Lithoquest Diamonds Inc. (LDI:TSX.V; CWVWF:OTCPK), a Canadian diamond explorer, became public through a reverse takeover late last November. The decision was driven by original volcanic findings in 2007 that could lead to long-term diamond mining in Australia.

Before diving into the specifics, first a little history on the management team.

Management Team with Success in Diamonds

Lithoquest's leadership has experience with the successful discovery and development of diamond assets. CEO and Director Bruce Counts boasts 25 years of experience in international diamond exploration. He has also served as a director and senior officer of public junior mining companies for past 14 years. He was a member of the team that discovered the Ekati Diamond Mine, the first diamond mine in Canada. Between 1998 and 2017, that mine produced more than 67.8 million carats of diamonds.

He is accompanied at the Board level by Gerald Prosalendis, who served as the VP Corporate Development of Dia Met Minerals, which owned a minority stake in the Ekati Diamond Mine, and he orchestrated the sale of the company for US$800 million to the majority partner.

Bruce Counts explains the genesis of the company, "In 2015, a colleague, Michael Dufresne, told me about the project in Northwest Australia that he had identified in 2007/2008 but that had failed to garner interest due to the ensuing global financial crisis. The results of his work were exceptional and rarely seen, so the decision was made to form the company to acquire and explore the project area for diamonds."

Kimberlite is a volcanic rock that is the primary source of diamonds. It acts as an "elevator," originating deep in the earth's mantle, picking up diamonds as it ascends to the surface. Kimberlites also contain a suite of minerals called "Kimberlite Indictor Minerals" or KIMs that occur in much greater concentrations than diamonds. Importantly, the chemical composition of KIMs indicate if a kimberlite is likely to contain diamonds. When Dufresne shared the results from a rock collected on the project in 2007, Counts was excited about the chemical composition of the indicator minerals.

Lithoquest currently holds a 100% interest with no underlying royalties in two exploration licences covering 1,000 sq km of prospective ground and a third licence that covers 450 sq km that is under application.

Logistics concerns are no issue for Lithoquest Diamonds. The project has a seasonal road and access to tidewater.

An Australian Find with Micro-Diamonds

Lithoquest began trading on November 29 of last year and management is eager to advance the project and confident in how it can increase the company's value.

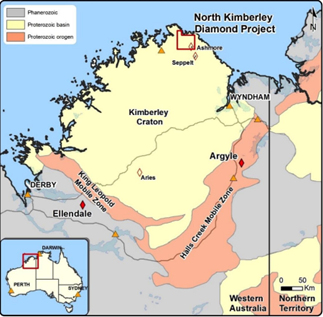

Lithoquest Diamonds notes the weathered rocks located on its North Kimberly Diamond project in the northern part of Western Australia, look very kimberlitic. But leadership isn't too surprised, as this region is the host to 70% of kimberlites discovered in Australia. In fact, the Kimberley Region is the home to two of the three economic diamond discoveries made in Australia.

Source: Lithoquest Diamonds Inc.

As seen in the image above, the Kimberley Region is home to both the Argyle Diamond Mine, which produces 90% of the world's pink diamonds, and the past-producing Ellendale Diamond Mine, which produced 50% of world's fancy yellow diamonds when in operation.

In April 2017, Lithoquest Diamonds released results from a 10Kg sample at Target 702. The finding of three micro-diamonds confirms that the area is diamond-bearing.

There's also more local evidence of diamonds in the vicinity. "Gem quality macro-diamonds have been found in historical stream samples throughout the project area, including a 1.73 carat diamond valued at US$740 per carat," shared the company.

"The recovery of micro-diamonds is extraordinary given that the primary objective of the laboratory process was to extract kimberlite indicator minerals, not diamonds," stated Bruce Counts. "This confirms that rocks present at target 0702 are diamond bearing and reinforces the prospective nature of the North Kimberley Diamond Project. We look forward to the commencement of the 2018 field program that will include drilling to collect samples specifically for micro-diamond testing."

Plans for 2018 Drilling

Lithoquest is anticipating its $2 million drill program for 2018, which will include 1,500 to 2,000 meters of drilling. Counts anticipates that results from this drill program will indicate how economic the project could be for the company.

"The goal of the company in 2018 is to first confirm that the targets are kimberlite and to then obtain first indications of size and diamond content," stated Counts.

The company anticipates the 2018 drilling program, set to launch the second half of July, could be the next catalyst for its stock. Counts anticipates results from the first phase of 2018 drilling will be available in fall 2018.

There are currently 46 million shares outstanding in Lithoquest Diamonds. 50% of the shares are held by seven people or the entities that they control. One major shareholder is Rosseau Asset Management (15.2%).

Rosseau Asset Management's Chief Investment Officer, Warren Irwin, told Streetwise Reports, "I really like that they are in a good jurisdiction with road access, have good chemistry, and have already found kimberlites. I have watched Bruce since he was exploring in the Arctic, and I am a big fan."

Other major shareholders include Eric Sprott (8.6%), Bruce Counts (8.2%), Michael Dufresne (5%), and Medalist Capital (3.6%).

LDI shares currently sit at $0.50.

Lithoquest has grabbed the attention of industry observers. James Kwantes of Resource Opportunities, discussing the diamond sector, stated on March 2 that "for a sector that has struggled—and been bypassed by many retail investors—there's a lot going on. . .There are new and rejuvenated exploration plays, including Bruce Counts' newly listed Lithoquest Diamonds with its North Kimberley project in Australia."

Technical analyst Clive Maund, on April 23, rated Lithoquest "an immediate strong speculative buy" and stated that the stock is "set to put in a sparkling performance."

Read what other experts are saying about:

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Nikia Wade compiled this article for Streetwise Reports LLC and provides services to Streetwise reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: Lithoquest Diamonds Inc. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own shares of Lithoquest Diamonds Inc., a company mentioned in this article.

Warren Irwin Disclosures

Warren Irwin is the Chief Investment Officer of Rosseau Asset Management, which owns shares of Lithoquest Diamonds Inc.

James Kwantes Disclosures:

Lithoquest is not a sponsor of Resource Opportunities and James Kwantes does not own shares.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.

Clive Maund: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None.