In a Nov. 28 research note, analyst Bill Newman reported that Pulse Oil Corp. (PUL:TSX.V) yielded "favorable results" from completion of phase two of the enhanced oil recovery (EOR) reservoir modeling of its two Bigoray Nisku reefs in central Alberta. The final, phase three, solvent and injection development study is now underway and should be finished by year-end 2018.

In the note, Newman described each of the three stages of the EOR modeling project.

Phase one involved analyzing and interpreting the logs and petrophysical data from 15 wells drilled in the two Nisku pools and then conducting the same with 10 cores also from the two pools. Those studies "confirmed excellent reservoir properties," Newman pointed out. Specifically, they showed the Nisku D and Nisku E reservoirs have "a trimodal porosity system, with matrix, vugular and fracture porosity that compares favorably with offsetting pools, where EOR implementation has resulted in recovery factors as high as 85% of petroleum initially in place."

Phase two consisted of constructing a reservoir model that incorporated the petrological and petrophysical data collected in phase one along with the company's three-dimensional (3D) seismic data. "This is the first time that 3D seismic data has been applied to the evaluation of these pools, which helped to better define the pool boundaries and could increase the interpretation of the structure closure," noted Newman.

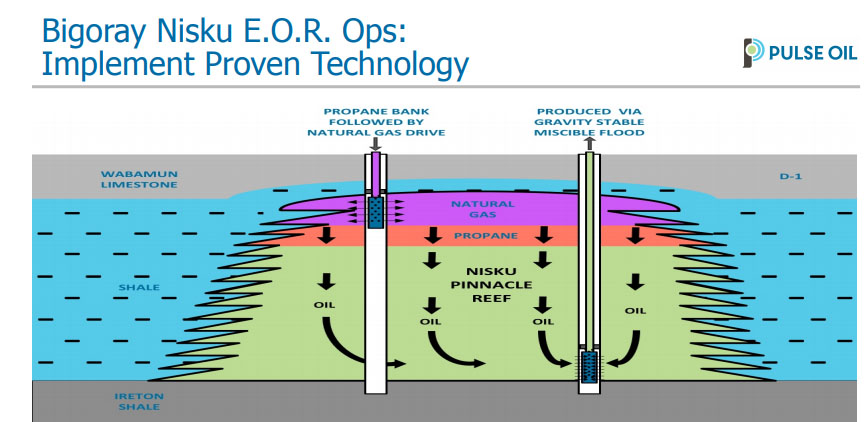

Phase three entails simulating various solvent and injection scenarios to determine the best type of solvent for injection and the ideal locations for the production and injection wells. These determinations should ultimately help maximize oil recovery from the Nisku D and E reservoirs.

In other news, Pulse received approval from the Alberta Energy Regulator for transfer of the remaining ownership of the Bigoray Nisku D and E pools. Now owning 100% of both, the company plans to reactivate them soon.

Mackie has a Buy recommendation and a $0.50 per share target price on Pulse, whose stock is currently trading at around $0.16 per share.

[NLINSERT]Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Disclosures from Mackie Research, Pulse Corp., Update, November 28, 2018

RELEVANT DISCLOSURES APPLICABLE TO COMPANIES UNDER COVERAGE

Relevant disclosures required under Rule 3400 applicable to companies under coverage discussed in this research report are available on our web site at www.mackieresearch.com.

ANALYST CERTIFICATION

Each analyst of Mackie Research Capital Corporation whose name appears in this report hereby certifies that (i) the recommendations and opinions expressed in this research report accurately reflect the analyst's personal views and (ii) no part of the research analyst's compensation was or will be directly or indirectly related to the specific conclusions or recommendations expressed in this research report.

Within the last 12 months, Mackie Research Capital Corporation has managed or co-managed an offering of securities by the subject issuer.

Within the last 12 months, Mackie Research Capital Corporation has received compensation for investment banking and related services from the subject issuer.

Mackie Research Capital Corporation, its directors, officers and other employees may, from time to time, have positions in the securities mentioned herein.