.5 million financing @C$0.05 with a full warrant will be closed, which is expected in the next weeks, Avrupa will have a working capital position of about C$1.4 million. A first tranche of C$0.5 million was already closed at November 9, 2018.

Share price; 3 year time frame

As can be seen in the chart, the current financing had a big impact on the share price, as interested parties for the full warrant routinely sell their shares when they hear of an upcoming capital raise in order to buy back lower into the financing, and get the coveted warrants for free. Other factors not helping Avrupa were news about the JV partner giving up on Alvito, deteriorating general mining sentiment, and tax loss selling which usually peaks mid-December. All things considered, it seems the share price has bottomed, and I view these levels as an excellent buying opportunity as I will elaborate on this later on.

3. The hybrid prospect generator model

Avrupa Minerals uses a hybrid prospect generator model as mentioned, after it used a pure prospect generator model since inception. The business model of a prospect generator consists of buying or optioning exploration projects at an early stage or even with a historical resource, do first stages of exploration before drilling, and try to joint venture with much larger companies, usually producers, in order to have the intended drill program financed by these larger companies. There is never a free lunch, so the prospect generator usually ends up as a minority JV partner, surrendering most of the project in return. I called it a hybrid as Avrupa decided to raise money and drill Alvalade itself, as the company had to spend a certain amount of exploration dollars (in this case Euros) within a certain timeframe.

This can still be a very profitable business for a junior when advancing a project into a resource could be successful, as we have seen with, for example, Reservoir Minerals at Timok. Reservoir held on to a pretty big stake in Timok along the way, but in most cases the junior converts into a 10–20% minority JV partner, or this small stake gets converted into a royalty. If exploration programs are not providing the desired success for the majority partner, the project often returns completely to the minority partner again, as a "tested and killed" opportunity. But often this doesn't have to mean that the project is worthless, as the stakes for a major are often much higher before it moves needles for them. A junior could very well still generate a company-building flagship asset out of such a drilled project, which could attract medium-sized producers instead of majors with high demands.

There are some advantages and disadvantages to the prospect generator model. In favor of this model is the spread-out risk over an entire portfolio of exploration projects, usually between three to five active at the same time, compared to the usual single asset juniors, which have much more binary outcomes from drill programs. The budgets are provided by the majority partners in the JVs, which prevents more dilution when raising money by the junior itself.

Avrupa management estimates that 65% of all exploration and claim holding costs since 2011 are financed by the majority partners throughout, so it had to raise about 35% itself, which helps the share structure meaningfully, of course. This percentage of self-financing was lowered even further to about 20% for 2018 according to management, but will rise of course again as the company financed the current drill program of Alvalade by itself. Investors in prospect generators are usually long-term investors, as there is no quick buck to be made. On the other hand, there isn't as much downside like with a single asset junior as well, when a drill program on the first project doesn't indicate a future deposit.

The most important disadvantage for a prospect generator is the difficulty of the valuation of the company for investors. On top of this, the junior is always dependent on the majority JV partner regarding determining drill programs, timelines, reports and continuation of the JV. The interests of the junior are not always aligned with the majority partner's interests as well. Sometimes the majority partner has reasons to keep drilling success or a resource or economic profitability as limited as possible, sometimes even below agreed terms on thresholds, etc., so in case of a buyout it has to pay the junior as little as possible.

Besides all this, a key aspect of good prospect generator management is the necessary ability to identify eligible projects and find majority partners for them. In other words they have to be excellent geologists and networkers. Considering the fact that Avrupa has been able to do exploration/drilling programs consistently since 2011 with large JV partners, it seems it fits the bill just nicely in this regard.

4. Projects

As mentioned earlier, Avrupa Minerals has a portfolio of projects in Europe, to be more specific in Germany, Kosovo and Portugal, and is working on things in Morocco, but the focus is clearly in Portugal at the moment, so I will predominantly discuss these projects.

The project in Germany called Erzgebirge is a very early stage gold-tungsten JV project, and currently shelved. I am not sure if any new serious mining outside the current brown coal mines have any chance of succeeding in Germany, as mining sentiment in this country is very negative according to German mining executives managing Canada-listed companies I know who have no agenda in this whatsoever. The company had this project reviewed by a German engineering firm before it acquired the project, and told me this firm noticed no such issues. Notwithstanding this, as a Dutchman living less than 100km away from the German border, I can relate to this negative sentiment towards mining or any large-scale landscape disturbance or industrial activity, and wouldn't expect too much from this project.

The Slivovo project in Kosovo was the former flagship project of Avrupa, before Alvalade. This small 99 koz @4.8g/t gold project is in the end stage of a typical prospect generator cycle, as the majority JV partner Byrnecut owns very close to 90% of the project now. It completed a PFS study, but the results of this are not public. As soon as Byrnecut reaches this 90% threshold, Avrupa's interest in the project will be converted automatically into a 2% NSR royalty. At the moment Byrnecut is in the process of selling Slivovo, which would imply a welcome cash infusion for Avrupa.

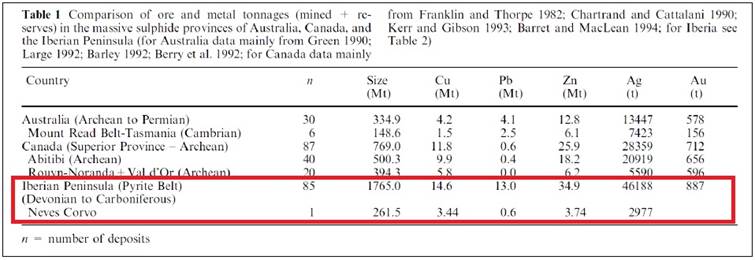

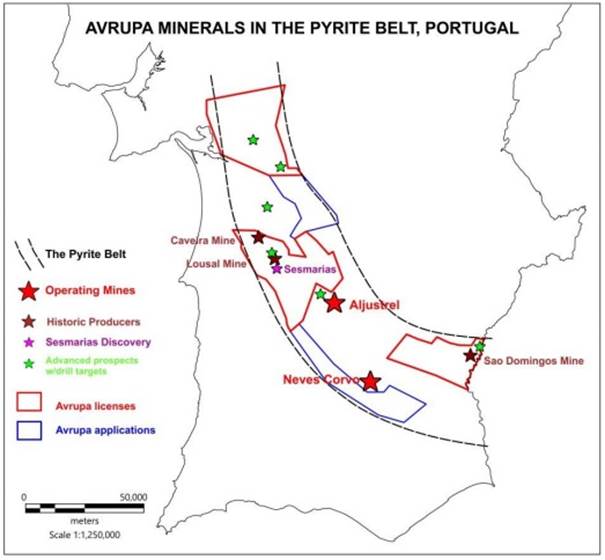

Avrupa Minerals owns huge land packages in Portugal, amounting to 1,475 km2 in total (after mandatory size reductions), consisting of flagship project Alvalade, Marateca, Mertola and Alvito. With these claims, Avrupa controls a significant part of the Iberian Pyrite Belt (IPB) in Portugal. The white colored areas on the map above represent the IPB. The IPB is the largest of its kind in the world for massive sulfides, as this table shows:

A refinement of the last map shows several trends within the IPB:

The flagship Alvalade claims are shown in red, and are part of the Aljustrel Trend and Neves Corvo Trend. If we zoom in even more, we see the other licenses of Avrupa in Portugal on the IPB:

Avrupa Minerals signed a non-binding LOI with a large North American base metal producer in March 2018, in order to option out Alvalade, Marateca and Mertola. This producer can earn in 51% on all projects by spending about C$20 million over three years. The majority of this, C$15 million, will be spent on Alvalade, a copper-zinc VMS project, involving exploration and drilling, and after this period the producer would have to produce a Feasibility Study before 2024, for another 24% on Alvalade. However, the finalization has been delayed so far without a clear outlook on an agreement, but significant exploration funding has to be completed before the end of Q4 2018 in the case of Alvalade, and Q2 2019 in the case of Mertola, to keep the claims in good standing, (to the tune of C$750K for Alvalade and C$600K for Mertola). So Avrupa management decided to raise its own cash and started drilling of its own at Alvalade.

The potential partner has to spend less on Marateca (C$3 million over the first two years) and Mertola (C$1.5 million before 2020). On a side note: in Portugal every mining project is subject to a 3% NSR, in addition to corporate taxes of 21%.

The Alvito IOCG (iron ore, copper, gold) project, which was part of a JV with OZ Minerals, was returned to Avrupa in October 2018 after the 2018 drill program wasn't successful enough for the majority partner, generating low-grade (0.10-0.20% Cu) copper intercepts. However, Avrupa did identify a 20 km2 area within the 300 km2 license that appears to have good potential for a copper-gold deposit. Enough work has been done to keep the claims in good standing during 2019, so Avrupa can search for a new JV partner without being in a hurry.

The most interesting projects are Alvalade and Mertola, as both contain former mines with historical resources. Avrupa sees an opportunity to review these past-producing mines along the lines of the Aljustrel story: a metamorphosis from a defunct pyrite mine to a world-class polymetallic mine. Another pillar of its strategy is the application of a modern era exploration model to an old district, repeating the Neves Corvo (operating copper-zinc mine of Lundin, 70km away) story, which already resulted in discoveries at Sesmarias and Monte da Bela Vista.

The Alvalade project consists out of two formerly producing mines, Lousal and Caveira, and two exploration targets: Sesmarias and Monte da Bela Vista. All have seen sampling and drilling in the recent past, and the massive sulfide discovery at Sesmarias, about 7 km away from Lousal, is the current focus of management, as it believes it could be an extension of the nearby reclaimed Lousal mine, which, for now, is a mining museum.

Former Lousal Mine

This former mine produced gold and silver from pyrite ore, and historical data indicates that only 15–20Mt of mineralized material has been mined of a total estimated orebody of about 50Mt. Besides the gold and silver, this deposit reportedly contains 0.7% Cu, 1.4% Zn and a bit of lead (Pb), which could point towards a possibly economic deposit of 30–35Mt according to management. The Lousal mine is situated on the Alvalade license. The museum is owned by the Lousal Foundation, and the government has provided funding and support for a remediation project there. However, this foundation is open to discussion about exploration in/around the mine area. The next phase of work would include verification and upgrade of the deposit.

Avrupa had an mining engineer do a cursory informal study, which indicated an economic project at current metal prices with a 50Mt, 20 year LOM, 2–2.5Mt/year underground mine at a grade of 2% CuEq, and a capex of US$800–850 million. No NPV or IRR numbers were disclosed by management. According to management, it is important to note that the mine produced only iron sulfide (pyrite) for the business of sulfuric acid production for the fertilizer industry during the 20th century, and was never explored for copper and zinc "impurities." Management expects that exploration for copper and zinc within the iron sulfide mass will be instrumental in upgrading the deposit.

For now, Avrupa intends to prove up an estimated target of 20–25Mt @ 2%CuEq for starters.

On a side note, with stories like this I am immediately interested in knowing what happened to the copper and zinc in the historically processed ore, as they were only looking for iron sulfides at the time. According to management, some copper and zinc was undoubtedly extracted at the smelter, but miners mined away from higher grade copper and zinc areas in the mine. The Alvalade project has been optioned out twice by Avrupa, to Antofagasta and Colt Resources. Antofagasta returned it as it didn't meet its thresholds, although it discovered Sesmarias, and Colt went bankrupt.

The other project that has a historical resource estimate is the Mertola copper/zinc project. The closed Sao Domingo mine reportedly has a historical resource of 27–30Mt @1.25% Cu, 3.0% Zn and 1.0% Pb, which is about 2.5% CuEq, contained in a single sulfide lens, unusual for the IPB, as normally there are more lenses. Therefore, the company will design an exploration and drilling program to search for them.

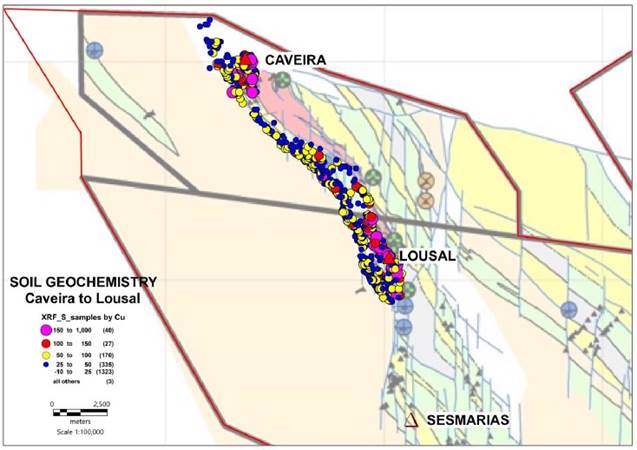

Sampling between Caveira and Lousal indicates that there might be a continuous, prospective mineralized zone in the Pyrite Belt rocks. This is a high priority exploration target for management.

The company has apparently lots of targets to choose from, but after close examination of data it picked the Sesmarias target to delineate further first.

5. Sesmarias Exploration

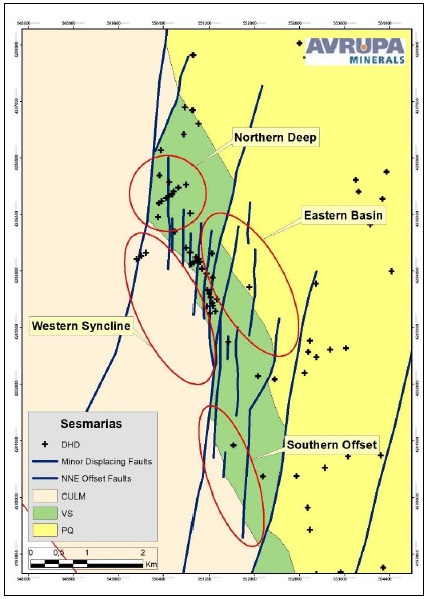

Avrupa Minerals has started drilling very recently at Sesmarias. Targets were based on drill/sampling results generated by the two earlier JVs involving Antofagasta and Colt Resources. Management distinguished four distinctive target zones, which are indicated on this map:

As the blue lines are fault lines, it will be clear that a structural logic of displaced zones can be conceptualized, but it will take a larger amount of drilling to determine/define these mineralized zones. The target zones are described by the company like this:

- Eastern Basin – Off-hole EM conductor suggests steeply dipping massive sulfide target.

- Southern Offset – The displacement of the SES010 massive sulfide body; target constrained geologically by previous drilling.

- Western Syncline – Structural and geophysical target; western limb of Sesmarias anticline rolls over into a syncline under younger rocks and further to the west an anticline which is "exposed" by magnetic anomaly: thus a repeat of mineralized section.

- Northern Deep – Historical drilling along a NE-SW fence shows increasing thickness and grade of semi-massive to massive sulfide material at depth; known sulfides lie in proper stratigraphic horizon, but have never been tested at depth.

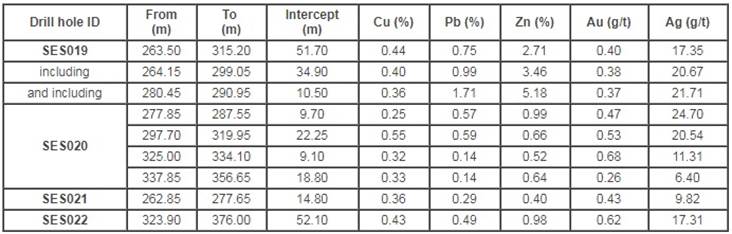

Drilling by Antofagasta outlined mineralized zones with several economic polymetallic intercepts, mostly dominated by copper. Highlights of this program looked like this:

- SES002 – 10.85 meters @ 1.81% Cu; 75.27 ppm Ag; 2.57% Pb; 4.38% Zn; 0.13% Sn

- SES006 – 1.5 meters @ 1.66% Cu; 54 ppm Ag; 2.30% Pb; 3.66% Zn; 0.091% Sn – mineralization cut off by faulting

- SES008 – 5.0 meters @ 0.64% Cu; 36.8 ppm Ag; 0.94% Pb; 1.54% Zn – mineralization cut off by faulting

- SES009 – 2.3 meters of massive pyrite (not analyzed)

- SES010 – 57.85 meters @ 0.45 g/t Au; 25.1 g/t Ag; 0.32% Cu; 0.61% Pb; 1.95% Zn

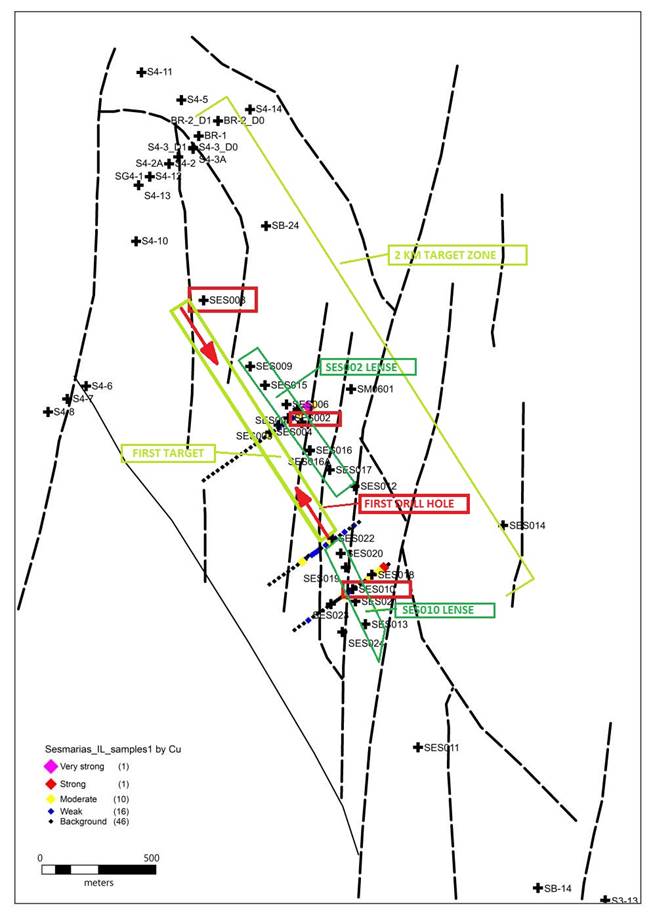

Delineation of a resource is not very easy in this area yet, as the geology is interfered by lots of faults, as can be seen here in this hand-drawn map by the company geologists (dotted lines are faults, small crosses are diamond drill holes, squares are sample locations, I added all the colored items):

This program resulted in the interpretation of two mineralized conceptual lenses, discovered by SES002 and SES010, indicated on the map in dark green. The Colt JV resulted in the SES010 lens having a longer strike length to the north (about 400m long, 175m deep and 25–30m wide), based on a few solid assays:

This lens alone already would generate 400 x 30 x 175m = 2.1M m3, at a gravity of 4.0t/m3 for massive sulfides this could result into 8.4Mt @ 1.7% CuEq, which is a decent start. According to the map and to CEO Paul Kuhn, he sees potential for a 2km mineralized strike length, and there might be more as an off-set at SES002. If these zones are continuously mineralized as the 400m zone, Avrupa is looking at 25-50Mt @1.5-1.7% CuEq. As this is a VMS zone, chances are that there are more mineralized bodies, as they typically appear in clusters. Other features of VMS deposits are the location of copper near the feeder structure and zinc farther away from the copper zones, and smaller deposits near surface when larger deposits can extend to great depths.

The company is using exploration techniques I didn't know before, among those are the mise-a-la-masse (MALM) geophysical survey, which is an electrical downhole scan, and the ionic leach geochemical method, which is a cheap sampling method but much more sensitive compared to usual soil sampling, as it measures metal gas ions. So far the MALM scan indicated a 300m long anomaly along the SES010 lens, past drill hole SES022, which it is drilling now at 150m step-out increments along strike to the northwest. Drilling has started 150 meters past SES022. Avrupa is planning the same for the zone starting at SES008, drilling step-outs to the north and south from there.

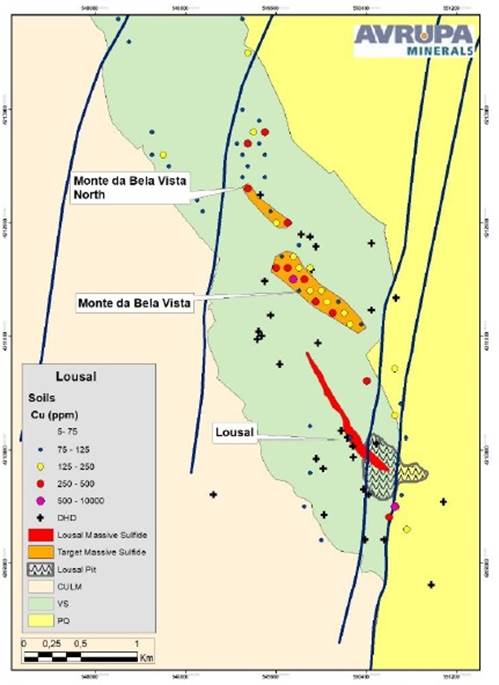

Management is planning to drill Monte da Bela Vista after this, and it thinks this could be the feeder system of it all at depth. The following map gives an indication of location and size of this target:

In red is visible what management perceives as the potential remaining resource of Lousal. As can be seen, the Monte da Bela Vista targets are substantial on their own as well. A drill program is currently being designed and will be executed after drilling is completed at Sesmarias, time and funding permitting. The program has to be completed by mid-January.

6. Conclusion

Avrupa Minerals has finally decided not to be completely dependent on JV partners anymore, as the current JV deal takes too long to finalize, and would jeopardize the good standing of its flagship Alvalade. C$0.5 million is already raised, another C$1 million is planned to close soon. The targets that are going to be explored in Portugal aren't small so a lot of cash is needed, and management is aiming at nothing less than finding a replica of the nearby Aljustrel deposit, which is successfully being mined for base metals at the moment.

Avrupa has several options to emulate this, and it is starting out by drilling Sesmarias, which could be the missing half of the next door former Lousal Mine. If the company succeeds in defining a 20+ Mt @ 2%CuEq resource, which should be economic according to management and a rather large project for a tiny junior like Avrupa, a re-rating could be a very real possibility. Especially since the markets are suffering from tax-loss selling at the moment, sending lots of stocks to 52-week lows like Avrupa, it looks like a very interesting buying opportunity.

And finally, have a Merry Christmas and a Happy New Year!

Alvito project

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at http://www.criticalinvestor.eu/, in order to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

Read what other experts are saying about:

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Avrupa Minerals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.avrupaminerals.com and read the company's profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Streetwise Reports Disclosure:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: Avrupa Minerals. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own shares of Avrupa Minerals, a company mentioned in this article.

Images and charts provided by the author.