I had the chance to speak with Martin Cronin, CEO, and Jeff Tindale, Director, of Patriot One Technologies Inc. (PAT:TSX.V; PTOTF:OTCQX). The shares of Patriot One have been weak since the company announced the acquisition of EhEye Inc. on Nov. 27.

I'm not really sure what to attribute this weakness to. Is it the dilution? That was minimal, especially for an acquisition of a novel technology. Frankly, it's better to have a company's acquiree take stock in lieu of cash in an acquisition as it commits it to working to make the integration successful and to ensure a long-term positive outcome. Under 2% dilution for a synergistic acquisition is not a good reason to sell a stock.

I think perhaps the weakness in shares was more the result of investor fatigue. Instead of seeing more shares issued, shareholders want to hear about sales and progress with the company's systems integrator partners. If this is the case, based on the recent call, I'd suggest that investors are likely to be very happy over the coming weeks. Patriot has a plethora of good things happening and I'd be surprised if news flow doesn't pick up very soon.

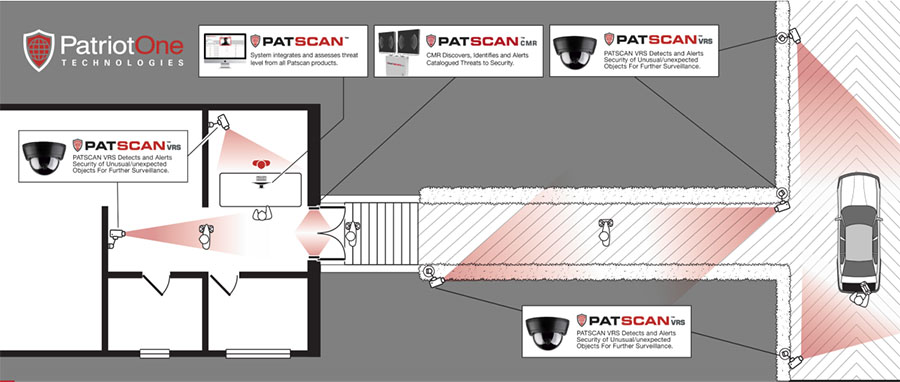

In my calls, we covered quite a few topics. But, before I get into individual items, I think it's important to remember the big picture here. Patriot One is not trying to simply sell a lot of PATSCAN CMR installations. It is looking to assemble a complete offering of security products under one umbrella. This is a large undertaking and, if successful, positions it to be a "must have" in the threat detection and prevention industry.

I believe Patriot One is on its way to achieving this goal. Management also expressed confidence in where they are in the process. As Martin said, companies like Cisco and tier 1 defense contracts would not be partnering with them if they didn't have a compelling product.

What I wrote after seeing the demonstration in Las Vegas is more true now than ever: Patriot One is assembling a very powerful suite of products and the company is on the verge of potentially huge success. Here's where it stands in terms of getting there at this time…

PATSCAN Pilots: The pilot projects are working well. While an AI algorithm will always be improving, they have achieved the required level to roll it out the PATSCAN CMR on a broader basis. The pilot facilities are now being used as customer demonstration units. Patriot One has a number of customers interested in being "client demonstration sites" and will select several of these soon. As Martin said, "we've had LOTS of customer demonstrations." It's important to note that the client demonstration sites will be PAID installations. Therefore, it's safe to assume that the company will likely have signed contracts and start customer installations very soon. Which means the target of revenue generation in Q4 is intact. As these contracts get signed, they will be announced, so news flow from customer signings shouldn't be too far off if all goes according to plans.

Cisco: the pipeline for business is large and Cisco is driving a lot of this. Patriot One was recently on the road with Cisco in Detroit, visiting a major U.S. corporation. Cisco has committed millions of dollars of effort towards this partnership, along with vetting the engineering. Proof of this lies in PATSCAN being brought into the Innovation Center, after having been substantially vetted by its lead engineer at the Center. The fact that Cisco is traveling with Patriot One and showing the company off to its clients show the excitement that Cisco has for this program.

Defense Contractor: it appears that Patriot One's unnamed partner is looking to get this deal announced in 2018 and is, therefore, pushing hard for approval before the end of the year. As everyone knows, this is a major defense firm and the terms (which have yet to be disclosed) have been negotiated; it's all about the approval, which has taken a while. However, when you think about the big picture here, similar to Cisco, you have a partner that has dedicated time and resources, including substantial technical due diligence, into this relationship. It is going to make a non-dilutive investment into developing this project, an investment of potentially several million dollars. This is a major endorsement of where Patriot One is with its product development.

TSX: Martin confirmed with me that Patriot One qualifies for a TSX listing. It is my suspicion that it will be looking to relist its shares on the TSX from the venture exchange. This would open the company up to a much larger pool of potential investors.

Other products: per the company's recent press release, "Additional technology candidates for potential inclusion into the PATSCAN product line-up are currently undergoing technical assessment, focus group and marketing evaluation." Martin went out of his way to say that, with its strong balance sheet and solid partners, many companies are coming to the company looking to partner. One deal in particular has been rumored to be about to close. I suspect Patriot One will have an announcement regarding this soon.

Daniel Carlson is the founder and managing member of Tailwinds Research Group and its parent company DFC Advisory Services, which is a licensed registered investment advisor (CRD # 297209). Tailwinds is a microcap focused research company that provides research on and consults to over 20 emerging growth companies in the technology and life sciences arenas. DFC Advisory Services is an RIA that manages money dedicated to investing in the companies covered by Tailwinds. For more information on these two companies and their track record, please see www.tailwindsresearch.com. Prior to founding these two entities, Dan spent many years working with small public companies, having been CFO of two public companies and helping finance many others. A 1989 graduate from Tufts University with a degree in Economics, Dan’s formative years in business were spent as an equity trader, first on the Pacific Coast Stock Exchange then on the buyside at several multi-billion dollar firms.

This article was submitted by Tailwinds Research. For more information on Tailwinds Research or on Patriot One, please visit www.tailwindsresearch.com.

Tailwinds is engaged by Patriot One and owns stock in the company. For a complete list of disclosures, please click here.

Read what other experts are saying about:

Disclosure:

1) Daniel Carlson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Patriot One. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies referred to in this article: Patriot One. Additional disclosures and disclaimers are above. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Patriot One. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Patriot One, a company mentioned in this article.