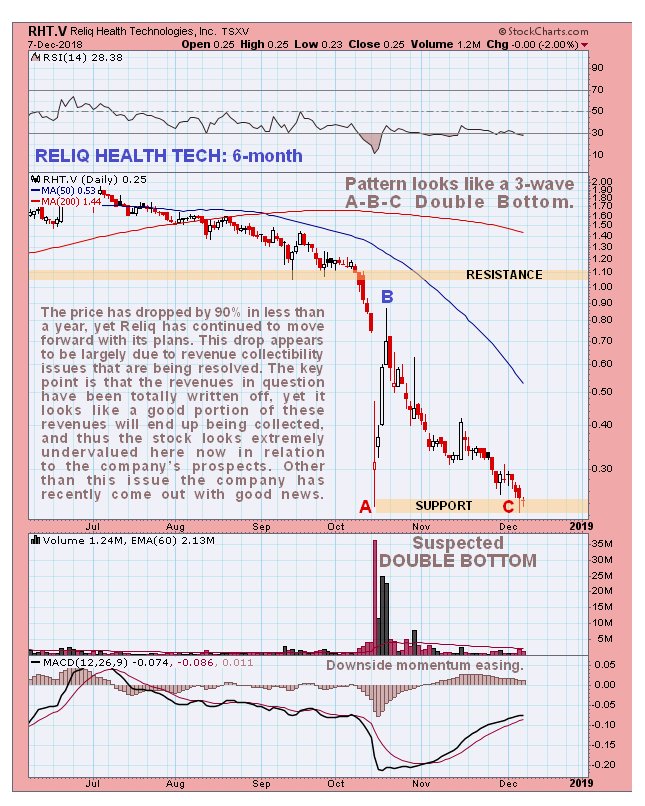

Reliq Health Technologies Inc. (RHT:TSX.V; RQHTF:OTCQB) has been through a classic boom and bust cycle, as we can see on its latest 18-month chart below, but the huge 90% loss from the peak is considered to be out of proportion to any change in the company’s fortunes. As far as can be ascertained the company's business seems to be continuing to go well, and the problem that has triggered this severe decline is centered on revenue collectability issues. As a result of these the company "bit the bullet" and wrote off some revenues completely, which is what caused the stock to crater in October, yet it would appear that they are in due course going to actually receive a goodly portion of these revenues, and if this is the case, then the stock is severely undervalued here. Aside from this issue the company has been coming out with good news, including being selected by Premier Health Group as its exclusive technology partner.

Technically the stock looks due for a substantial rebound soon after its recent pummeling. The gradual decline from the peak last February–March, which saw it get as high as C$2.62, finally culminated in what looks like a capitulative selloff in October, triggered by the earnings write down. After this plunge it rebounded sharply for a brief period before sloping off into a more gradual decline back to the vicinity of the October lows, so that the period from when it broke down into the October plunge looks like a 3-wave A-B-C flat decline that should be followed by renewed advance. What typically happens following a decline of this magnitude is that a "Son of Bubble" rally occurs, where those who missed the bubble buy in and stoke another rally, of lesser magnitude than the first one, but still very worthwhile in terms of the percentage gains it can generate.

Best case for a Son of Bubble recovery rally, which is certainly possible given the company's still favorable fundamentals, is a rally to the resistance in the C$1.10 area, but we wouldn’t look for more than that, and may be happy to settle for less, depending on what happens. Nevertheless this is still very worthwhile as it would involve a more than fourfold gain from the current low price, which could happen quite quickly—and here we should mention that this stock has probably also been suffering from end-of-year tax-loss selling. Finally it is worth pointing out that this trade has a favorable risk/reward ratio, as we can simply ditch it, if it doesn't want to play ball and drops below recent lows (on the Canadian chart), by dropping below say C$0.215, although this close a stop does risk being whipsawed out.

In conclusion, Reliq Health is viewed as an attractive speculative trade here with potential for sizeable percentage gains quite quickly, but it should be dumped if it drops below C$0.215. Reliq trades in good volumes on the U.S. OTC market. Reliq is a stock that we successfully traded in 2017, but missed the final big run-up.

Reliq Health Technologies website.

Reliq Health Technologies, RHT.V, RQHTF on OTC, closed at C$0.25, $0.187 on 7th December 2018.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

[NLINSERT]Disclosure:

1) Clive Maund: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. CliveMaund.com disclosures below. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Premier Health Inc. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Premier Health Inc., a company mentioned in this article.

Charts provided by the author.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.