Copper Mountain Mining Corp. (CMMC:TSX; CPPMF:OTC.MKTS; C6C:ASX) is listed on three exchanges, although the highest daily share turnover (by a factor of 5 to 10x ASX turnover) is on the Toronto TSX. The company is a medium rank copper producer, with byproduct gold and silver, with its mines located in two of the lowest sovereign risk countries in the world, Canada and Australia. The company has a total of 203.1 million fully diluted shares in issue, which includes 187.9 fully paid up ordinary shares and 10 million options and 5.1 million warrants. Management and insiders own a total of 8% and institutions are holding 45% of the stock. At today's TSX share price of C$1.03, the current market capitalization is C$194 million or US$148.4 million. The Enterprise Value is C$453.9 million, including C$248 million in long-term debt with total liabilities at C$392 million and a debt to assets ratio of 41.23%.

The current P/E ratio stands at 5 and the Bloomberg (BEst) P/E ratio stands at 10.88. EPS stands at C$0.22. Price to Book Ratio stands at 0.84 and Price to Sales Ratio stands at 0.49.

Q2 2018's last financial results show that the Copper Mountain Mine produced 20 million pounds of copper, 6,500 ounces of gold and 68,400 ounces of silver, giving a revenue of C$84.2 million. Cash flow from mining operations was C$40.1 million producing an EBITDA of C$22.6 million. Q3's financial results will be out by the end of the first week of November.

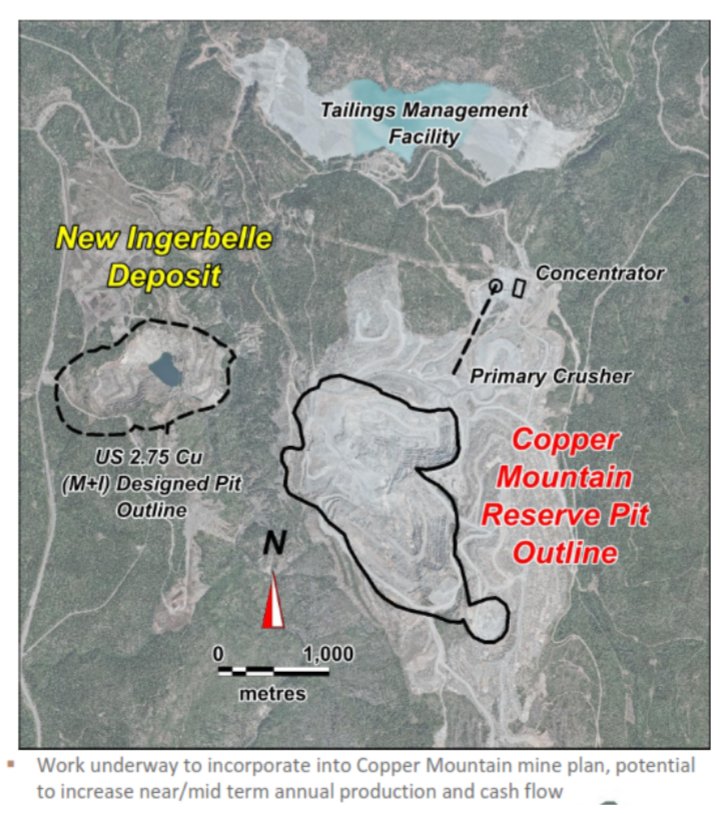

CMMC's core asset is its 75% (Mitsubishi 25%) owned Copper Mountain alkalic porphyry copper mine located in southern British Columbia, shown on Figure 1 below. However, CMMC has further emergent copper–gold producers, such as the 75%-owned Ingerbelle deposit, located 1 kilometer NW of the current open-pit mining operations, as well as the 100%-owned Eva copper project (Figure 2) located in the Mount Isa Inlier of Central North West Queensland, Australia. Hence, the upside potential is considerable.

Plate 1: Summary location map of the Copper Mountain – Ingerbelle porphyry copper + (gold) Mine in Southern British Columbia, some 300 km east of Vancouver.

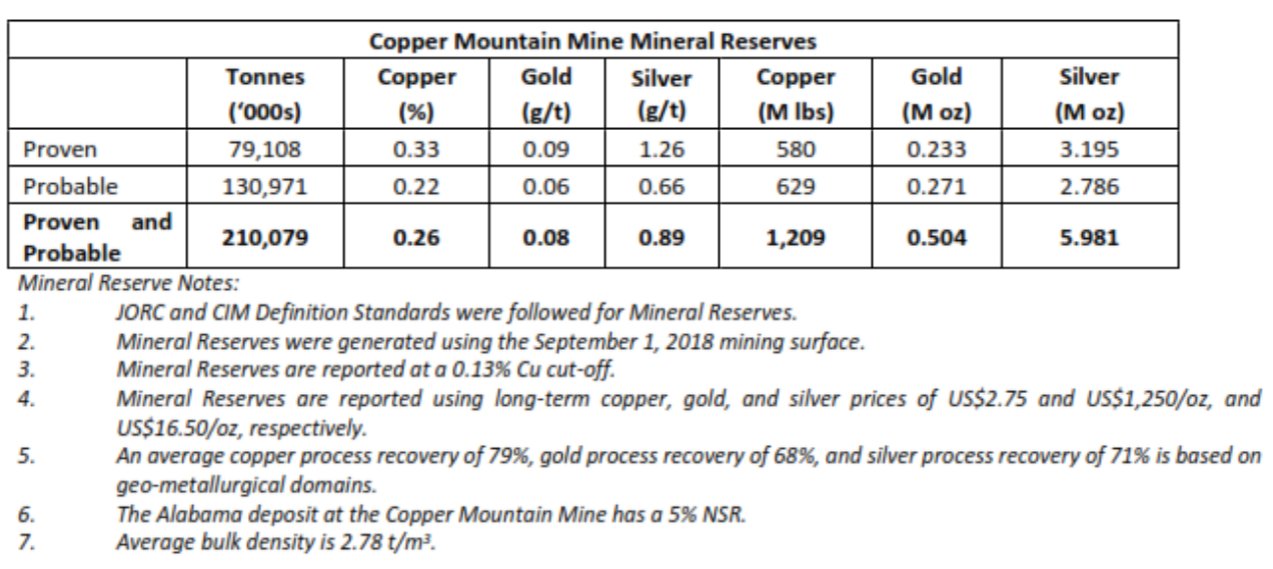

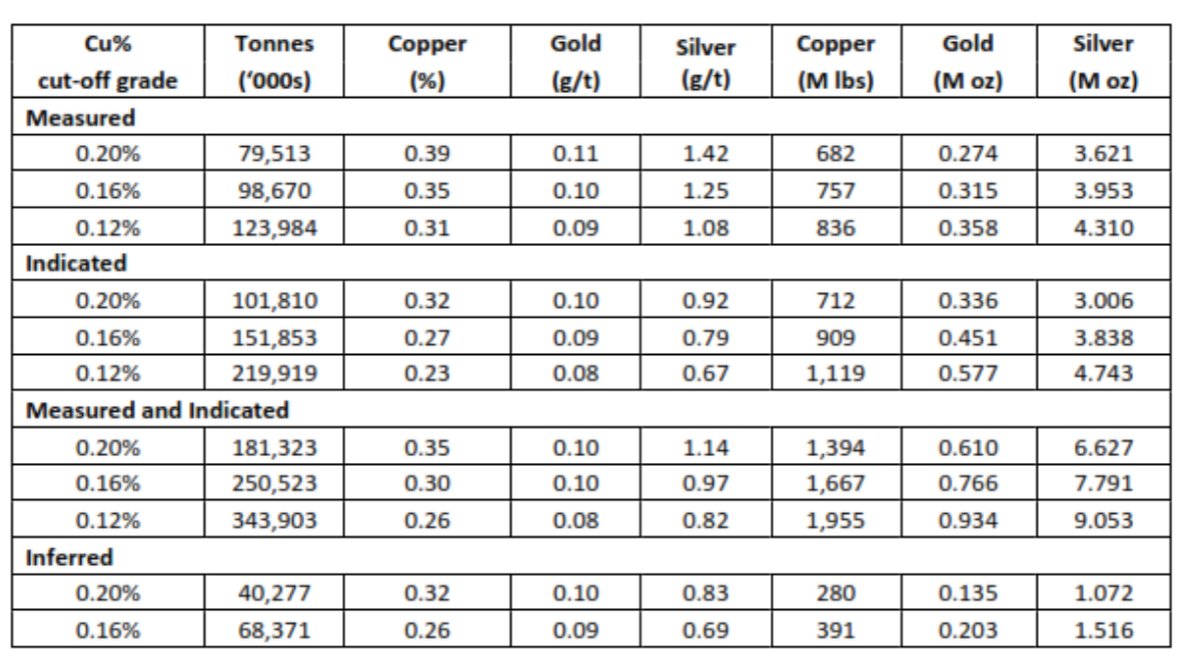

As shown on the detailed Table 1 below, the latest CMMC Ore Resource update, with overall resources having increased by 36%, as of 1st October 2018. The table illustrates clearly that the Copper Mountain project is a modest sized low-grade open pit porphyry copper + (gold) deposit, with a low to moderate stripping ratio of 2.88:1, whose overall profitability is very sensitive and leveraged to the C$ copper price and, to a much lesser degree, the gold price. Annual production is around 80 million pounds of copper in concentrates, with modest gold and silver credits of around 25,000 ounces of gold and 270,000 ounces of silver. Given the low grade of the deposit, the stripping ratio becomes more significant as a cost component. To further highlight this copper price sensitivity, during the last financial year overall profitability was reduced by 30.63% due to lower average copper prices.

Plate 2: A view across the Copper Mountain Open Pit Complex (Pits 1 through 3 being merged into a Super Pit).

Plate 3: A monochrome aerial photograph of the Copper Mountain Mining Operations showing basic mine infrastructure and the location of the new Ingerbelle porphyry copper + (gold) deposit less than 1 km WNW from the main open pit.

Cash operating costs currently amount to U$2.10 to 2.20 for years 1 to 3; i.e., 2018 to 2020. Thereafter, these cash operating costs increase to U$2.25 to 2.45 in Years 4 to 10 and then fall to U$1.75 to 1.85 at the base of the open pit where the stripping ratio is substantially reduced. Total material mined and removed over the life of the mine has been estimated at 572 million tonnes, with total ore mined amounting to 148 million tonnes and total waste rock of 424 million tonnes.

The overall metallurgical recovery of copper (79%), gold (68%) and silver (71%) all err on the low side, which with the low mined grades, further add to the price sensitivity and reduced profitability of the project and its strong leverage to the copper price. Clearly, given these figures, any significant lift in copper and precious metal prices will significantly alter the overall profitability of the project and stock price of CMMC. The mine operates a 40,000 tonnes per day (tpd) conventional crushing, grinding and sulphide flotation plant.

Table 1: 1st October 2018 updated ore resources for the Copper Mountain Mine. The table shows the impact on resources at different cut off copper grades at different resource categories applicable under Aus.IMM JORC 2012 and Canadian NI 43-101 systems.

Given the updated ore resources, shown in Table 1 above, and the anticipated production rate, CMMC have projected a 14-year life of mine at current production rates without factoring in the increased resources provided by the Ingerbelle deposit detailed below. The June 2018 production schedule for the Copper Mountain Mine is presented below.

Table 2: this summarizes the Production Plan for the Copper Mountain Mine projected over the Life of Mine (LOM) split into tranches reflecting changes in production as mining progresses to depth within the open pit. Note the progressive and significant decrease in the volume of ore mined and the fall of in grade and metal production, although cash operating costs decline due to less waste rock mining at the pit base.

From Table 2 above, it is apparent that CMMC will be looking to develop the open pit mine at Ingerbelle to replace the falling copper and precious metal production from the Copper Mountain open pit from Year 3 onward.

CMMC released an Ore Resource Estimate for Ingerbelle on 21st September 2018. In summary, this comprises a "Measured and Indicated" (M&I) resource of 151 million tonnes at a grade of 0.29% copper and 0.18 g/t gold (0.41% copper equivalent) at a 0.16% copper cut-off grade. This resource contains more than one billion pounds of copper and one million ounces of gold at a 0.12% copper cut off grade. A further "Inferred" category resource of 69 million tonnes at a grade of 0.27% copper and 0.16 g/t gold (0.38% copper equivalent) containing 405 million pounds of copper and 360,000 ounces of gold at a 0.16% copper cut-off grade has been defined.

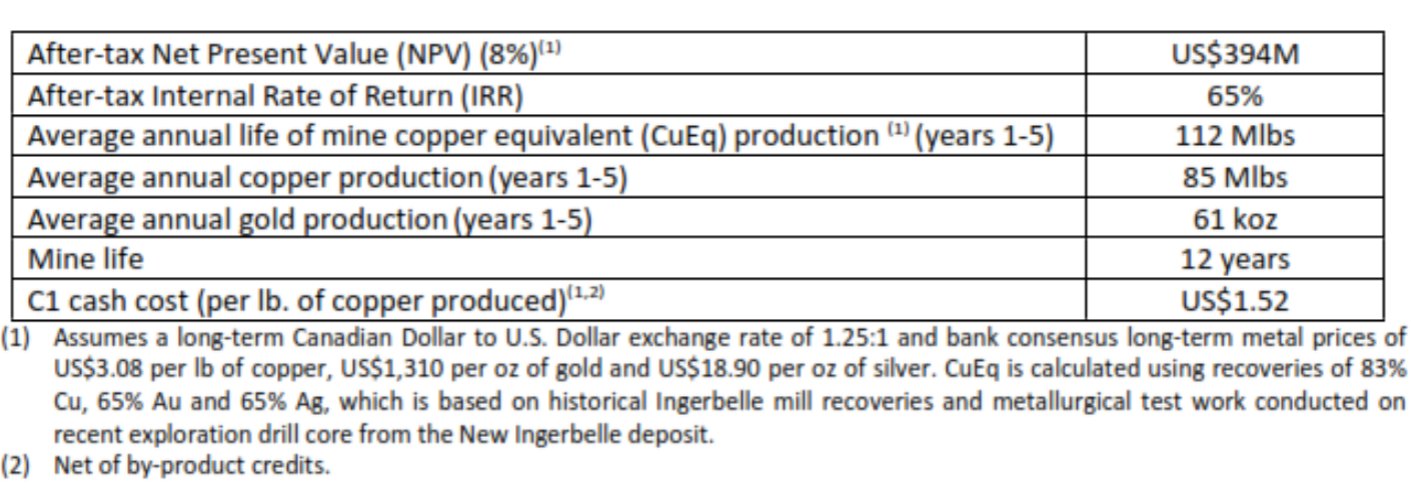

It is noteworthy that the gold content of Ingerbelle is between 200% to 300% more than that of the Copper Mountain Resource with a comparable copper grade. Hence, Ingerbelle is strongly leveraged to both the gold and copper price. A Preliminary Economic Assessment (PEA) of the Ingerbelle Project has been undertaken and its key findings are summarized in Table 3 below.

Table 3: Highlights of the PEA for the Ingerbelle Mining Project focusing on the first 5 years of production for a LOM of 12 years. Assumptions made are listed below the Table.

CMMC's other major copper project, Eva, is located in Central NW Queensland, Australia, within the Proterozoic age (1,600 to 1,500 Ga.) Mount Isa Inlier (MII), with its location shown on Figure 3 below. The MII has been one of the world's greatest metallotects, hosting world-class copper, gold, copper-lead–zinc–silver and Iron Oxide Copper Gold (IOCG) mines such as Mount Isa (Cu, Zn, Pb, Ag), Hilton (Zn, Pb and Ag), Dugald River (Zn, with lesser Pb and Ag) and Ernest Henry {IOCG - Cu, Au, Fe, (Co)}, plus numerous medium rank and smaller deposits, mostly of copper, molybdenum and gold.

The Eva Copper Project is 100% owned by CMMC. The project was acquired during early 2018 following a merger between CMMC and Australia's Altona Mining Limited (ASX), where CMMC acquired all Altona's stock for a premium of 40% above market. Infrastructure in proximity to the project is excellent and access easy.

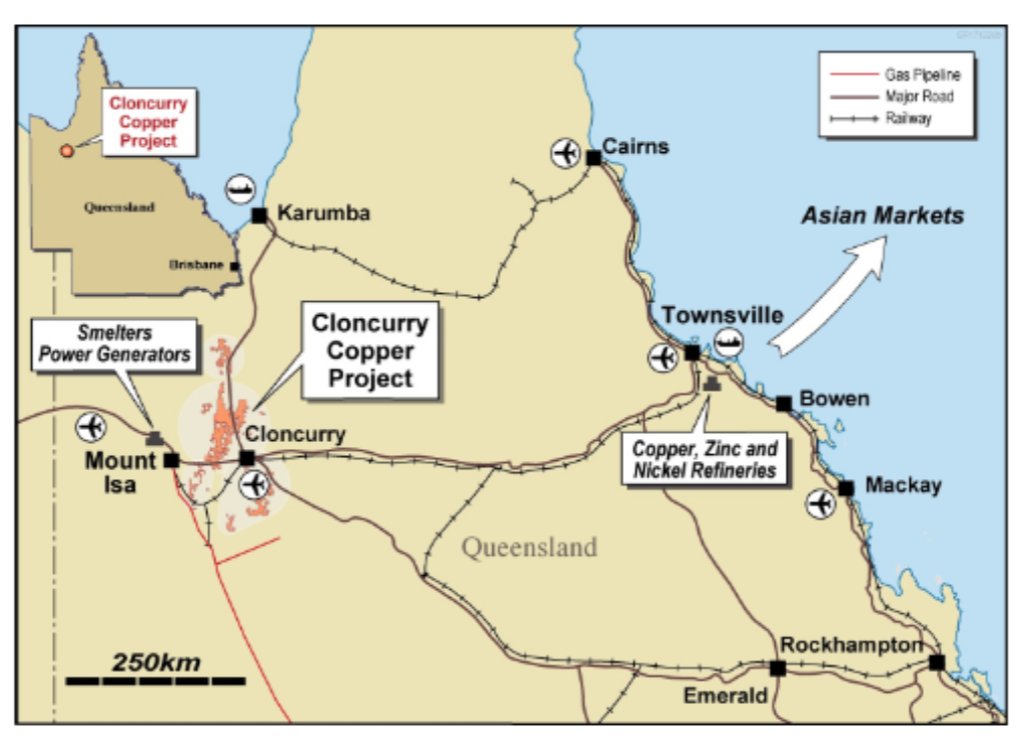

Plate 4: A summary map showing the location of the Cloncurry Copper Project, amidst the major infrastructure in the State, which includes the Eva copper deposits amongst a cluster of other neighboring smaller deposits. The project area is served by a major rail connection between Mount Isa and the Port of Townsville, a National Asphalted Highway, Power Generation (Mt Isa) and asphalted airport with direct jet flights to Brisbane, Capital of the State of Queensland.

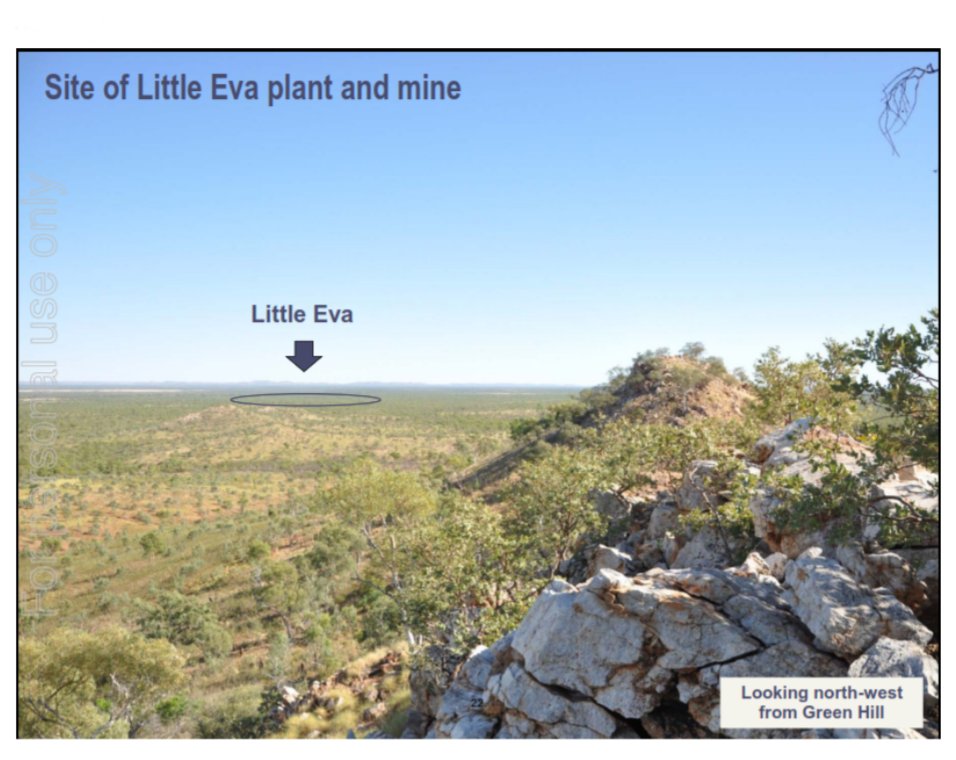

Plate 5: a photo showing the location of the Little Eva Mine and Plant.

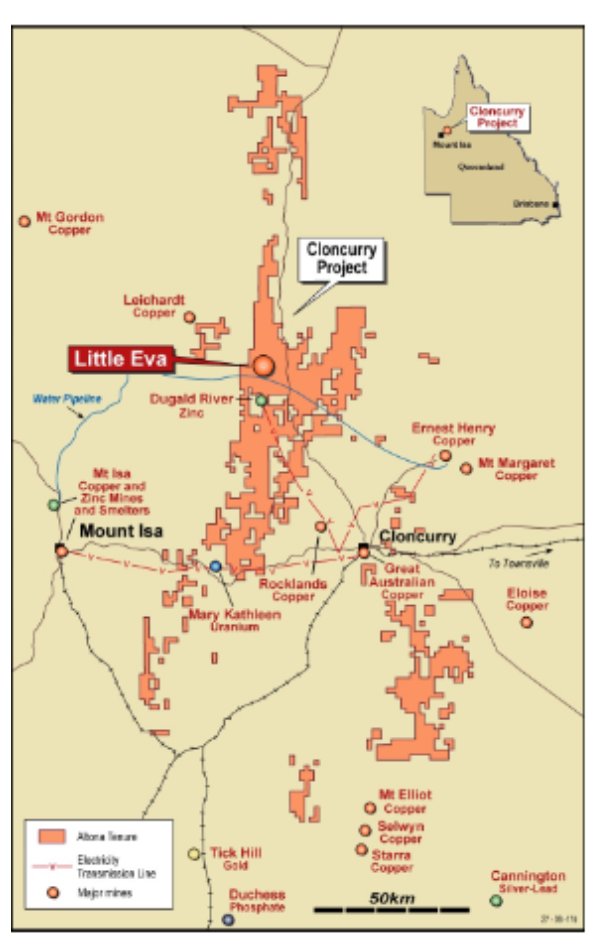

Among Altona's mineral assets, besides the Cloncurry Copper Project, the company had built up an outstanding land position comprising a total area of 3,970 sq. km in the highly prospective MII as shown on Plate 6 below.

Plate 6: A summary map showing CMMC's extensive land position in the highly prospective Mount Isa Inlier, also showing the location of the Little Eva copper project and local infrastructure.

This gives CMMC a very strong platform from which to build its overall copper and gold resource inventory over the coming years and to sustain the project's LOM through definition of further near mine resources. Initial advanced exploration targets were generated by Altona prior to the merger, at the Brolga and Reaper prospects, where deep Induced Polarisation (IP) chargeability anomalies lie directly beneath major regional copper in soil geochemical anomaly.

Prior to acquisition, Altona completed a Definitive Feasibility Study (DFS) on the Cloncurry Copper Project, which comprises four deposits, as follows: Little Eva, Lady Clayre, Ivy Anne and Bedford. Little Eva is the largest single copper project of this group and is regarded as a close geologic analogue of the Ernest Henry (GLENCORE) IOCG deposit. Mineralization at the Little Eva deposit comprises structurally controlled veins, veinlets and breccia bodies, hosted with an envelope of strong hydrothermal alteration comprising: sodium and potassium feldspars, hematite and magnetite, developed within subvolcanic porphyritic and amygdaloidal intermediate rocks. All the other deposits are substantially smaller, shear zone, faulted and vein hosted deposits developed within metasedimentary and igneous rocks.

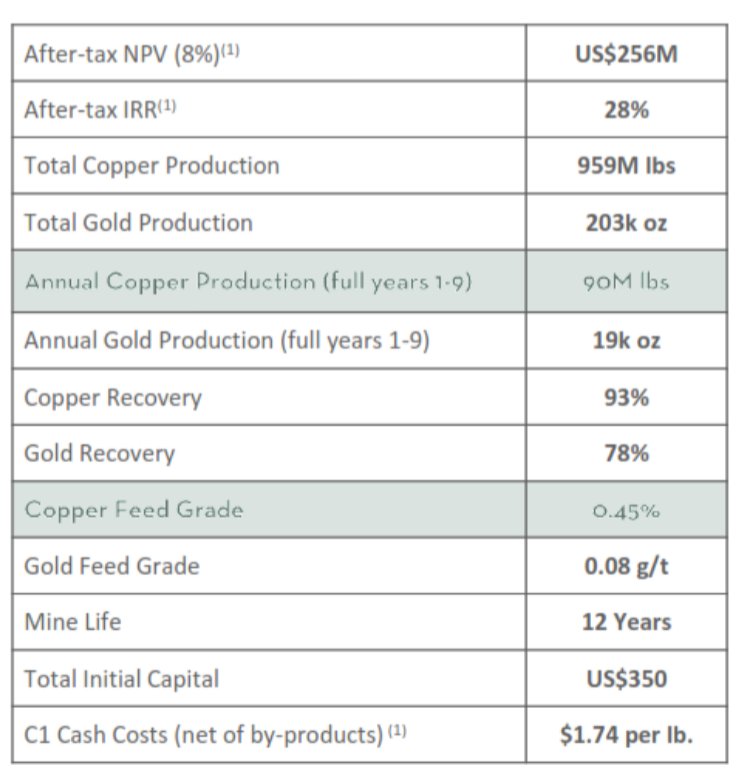

A DFS was prepared under Aus.IMM JORC 2012 Ore Resource Code, in mid-2017 by Altona for the Eva Copper Project. Following the merger, CMMC completed an NI 43-101 Project Feasibility Study in October 2018, Key findings of this study are presented below, based solely on the sulphide resources.

Table 4: key findings of NI 43-101 Project Feasibility Study in October 2018.

Conclusions and Recommendations

CMMC is now a fully fledged experienced operator of bulk tonnage low grade copper (with minor gold and silver credits) mines having cut its teeth on the Copper Mountain deposits. The Copper Mountain Mine has substantial operating upside from the development of the open pit Ingerbelle deposit that has very similar geology and metallurgy. The combined Copper Mountain and Ingerbelle deposits, plus the brownfield's exploration potential around both deposits and along the CM copper trend, in ground that CMMC holds, should sustain reserves well into the future. The merger with Altona Mining Ltd (ASX) was well timed, in market terms, with Altona having substantially augmented CMMC's overall resource base and lifted overall ore resource mine grades. The same exploration scope to substantially add to its copper and gold resource base exists at the Eva Project in Australia, given the superb ground holding CMMC holds around the projected copper operations near Cloncurry. The mining projects are moderately robust at today's relatively weak copper prices. Given the decline in overall global copper resources and the reduction in average mined grades together with the projected substantial increase in demand for copper metal from, especially, electric vehicles (EVs) and grid supporting storage batteries, the upside potential for CMMC could hardly look better. All CMMC's copper projects are highly leveraged to the price of copper. Therefore, given the foregoing metal demand projections the stock is viewed as a strong, longer term, investment play with substantial upside growth potential and scope for potentially significant dividends and/or organic growth as earnings improve.

Nigel Maund, MSc, DIC, MBA, F.Aus.IMM, F.AIG, FSEG, FGS, MMSA, is an economic geologist.

[NLINSERT]Disclosure:

1) Nigel Maund: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Charts and images provided by the author.