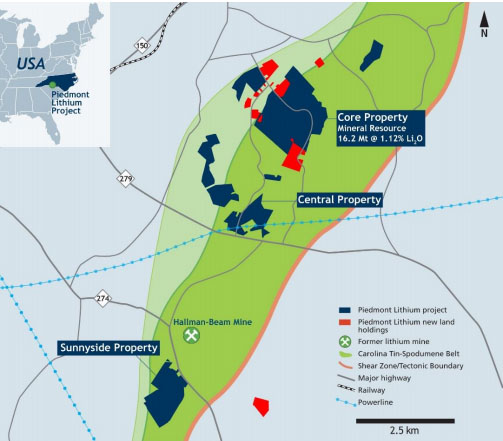

Piedmont Lithium Ltd. (PLLL:NASDAQ; PLL:ASX) increased its land package via acquisition at its Piedmont lithium project by 15% to 1,383 acres, it announced in a news release.

The acquisitions were strategic, with 122 of the purchased acres being located in the Carolina Tin Spodumene Belt (TSB), where Piedmont's Core property sits. The significant new parcels related to Core are contiguous, 55 acres in the southeast and 20 acres in the west. Together, they expanded Core's acreage by 93 acres or 18% to 622 in all.

Both of these recent acquisitions expanded highly prospective strike length at Core, the southeast acres adding more than 600 meters (600m) along the F corridor and the west acres adding more than 400m along the B corridor. "These two properties have significant potential to add to the current Core resource," the release stated.

"We have found high-grade mineralization in over 90% of the holes we've drilled on the TSB, and our expectation is that the larger our land position, the larger our ultimate resource and mine life will be," President and CEO Keith Phillips stated in the release.

Piedmont plans another drill program to explore these new properties, to upgrade Inferred resource ounces to Indicated, to change the exploration target areas to Indicated ounces where possible and to follow up previous drilling at Central. The company is currently finalizing targets for its phase four drilling.

The new land acquisitions also included 42 acres for the lithium company's concentrator and waste rock disposal locations. Several other purchased properties may be used for "future waste rock disposal, possible exchange properties for on-trend parcels, buffer zones or as conservation targets for mitigation purposes," the release noted.

The company controls these new land parcels via lease, option agreement or deferred purchase contract to minimize its pre-development outlay of cash.

Read what other experts are saying about:

Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: Piedmont Lithium. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own shares of Piedmont Lithium, a company mentioned in this article.