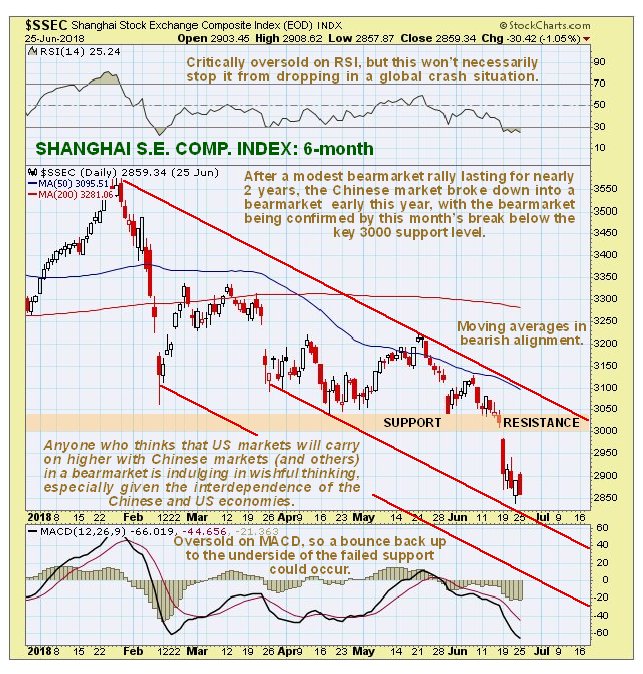

If there were any doubts that the Chinese stock market had entered a bear market, these were dispelled by the breach of key support at 3000 and plunge last week, which we can see to advantage on the 6-month chart for the Shanghai Composite index shown below. A tentative downtrend channel is drawn on this chart, but it is important to note that this drop could rapidly gather momentum and get a lot steeper now that the key 3000 level has been breached, making the channel shown obsolete, for reasons that become clear on the 5-year chart. For now, it is oversold on both its RSI and MACD indicators and close to trendline support, so we may see a bounce, although any such bounce is unlikely to get far before the decline resumes.

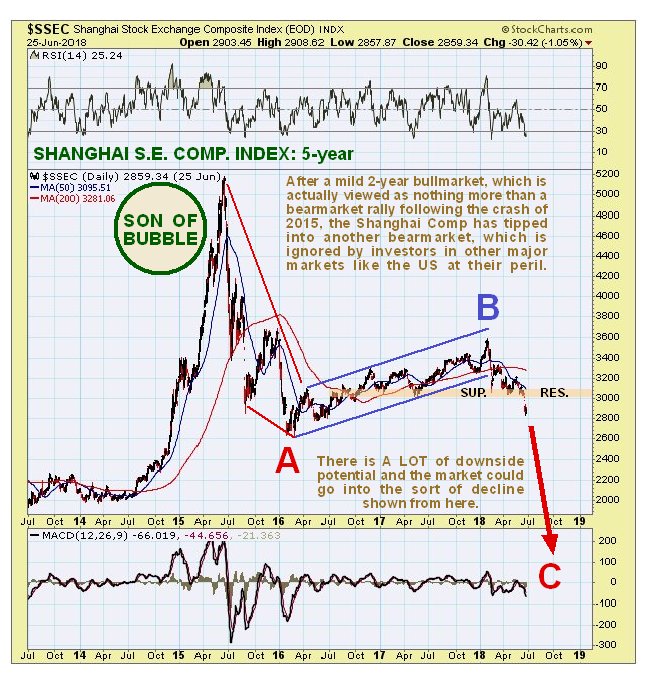

Just where the Chinese market is in its life cycle becomes clear when we look at a 5-year chart, on which we can see the "Son of Bubble" rally of 2014–2015, which was largely caused by naïve investors hoping for a repeat of the monstrous spectacular bubble of 2006 and 2007, which will go down in the annals of Chinese investing history, and which we label "Big Daddy Bubble" on the 20-year chart further down the page. Full marks to them: they almost succeeded in creating a self-fulfilling prophecy, as Son nearly grew up to be as big as his Dad. After Son of Bubble burst a much weaker attempt to get it going again, which of course was partly an unwinding of an oversold condition, resulted in the relatively mild protracted bear market rally that unfolded from early 2016 through early this year. Then the rot set in again and a bear market downleg started, with it being fully confirmed by last week's breakdown below key support at 3000. The entire pattern from mid-2015 is considered to be a larger order 3-wave bear market, with the 3rd C-wave just starting, that promises to be really severe, given collapsing markets elsewhere and the intensifying trade war. A potential path for this bear market is shown, although this is an approximation and shouldn't be taken too literally.

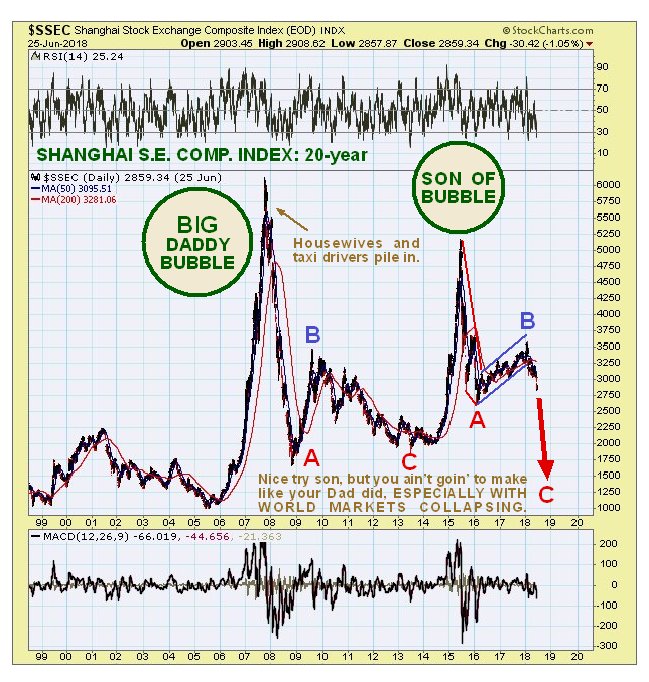

The long-term 20-year chart enables us to directly compare Son of Bubble to his Dad, Big Daddy Bubble, who was one big geezer and a helluva hard act to follow, but we must give credit where it is due for his valiant attempts to follow in his father's footsteps—he very nearly made it to his stature, and it's not often you see that. In the old days, especially in the U.S., you would often see shop fronts with names like Laurel & Son or Hardy & Son. The Dad did the work building up a business from scratch, and the easiest thing for the son to do was to carry on doing the same thing, rather than strike out on his own, but invariably the spark was gone, as in the sorry case of George W. Bush following on from George H. W. Bush, but sometimes it worked and the son was a worthy successor, a notable example being Michael Douglas who followed his father, Kirk Douglas, into acting, and made a very good job of it, as in his 1992 film "Falling Down."

Back to the chart, there is considered to be a high probability that the Shanghai Comp will collapse back near to the sort of levels that it was at before the 2006–2007 ramp, especially given the background of imminent collapse of most world markets due to the intensifying debt crisis.

The Chinese market in 2007 had a lot of similarities with the Bitcoin market late last year, with the same caliber of investor getting involved, such as this gentleman pictured multi-tasking on the streets of China back in 2007. Given the nature of his day job, one suspects that he didn't buy stocks singly, but by the bunch.

A big reason for the growing weakness of the Chinese market is, of course, the prospect of a worsening trade war, but trade wars are not a one-way street, there are no winners—everybody loses, and that will certainly include the instigators of the trade wars, the U.S. They are the product of desperation, and while they may please a few coal miners and steel workers in the rust belt of the U.S., their minimal beneficial effect will be much more than offset by their negative impact. U.S. investors had therefore better take heed of the worsening Chinese markets as another indication of what lies in store for U.S. markets, which are expected to follow suit.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Charts and images provided by the author.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.