Aben Resources Ltd. (ABN:TSX.V; ABNAF:OTCQB) whacked it out of the park on Thursday with the release of assays from the first hole of the summer drill program at Forrest Kerr, its property in the highly prospective Golden Triangle area play of northwestern British Columbia.

Multiple high-grade zones

ABN's 2018 drilling in the North Boundary, a new mineralized zone discovered at the end of 2017's drilling season, has intersected multiple high-grade zones and precious metal values, near surface. Hole FK-10, the first of eight holes drilled during the first batch of the current 4,000m program, features four separate high-grade zones all within 190 meters downhole. The hole was drilled 35 meters northwest of discovery holes FK17-04, 05 and 06 from last summer. It significantly increases the North Boundary Zone of precious and base metal mineralization, according to ABN's press release.

The highest-grade zone assayed at a whopping 331 grams per tonne (g/t), or 9.65 ounces per tonne, over 1.0m, within a broader zone of 38.7 g/t over 10m. The results from other high-grade zones in the discovery hole included 22.0 g/t gold and 22.4 g/t silver over 4.0m, 4.0 g/t silver over 13.0m, and 8.2 g/t gold with 1.4 g/t silver over 6.0m. The hole was drilled 230m north of a high-grade historical hole drilled by Noranda in 1991, which hit 326 g/t gold.

"The high-grade gold and base metal values in the first hole of the 2018 drill program have far exceeded our expectations and confirm the presence of a robust and strong mineralizing system at the recently discovered North Boundary Zone," said Jim Pettit, president and CEO of Aben Resources.

"We are now looking at an area that extends 230m south to the historic high-grade Noranda drill hole from 1991 and although the geology is complex we believe more drilling will delineate additional high-grade mineralization. The target areas in and around the Boundary Zone are relatively shallow and continue to provide strong discovery potential as we look to value-add the project using a systematic exploration methodology."

Ron Netolitzky, Chairman of Aben Resources, stated: "The presence of multiple mineralized zones associated with mesothermal veining and adjacent to major structural breaks is very encouraging. Close proximity to infrastructure will facilitate ongoing exploration."

Netolitzsky has an extensive exploration background and is best known for discovering and putting into production the Eskay Creek and Snip mines in the Golden Triangle, and the Brewery Creek Mine in the Yukon.

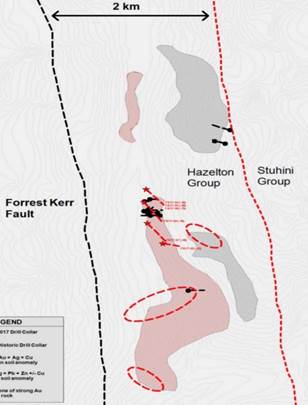

The goal of this year's drill program is to expand the mineralization at the North Boundary Zone, and test other prospective targets. According to Aben, this part of the Forrest Kerr property hosts gold-silver-copper in rock and soil anomalies that span over 2 km by 4 km and remain relatively under-explored. The zone's mineralization remains open in multiple directions with numerous soil geochemical anomalies and geophysical targets currently being drill-tested.

45% gain

The market responded well to the news on Thursday morning, with Aben spiking up 70% in the first 20 minutes of trading. By 10:17 am in Toronto, 6.4 million shares were changing hands, and by the end of the day, volume was at 22.5 million shares traded.

The stock closed Thursday at 29 cents per share, a gain of 45% from the open. Assays are pending for seven more drill holes.

The right time for gold

Smart gold investors know that we are in discovery-hole season, with most Canada-focused gold juniors running full-bore to get their drilling done before the snow starts flying in a couple of months. They also know that gold has been drifting downward during its normal period of summer weakness, providing an excellent entry point for gold stocks.

Over the last six weeks the precious metal has dipped from US$1,267 on June 22 to $1,213 on Wednesday, a difference of $54. Part of the reason gold has flopped is seasonal weakness, the other reason being the U.S. dollar, which has increased by 60 cents during the same period. Gold and the dollar typically move in opposite directions.

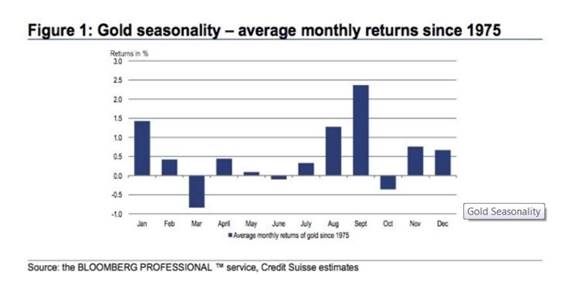

Historically gold's worst month is March, with January and September the next best months to look for a rally. September is when gold demand spikes in India due to the buying of jewelry for weddings to correspond with the Diwali festival in October-November. April to July is when gold usually drops below its average monthly return. So we are only a few weeks away from the month of September when gold historically rallies.

This fall's gold season looks particularly promising due to all the geopolitical tensions we outlined in a previous article, plus the inflationary pressures in the United States due to Donald Trump's trade war. Everything from beer and Coke to cars are going up, as countervailing duties bite.

The import tariffs on goods imported into China and the U.S. have just taken effect, so it's a little early to say how they will play out in the U.S. economy. So far the U.S. dollar is holding steady, and that has meant no love for gold, as investors funnel funds into dollars instead of gold amid the uncertainty of a trade war.

However the good news for gold is that as higher prices trickle through the economy (imported steel and aluminum are already more expensive), the inflationary effects will benefit gold. "As the tariffs take hold and the market adjusts to the effects, we expect inflationary pressures to increase, which will benefit holders of gold and commodities," Reuters quoted the CEO at fund manager GraniteShares Inc.

While the trade war has punished commodities including gold there are other less obvious signals that gold is poised for a rally. On July 3, MINING.com reported that hedge funds and large-scale speculators cut their long positions on gold by 82%—the equivalent of selling 700 tonnes of gold. The site quotes Ross Norman of Sharps Pixley, London's top bullion broker, saying in a blog post that "the market is now at least clear for a rally." A similar pattern appeared in 2015, when gold hit a six-year low in December but then speculators ran it up by over $300 the following July.

There are also more voices in the industry saying that we have reached "peak mined gold," which is the point in time when the gold mined every year will shrink. Up to 2016, it increased continually, with discovery of new reserves happening each year despite the dips in the gold price. 2016 was the first year the gold mine output fell by 3%, or 22 tonnes.

South African gold production has plummeted below 250 tonnes compared to 1,000 tonnes in the 1970s, and China, the leading gold producer, is the only country to increase production in recent years, notes Goldcore via ZeroHedge.

As for new gold mines, the bear market of 2012 to 2016 meant most large gold companies slashed exploration budgets and small explorers had an extremely tough time raising cash. The experts agree the industry is seeing a significant slowdown in the number of large deposits being discovered.

Goldcorp CEO Ian Telfer has said that peak gold is already here, Seabridge Gold chairman Rudi Fronk says that gold reserves are shrinking fast, and Barrick Gold's Kevin Dushinsky notes that ore grades and production levels continue to deteriorate as discovery of new mines falls off, reports Safehaven.

This is especially the case when gold is produced as a copper mining byproduct, as is common in many of the world's largest porphyries. All the big copper porphyries—the largest sources of copper ore—have been found, and as we have recently written, copper is heading for a supply crunch by 2020. This is when global copper demand is expected to strip mine output. Gold supply will be heavily impacted by declining copper production.

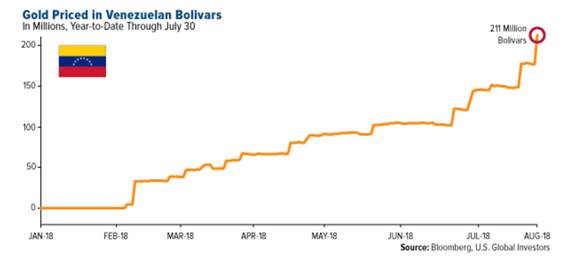

Frank Holmes, CEO of U.S. Global Investors, pointed out recently that "the fear trade" in gold has never been stronger. Using Venezuela as an example, Holmes notes that, like Zimbabwe back in the late 1990s, Venezuela is experiencing hyperinflation. Prices are doubling every 18 days. What does this have to do with gold? Because owning gold in Venezuela right now could actually save families from financial ruin. Or at least, provide some protection against the basket case of an economy being run by Venezuelan President Maduro.

On July 30, an ounce of gold in Venezuela could be bought for 211 million bolivars. That's 3.1 million percent higher than in the beginning of the year. Imagine what you, the average Venezuelan, could purchase now in Venezuela, with that kind of return, if you'd bought gold in January. Similarly as Holmes points out, after the fall of Saigon in 1975:

If not for gold, many South Vietnamese families might not have managed to escape the country. A seat on one of the thousands of fleeing boats reportedly went for eight or 10 taels of gold per adult, four or five taels per child. (A tael is slightly more than an ounce.) Gold was their passport. Thanks to the precious metal, tens of thousands of Vietnamese "boat people," as they're now known, were able to start new lives in the U.S., Canada, Australia and other developed countries.

The Golden Triangle

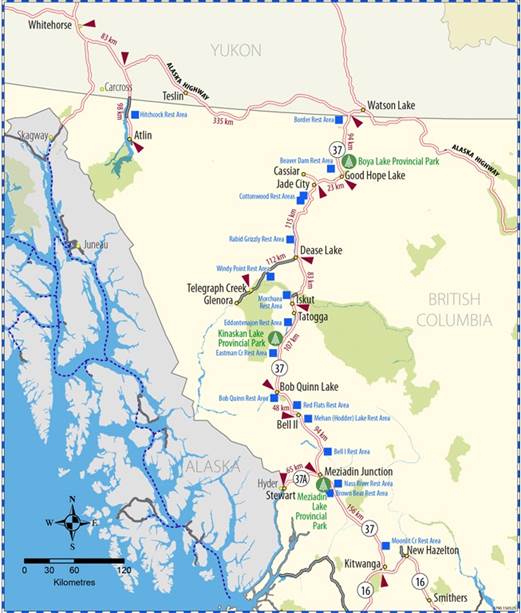

Into this bullish scenario for gold, enter Aben Resources (TSX-V:ABN), a gold junior operating in the Golden Triangle of British Columbia. With a rich gold mining history that spans 100 years, the Golden Triangle, just inland from the Alaska panhandle, has been the site of three gold rushes and some of Canada's greatest mines, including Premier, Snip and Eskay Creek. Other significant and well known deposits located within the Triangle include Brucejack, Galore Creek, Copper Canyon, Schaft Creek, KSM, Granduc, and Red Chris.

In 2017 the Golden Triangle witnessed some notable success stories. Garibaldi Resources (TSX-V:GGI) intersected two long intervals of nickel-copper sulfide mineralization in its first hole, impressing investors who saw the prospect of a major base metal mine.

Other hits in the Golden Triangle in 2017:

- Colorado Resources Ltd. (CXO:TSX.V) assayed 4,770 grams per tonne gold over half a meter at its KSP project.

- GT Gold Corp. (GTT:TSX.V) made a gold-silver discovery at its Saddle prospect: a high-grade epithermal gold-silver vein system; and a copper-gold-silver mineralized porphyritic intrusive it believes to be "the engine" for the system.

2017 was also the year that Pretium Resources Inc. (PVG:TSX; PVG:NYSE) put its Brucejack underground gold-silver mine into production. Most observers point to Pretium's discovery of the Valley of the Kings high-grade gold and silver deposit in 2013 as the catalyst that ignited interest in the Golden Triangle.

Aben has three separate projects on the go, including Forrest Kerr in the Golden Triangle, located between the Snip and Eskay Creek mines and south of the Schaft Creek mine. The other two development projects it has underway are the Chico Gold Project in Saskatchewan and the Justin Gold Project in the Yukon.

Forrest Kerr

When Aben Resources acquired the Forrest Kerr set of properties they came with a significant amount of exploration—120 holes and about 20,000 soil samples. Highlights of historical drilling included the Carcass Creek hole which returned 9.87 g/t gold over 29 meters and the Forrest Creek hole with 2.28 g/t, 0.3% copper and 6.3 g/t silver over 28 meters. The most promising intersection was in the Boundary Zone hole which returned 33.4 g/t gold over 11 meters including 326 g/t gold over 0.45 meters. However the high grades were not followed up on due to high drilling costs, limited accessibility, and glacier coverage in the Golden Triangle.

Recent glacial recession and significant improvements to infrastructure—construction of the 335-km Northwest Transmission Line, AltaGas' Forrest Kerr (the largest run-of-river project in the province and an engineering marvel—three run-of-river projects that contribute 77 MW of electricity to the provincial grid via the Northwest Transmission line), and the paving of the Stewart-Cassiar highway north from Hazelton—have lowered exploration costs and made the project more accessible. The property is accessible by road and has an existing power line and hydroelectric facilities on the southern part of the property.

Aben was interested in the 23,000-hectare land package because of the Forrest Kerr fault, a large structural feature that the company theorizes may be a significant gold source for Golden Triangle plays. The strategy is to search for splays that come off the main Forrest Kerr fault.

Former explorers around Forrest Kerr were looking for VMS-type deposits similar to the Eskay Creek mine, but the property is being looked at in a new way. Aben's technical team spent over a year analyzing and reinterpreting the historical data with the help of structural geologists to get a better understanding of the existing targets and high-grade gold mineralization at the project.

In 2017 Aben decided to begin exploring around the Boundary Zone, where the highest grades were found, and stepping out from there. The results of a nine-hole drill campaign that started last summer were extremely positive for Aben. Continuous mineralization was identified in the first three holes of a new North Boundary Zone. Highlights included 21.5 g/ t gold, 28.5 g/t silver and 3.1% copper over 6 meters; 2.91 g/t gold, 5.2 g/t silver and 0.6% copper over 14 meters.

View of the Boundary and North Boundary Zones, looking up the Forrest Creek drainage

Looking down the Forrest Creek drainage, from the core shack

In an interview with Ahead of the Herd, Cornell McDowell, Aben's head geologist and VP Exploration, said:

"The first three holes at Boundary, which are four, five, and six in the same pattern, that's about as far north in that zone where there is actual outcrop. There was some good gold numbers from one of the outcrops there. We looked at it. We saw the vein, we saw what we liked, we took a sample, and it was proven that there was mineralization there. So that was the most northerly path and, of course, we hit on the first one. So we steepened the dip on five and six in the same setup, and we were able to drill through that zone with all three. So that was the thinking there. It's ground-based direct observation, what you see with the boots and hammer essentially. I didn't want to focus on a small blip of the area. We have large soil anomalies there, gold and copper and silver, so we cut across a little bit of that and we still have a whole lot of gold and soil anomalies and rock to look at in the Boundary Zone yet."

The theory

According to McDowell, there is a large hydrothermal system with alterations of quartz, sericite and pyrite spread over several kilometers. The gold and silver mineralization is often associated with high-grade copper over the tested intervals but has not had a distinctly epithermal (near-surface) nor mesothermal (deeper) geochemical signature, nor does it display typical porphyry deposit characteristics. The observed alteration and mineralization is difficult to pigeonhole into a distinct type at this time so Aben geologists continue to analyze what comes out of the ground closely.

"I know what we've seen is fault controlled so far, but the subsurface is full of surprises and you never know what the next drill hole pokes into. So we'll probably run a couple of holes a bit deeper than we normally would just to see, and it'll totally depend on what rock is coming out of the ground," McDowell said a few weeks ago.

The geology

When McDowell says "fault controlled," he's referring to the Forrest Kerr fault. Aben was originally interested in the Forrest Kerr project because of the fault, a large structural feature that the company theorizes may be a significant gold source for the Golden Triangle. Aben's 50-kilometer-long property runs along the fault, which acts as a major geological "engine" for the whole region, giving Aben tremendous discovery upside due to the amount of geological activity in the area.

The fact that the Forrest Kerr fault—a 40-km-long trend—transects Forrest Kerr is important, because it divides the Mesozoic stratigraphy (rock layers) to the east from the older Paleozoic stratigraphy to the west (Click here for an on-site video interview with VP Exploration Cornell McDowell re Forrest Kerr fault system). The fault acts as a conduit to conduct the hydrothermal fluids that are generated with volcanic activity. "What we have is a lot of intrusives centered along the margins of this fault. So we know that it's been active prior to this large movement in the Tertiary period. This is important because what we have is a crustal weakness that is localized volcanic activity throughout time," McDowell explained.

Aben is looking for "splays" that run off the Forrest Kerr fault, since these splays, which are subsidiary faults that branch off the main fault, are known to host mineralization, sometimes with bonanza grades.

For more detail on Forrest Kerr, read our Aben's boots, hammers, smoke and fire, and to learn more about The Golden Triangle including a new geological theory that is sparking explorer and investor excitement in the area, read Golden Triangle's Red Line.

Site visit

Ahead of the Herd was recently given an exclusive invitation to tour the Forrest Kerr property, where VP Exploration Cornell McDowell and his crew of drillers and geologists are exploring on the west side of Forrest Kerr Creek. The current drill hole follows up on early success at Forrest Kerr this year. After only two weeks of drilling, the Vancouver-based company put out a news release mid-July saying the drills intersected mineralization on the first five holes at the North Boundary Zone. We now know the assay results from the first hole, described above, and they're outstanding. AOTH was there at the perfect time to witness current drilling just before first assays were released. What follows is a brief summary of our trip:

Day 1: Led by Aben CEO Jim Pettit and Director Tim Termuende, the tour group left early in the morning by truck from Smithers, travelling west on Highway 16 to Hazelton. After turning north at Hazelton onto the Stewart-Cassiar Highway (highway 37) which until recently was a gravel road but is now paved providing much easier access to mining, forestry and firefighting operations in this remote corner of northwestern BC. Aben's base of operations is at Bob Quinn Lake, about five hours drive from Smithers.

This gas station, combined with a general store and restaurant, has a decidedly frontier feel to it. On this stretch of road there is no Internet and the next town isn't for another 237 km

The drive up was uneventful apart from a couple of bear sightings. We passed a First Nations reserve outside of Hazelton, a reminder that we were travelling through large swathes of wilderness that have not been settled by treaty and are claimed as traditional territories by local First Nations. Fortunately Aben has good relationships with these bands including the Tahltan, whose traditional territory encompasses over 93,000 square kilometers. Unlike some First Nations who oppose mining and oil and gas developments, the Tahltan appear to be open to benefits agreements. For example the Tahltan built a supply road to the new Brucejack Mine overtop of a glacier, an impressive site from the air.

It was around noon when we arrived at Bell 2, a staging point for heli-skiing operations and location for a series of higher-end log cabins built in a Swiss style. This would be our accommodation for a night. We filled up with gas and then proceeded up the road another few kilometers to Bob Quinn Lake, where Aben has set up a camp, including lodgings, kitchen, a helicopter pad and fuel storage.

We sat down with head geologist Cornell McDowell, who walked us through the exploration program to date and plans going forward. In June Aben started off drilling at the North Boundary Zone, putting in eight holes there (it lost one), before moving down the drainage to the west side of the Forrest Kerr Creek, a new target that has never been drilled before. Of the 4,000m drill program, about 3,100m had been drilled, as of August 4.

The exploration zone is about two kilometers wide and as seen in the map below; historic drilling in the blind fault (upper grey area) and strong soil and rock samples show a definite line of silver-lead-zinc mineralization on the east side of the creek, according to McDowell. Going downhill (the lower pink areas), the mineralization turns to gold-silver copper. "They're almost stacked on top of each other… It's called the Forrest Kerr property because of the Forrest Kerr fault. It's been strongly structurally controlled. Lots of movement since whenever this was mineralized. The trick is finding where it's gone to."

Embarking on a helicopter tour of the Forrest Kerr property

At this point we climbed into a helicopter contracted by Aben, operated by a veteran pilot familiar with the area, and flew to the core shack, about a 15-minute ride. On the way we passed over the Boundary North Zone, while Termuende pointed out rust-colored gossans in the cliffs, indicating an exposed part of an ore deposit or mineralized veins.

Quartz veins indicative of possible mineralization, in the Boundary Zone

We also checked out the Blind Fault, another rust-colored gossan high up on the mountain, before circling back to land at the core shack. There Aben has stored its core, and has assembled a base tent, core shack and core cutting tent.

Core shack, located within the Boundary Zone, not far from where current drilling is taking place

Two experienced geologists are on site logging core from the drill hole about 600m down the bank, not far from the creek running through the valley. This is convenient for the drillers who need a regular water supply for biting through bedrock and pulling up core.

2017 core samples. Hole FK17-04 hit near-surface mineralization 18 to 21m deep, returning grades of 18.9 g/t gold, 16.6 g/t silver, and 2.2% copper

A chunk of mineralized core showing quartz veining and chalcopyrite

Drillers are pulling core that is being logged by geologists at the core shack

After an hour or so of checking out the new core (we were not allowed to take photos of the core because at that point the assays had not been returned) and the drill rig, we hopped back in the chopper and flew down the drainage, where the creek opens up into a mud flat. This is where AltaGas' run-of-river hydro project is located, where you can see a penstock entering one side of the mountain and water gushing out the other. The three run-of-river projects contribute 77 MW of electricity to the grid.

Then it was back to the camp and some R&R, including a steak dinner put on by the camp cook, a Tahltan member.

Day 2: We awoke on Sunday morning to a "blue bird" day - not a cloud in the sky, a rare occurrence for this part of the province where fog and rain regularly rolls in. We had gotten lucky as we had arranged for Monty, the helicopter pilot, to give us a tour of the surrounding exploration properties and the Brucejack Mine. About five minutes into the air we came up on the Eskay Creek Mine. Currently shuttered, Eskay Creek was discovered in 1988. Over its 14-year lifespan, the mine produced about 3.3 million ounces of gold and 160 million ounces of silver at 45 g/t gold on average and 2,224 g/t silver. It was once the world's highest-grade mine and fifth-largest silver mine. Eskay Creek was optioned to Skeena Resources from Barrick Gold in 2017. The mine is a volcanogenic massive sulfide (VMS) deposit rich in precious and base metals.

Then it was on to the KSM project being developed by Seabridge Gold Inc. (SEA:TSX; SA:NYSE.MKT). Flying over the three deposits—Kerr, Sulpherets and Mitchell—now all rolled into one, really gives you an idea of the daunting terrain in this area. Surrounded by glaciers and high mountains, nature would not appear to be giving up this mineralization easily. Seabridge is apparently planning to tunnel through a mountain for access. Going through that kind of engineering will be expensive, but may be worth it. The KSM deposit is considered one of the world's largest undeveloped gold deposits by reserves, which currently stand at 38.8 million ounces of gold and 10.2 billion pounds of copper, according to a preliminary feasibility study. Between 2013 and 2016, Seabridge targeted higher grade zones under KSM's near-surface porphyry deposits, resulting in the Deep Kerr and the Iron Cap Lower Zone discoveries.

Our last viewing from the helicopter was the Brucejack Mine. Discovered and operated by Pretium Resources, the mine is truly an engineering marvel. Butted up against a glacier, the high-grade underground gold mine produced just over 111,000 ounces in the second quarter, from 14.9 grams per tonne mill feed. Together with the 187,000 ounces delivered in Q1, Pretium is on track to meet first half guidance of 150,000 to 200,000 ounce of gold. Seeing the mine sandwiched in between the glacier, which has a supply road running overtop of it, and the turquoise-colored tailings facility, really is a point of pride for BC mining. It's no wonder that Pretium's success is something other juniors are trying to emulate.

Aerial shot of the Brucejack Mine, which went into production last summer

A supply road built overtop of a glacier, leading in and out of the Brucejack Mine

We took a short, westerly detour to the port of Stewart, from where Aben's concentrate would be shipped, and a taste of the U.S. in Hyder, Alaska, where we had lunch before embarking on the five-hour drive back to Smithers.

Conclusion

Six weeks into its 2018 drill program, Aben Resources has hit pay dirt. The assays from the first hole of the current 4,000m program are spectacular, with multiple high-grade zones showing, including 62.4 g/t gold over 6.0m within 38.7 g/t over 10.0m. The highest-grade chunk of core, jewelry box style gold mineralization, assayed an eye-popping 331.0 grams per tonne.

This was clearly what the market was looking for from Aben, which set the bar high last year with its three discovery holes at North Boundary. Last year's drilling success translated into a 4-bagger return of about 450% from trough to peak. While the stock did pare back some its gains last fall, it was still an unbelievable result considering Aben only drilled nine holes, coming into the Triangle late in the season, and came back with three winners. Fast forward to this year's program, and we are seeing the same, quick return of high-grade assays, a testament to the skill of McDowell and his team on the geological side and CEO Jim Pettit, a capital markets veteran.

As the saying goes, seeing is believing, and what we saw at Forrest Kerr is a first-class project that is only getting started.

The terrain is certainly challenging to be conducting exploration in. The mountains are high, the valleys deep and you are often drilling into the mountain, sometimes with the drill having to be built onto a platform and anchored to the mountainside. We're too early, obviously, to start talking about a mine, but the fly-over at Brucejack showed that it can be done. And the terrain at Forrest Kerr is a lot gentler from that encountered by Pretium.

If you already had Aben in your portfolio, you enjoyed a pretty nice run on Thursday. There are still assays from seven holes to come in, and if the first hole is any indication, the company is into a high-grade jumble of mineralized material at North Boundary. As for what could be lurking downhill from North Boundary, that remains to be seen, but if the mineralization extends south, we could be looking at a deposit that runs down the drainage, on both east and west sides of the creek.

We'll leave the geologists to figure out what it all means, but for now, Aben's drill program is delivering results, and there's more to come. Stay tuned.

Richard (Rick) Mills

aheadoftheherd.com

Just read, or participate in if you wish, our free Investors forums.

Ahead of the Herd is now on Twitter.

Newsletter Archives.

Richard (Rick) Mills, AheadoftheHerd.com, lives on a 160-acre farm in northern British Columbia. Richard's articles have been published on over 400 websites, including: WallStreetJournal, USAToday, NationalPost, Lewrockwell, MontrealGazette, VancouverSun, CBSnews, HuffingtonPost, Beforeitsnews, Londonthenews, Wealthwire, CalgaryHerald, Forbes, Dallasnews, SGTreport, Vantagewire, Indiatimes, Ninemsn, Ibtimes, Businessweek, HongKongHerald, Moneytalks, SeekingAlpha, BusinessInsider, Investing.com, MSN.com and the Association of Mining Analysts.

Read what other experts are saying about:

Disclosures:

1) Rick Mills: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Aben Resources. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company currently has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures/disclaimer below.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: Aben Resources, Pretium Resources and Seabridge Gold. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this interview, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Aben Resources and Pretium Resources, companies mentioned in this article.

Ahead of the Herd Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified.

Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard owns shares of Aben Resources (TSX-V:ABN).

Images provided by the author.